Swisstrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive swisstrade review presents a balanced evaluation of an offshore forex and cryptocurrency broker. The broker has generated mixed feedback from the trading community. Based on available user reviews showing ratings of 7.0 out of 10 from 498 reviews and 4.6 out of 10 from 11 reviews on different platforms, Swisstrade demonstrates polarized user experiences that warrant careful consideration.

The broker offers competitive spreads starting from 0.5 pips and leverage ratios reaching up to 1:500. This positions it as a potential option for traders seeking high-leverage opportunities in forex and cryptocurrency markets. However, significant red flags have emerged, including scam warnings and negative user feedback that raise concerns about the broker's reliability and transparency.

Swisstrade primarily targets forex and cryptocurrency traders who prioritize high leverage trading opportunities. These traders are comfortable with elevated risk levels. The platform operates through MetaTrader 4, offering access to various asset classes including forex pairs, cryptocurrencies, CFDs, and stocks. Despite these offerings, the presence of five identified red flags and scam alerts significantly impact the broker's overall credibility assessment.

Important Notice

This swisstrade review is based on publicly available user feedback, market analysis, and information gathered from various review platforms. Due to limited regulatory transparency mentioned in available sources, traders should exercise heightened caution when considering this broker. The evaluation reflects information available as of 2025 and may be subject to changes in the broker's operational status or regulatory standing.

Rating Framework

Broker Overview

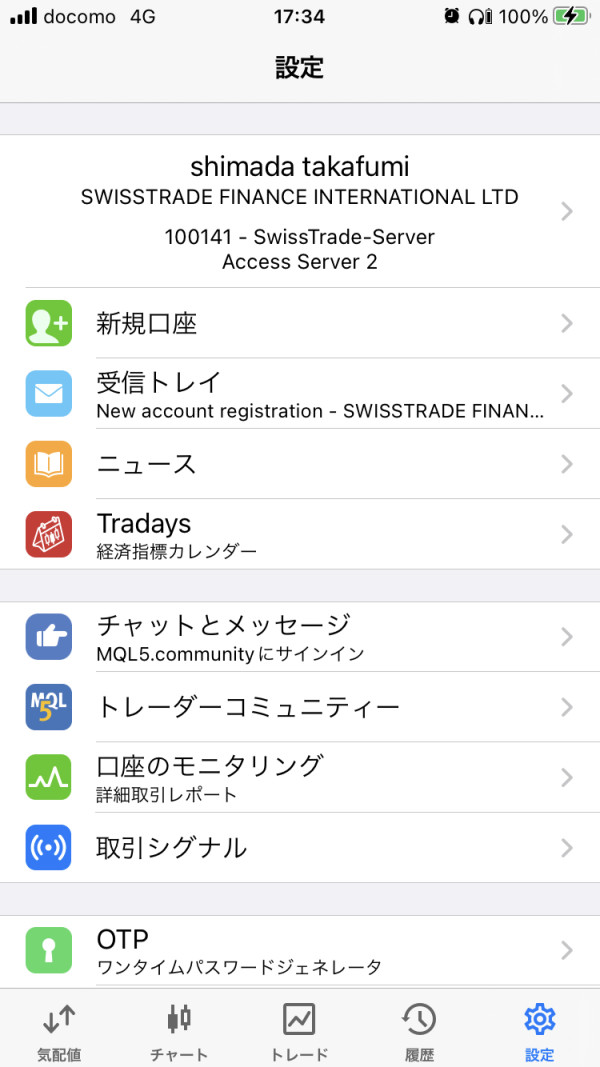

Swisstrade operates as an offshore forex and cryptocurrency broker. The company specializes in providing trading services across multiple asset classes. According to available information, the company focuses primarily on forex and cryptocurrency investment services, positioning itself as a platform for traders seeking access to international financial markets with enhanced leverage opportunities.

