Is SwissTrade safe?

Business

License

Is Swisstrade Safe or a Scam?

Introduction

Swisstrade positions itself as an online trading platform, claiming to offer a variety of financial instruments, including forex, commodities, and cryptocurrencies. In the rapidly evolving forex market, the importance of choosing a reliable broker cannot be overstated. Traders must be vigilant in evaluating brokers to avoid potential scams and protect their investments. This article aims to provide an objective assessment of Swisstrade, analyzing its regulatory status, company background, trading conditions, client fund security, and customer experiences. Our investigation is based on a thorough review of online sources, regulatory databases, and user feedback.

Regulation and Legality

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. Swisstrade claims to operate from the United Kingdom; however, it lacks authorization from reputable financial authorities. Below is a summary of Swisstrade's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Unregulated |

The absence of a valid regulatory license raises significant concerns regarding the safety of client funds and the transparency of operations. The Financial Conduct Authority (FCA) has issued warnings against Swisstrade, categorizing it as an unauthorized entity. This lack of oversight means that traders engaging with Swisstrade are operating in a high-risk environment where recourse for disputes or issues is limited. It is essential for potential investors to recognize that trading with an unregulated broker like Swisstrade poses substantial risks, including potential financial loss and fraudulent practices.

Company Background Investigation

Swisstrade's history and ownership structure are vital in assessing its credibility. The broker claims to have a presence in London, yet the lack of verifiable information about its founding and operational history raises red flags. There is little transparency regarding the management team, their qualifications, and their experience in the financial industry.

In a trustworthy brokerage, one would expect clear disclosures about the company's operations, including its ownership structure and the backgrounds of key personnel. However, Swisstrade fails to provide this level of transparency, leading to concerns about its legitimacy. The absence of a physical office address, coupled with vague claims about its services, suggests that Swisstrade may not be a legitimate trading entity. Without proper oversight and transparency, traders should approach this broker with caution and consider alternative options.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value to traders. Swisstrade advertises a variety of trading instruments and claims to provide competitive spreads. However, the specifics of their fee structure are not clearly outlined, which is a common tactic among dubious brokers. Below is a comparison of core trading costs:

| Fee Type | Swisstrade | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not Specified | 0.5 - 1.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clarity regarding spreads and commissions is concerning. Legitimate brokers typically provide detailed information about their pricing structures, enabling traders to make informed decisions. Moreover, Swisstrade's high minimum deposit requirement of €5,000 is significantly above the industry average, which can deter potential traders. Such unusual practices further indicate that Swisstrade may not be operating with the best interests of its clients in mind.

Client Fund Security

The security of client funds is paramount when assessing a broker's reliability. Swisstrade claims to implement measures to protect client funds; however, the absence of regulatory oversight raises questions about the effectiveness of these measures. The broker does not provide details on whether it offers segregated accounts or any investor protection schemes.

In reputable brokers, segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security. Furthermore, negative balance protection is often a standard feature among regulated brokers, safeguarding traders from losing more than their initial investment. Without such protections, traders using Swisstrade are exposed to potential financial risks.

Customer Experience and Complaints

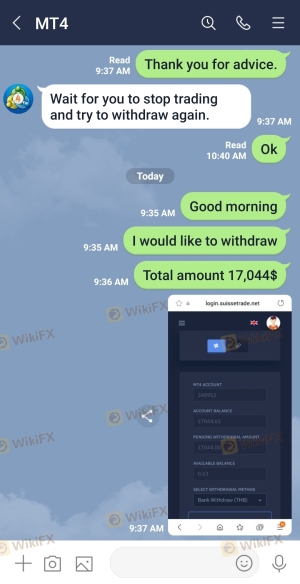

Customer feedback is an essential aspect of evaluating a broker's reliability. Swisstrade has received numerous negative reviews, with many users reporting difficulties in withdrawing funds and poor customer service. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Limited feedback |

| Poor Customer Support | High | Unresolved issues |

Several users have shared experiences of being unable to access their funds after making deposits, which is a significant warning sign. In many cases, clients reported that their accounts were locked without explanation, and attempts to contact customer support were met with delays or no response at all. These patterns of complaints suggest a troubling trend that potential traders should consider seriously.

Platform and Trade Execution

The performance of a trading platform is crucial for a smooth trading experience. Swisstrade offers a proprietary trading platform, but user reviews indicate that it lacks the advanced features commonly found in established platforms like MetaTrader 4 or 5. Issues such as order execution delays, slippage, and high rejection rates have been reported by users, leading to frustration and potential financial loss.

The absence of a reliable trading platform can severely impact a trader's ability to execute trades effectively. If a broker's platform does not perform well, it can lead to missed opportunities and increased trading costs. Traders should be wary of platforms that do not provide transparent information about their execution quality or have a history of complaints regarding trade execution.

Risk Assessment

Using Swisstrade presents a range of risks that traders must consider. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker poses significant risks. |

| Fund Security Risk | High | Lack of investor protection and fund segregation. |

| Trading Platform Risk | Medium | Poor performance and execution issues reported. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to only invest funds that one can afford to lose, especially when dealing with unregulated brokers like Swisstrade. Seeking alternative, regulated brokers with proven track records can also help in safeguarding investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Swisstrade is not a safe trading option. The lack of regulation, transparency issues, and numerous negative user experiences indicate that traders should exercise extreme caution. The absence of investor protection and the potential for withdrawal issues further highlight the risks associated with this broker.

For traders seeking a reliable and secure trading environment, it is advisable to consider regulated alternatives. Brokers like eToro and IG, which are well-regulated and provide transparent trading conditions, should be prioritized. Ultimately, safeguarding your investments should be the primary concern when choosing a trading platform.

Is SwissTrade a scam, or is it legit?

The latest exposure and evaluation content of SwissTrade brokers.

SwissTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SwissTrade latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.