Is SwedenCap safe?

Business

License

Is SwedenCap A Scam?

Introduction

SwedenCap is a forex broker that positions itself in the competitive landscape of the forex market by offering various trading instruments, including forex, cryptocurrencies, and CFDs. As a potential trading partner, it is crucial for traders to assess the credibility and reliability of SwedenCap before committing their funds. The forex market is rife with both legitimate brokers and scams, making it essential for investors to conduct thorough due diligence to protect their investments. In this article, we will explore SwedenCap's regulatory status, company background, trading conditions, customer safety, and user experiences to determine whether SwedenCap is safe or a scam.

Our investigation is based on a comprehensive analysis of online reviews, regulatory information, and user feedback. We will present a structured evaluation framework that covers key aspects of the broker's operations, providing readers with clear insights into its trustworthiness.

Regulation and Legitimacy

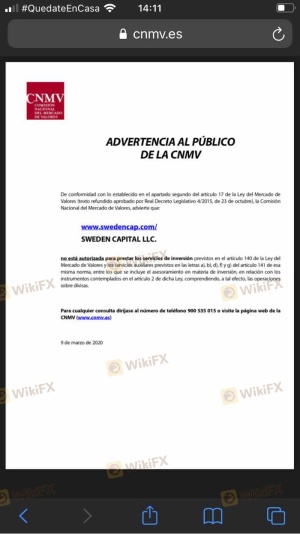

The regulatory environment is a pivotal factor in determining the safety of any forex broker. Regulation ensures that brokers adhere to strict standards, providing a layer of protection for traders. Unfortunately, SwedenCap is not regulated by any recognized financial authority, raising significant red flags about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that SwedenCap does not have to comply with any stringent operational guidelines, which can result in a lack of transparency and accountability. Furthermore, numerous reviews have highlighted that SwedenCap has been flagged as a fraudulent entity by various financial authorities, including the Chilean Financial Market Commission (CMF), which added SwedenCap to its list of fraudulent financial companies in February 2022. This lack of regulatory oversight is a serious concern for potential investors, as it suggests that SwedenCap may not prioritize the safety of client funds.

Company Background Investigation

SwedenCap operates under the ownership of Sweden Capital LLC, which is registered in Charlestown, Nevis. However, details about the company's history, management team, and operational structure are scarce. The lack of transparency regarding the company's ownership and leadership raises questions about its legitimacy and operational integrity.

The management team behind SwedenCap consists of individuals with limited publicly available information, which further complicates the assessment of their qualifications and experience in the financial industry. A reputable broker typically provides detailed information about its leadership team, including their backgrounds and expertise. The absence of such information about SwedenCap intensifies concerns regarding its transparency and trustworthiness.

In summary, the lack of regulatory oversight and transparency about the company's ownership and management structure suggest that traders should approach SwedenCap with caution.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. SwedenCap offers a variety of account types, each with different minimum deposit requirements and features. However, its overall fee structure appears to be higher than industry standards, which could deter potential traders.

| Fee Type | SwedenCap | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low |

SwedenCap's spreads are reportedly variable, but the specifics are vague, leading to concerns about potential hidden fees. Additionally, the lack of a clearly defined commission structure could indicate that traders might face unexpectedly high costs, especially in volatile market conditions. These costs could significantly impact overall profitability, making it essential for traders to be aware of the potential for elevated trading expenses.

Client Fund Safety

Client fund safety is paramount when selecting a forex broker. SwedenCap claims to implement various safety measures; however, the absence of regulation raises doubts about the effectiveness of these measures.

SwedenCap does not provide clear information regarding fund segregation, which is a critical practice that ensures client funds are held separately from the broker's operational funds. This lack of segregation means that in the event of bankruptcy or insolvency, clients may not have any recourse to recover their funds. Furthermore, SwedenCap does not participate in any investor compensation schemes, which typically provide additional protection for traders in the event of a broker's failure.

Additionally, historical complaints from users indicate that withdrawing funds from SwedenCap can be problematic, with many reporting difficulties in accessing their money. This history of withdrawal issues is a significant concern for anyone considering trading with SwedenCap, as it raises questions about the broker's commitment to client fund safety.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability. Reviews of SwedenCap reveal a pattern of negative experiences, with users frequently reporting issues related to withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Inconsistent |

| Account Verification Delays | Medium | Slow |

Common complaints include difficulties with withdrawing funds, with many users stating that once they deposited money, they encountered numerous obstacles when attempting to access their accounts. Additionally, the quality of customer support has been criticized, with users reporting slow response times and unhelpful answers to inquiries.

Two notable cases involve traders who were unable to withdraw their funds despite fulfilling the broker's withdrawal requirements. These experiences highlight the potential risks associated with trading with SwedenCap and underscore the importance of evaluating a broker's reputation before committing funds.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering. SwedenCap utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading features. However, user reviews indicate that the platform's performance can be inconsistent, with reports of slippage and order rejections.

Traders have expressed concerns about the execution quality, with some stating that their orders were not filled at the expected prices, leading to unexpected losses. Moreover, there are allegations of potential platform manipulation, where the broker's trading conditions are altered to benefit the broker at the expense of the trader.

Risk Assessment

Utilizing SwedenCap poses several risks that traders should consider before opening an account. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Fund Safety Risk | High | Lack of segregation and compensation schemes. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should exercise caution and consider trading with brokers that are regulated and have a proven track record of reliability. It is advisable to start with a demo account or invest only a small amount of capital until more is known about the broker's operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that SwedenCap presents several red flags that warrant caution. The lack of regulation, transparency issues, and a history of customer complaints raise significant concerns about the broker's legitimacy and safety. Given these factors, it is prudent for traders to avoid engaging with SwedenCap.

For those seeking reliable alternatives, consider brokers that are well-regulated and have demonstrated a commitment to client safety and transparency. Regulatory bodies such as the FCA, ASIC, and CySEC oversee reputable brokers, ensuring that traders have recourse in the event of disputes or issues. By prioritizing safety and regulatory compliance, traders can better protect their investments and enhance their trading experience.

Is SwedenCap a scam, or is it legit?

The latest exposure and evaluation content of SwedenCap brokers.

SwedenCap Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SwedenCap latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.