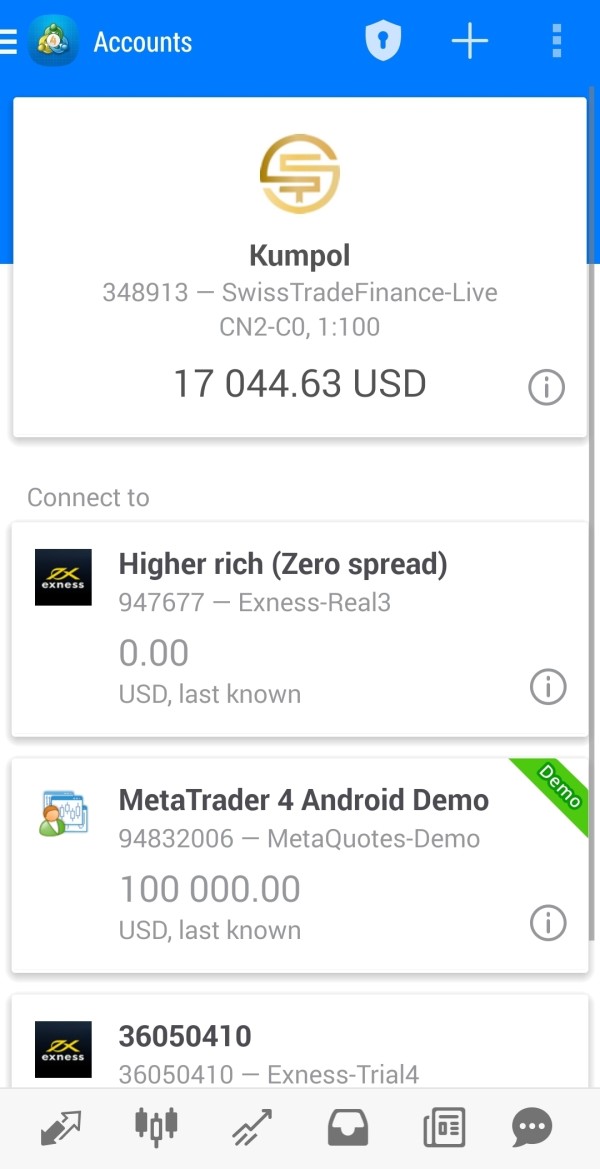

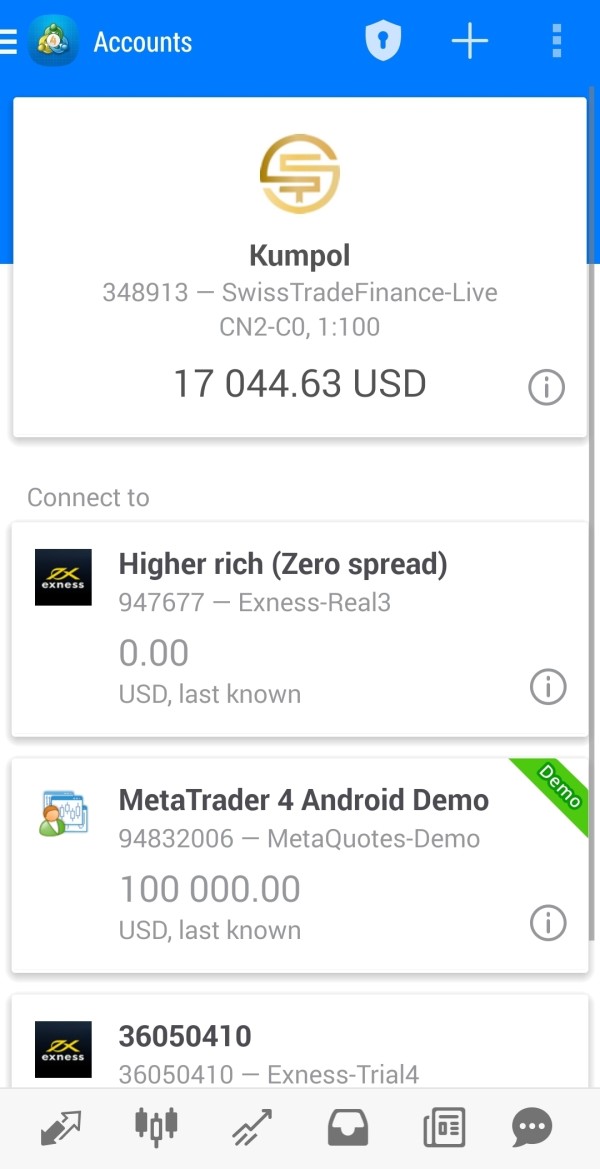

The broker's business model centers around offering MetaTrader 4 as its primary trading platform. This platform supports various financial instruments including forex currency pairs, cryptocurrencies, contracts for difference, and stock trading options. While specific establishment dates and detailed company background information were not clearly detailed in available sources, the platform has gained attention in the trading community. However, it has received mixed reception from users and industry observers.

This swisstrade review reveals that the broker operates without clearly disclosed regulatory oversight. This represents a significant consideration for potential clients. The absence of transparent regulatory information in available materials raises important questions about client fund protection and operational compliance with international trading standards.

