Is SOPHIE CAPITAL FINANCIAL TRADING PTY LTD safe?

Business

License

Is Sophie Capital Financial Trading Pty Ltd A Scam?

Introduction

Sophie Capital Financial Trading Pty Ltd positions itself as a forex broker within the competitive landscape of online trading. Established in 2022, it claims to offer a variety of trading services, including forex trading and contracts for difference (CFDs). However, the influx of unregulated brokers in the market necessitates a cautious approach for traders. Evaluating the credibility of a broker is crucial to safeguarding investments, as numerous fraudulent entities exploit the anonymity of online trading platforms. This article employs a comprehensive investigative approach, analyzing Sophie Capitals regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine if Sophie Capital Financial Trading Pty Ltd is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is paramount in assessing its legitimacy. A licensed broker must adhere to strict standards set by financial authorities, ensuring investor protection and operational transparency. Unfortunately, Sophie Capital Financial Trading Pty Ltd operates without any recognized regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license raises significant concerns about the safety of funds and the broker's accountability. Various sources indicate that Sophie Capital falsely claims to be registered with the National Futures Association (NFA) in the United States, presenting a non-existent NFA ID as proof. Furthermore, it has been reported that the broker is not listed in the Australian Securities and Investments Commission (ASIC) registry, further substantiating its unregulated status. This lack of oversight means that Sophie Capital is not held to any compliance standards, making it potentially dangerous for traders seeking a safe trading environment.

Company Background Investigation

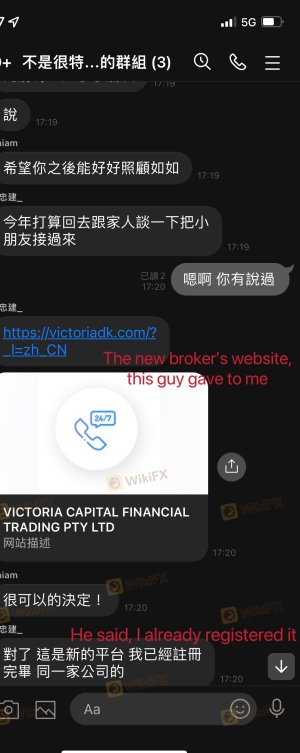

Sophie Capital Financial Trading Pty Ltd was established in 2022, but details surrounding its ownership and management remain obscure. The company claims to operate from the United States and Australia, yet its regulatory status and operational transparency are questionable. The lack of publicly available information regarding its management team, including their professional backgrounds and experience in the financial sector, raises red flags.

The company appears to have minimal online presence, with scant details on its website about its operations, leading to concerns about transparency. A reputable broker typically provides comprehensive information about its team, including qualifications and industry experience, which is essential for building trust with potential clients. The absence of such information about Sophie Capital further indicates a lack of credibility, suggesting it may not be a safe option for traders.

Trading Conditions Analysis

In evaluating whether Sophie Capital Financial Trading Pty Ltd is safe, it is crucial to consider the trading conditions it offers. Reports indicate that the broker has an unusual fee structure and lacks clarity in its pricing model.

| Fee Type | Sophie Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Variable |

| Overnight Interest Range | N/A | 0.5%-2% |

The absence of transparent information regarding spreads, commissions, and overnight fees is alarming. Traders typically expect brokers to provide clear details about their fee structures, allowing for informed decision-making. The lack of such disclosures from Sophie Capital raises concerns about hidden fees and unfavorable trading conditions, which could significantly impact profitability. Furthermore, the broker's failure to outline its trading costs suggests a potential strategy to lure traders into unfavorable terms, reinforcing the notion that it may not be a safe trading option.

Client Fund Safety

The safety of client funds is a critical consideration when evaluating any broker. Regulatory frameworks often mandate that brokers segregate client funds from their operational capital, providing an additional layer of protection in the event of insolvency. However, Sophie Capital Financial Trading Pty Ltd lacks regulatory oversight, which means it is not bound by such protective measures.

