Regarding the legitimacy of SHENG BAO forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is SHENG BAO safe?

Pros

Cons

Is SHENG BAO markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Fortrade Limited

Effective Date:

2014-04-17Email Address of Licensed Institution:

compliance.uk@fortrade.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fortrade.comExpiration Time:

--Address of Licensed Institution:

Michelin House 81 Fulham Road London SW3 6RD UNITED KINGDOMPhone Number of Licensed Institution:

+442077102700Licensed Institution Certified Documents:

Is Sheng Bao Safe or Scam?

Introduction

Sheng Bao, a forex broker, has been gaining attention in the trading community for its offerings in the foreign exchange market. As with any financial service provider, it is crucial for traders to carefully evaluate the credibility and reliability of such brokers before committing their funds. With the rise of online trading, the forex industry has seen a surge in both legitimate and fraudulent brokers, making it imperative for traders to be vigilant. This article aims to provide an objective analysis of Sheng Bao, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation utilizes data from various reputable sources, including regulatory bodies and user reviews, to assess whether Sheng Bao is safe or a scam.

Regulation and Legitimacy

The regulatory environment is a key factor in determining a broker's trustworthiness. A broker that operates under strict regulations is more likely to adhere to best practices and protect clients' interests. Sheng Bao claims to be regulated, but the scrutiny reveals a more complex picture.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 609970 | United Kingdom | Suspicious Clone |

The above table illustrates that while Sheng Bao operates under a license from the FCA, it has been flagged as a suspicious clone. This raises significant concerns about its legitimacy. The FCA is known for its stringent regulatory standards; however, the classification of Sheng Bao as a suspicious clone suggests that it may not be operating in compliance with these standards. The lack of a solid regulatory framework can expose traders to higher risks, making it crucial to question whether Sheng Bao is safe.

Company Background Investigation

Sheng Bao's history and ownership structure provide further insight into its operational integrity. Established approximately 5 to 10 years ago, the company claims to have a solid foundation in the forex market. However, the details surrounding its ownership and management team are somewhat opaque.

The management team is critical in establishing a company's credibility. Unfortunately, information regarding the qualifications and professional backgrounds of the management team at Sheng Bao is either scarce or unverified. This lack of transparency can be a red flag for potential investors. A broker that is unwilling to disclose key information about its management may not have the best interests of its clients at heart. Thus, when assessing if Sheng Bao is safe, it is essential to consider the company's transparency and the experience of its leadership.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for traders looking to maximize their investments. Sheng Bao offers various trading options, but the fee structure warrants careful examination.

Trading Costs Comparison

| Fee Type | Sheng Bao | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The above table indicates that specific trading costs are yet to be determined. However, anecdotal evidence suggests that traders have encountered unexpected fees and high spreads, which can significantly impact profitability. Traders should be wary of any broker that lacks clarity in its fee structure, as this can lead to hidden costs that may compromise their trading experience. Therefore, it is crucial to consider whether Sheng Bao is safe based on its fee transparency and overall trading conditions.

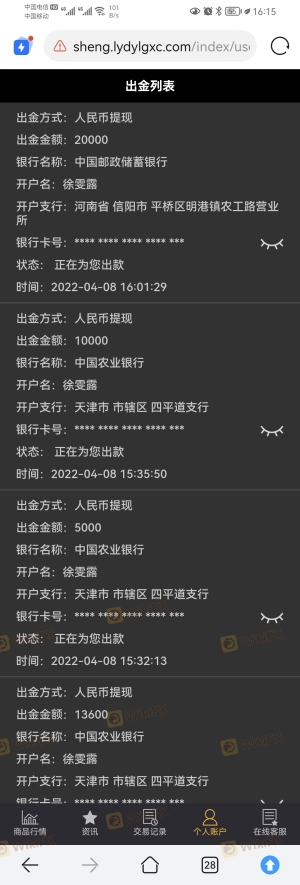

Client Funds Security

The security of client funds is paramount in the forex trading industry. Brokers are expected to implement robust measures to protect traders' investments. Sheng Bao claims to have several security protocols in place, but a deeper dive into these measures reveals potential vulnerabilities.

