Is Swedbank safe?

Business

License

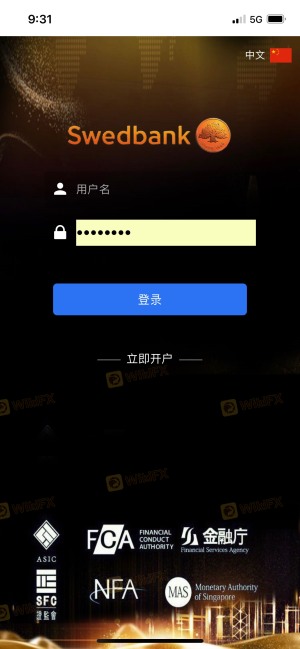

Is Swedbank Safe or Scam?

Introduction

Swedbank is a prominent financial institution in Northern Europe, primarily known for its banking services, including forex trading. As traders increasingly turn to online platforms for their investment needs, the importance of evaluating the legitimacy and safety of these brokers cannot be overstated. The forex market is rife with both opportunities and risks, making it essential for traders to discern between trustworthy brokers and potential scams. This article will investigate the safety of Swedbank by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our assessment is based on a thorough review of available data, user feedback, and regulatory information.

Regulation and Legitimacy

Understanding the regulatory environment in which a broker operates is crucial for assessing its safety. Swedbank currently operates without valid regulatory oversight, which raises significant concerns. The absence of regulation means that there is no government or financial authority monitoring its operations, leaving clients vulnerable to potential risks. Below is a summary of Swedbank's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight is alarming, particularly in an industry where compliance with financial regulations is vital for protecting investors' interests. Swedbank's history of compliance is questionable, with reports indicating that it has faced scrutiny for its operational practices. This unregulated status makes it imperative for potential clients to exercise caution and thoroughly research before engaging with Swedbank.

Company Background Investigation

Swedbank was founded in 1820, establishing itself as one of the leading banks in the Nordic and Baltic regions. Over the years, it has expanded its services to include a variety of financial products, including forex trading. However, the company's ownership structure and management team are not well-documented, which raises concerns about transparency. The management team lacks publicly available information regarding their professional backgrounds and experience in the financial sector, making it difficult for clients to assess their qualifications.

The level of transparency and information disclosure from Swedbank is another area of concern. While the bank offers a range of services, the details surrounding its operational practices and compliance measures are not readily available to the public. This lack of transparency could be a red flag for potential investors, as it may indicate an unwillingness to provide necessary information regarding their safety protocols.

Trading Conditions Analysis

Swedbank offers various trading services, including forex trading, but the overall cost structure and fee policies warrant scrutiny. Traders should be aware of any unusual fees that may not be immediately apparent. Below is a comparison of Swedbank's core trading costs:

| Fee Type | Swedbank | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.5 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.5% | 0.3% |

Swedbank's variable spreads can lead to higher trading costs, particularly during volatile market conditions. Additionally, the absence of a clear commission structure may confuse traders, making it difficult to predict overall trading expenses. This lack of clarity can be problematic, especially for new traders who may not fully understand the implications of these costs on their profitability.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Swedbank's measures for safeguarding client funds are concerning, particularly due to the absence of regulatory oversight. Without proper regulation, there are no guarantees regarding the segregation of client funds or investor protection policies.

Swedbank does not publicly disclose its policies on fund segregation or negative balance protection, which are critical components for ensuring the safety of client investments. Furthermore, there have been reports of withdrawal issues and potential scams associated with Swedbank, raising alarms about the security of client funds. Historical disputes regarding fund safety further complicate the broker's reputation, making it essential for potential clients to weigh these risks carefully.

Customer Experience and Complaints

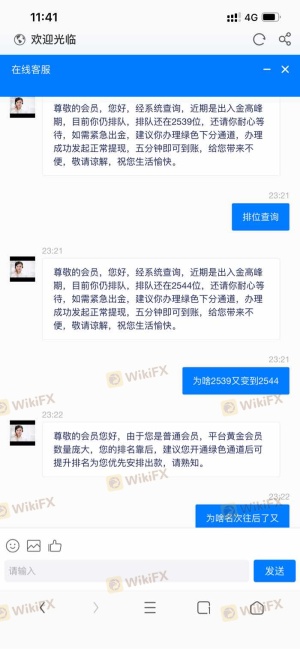

Customer feedback is a crucial factor in assessing the reliability of any broker. Swedbank has received mixed reviews from users, with a notable number of complaints regarding withdrawal difficulties and unresponsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

| Hidden Fees | High | Poor |

Typical complaints often highlight the challenges faced by traders when attempting to withdraw funds, with many users reporting that their requests were ignored or met with unreasonable delays. One case involved a trader who was unable to withdraw their profits and faced additional fees, which led to frustration and dissatisfaction. Such experiences raise significant concerns about the overall client experience with Swedbank.

Platform and Execution

The quality of the trading platform and execution speed is another critical aspect of a broker's reliability. Swedbank's trading platform is proprietary, and while it offers basic functionalities, it lacks the advanced features found in more established platforms like MetaTrader 4 or 5.

Users have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejected orders. These issues can significantly impact trading performance, leading to potential losses. Furthermore, any signs of platform manipulation should be viewed with caution, as they could indicate deeper issues within the brokers operational integrity.

Risk Assessment

Using Swedbank as a trading platform presents several risks that potential clients should be aware of. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Fund Safety Risk | High | Lack of fund segregation policies. |

| Customer Service Risk | Medium | Poor response to client complaints. |

To mitigate these risks, prospective clients should consider conducting thorough due diligence, including researching alternative brokers with robust regulatory frameworks and better customer service records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Swedbank may not be a safe choice for traders. The absence of regulatory oversight, coupled with numerous complaints regarding fund safety and customer service, raises significant red flags. While Swedbank has a long history as a financial institution, its current operational practices and lack of transparency make it a risky option for potential investors.

For traders seeking a reliable and secure trading environment, it is advisable to consider well-regulated brokers with a proven track record of client satisfaction and transparent operational practices. Alternatives such as Interactive Brokers or eToro, which are subject to stringent regulatory oversight and offer robust customer support, may provide safer options for traders looking to engage in the forex market.

Is Swedbank a scam, or is it legit?

The latest exposure and evaluation content of Swedbank brokers.

Swedbank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Swedbank latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.