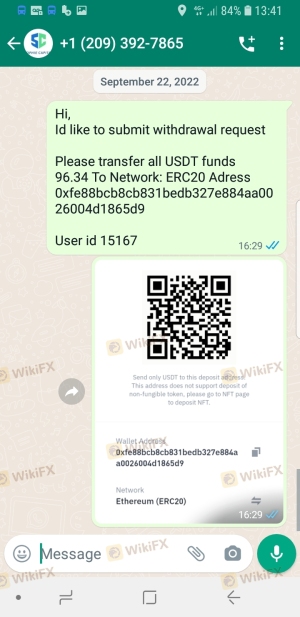

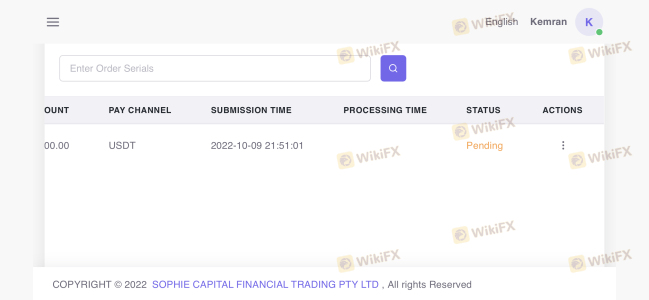

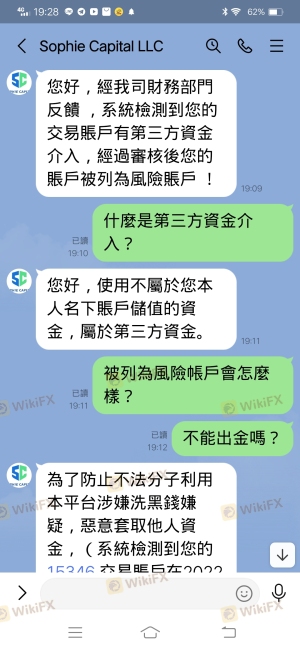

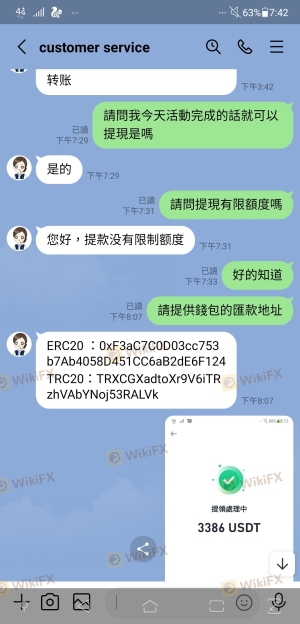

The absence of investor protection mechanisms, such as negative balance protection or compensation schemes, further jeopardizes the safety of client funds. Historical complaints and reports indicate that clients have faced challenges in withdrawing their funds, with some alleging that the broker imposes excessive fees or creates obstacles during the withdrawal process. Such practices are indicative of a potentially fraudulent operation, leading to the conclusion that investing with Sophie Capital may not be safe.

Customer Experience and Complaints

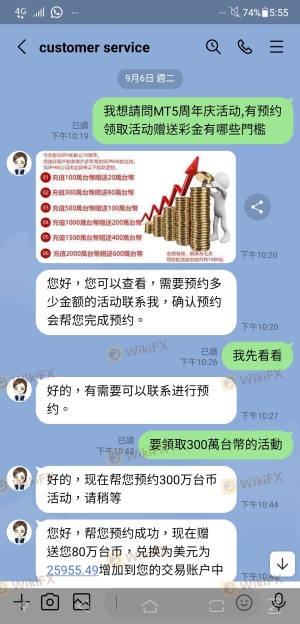

Customer feedback is invaluable in assessing a broker's reliability. Unfortunately, reviews and testimonials about Sophie Capital reveal a pattern of dissatisfaction among clients. Many users report difficulties in withdrawing their funds, with complaints indicating that the broker employs aggressive sales tactics to persuade clients to invest more money.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High-Pressure Sales Tactics | Medium | Inconsistent |

| Lack of Communication | High | Poor |

Case studies highlight instances where clients were denied access to their funds after submitting withdrawal requests, often being met with excuses or requests for additional fees. This behavior is characteristic of scam brokers, further underscoring the risks associated with trading through Sophie Capital. The broker's lack of effective customer support exacerbates the situation, leaving clients feeling vulnerable and frustrated.

Platform and Trade Execution

The trading platform offered by a broker is a critical component of the trading experience. Sophie Capital claims to provide access to the MetaTrader 5 (MT5) platform, which is widely recognized for its advanced trading features. However, reports indicate that the broker does not provide a legitimate version of the software, instead offering a demo version without proper credentials.

The execution quality of trades is another area of concern. Users have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. The absence of a reliable platform and the potential for manipulation raise serious questions about the broker's integrity and whether it is safe to trade with Sophie Capital.

Risk Assessment

Using Sophie Capital Financial Trading Pty Ltd entails several risks, primarily due to its unregulated status and questionable practices.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities |

| Fund Safety Risk | High | Lack of segregation and protection |

| Trading Condition Risk | Medium | Unclear fee structures and hidden charges |

| Customer Service Risk | High | Poor response to complaints |

To mitigate these risks, traders should conduct thorough research before committing funds, consider using regulated brokers, and remain vigilant about the potential for scams in the online trading environment.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Sophie Capital Financial Trading Pty Ltd is not a safe broker. Its lack of regulation, questionable trading conditions, and numerous customer complaints indicate that it operates more like a scam than a legitimate trading platform. Traders seeking to invest in forex should exercise extreme caution and consider alternative brokers with established regulatory oversight and positive reputations.

For those interested in safe trading experiences, consider reputable brokers regulated by authorities such as the FCA, ASIC, or NFA. These brokers provide the necessary protections and transparency that are essential for a secure trading environment. Ultimately, the risks associated with Sophie Capital far outweigh any potential benefits, making it a broker to avoid.

Is SOPHIE CAPITAL FINANCIAL TRADING PTY LTD a scam, or is it legit?

The latest exposure and evaluation content of SOPHIE CAPITAL FINANCIAL TRADING PTY LTD brokers.

SOPHIE CAPITAL FINANCIAL TRADING PTY LTD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SOPHIE CAPITAL FINANCIAL TRADING PTY LTD latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.