Executive Summary

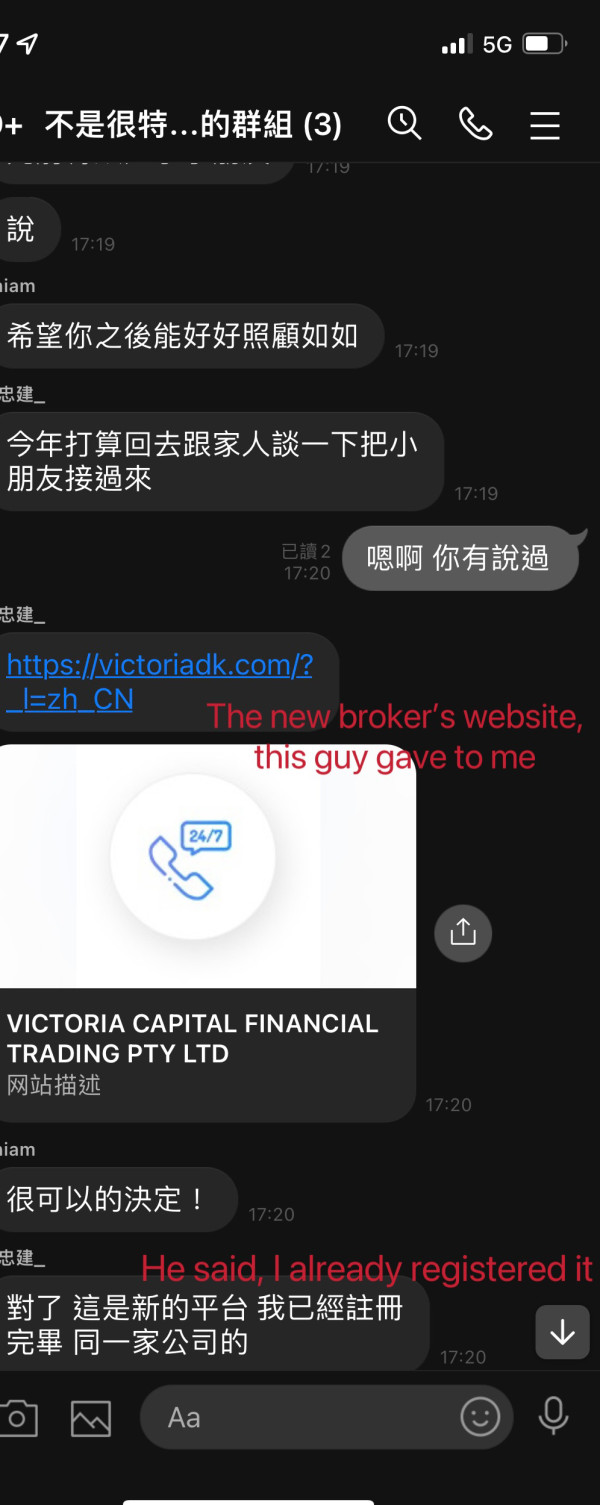

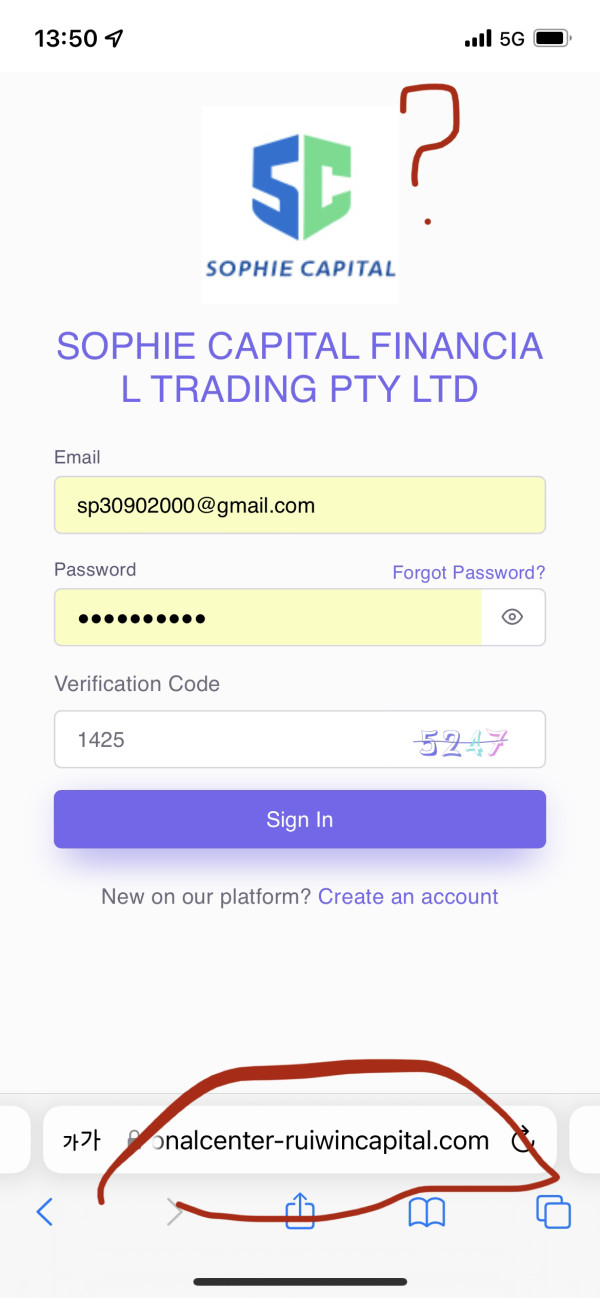

This comprehensive sophie capital financial trading pty ltd review examines a new forex broker that has attracted attention for troubling reasons. Sophie Capital Financial Trading Pty Ltd was established in 2022 and presents itself as an online trading platform offering forex, commodities, and indices trading services. Our analysis reveals major red flags that potential investors should carefully consider.

The broker requires a minimum deposit of $500 for professional accounts. It provides access to the MetaQuotes trading platform along with free demo accounts. Despite these standard features, Sophie Capital has faced many user complaints and has been flagged by multiple industry watchdogs as an unregulated broker that poses serious risks to client funds.

According to various industry reports, the company claims headquarters in both the United States and Australia. However, it fails to provide concrete regulatory information. The platform supports mobile trading and offers CFD trading options across forex, commodities, and indices, but notably excludes cryptocurrency trading. Most concerning is the pattern of user complaints suggesting difficulties with fund withdrawals and poor customer service experiences, raising serious questions about the broker's legitimacy and operational integrity.

