Is SHD safe?

Pros

Cons

Is SHD Safe or Scam?

Introduction

SHD is a relatively new player in the forex trading market, having been established in 2021 and operating primarily out of Hong Kong. As the foreign exchange market continues to grow, it becomes increasingly crucial for traders to carefully evaluate the safety and legitimacy of brokers like SHD. With numerous platforms available, the risk of falling victim to scams is ever-present. This article aims to provide a comprehensive assessment of SHD by investigating its regulatory background, company history, trading conditions, client experiences, and overall safety. Our evaluation is based on data collected from various reputable sources, including user reviews, regulatory bodies, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its trustworthiness. Brokers that operate under strict regulatory oversight are generally considered safer for traders. In the case of SHD, it is essential to examine its regulatory affiliations and the quality of oversight it receives.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001293841 | Australia | Suspicious clone |

| N/A | N/A | N/A | N/A |

SHD claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, various reports indicate that SHD may be operating as a suspicious clone of a legitimate broker. The term "suspicious clone" refers to brokers that impersonate regulated entities to mislead traders. This raises significant concerns about the authenticity of SHD's claims. Furthermore, the lack of a solid regulatory framework can expose traders to higher risks, including potential fraud and loss of funds.

Company Background Investigation

Understanding a broker's company history and ownership structure is vital for assessing its credibility. SHD is operated by Starhonor Development Limited, a company registered in Hong Kong. Despite its recent establishment, the company has already garnered a negative reputation among users.

The management team behind SHD lacks transparency, and there is limited information available regarding their professional experience and qualifications. This opacity can be a red flag for potential investors, as a reputable broker should ideally provide clear information about its leadership and operational structure.

Moreover, the company has received numerous complaints regarding its operations, further complicating its credibility. A lack of transparency and a questionable management background can significantly affect a broker's reliability and, consequently, the safety of its clients' funds.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience. SHD's fee structure and trading conditions warrant careful consideration. While the broker claims to provide competitive spreads and a variety of trading instruments, user reviews often highlight hidden fees and unfavorable trading conditions.

| Fee Type | SHD | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | Unknown | $0-$10 per trade |

| Overnight Interest Range | High | Low to Moderate |

Traders have reported facing issues with withdrawal processes and hidden charges that diminish their profits. Such practices are often indicative of less-than-reputable brokers, which raises the question: Is SHD safe for trading? The potential for unexpected costs and the lack of clarity in their fees could deter many traders from engaging with this broker.

Client Funds Security

The security of client funds is a paramount concern for any trader. SHD's approach to safeguarding client funds deserves scrutiny. A trustworthy broker should implement robust measures for fund protection, such as segregating client accounts and offering investor protection schemes.

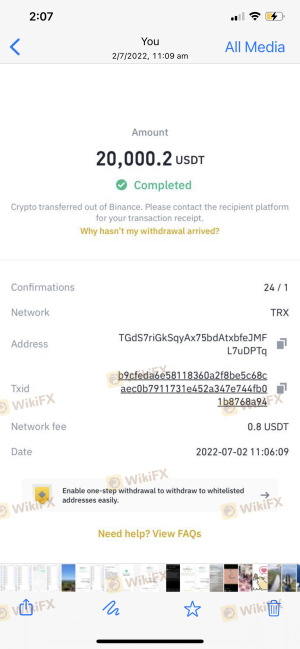

Unfortunately, there is little information available regarding SHD's fund security practices. Reports suggest that clients have experienced issues with fund withdrawals, raising concerns about the broker's ability to manage client funds responsibly. The absence of transparent policies regarding fund protection can lead to significant risks for traders, making it essential to question Is SHD safe for your investments?

Client Experience and Complaints

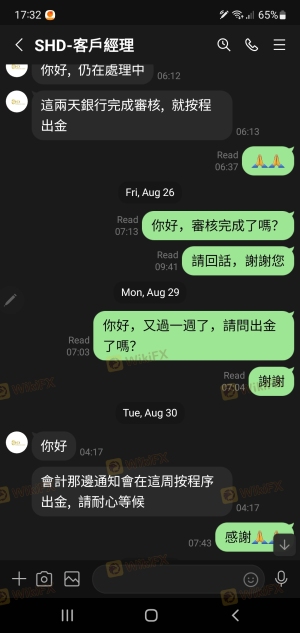

Client feedback is a crucial indicator of a broker's reliability. In the case of SHD, numerous complaints have surfaced across various platforms, highlighting a pattern of negative experiences. Common issues include withdrawal difficulties, lack of customer support, and high-pressure sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Hidden Fees | Medium | Average |

| Customer Support | High | Poor |

For instance, several users have reported that after requesting withdrawals, their accounts were suddenly inaccessible, leading to fears of potential fraud. Such incidents raise significant concerns about the broker's operational integrity and its commitment to customer service. This leads us to ask again, Is SHD safe for traders looking for a reliable platform?

Platform and Trade Execution

The trading platform's performance is another critical aspect of a broker's overall reliability. SHD claims to offer a user-friendly trading platform, but user experiences indicate potential issues with execution quality. Traders have reported instances of slippage and rejected orders, which can significantly affect trading outcomes.

The quality of order execution is vital for traders, particularly in a fast-paced market like forex. If a broker fails to provide consistent execution, it can lead to substantial financial losses. Therefore, assessing whether Is SHD safe involves considering the execution quality and reliability of the trading platform.

Risk Assessment

Using SHD as a trading platform comes with inherent risks, primarily stemming from its regulatory standing and user complaints.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated or suspicious clone status. |

| Financial Risk | Medium | Potential for hidden fees and withdrawal issues. |

| Operational Risk | High | History of negative user experiences and complaints. |

To mitigate these risks, traders should conduct thorough research, consider diversifying their investments, and avoid investing more than they can afford to lose.

Conclusion and Recommendation

In conclusion, the investigation into SHD raises several red flags that suggest it may not be a safe option for traders. The lack of robust regulatory oversight, combined with numerous complaints regarding withdrawal issues and hidden fees, leads to serious concerns about the broker's legitimacy. Therefore, it is crucial to approach SHD with caution.

For traders seeking reliable alternatives, it may be advisable to consider brokers that are regulated by reputable authorities, have transparent fee structures, and maintain positive user feedback. Ultimately, ensuring the safety of your investments should be a top priority, and careful evaluation of brokers like SHD is essential in making informed trading decisions.

Is SHD a scam, or is it legit?

The latest exposure and evaluation content of SHD brokers.

SHD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SHD latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.