Regulatory Status: Available sources do not provide specific information regarding Swisstrade's regulatory jurisdiction or licensing details. This represents a significant transparency concern for potential clients.

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and associated fees was not detailed in available source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in the reviewed information sources.

Promotional Offers: Details regarding welcome bonuses, promotional campaigns, or trading incentives were not mentioned in available materials.

Available Assets: The platform offers trading in forex currency pairs, cryptocurrencies, CFDs, and stocks. This provides diversified market access for different trading strategies.

Cost Structure: Spreads begin from 0.5 pips, which appears competitive within the industry standard. However, detailed commission structures and additional trading costs were not comprehensively outlined in available sources.

Leverage Options: Maximum leverage ratios reach up to 1:500. This offers significant amplification opportunities for experienced traders willing to accept corresponding risk levels.

Platform Selection: Trading is conducted exclusively through MetaTrader 4. This limits platform diversity but provides access to a well-established trading environment.

Geographic Restrictions: Specific regional limitations or restricted territories were not detailed in available information sources.

Customer Support Languages: Available language support options were not specified in the reviewed materials.

This swisstrade review highlights several information gaps that potential clients should consider when evaluating the broker's suitability for their trading requirements.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Swisstrade's account conditions present a mixed picture that reflects both competitive elements and concerning transparency issues. The broker's spread structure begins from 0.5 pips, demonstrating competitive pricing that aligns with industry standards for retail forex trading. However, the absence of detailed information about different account tiers, specific minimum deposit requirements, and comprehensive fee structures creates uncertainty for potential clients.

User feedback suggests that account opening procedures lack transparency. Several reviews indicate unclear terms and conditions. The availability of different account types was not clearly outlined in available sources, limiting traders' ability to select appropriate account structures based on their experience levels and trading volumes. Additionally, specialized account options such as Islamic accounts or professional trader classifications were not mentioned in reviewed materials.

The leverage offering of up to 1:500 represents a significant feature for traders seeking amplified market exposure. However, this high leverage ratio also increases risk exposure substantially. Without clear regulatory oversight mentioned in available sources, the protection mechanisms for client accounts remain unclear, which impacts the overall assessment of account condition quality.

This swisstrade review notes that while competitive spreads provide some appeal, the lack of comprehensive account information and transparency issues significantly limit the positive aspects of the broker's account offerings.

The trading tools and resources provided by Swisstrade center primarily around the MetaTrader 4 platform. This offers a standard but limited technological foundation for trading activities. MT4 provides essential charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, meeting basic trading requirements for most retail traders.

However, the absence of additional proprietary tools, advanced research resources, or educational materials represents a significant limitation in the broker's offering. User feedback indicates that the platform provides basic functionality without enhanced features that distinguish modern brokers in the competitive marketplace. Advanced charting packages, market sentiment indicators, or sophisticated analytical tools were not mentioned in available source materials.

Educational resources appear to be limited or non-existent based on available information. These resources are crucial for trader development and platform familiarization. The lack of webinars, trading guides, market analysis, or educational content reduces the platform's value proposition, particularly for newer traders who require guidance and learning resources.

Research and analysis capabilities also appear constrained. There was no mention of daily market commentary, economic calendar integration, or professional analyst insights. These limitations impact traders who rely on comprehensive market information to make informed trading decisions.

Customer Service and Support Analysis (Score: 4/10)