Important Notice

This review is based on publicly available information and user feedback collected from various sources as of 2025. Sophie Capital Financial Trading Pty Ltd operates across different jurisdictions, and the legal and regulatory framework may vary significantly between regions. Potential clients should be aware that the broker's regulatory status remains unclear, with no confirmed oversight from recognized financial authorities.

Our evaluation methodology incorporates user testimonials, industry reports, and publicly disclosed information. However, this assessment may not reflect the complete experience of all users, and individual experiences may vary. We strongly recommend conducting independent research and consulting with financial advisors before making any investment decisions with this broker.

Rating Framework

Broker Overview

Sophie Capital Financial Trading Pty Ltd entered the online trading market in 2022. The company positions itself as a multi-asset broker serving clients interested in forex, commodities, and indices trading. The company claims to operate from headquarters in both the United States and Australia, though the exact nature of these operations and their regulatory compliance remains unclear from available documentation.

The broker's business model centers on providing online trading services through the MetaQuotes platform. This platform is widely recognized in the industry. Sophie Capital offers access to major forex pairs, commodity markets, and various indices, targeting retail traders seeking exposure to these financial instruments. The platform emphasizes accessibility through mobile trading capabilities and provides demo accounts for prospective clients to test their services.

However, this sophie capital financial trading pty ltd review must highlight significant concerns about the broker's operational transparency and regulatory compliance. Multiple industry sources have raised questions about the company's legitimacy, with some reports suggesting that Sophie Capital operates without proper regulatory oversight. The broker's recent establishment in 2022, combined with the absence of clear regulatory information, creates substantial uncertainty about its long-term viability and client fund security.

The trading environment offered by Sophie Capital includes CFD trading options. These allow clients to speculate on price movements without owning underlying assets. While this approach can provide opportunities for profit in both rising and falling markets, it also introduces additional risks, particularly when dealing with an unregulated broker that lacks transparent operational procedures.

Regulatory Status: Information regarding specific regulatory oversight remains unavailable in public documentation. This absence of clear regulatory information represents a significant concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods has not been detailed in available sources. This creates uncertainty about fund transfer procedures and potential restrictions.

Minimum Deposit Requirements: Sophie Capital requires a minimum deposit of $500 for professional accounts. This may be considered relatively high for entry-level traders compared to some industry competitors.

Bonus and Promotional Offers: While some sources indicate the availability of deposit bonuses, specific details about promotional terms and conditions are not readily available in public documentation.

Available Trading Assets: The broker provides access to forex pairs, commodities, and indices. Notably, cryptocurrency trading is not supported on the platform, limiting options for traders interested in digital asset markets.

Cost Structure: Detailed information about spreads, commissions, and other trading costs remains unclear from available sources. This makes it difficult for potential clients to accurately assess the total cost of trading.

Leverage Ratios: Specific leverage information has not been disclosed in available documentation. This prevents accurate assessment of risk management parameters.

Platform Options: Sophie Capital utilizes the MetaQuotes platform and supports mobile trading. This provides traders with familiar interface options and mobile accessibility.

Geographic Restrictions: Information about specific geographic restrictions or client acceptance policies is not detailed in available sources.

Customer Service Languages: Details about supported languages for customer service have not been specified in available documentation.

This sophie capital financial trading pty ltd review emphasizes the concerning lack of transparency in many critical operational areas. Potential clients would typically expect to understand these areas before opening trading accounts.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Sophie Capital's account conditions present a mixed picture with several concerning gaps in transparency. The broker offers professional accounts with a $500 minimum deposit requirement, which positions it in the mid-range category compared to industry standards. However, the lack of detailed information about different account types, their specific features, and associated benefits creates uncertainty for potential clients.

The absence of Islamic account options limits accessibility for Muslim traders who require Sharia-compliant trading conditions. Additionally, the account opening process details remain unclear, with no specific information about required documentation, verification procedures, or timeline expectations. This lack of transparency extends to account maintenance requirements, potential fees, and upgrade procedures.

User feedback suggests frustration with account-related policies and procedures. However, specific details about these issues are limited. The professional account minimum deposit of $500 may be prohibitive for novice traders seeking to start with smaller amounts, particularly given the questionable regulatory status of the broker.

The sophie capital financial trading pty ltd review data indicates that account conditions lack the comprehensive structure and transparency typically expected from established, regulated brokers. This contributes to overall concerns about the platform's legitimacy and client-focused approach.

Sophie Capital provides access to the MetaQuotes trading platform. This is a recognized and widely-used platform in the forex industry. This choice offers traders familiar charting tools, technical indicators, and order management capabilities that many experienced traders expect. The platform's mobile compatibility adds convenience for traders who need to monitor positions and execute trades while away from their computers.

However, the broker's offering appears limited beyond the basic platform access. Available sources do not indicate comprehensive research resources, market analysis, or educational materials that would support trader development and informed decision-making. The absence of detailed information about advanced trading tools, automated trading support, or specialized analytical resources suggests a relatively basic service offering.

The provision of free demo accounts represents a positive feature. This allows potential clients to test the platform and trading conditions before committing real funds. This is particularly important given the concerns about the broker's regulatory status and operational transparency.

User feedback regarding trading tools and resources appears limited. This possibly indicates either low user engagement or restricted access to advanced features. The lack of detailed tool descriptions and capabilities in available documentation further limits the ability to assess the true value proposition of Sophie Capital's technological offerings.

