Is Otto Forex safe?

Business

License

Is Otto Forex A Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, brokers play a crucial role in facilitating trades for individual and institutional investors. One such broker is Otto Forex, which claims to provide a range of trading services. However, potential traders must exercise caution when evaluating forex brokers, as the industry is rife with scams and unregulated entities. This article aims to provide an objective analysis of Otto Forex, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The findings are based on a comprehensive review of multiple online sources, including regulatory warnings and user reviews.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and safety. A broker that operates under the oversight of a reputable financial authority is generally considered safer for trading. In the case of Otto Forex, the broker's claims of being regulated by the National Futures Association (NFA) and other authorities have come under scrutiny.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0545302 | USA | Not authorized |

| FCA | N/A | UK | Warning issued |

| CNMV | N/A | Spain | Warning issued |

Otto Forex has faced warnings from both the Financial Conduct Authority (FCA) in the UK and the Comisión Nacional del Mercado de Valores (CNMV) in Spain, indicating that it is not authorized to provide forex trading services in these jurisdictions. The NFA also categorizes Otto Forex as unauthorized, which raises significant concerns regarding the broker's legitimacy. The absence of regulatory oversight means that traders funds are not protected, and there is no recourse in the event of disputes or fraudulent activities. Therefore, it is crucial for potential investors to ask, is Otto Forex safe? The overwhelming evidence suggests that it is not.

Company Background Investigation

Understanding the background of a broker is essential in assessing its reliability. Otto Forex claims to be headquartered in London, but there is a lack of transparency regarding its ownership and operational history. The company was incorporated in December 2021 and was dissolved by June 2023, indicating a very short operational lifespan.

The management team behind Otto Forex has not been adequately disclosed, leaving potential clients in the dark regarding their qualifications and experience. This lack of transparency raises red flags about the broker's intentions and operational integrity. Furthermore, the absence of clear information about the company's registration and operational history further complicates the determination of whether is Otto Forex safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer, including fees and spreads, are of utmost importance. Otto Forex claims to provide competitive trading conditions, but many specifics remain undisclosed.

Trading Costs Comparison Table

| Cost Type | Otto Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding spreads, commissions, and overnight fees raises concerns for potential traders. Many users have reported hidden fees and unexpected charges, which are common tactics used by scam brokers to siphon funds from unsuspecting traders. Without clear information on these costs, it is difficult to assess whether is Otto Forex safe for trading.

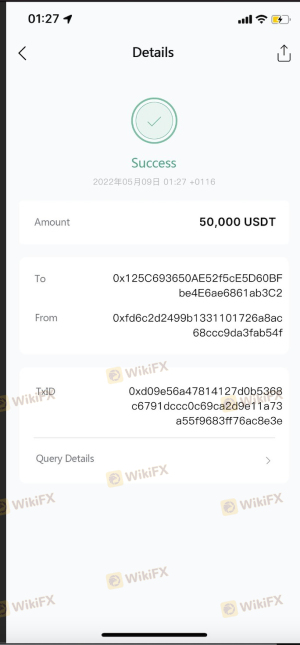

Client Funds Security

The safety of client funds is another critical aspect to consider when evaluating a forex broker. Otto Forex has not provided any clear information regarding its policies on fund segregation, investor protection, or negative balance protection.

The absence of these safeguards means that traders funds may not be kept separate from the broker's operational funds, increasing the risk of loss in case of insolvency. Additionally, the lack of investor protection measures implies that clients may not be compensated in the event of fraud or mismanagement. Historical reports have indicated that many traders have faced difficulties in withdrawing their funds from Otto Forex, further supporting the notion that is Otto Forex safe is a question worth asking.

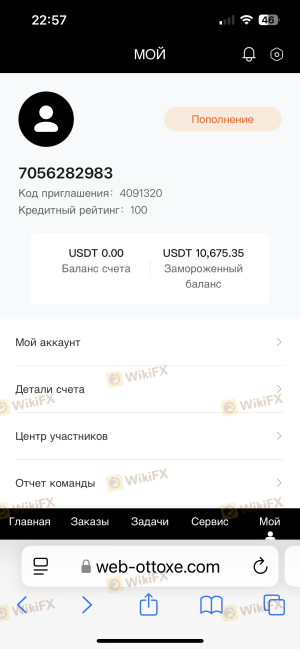

Customer Experience and Complaints

Analyzing customer feedback is vital in understanding a broker's reliability. Many users have reported negative experiences with Otto Forex, including difficulties in withdrawing funds, lack of customer support, and issues with account management.

Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal issues | High | Poor |

| Customer support | Medium | Poor |

| Account management | High | Poor |

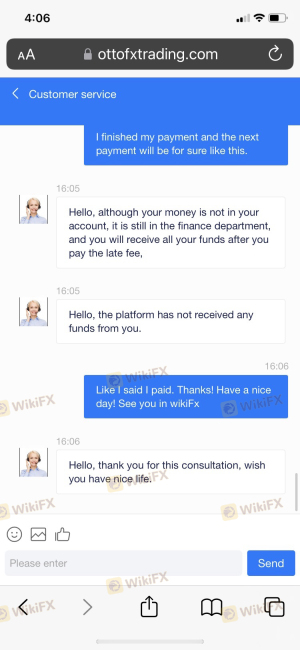

Common complaints include excessive delays in processing withdrawals, unresponsive customer service, and unclear terms regarding account management. In some instances, traders have reported being pressured to deposit more funds to facilitate withdrawals, a tactic often associated with fraudulent brokers. These experiences raise serious concerns about whether is Otto Forex safe for potential investors.

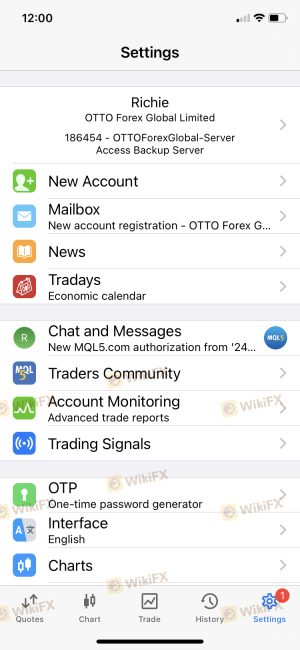

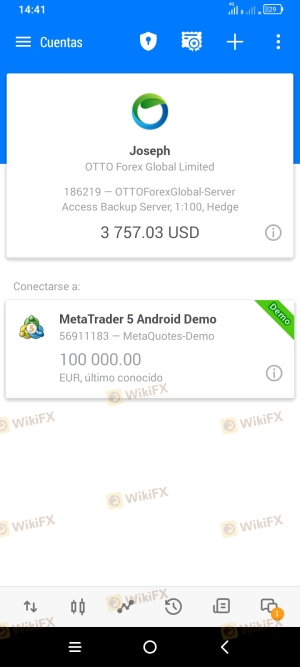

Platform and Trade Execution

The performance of a trading platform is critical to a trader's success. Otto Forex claims to offer the MetaTrader 5 (MT5) platform, which is widely regarded for its advanced trading features. However, user reviews indicate mixed experiences regarding platform stability and execution quality.

Issues such as slippage, high rejection rates, and execution delays have been reported, suggesting that the platform may not operate as efficiently as claimed. Furthermore, there are concerns about potential manipulation of trade executions, a common practice among dubious brokers. Given these factors, the question of is Otto Forex safe becomes increasingly relevant.

Risk Assessment

Using an unregulated broker like Otto Forex carries inherent risks. The lack of oversight, transparency, and customer support creates a precarious trading environment.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | No segregation of client funds |

| Operational Risk | Medium | Poor platform stability and support |

To mitigate these risks, potential traders should conduct thorough research, avoid depositing large sums, and consider using regulated brokers instead.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Otto Forex is not safe for trading. The lack of regulation, transparency, and poor customer feedback raises significant red flags. For traders seeking to engage in forex trading, it is advisable to steer clear of Otto Forex and consider alternatives that are regulated and have a proven track record of reliability. Recommended options include brokers that are regulated by the FCA, NFA, or other reputable authorities, which offer better protection for clients funds and a more transparent trading environment.

Ultimately, the question remains: is Otto Forex safe? The overwhelming consensus is that it is not, and traders should exercise extreme caution before considering any engagement with this broker.

Is Otto Forex a scam, or is it legit?

The latest exposure and evaluation content of Otto Forex brokers.

Otto Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Otto Forex latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.