Sheng Bao's approach to fund security includes segregating client accounts and offering negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status. Traders should be cautious, as the absence of a credible regulatory framework can lead to a lack of accountability in fund management. Historical data on fund security issues related to Sheng Bao is limited, but the potential for risk remains high. Thus, when pondering if Sheng Bao is safe, the evaluation of fund security measures is critical.

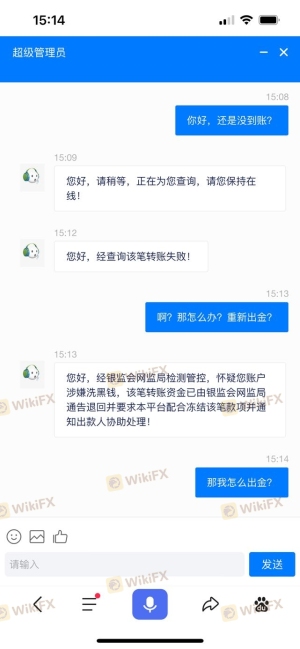

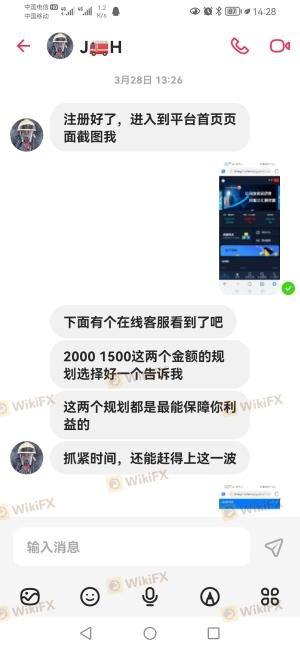

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing a broker's reliability. User reviews of Sheng Bao present a mixed picture, with some traders reporting positive experiences, while others express significant concerns.

Common Complaints Overview

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| High Fees | Medium | Lacks Transparency |

| Poor Customer Support | High | Inconsistent |

The table above summarizes prevalent complaints against Sheng Bao, highlighting withdrawal issues as a significant concern. Many users have reported difficulties in accessing their funds, which raises red flags about the broker's reliability. A broker that fails to address withdrawal requests promptly can be seen as untrustworthy, leading to the question of whether Sheng Bao is safe for traders.

Platform and Execution

The performance of a trading platform directly impacts the trading experience. Sheng Bao offers a trading platform that is user-friendly, but the execution quality and reliability require scrutiny.

Traders have reported instances of slippage and rejected orders, which can be detrimental in a fast-paced trading environment. These issues can indicate potential manipulation or inefficiencies within the trading system. A broker that cannot ensure timely order execution may not be acting in the best interests of its clients. This leads to further concerns about if Sheng Bao is safe for traders seeking reliable execution.

Risk Assessment

Using Sheng Bao comes with inherent risks that need to be carefully weighed.

Risk Assessment Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone status raises concerns. |

| Fund Security | Medium | Segregated accounts but lacks robust oversight. |

| Customer Support | High | Numerous complaints about withdrawal issues. |

The risk assessment table highlights the significant risks associated with trading with Sheng Bao. Traders should consider these risks carefully and implement strategies to mitigate them, such as starting with a small investment or seeking alternatives.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sheng Bao may not be a safe option for traders. The broker's suspicious regulatory status, mixed customer experiences, and potential issues with fund security raise significant concerns. Traders should exercise caution and consider more reputable alternatives with established regulatory oversight. For those still interested in forex trading, it is advisable to seek brokers that are regulated by top-tier authorities to ensure a safer trading environment. Always conduct thorough research and due diligence before investing with any broker, including whether Sheng Bao is safe.

Is SHENG BAO a scam, or is it legit?

The latest exposure and evaluation content of SHENG BAO brokers.

SHENG BAO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SHENG BAO latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.