Customer Service and Support Analysis (Score: 3/10)

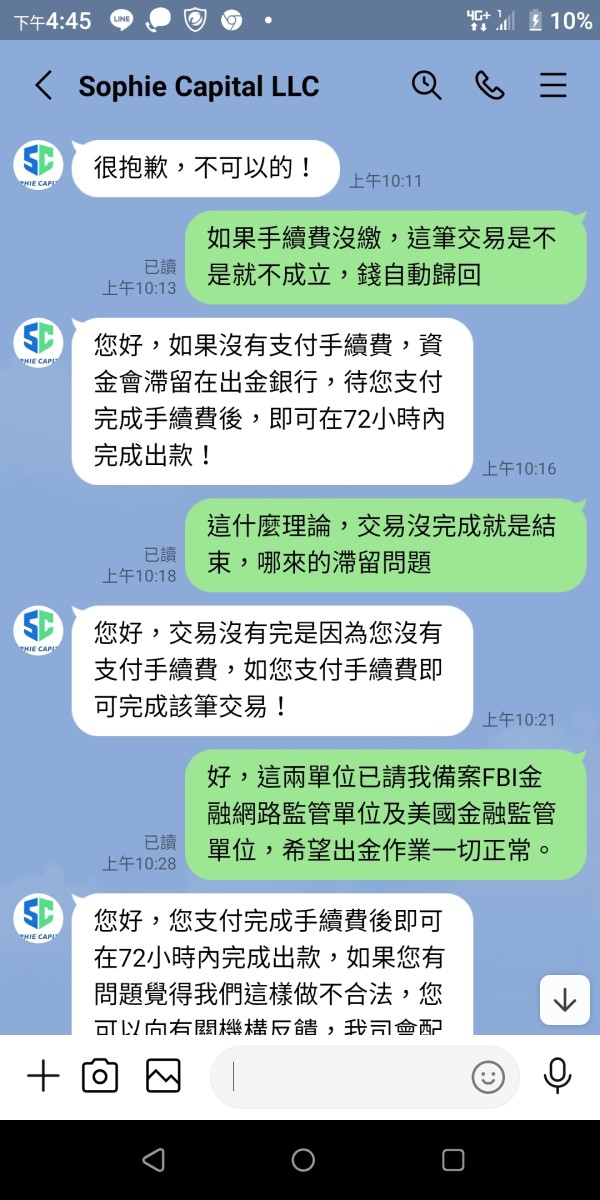

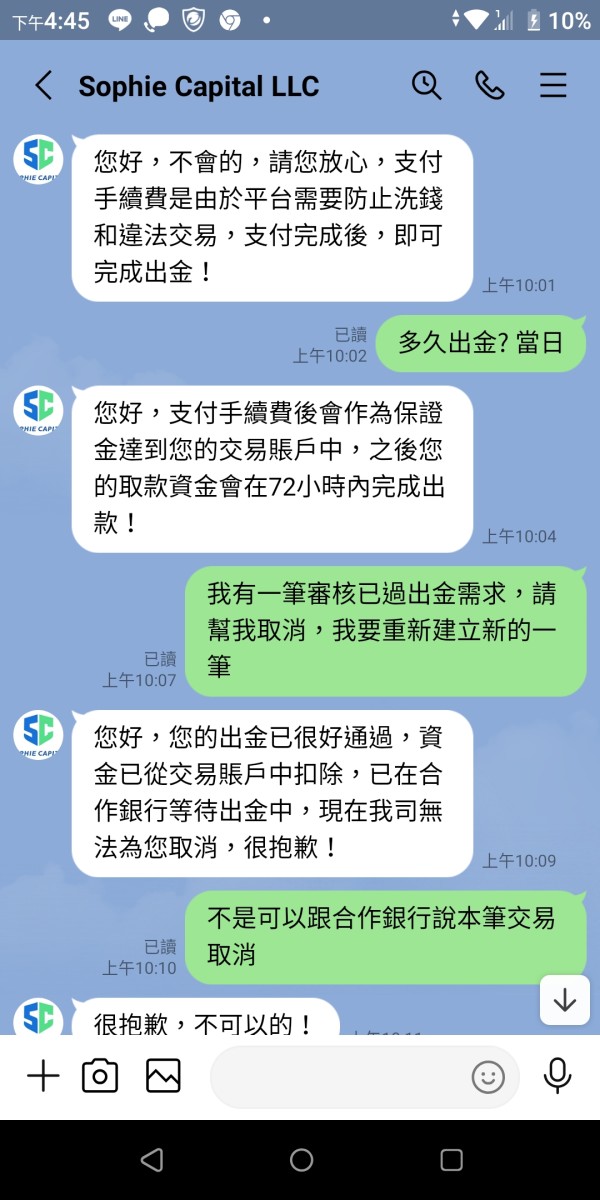

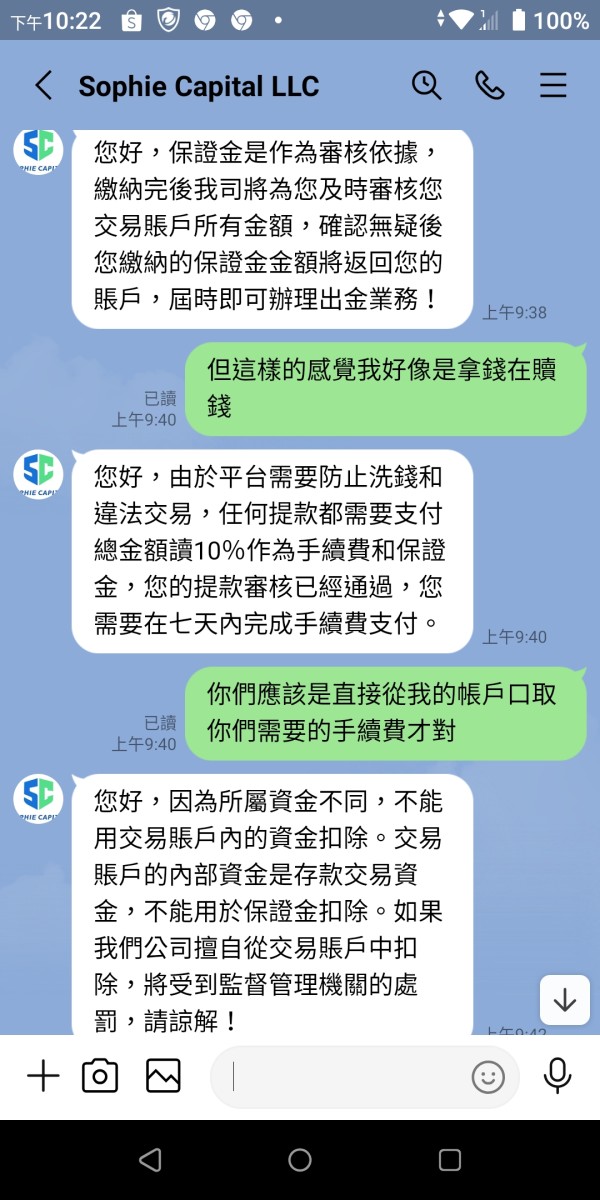

Customer service represents one of the most concerning aspects of Sophie Capital's operations based on available user feedback and documentation gaps. Multiple sources indicate significant issues with customer support responsiveness, professionalism, and problem resolution capabilities. Users have reported difficulties in reaching customer service representatives and receiving timely responses to urgent inquiries.

