Regarding the legitimacy of RUI DA INTERNATIONAL FINANCE COMPANY forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is RUI DA INTERNATIONAL FINANCE COMPANY safe?

Business

Risk Control

Is RUI DA INTERNATIONAL FINANCE COMPANY markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Rui Da International Finance Holding Limited

Effective Date:

2012-03-30Email Address of Licensed Institution:

patrice@ruida-int.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ruida-int.comExpiration Time:

--Address of Licensed Institution:

香港灣仔, 香港大同大廈, 菲林明道8號17樓1705 - 06室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Rui Da Safe or Scam?

Introduction

Rui Da is a Hong Kong-based forex broker established in 2012, primarily serving clients in Hong Kong and mainland China. The broker claims to provide a range of trading services, including futures and options trading. As the forex market continues to grow, it becomes increasingly vital for traders to evaluate the trustworthiness and reliability of their brokers. With numerous reports of scams and fraudulent activities in the industry, traders must exercise caution when selecting a broker. In this article, we will conduct an in-depth analysis of Rui Da, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. Our evaluation will be based on information gathered from reputable sources, including regulatory bodies and user reviews.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Rui Da is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is recognized for its stringent regulatory framework aimed at protecting investors. Below is a summary of the core regulatory information for Rui Da:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AYE 774 | Hong Kong | Verified |

Being regulated by a reputable authority like the SFC adds a layer of credibility to Rui Da, as it requires the broker to adhere to strict compliance standards, including maintaining client funds in segregated accounts and ensuring fair trading practices. However, while Rui Da has a regulatory framework in place, it is essential to note that the quality of regulation can vary significantly between jurisdictions. In the past three months, there have been 12 complaints against Rui Da, raising concerns about its operational practices. Therefore, while Rui Da is regulated, traders should remain vigilant and conduct thorough due diligence before engaging with this broker.

Company Background Investigation

Rui Da International Finance Holding Limited, the parent company of Rui Da, has been operational since 2012. The company has a relatively long history in the forex market, which can be a positive indicator of its stability. However, the ownership structure and management team details are not extensively disclosed, which can lead to transparency issues.

The management teams qualifications and experience are crucial in assessing a broker's reliability. Unfortunately, specific information about Rui Da's management team is scarce, making it difficult to gauge their expertise and commitment to ethical practices. Transparency in ownership and management is vital for building trust with clients, and the lack of such information may raise red flags for potential investors.

Overall, while Rui Da has been in the market for over a decade, the limited transparency regarding its management and ownership raises questions about its commitment to client welfare and ethical trading practices.

Trading Conditions Analysis

Rui Da offers various trading conditions, including access to multiple trading instruments and services. However, understanding the fee structure is essential for traders to evaluate the overall cost of trading with this broker. The following table summarizes the core trading costs associated with Rui Da:

| Fee Type | Rui Da | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0-2.0 pips |

| Commission Model | Variable | Variable |

| Overnight Interest Range | 2%-5% | 1%-3% |

Rui Da's spreads for major currency pairs are competitive but can be higher than the industry average, which may affect overall profitability for traders. The commission structure appears to be variable, and without clear disclosure, traders may encounter unexpected fees. Additionally, the overnight interest rates are relatively high compared to the industry average, which could significantly impact long-term positions.

Traders should carefully review the terms and conditions associated with trading on Rui Da's platform to ensure they are comfortable with the fee structure. Overall, while Rui Da offers a range of trading options, the potential for higher costs may be a concern for some traders.

Client Funds Security

The security of client funds is paramount when evaluating a broker's safety. Rui Da claims to maintain client funds in segregated accounts, which is a standard practice among regulated brokers. This means that client funds are kept separate from the broker's operational funds, providing an additional layer of protection in case of financial difficulties.

Furthermore, Rui Da is regulated by the SFC, which imposes strict requirements on brokers to ensure the safety of client investments. However, despite these measures, traders should remain cautious. There have been reports of clients experiencing difficulties withdrawing funds, which raises questions about the broker's operational practices and overall commitment to client security.

In summary, while Rui Da appears to have measures in place to protect client funds, historical complaints regarding withdrawal issues suggest that traders should exercise caution and consider the potential risks associated with this broker.

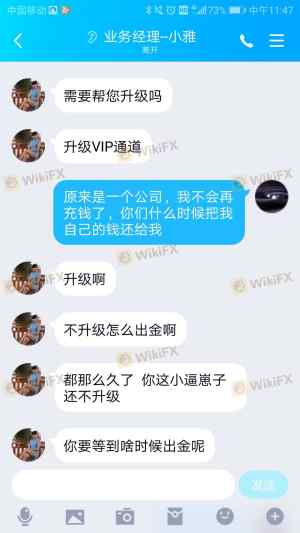

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Rui Da indicate a mixed experience among clients. While some users report satisfactory trading conditions, others have raised concerns about withdrawal difficulties and the quality of customer support. The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Delay | Medium | Average response |

| Account Management | Medium | Inconsistent |

Common complaints include difficulties in withdrawing funds, which can significantly impact a trader's experience and trust in the broker. Additionally, the responsiveness of customer support has been criticized, with users reporting long waiting times for assistance. These issues can be concerning, especially for new traders who may require more guidance and support.

Overall, while Rui Da has some positive aspects, the prevalence of complaints regarding withdrawal issues and customer support suggests that potential clients should approach this broker with caution.

Platform and Execution

Rui Da offers a trading platform that claims to provide a stable and efficient trading experience. However, the performance of the platform, including order execution quality and slippage rates, is crucial for traders. Users have reported varying experiences with order execution, with some noting instances of slippage during volatile market conditions.

Additionally, the platform's stability and user experience are essential factors in determining its reliability. While Rui Da claims to offer a user-friendly interface, the actual performance may vary, and traders should consider testing the platform with a demo account before committing significant funds.

In conclusion, while Rui Da offers a trading platform, the variability in execution quality and user experiences raises questions about its overall reliability.

Risk Assessment

Using Rui Da as a broker comes with inherent risks that traders should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Complaints against the broker raise concerns. |

| Withdrawal Risk | High | Users report difficulties in withdrawing funds. |

| Customer Support Risk | Medium | Slow response times can hinder trading experiences. |

To mitigate these risks, traders are advised to conduct thorough research, start with smaller investments, and maintain effective communication with the broker. Additionally, having a clear understanding of the broker's terms and conditions can help avoid potential pitfalls.

Conclusion and Recommendations

In conclusion, while Rui Da is regulated by the SFC and has been operating since 2012, the existence of multiple complaints and issues related to fund withdrawals raises red flags. Traders should be cautious and consider the potential risks associated with this broker.

For those looking for alternatives, it may be advisable to explore other regulated brokers with a proven track record of customer satisfaction and transparent trading conditions. Ultimately, due diligence is essential to ensure a safe and successful trading experience.

Is RUI DA INTERNATIONAL FINANCE COMPANY a scam, or is it legit?

The latest exposure and evaluation content of RUI DA INTERNATIONAL FINANCE COMPANY brokers.

RUI DA INTERNATIONAL FINANCE COMPANY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RUI DA INTERNATIONAL FINANCE COMPANY latest industry rating score is 5.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.