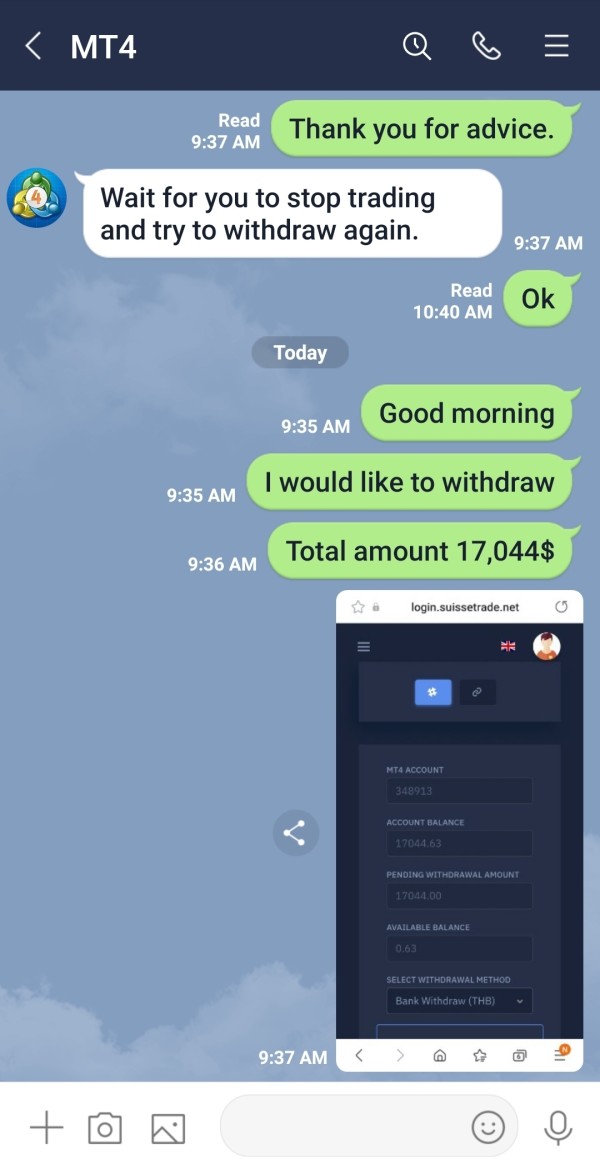

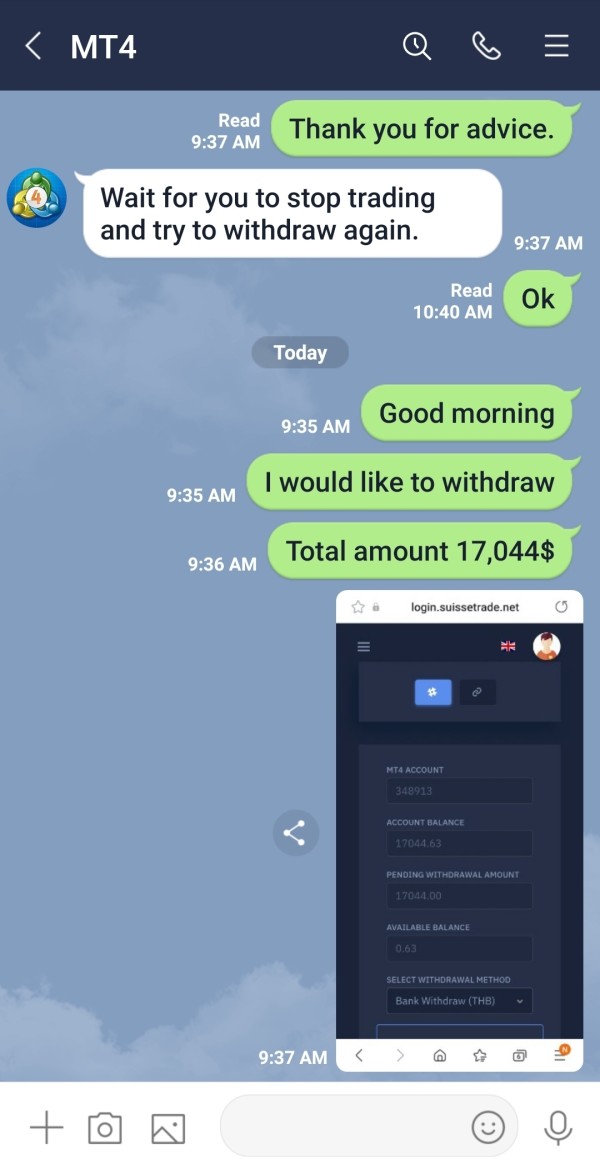

Customer service represents a significant weakness in Swisstrade's operational framework, based on available user feedback and review analysis. Multiple user reviews indicate concerns about response times, service quality, and overall support effectiveness. The absence of clearly outlined customer service channels, operating hours, or multilingual support options creates additional uncertainty about the broker's commitment to client service.

User feedback suggests that support responsiveness falls below industry standards. Several reviews mention delayed responses to inquiries and insufficient problem resolution capabilities. The lack of comprehensive contact information, including telephone support, live chat availability, or dedicated account management, limits clients' ability to receive timely assistance when needed.

Communication quality appears inconsistent based on available reviews. Users report varying experiences in problem resolution effectiveness. The absence of detailed support documentation or FAQ resources further compounds service limitations, requiring clients to rely primarily on direct contact methods that may not provide adequate responsiveness.

Professional support standards were not clearly demonstrated in available user feedback. This includes qualified staff expertise and technical problem resolution capabilities. These service limitations significantly impact the overall client experience and contribute to negative reviews mentioned in various evaluation sources.