The lack of detailed information about customer service channels, operating hours, and supported languages creates additional uncertainty about support accessibility. Standard industry practices typically include multiple contact methods such as phone, email, live chat, and potentially social media support, but Sophie Capital's specific offerings in this area remain unclear.

Response time issues appear to be a recurring complaint among users. Some reports suggest extended delays in addressing account-related problems and withdrawal requests. The quality of support when contact is established has also been questioned, with users expressing dissatisfaction with the level of expertise and helpfulness provided by support staff.

The absence of comprehensive FAQ sections, help documentation, or self-service resources further compounds customer service limitations. Professional brokers typically provide extensive educational and support materials to help clients navigate platform features and resolve common issues independently.

Trading Experience Analysis (Score: 4/10)

The trading experience with Sophie Capital presents several areas of concern based on user feedback and platform limitations. While the MetaQuotes platform provides a familiar trading environment, users have reported issues with platform stability, execution quality, and overall trading conditions that impact their ability to trade effectively.

Execution quality complaints include reports of slippage, requotes, and delays in order processing. These issues can significantly impact trading profitability and strategy implementation. These issues are particularly concerning for active traders who rely on precise timing and accurate order execution for their trading success.

Platform stability appears to be another area of concern. Some users experience connectivity issues and platform downtime that prevents access to positions and market opportunities. The mobile trading experience, while available, lacks detailed user feedback about functionality and reliability compared to desktop platform access.

The absence of detailed information about trading conditions, including spreads, overnight fees, and execution policies, makes it difficult for traders to accurately assess the true cost and feasibility of their trading strategies. This sophie capital financial trading pty ltd review highlights that transparency in trading conditions is essential for informed decision-making, yet Sophie Capital appears to fall short in this area.

Trust and Reliability Analysis (Score: 2/10)

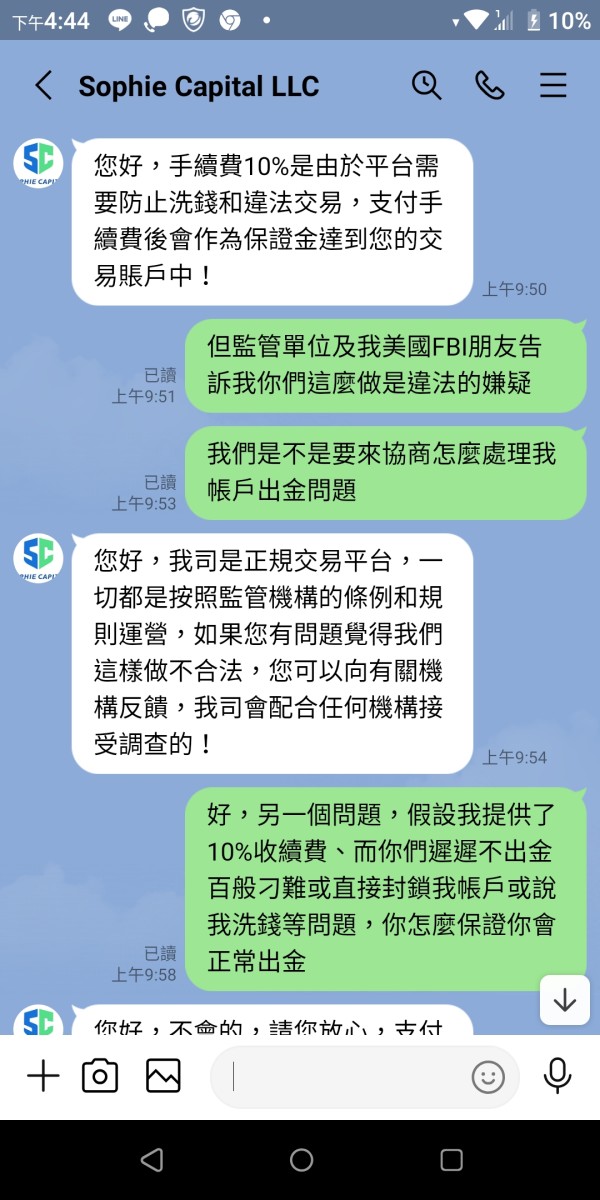

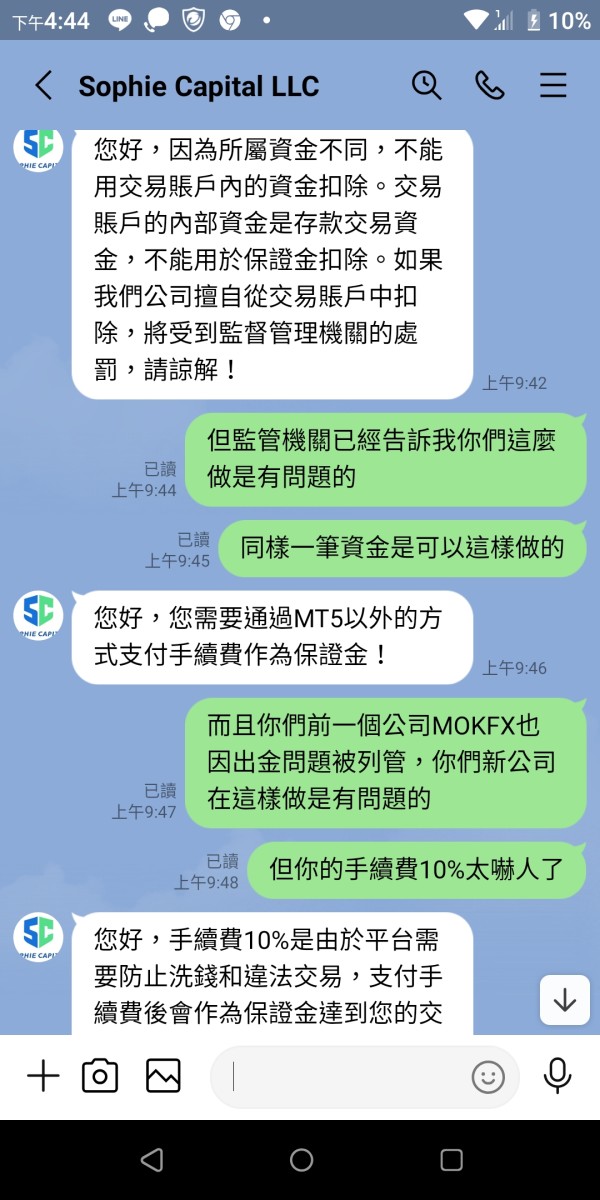

Trust and reliability represent the most significant concerns in this Sophie Capital evaluation. The broker's lack of clear regulatory oversight creates fundamental questions about client fund safety and operational legitimacy. Regulated brokers are required to maintain client funds in segregated accounts and provide various protections, but Sophie Capital's unregulated status means these safeguards may not exist.

