Regarding the legitimacy of SEC Limited forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is SEC Limited safe?

Business

License

Is SEC Limited markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Stone Edge Capital Ltd

Effective Date:

2016-08-09Email Address of Licensed Institution:

reception@stedcap.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.stedcap.com/Expiration Time:

--Address of Licensed Institution:

85, Michail Zavou, 1st Floor, Agios Athanasios, CY-4107 Limassol, Michail Zavou, 85, 1st floor, Agios Athanasios, 4107, Limassol, CyprusPhone Number of Licensed Institution:

35725728708Licensed Institution Certified Documents:

Is Sec Limited Safe or a Scam?

Introduction

Sec Limited is an emerging player in the forex market, primarily catering to retail traders seeking access to global financial markets. As the forex trading landscape becomes increasingly crowded, traders must exercise caution and thoroughly evaluate their brokers before committing their funds. The potential for scams and unregulated brokers is significant, which can lead to financial losses for unsuspecting traders. This article aims to investigate whether Sec Limited is a safe trading option or if it raises red flags that warrant concern. Our assessment will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer feedback, and risk factors associated with using Sec Limited.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for determining its legitimacy and safety. Sec Limited's regulatory status is a key area of concern. An unregulated broker poses significant risks to traders, including the potential for fraud and lack of recourse in the event of disputes.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

Currently, Sec Limited operates without oversight from any recognized financial authority. This absence of regulation is alarming, as it implies that the broker is not held to the standards set by authoritative bodies that protect traders' interests. The lack of regulatory oversight raises questions about the broker's operational practices and financial stability. Furthermore, without a regulatory framework, traders have limited recourse in the event of disputes or financial mishaps. The historical compliance of Sec Limited is also under scrutiny, as there are no records of adherence to industry standards, which further complicates its credibility.

Company Background Investigation

Sec Limited's history and ownership structure provide insight into its operational integrity. The company was founded recently, and little information is available regarding its founders or management team. A lack of transparency in a broker's background can be a red flag for potential investors.

The management teams qualifications and experience are critical in evaluating the broker's reliability. However, Sec Limited does not provide sufficient information regarding its leadership or their professional backgrounds, which raises concerns about the broker's expertise and commitment to ethical trading practices. Transparency in operations and clear information about company ownership are essential for building trust with clients. The absence of this information can lead to skepticism among potential traders.

Trading Conditions Analysis

Understanding the trading conditions offered by Sec Limited is vital for assessing its overall value proposition. A broker's fee structure and trading policies can significantly impact a trader's profitability.

| Fee Type | Sec Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 2.5% | 1.5% |

Sec Limited's spreads are notably higher than the industry average, which could erode potential profits for traders. Additionally, the absence of a commission model raises questions about how the broker generates revenue, potentially leading to hidden fees or unfavorable trading conditions. Traders should be wary of any unusual fee structures that could indicate a lack of transparency or ethical practices. Overall, the trading conditions at Sec Limited do not appear competitive when compared to established brokers in the market.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Sec Limited's measures for safeguarding funds are critical in determining whether it is a safe broker.

The broker does not provide clear information about its policies regarding fund segregation, investor protection, or negative balance protection. These are essential features that reputable brokers typically offer to ensure that clients' investments are secure. The lack of disclosure on these matters raises significant concerns about the safety of funds deposited with Sec Limited. Furthermore, there have been no documented incidents of fund security breaches or disputes, but the absence of a regulatory body means that traders have little recourse if issues arise.

Customer Experience and Complaints

Examining customer feedback and complaints is crucial for understanding the overall client experience with Sec Limited.

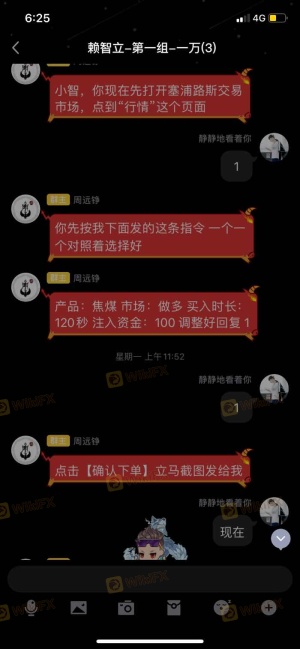

Many users have expressed concerns regarding the broker's customer service and responsiveness to issues. Common complaints include delays in withdrawals, lack of communication, and difficulty in resolving disputes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Fair |

| Lack of Transparency | High | Poor |

Two notable cases involve traders who reported significant delays in accessing their funds, leading to frustration and financial loss. Such patterns of complaints may indicate systemic issues within the broker's operations and raise questions about its commitment to customer satisfaction.

Platform and Trade Execution

The performance and reliability of the trading platform are essential for a smooth trading experience. Sec Limited offers a standard trading platform, but user reviews suggest mixed experiences.

Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes. Without reliable execution, traders face increased risks and potential losses. Moreover, any signs of platform manipulation could indicate deeper issues within the broker's operations.

Risk Assessment

Using Sec Limited comes with inherent risks that traders must consider before opening an account.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | Medium | Lack of transparency |

| Operational Risk | High | Poor customer service |

To mitigate these risks, traders should conduct thorough research, consider using a demo account, and remain vigilant about their trading activities.

Conclusion and Recommendations

In conclusion, the investigation into Sec Limited raises significant concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with a lack of transparency in its operations, suggests that traders should exercise extreme caution. While there are no definitive signs of fraud, the broker's practices warrant scrutiny.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by recognized authorities and offer transparent trading conditions. Some reputable options include brokers with strong regulatory backgrounds, competitive spreads, and excellent customer service. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is SEC Limited a scam, or is it legit?

The latest exposure and evaluation content of SEC Limited brokers.

SEC Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SEC Limited latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.