Trading Experience Analysis (Score: 6/10)

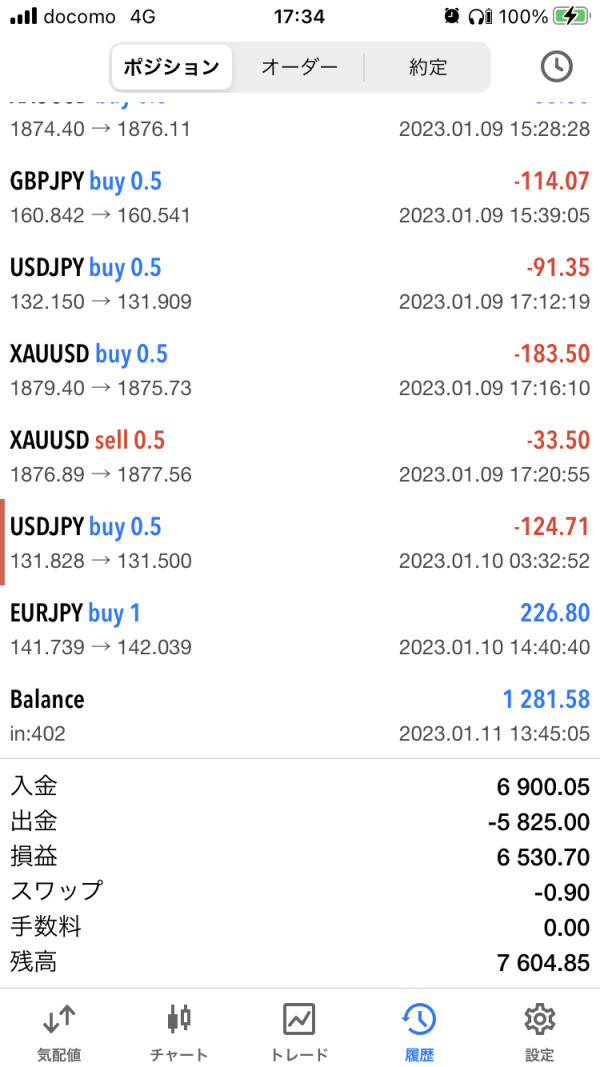

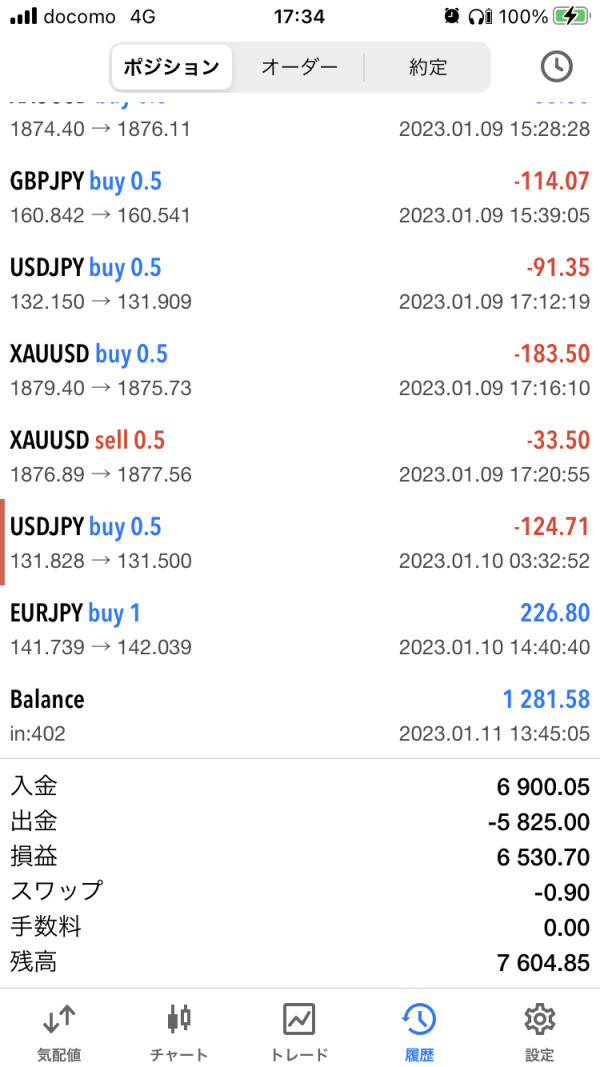

The trading experience with Swisstrade presents a moderate performance level that balances some positive technical elements against concerning reliability issues. User ratings of 7.0 from a substantial review base suggest that basic trading functionality meets acceptable standards for many clients. However, significant variation in user experiences indicates inconsistent service delivery.