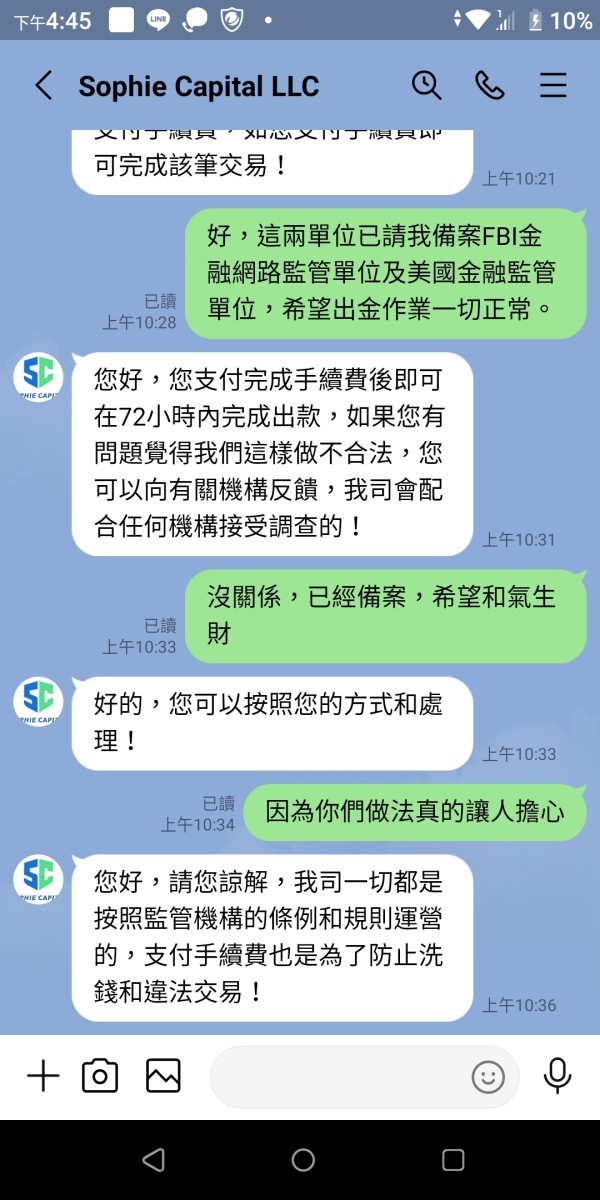

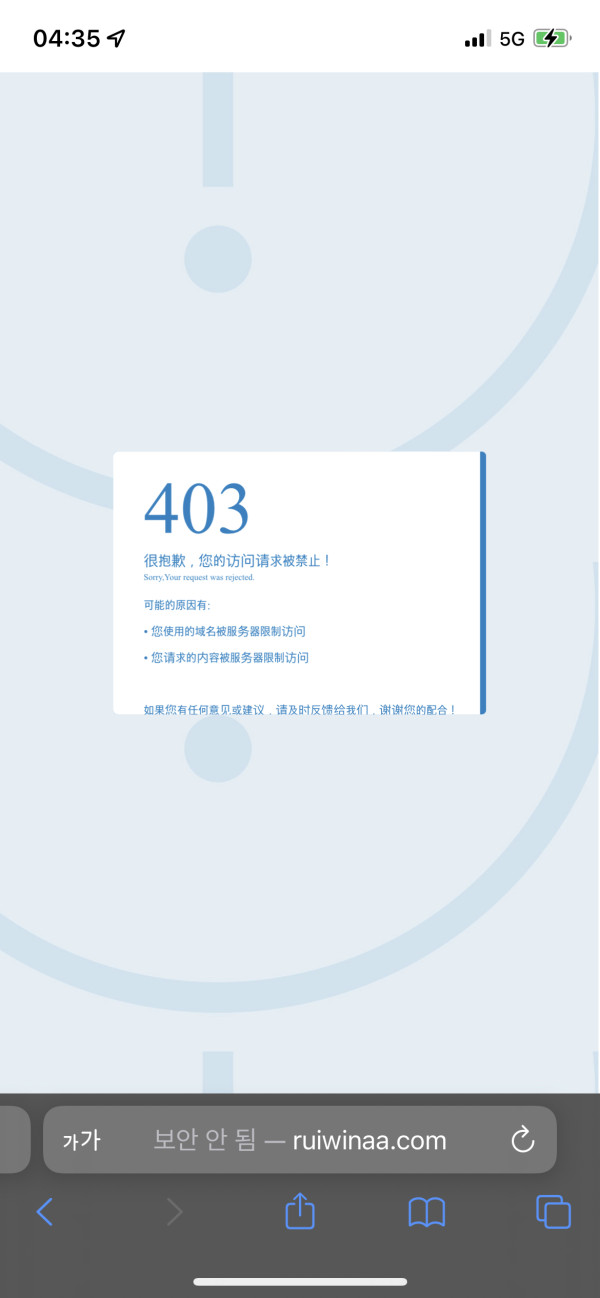

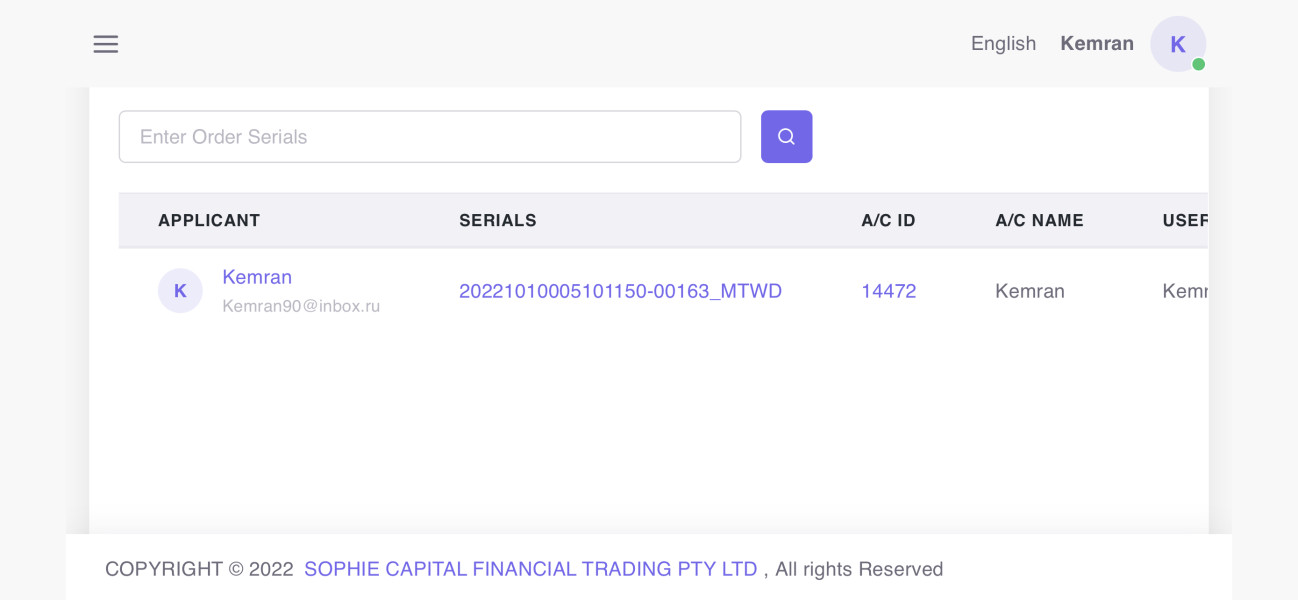

The absence of transparent financial reporting, management information, and regulatory compliance documentation further undermines confidence in the broker's operations. Industry reports have specifically flagged Sophie Capital as an unregulated broker, with some sources describing it as having "vanished" and left clients unable to access their funds.

Company transparency issues extend beyond regulatory concerns to include unclear business practices, limited operational information, and inadequate disclosure of potential risks and conflicts of interest. The broker's relatively recent establishment in 2022, combined with these transparency issues, creates a high-risk profile for potential clients.

Third-party industry evaluations have been predominantly negative. Multiple sources warn against engaging with Sophie Capital due to regulatory and operational concerns. The pattern of user complaints about fund access and withdrawal difficulties provides additional evidence supporting these trust and reliability concerns.

User Experience Analysis (Score: 3/10)

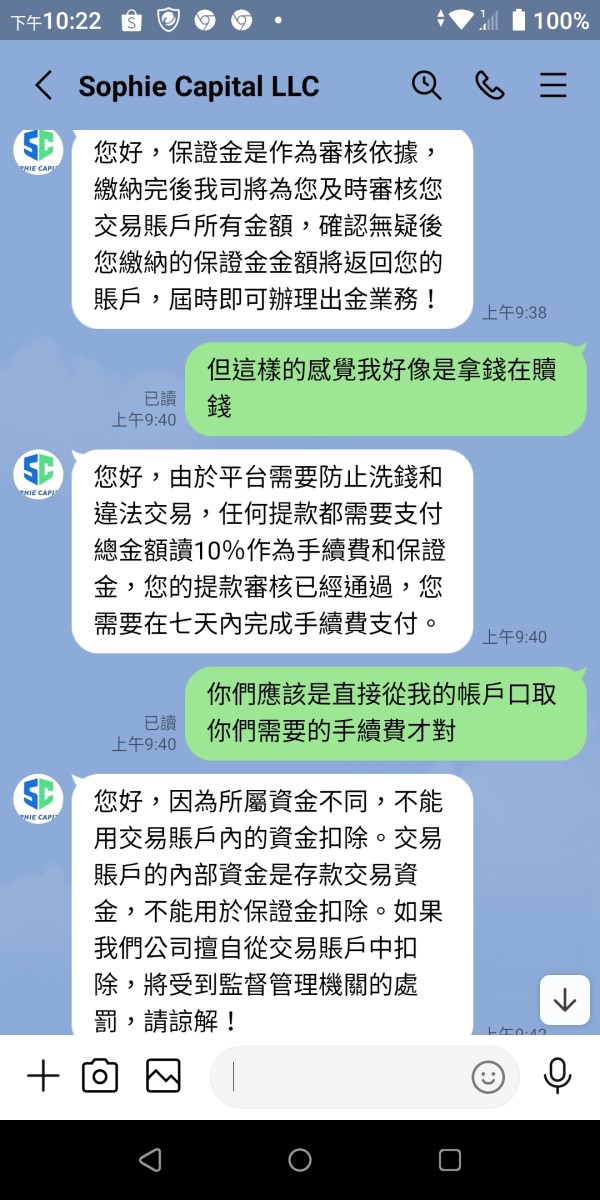

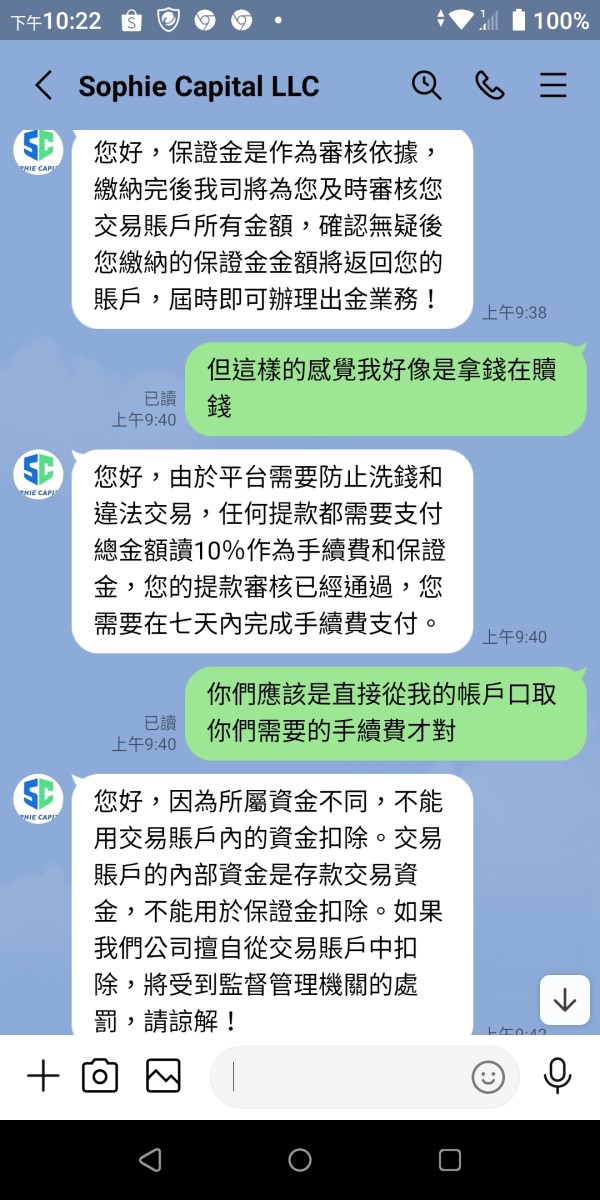

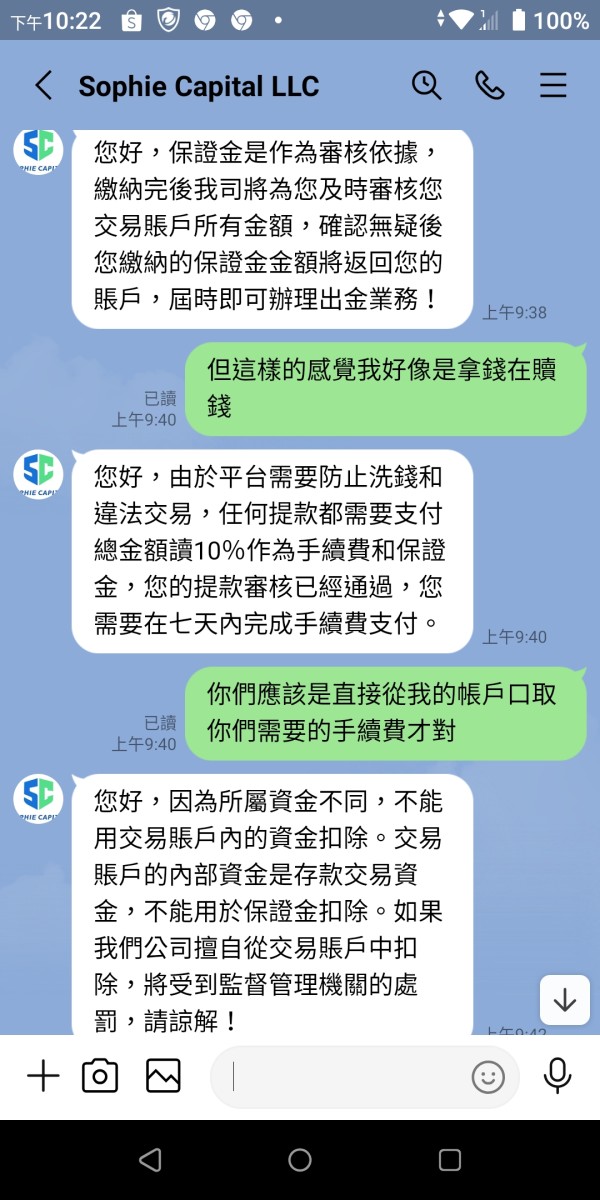

Overall user satisfaction with Sophie Capital appears significantly below industry standards based on available feedback and reviews. The predominance of negative user experiences suggests systemic issues with the broker's service delivery and client relationship management. Common complaints focus on customer service quality, trading platform issues, and difficulties with account management and fund withdrawal processes.

The user interface and platform usability, while benefiting from the familiar MetaQuotes environment, appears to suffer from implementation and support issues that impact the overall user experience. Registration and account verification processes lack clear documentation about requirements and timelines, creating frustration for new clients attempting to begin trading.