Platform stability appears adequate for routine trading activities. MetaTrader 4 provides a familiar environment for experienced forex traders. However, user feedback mentions occasional slippage issues and execution concerns that impact trading effectiveness during volatile market conditions. The absence of advanced execution technologies or premium liquidity arrangements may contribute to these performance limitations.

Order execution quality receives mixed reviews. Some users report satisfactory fill rates while others mention delays or price discrepancies during high-volume trading periods. The lack of detailed execution statistics or transparency about liquidity providers creates uncertainty about trading condition consistency.

Mobile trading capabilities are supported through standard MT4 mobile applications. However, these do not appear enhanced with broker-specific features or optimizations. This limitation affects traders who require advanced mobile functionality for active trading strategies.

This swisstrade review indicates that while basic trading needs may be met, the overall experience lacks the refinement and reliability expected from premium brokers in the current market environment.

Trust and Reliability Analysis (Score: 3/10)

Trust and reliability represent the most significant concerns in this Swisstrade evaluation. Multiple red flags and scam warnings severely impact the broker's credibility assessment. The presence of five identified red flags, combined with scam alerts mentioned in review sources, creates substantial doubt about the platform's legitimacy and operational integrity.

The absence of clear regulatory oversight or licensing information represents a fundamental transparency failure. This undermines client confidence. Without verifiable regulatory compliance, clients lack essential protections typically provided through established financial regulatory frameworks. This regulatory ambiguity creates significant risk exposure for traders considering the platform.

User reviews contain multiple references to transparency issues, unclear business practices, and concerns about fund security. These negative feedback patterns suggest systematic problems rather than isolated incidents. This indicates deeper operational or ethical concerns that affect overall trustworthiness.

The company's background information remains largely unclear based on available sources. This includes ownership structure, operational history, and financial stability indicators. This lack of corporate transparency further compounds trust issues and makes independent verification of the broker's legitimacy extremely difficult.

Industry reputation appears significantly damaged by negative reviews and scam warnings. This limits the broker's credibility within the professional trading community and among potential clients seeking reliable trading partnerships.

User Experience Analysis (Score: 5/10)

User experience with Swisstrade demonstrates significant variation, reflecting the polarized nature of client feedback and the inconsistent service delivery mentioned throughout this review. The 7.0 rating from 498 reviews suggests that a portion of users find acceptable value. However, the contrasting 4.6 rating from 11 reviews indicates substantial dissatisfaction among other client segments.

Interface design and platform usability center around the standard MetaTrader 4 environment. This provides familiar functionality for experienced traders but may lack modern interface enhancements expected by newer market participants. The absence of proprietary platform development or user experience optimizations limits the broker's ability to differentiate itself through superior usability.

Registration and account verification processes appear to lack clarity and efficiency based on user feedback. Several reviews mention confusing procedures or inadequate guidance during account setup. These onboarding difficulties create negative first impressions and may discourage potential clients from completing account establishment.

Fund management operations were not comprehensively detailed in available sources. This includes deposit and withdrawal experiences. However, user feedback suggests potential issues with transaction processing and communication about financial operations. The lack of transparent information about payment processing creates uncertainty about fund access reliability.

Common user complaints focus on transparency issues, service quality concerns, and communication problems that impact overall satisfaction levels. These recurring themes suggest systematic operational issues that require significant improvement to enhance user experience quality.

Conclusion

This comprehensive swisstrade review reveals a forex broker with mixed characteristics that require careful consideration by potential clients. Swisstrade offers some competitive features including low spreads from 0.5 pips and high leverage ratios up to 1:500. However, significant concerns about transparency, regulatory oversight, and operational reliability substantially impact its overall assessment.

The broker may appeal to high-risk tolerance traders seeking leverage opportunities in forex and cryptocurrency markets. However, the presence of scam warnings, negative user feedback, and regulatory ambiguity makes it unsuitable for risk-averse traders or those prioritizing security and transparency. The primary advantages of competitive pricing and high leverage are overshadowed by fundamental concerns about trust and reliability that affect the platform's viability as a long-term trading partner.

Potential clients should exercise extreme caution and conduct thorough due diligence before considering Swisstrade for their trading activities. This is particularly important given the regulatory uncertainties and negative feedback patterns identified in this evaluation.