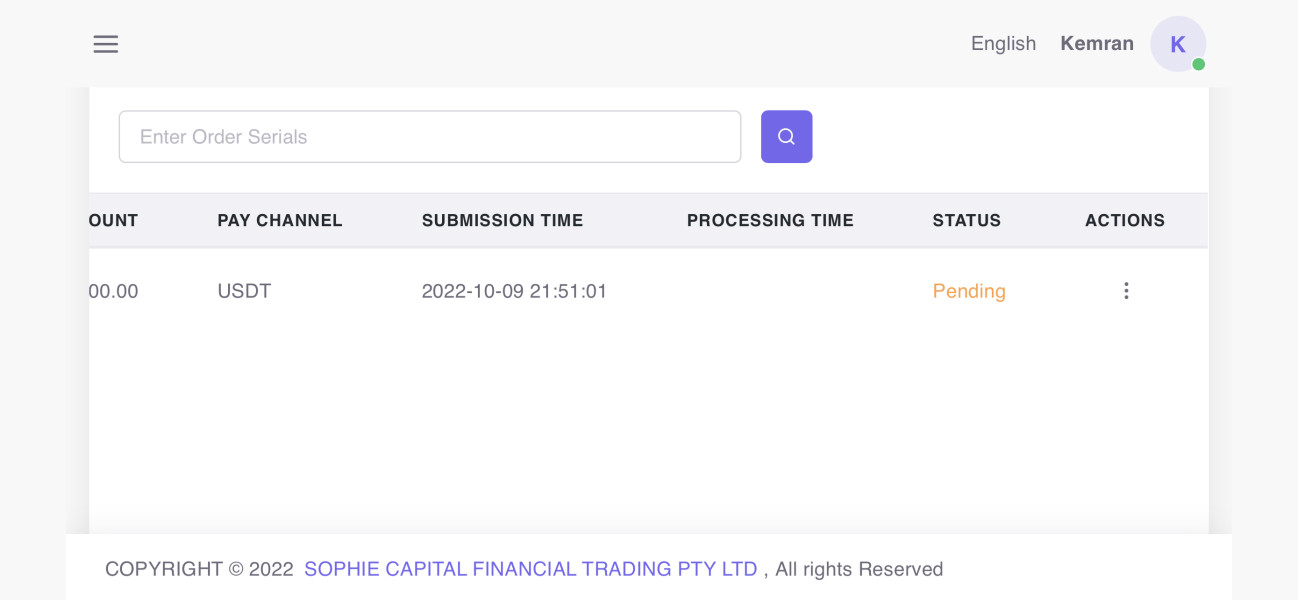

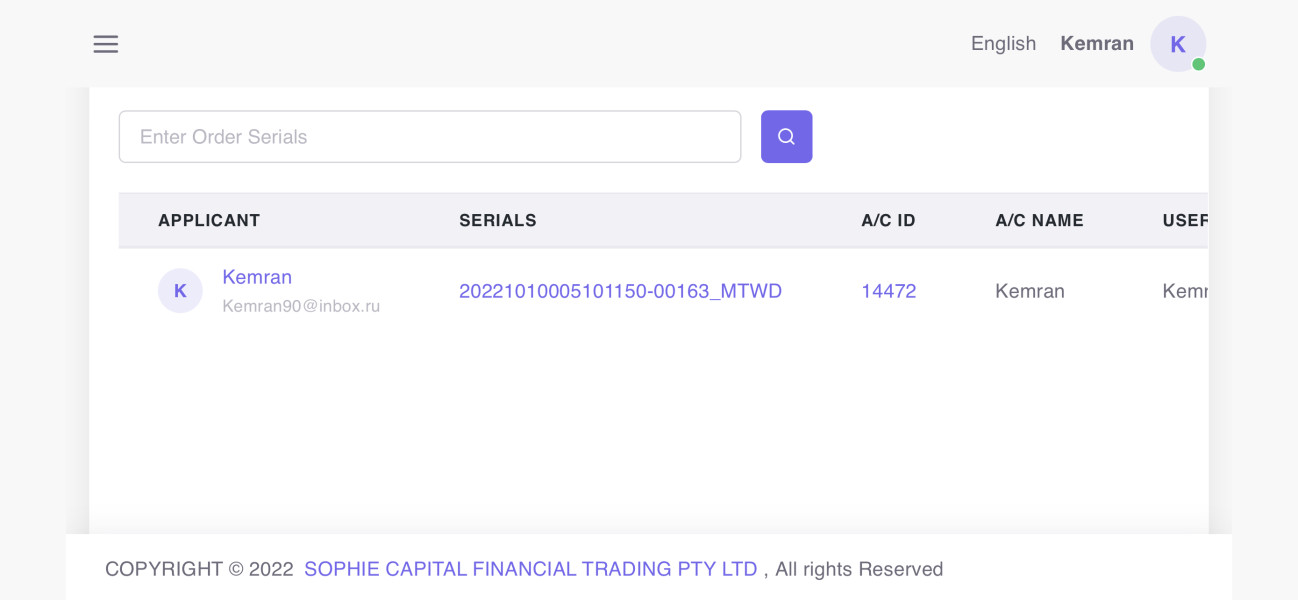

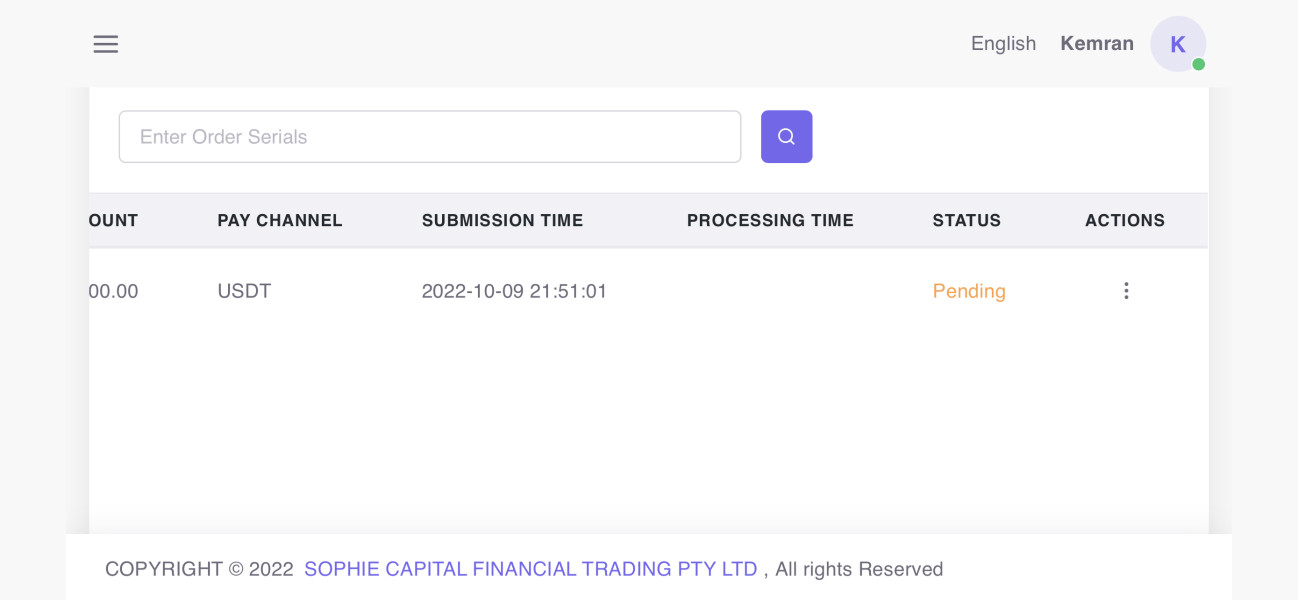

Fund operation experiences represent a particular area of user dissatisfaction. Reports suggest difficulties in both depositing and withdrawing funds. These issues are especially concerning as they directly impact clients' ability to access their own money and profits from trading activities.

The demographic analysis suggests that Sophie Capital may be unsuitable for risk-averse investors or those seeking reliable, long-term trading relationships. The pattern of user complaints and negative feedback indicates that even risk-tolerant traders should exercise extreme caution when considering this broker.

Conclusion

This comprehensive sophie capital financial trading pty ltd review reveals a broker with substantial red flags that significantly outweigh any potential benefits. While Sophie Capital offers some standard features such as MetaQuotes platform access and relatively accessible minimum deposits, the fundamental concerns about regulatory compliance, operational transparency, and user satisfaction create an unacceptable risk profile for most traders.

The broker appears unsuitable for conservative investors, beginner traders, or anyone prioritizing fund safety and reliable customer service. Even experienced traders comfortable with higher risk levels should seriously consider the documented issues with fund access and withdrawal difficulties before engaging with this platform.

The primary advantages include access to a recognized trading platform and demo account availability. However, these benefits are overshadowed by significant disadvantages including lack of regulatory oversight, poor customer service, questionable fund security, and widespread negative user feedback. Based on this analysis, we recommend exploring well-regulated alternatives that provide greater transparency, client protection, and operational reliability.