Regarding the legitimacy of RT forex brokers, it provides ASIC and WikiBit, .

Is RT safe?

Business

License

Is RT markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

CMC MARKETS ASIA PACIFIC PTY LTD

Effective Date: Change Record

2004-02-24Email Address of Licensed Institution:

external.dispute.resolution@cmcmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cmcmarkets.com.auExpiration Time:

--Address of Licensed Institution:

'TOWER 3, INTERNATIONAL TOWERS', LEVEL 20 300 BARANGAROO AVENUE SYDNEY NSW 2000Phone Number of Licensed Institution:

0289159335Licensed Institution Certified Documents:

Is RT Safe or Scam?

Introduction

RT is a relatively new player in the forex trading market, having been established in 2020. As an online broker, it primarily targets traders looking for access to foreign exchange and contracts for difference (CFDs). Given the increasing number of scams and fraudulent activities in the forex market, traders must exercise caution when selecting a broker. This article aims to provide an objective analysis of RT's credibility, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on data gathered from various reputable sources, including regulatory bodies and customer reviews.

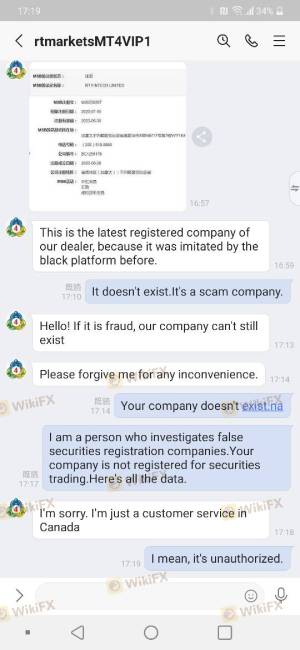

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its credibility and safety for traders. A regulated broker is generally seen as more trustworthy because it must adhere to specific standards set by financial authorities. Unfortunately, RT does not appear to hold any significant regulatory licenses.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation raises significant concerns. Without oversight from a reputable authority, traders have limited recourse in case of disputes or financial malpractice. Furthermore, the lack of regulatory history means that potential investors cannot assess RTs compliance with financial laws or its operational integrity. This lack of oversight is a significant red flag when evaluating whether “Is RT safe” for trading.

Company Background Investigation

RT's company background reveals a concerning lack of transparency. Established in 2020, it claims to be based in China, but there is little verifiable information regarding its actual location or ownership structure. The absence of identifiable ownership raises questions about accountability and transparency.

The management teams professional experience is also unclear, as there is no available information about their qualifications or previous roles within the financial sector. This lack of clarity can be a warning sign for potential investors. A reputable broker typically provides detailed information about its management and operational practices, but RT has not done so.

In summary, the limited information available about RT raises concerns about its credibility and reliability. This lack of transparency makes it difficult to determine whether "Is RT safe" for traders looking to invest their funds.

Trading Conditions Analysis

When assessing a broker's credibility, understanding its trading conditions is crucial. RT offers a trading platform that utilizes the MetaTrader 4 (MT4) software, which is popular among traders for its user-friendly interface and advanced tools. However, the costs associated with trading on RT are not clearly defined, which can lead to confusion and potential hidden fees.

| Fee Type | RT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | N/A |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The lack of transparent fee structures can be problematic for traders. If a broker does not clearly outline its fees, it raises the question of whether there are hidden costs that could affect profitability. Additionally, the absence of detailed information about spreads and commissions makes it challenging for traders to make informed decisions. This ambiguity leads to further skepticism about whether "Is RT safe" for trading, as unclear costs can often be associated with less reputable brokers.

Client Funds Security

The safety of client funds is a primary concern for any trader. RT's website does not provide specific details about its measures for safeguarding client funds. Key aspects such as segregated accounts, investor protection schemes, and negative balance protection are not clearly stated.

The absence of these protective measures can pose a significant risk to traders. If a broker does not have protocols in place to protect client funds, it raises questions about its legitimacy and reliability. Furthermore, any historical incidents involving fund security or disputes could further tarnish its reputation.

In conclusion, the lack of information regarding RT's client fund security measures is alarming. Traders must consider whether "Is RT safe" given the absence of robust protection for their investments.

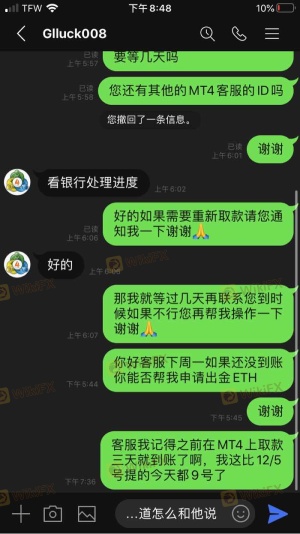

Customer Experience and Complaints

Customer feedback is an essential component when evaluating a broker's credibility. Reviews and testimonials can provide insights into the experiences of other traders. However, RT has received a number of complaints regarding its customer service and trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Slow |

| Hidden Fees | High | Unclear |

Common complaints include difficulties in withdrawing funds, poor customer support, and unclear fee structures. The severity of these issues suggests that traders have had negative experiences, which could deter potential investors.

For instance, one complaint highlighted a trader's experience of being unable to withdraw funds for several weeks, leading to frustration and distrust. Such issues can severely impact a trader's confidence in the broker. Therefore, it is essential to consider whether "Is RT safe" based on the experiences of existing customers.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. RT uses the MT4 platform, which is generally regarded as reliable. However, there are concerns regarding order execution quality, slippage, and the potential for trade manipulation.

Traders have reported instances of slippage during volatile market conditions, which can lead to unexpected losses. Additionally, the platform's stability and responsiveness are vital for executing trades effectively. Any signs of manipulation or unfair practices can significantly undermine a broker's credibility.

In summary, while RT employs a well-known trading platform, the execution quality and potential issues with slippage raise concerns about whether "Is RT safe" for traders who rely on timely and accurate trade execution.

Risk Assessment

Using RT as a trading platform involves certain risks that potential investors should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No significant regulation |

| Operational Risk | Medium | Lack of transparency |

| Financial Risk | High | Unclear fee structures |

The overall risk profile for RT suggests that there are considerable concerns regarding its credibility and safety. Traders should be vigilant and consider risk mitigation strategies, such as starting with a small investment or seeking alternative brokers with better regulatory oversight.

Conclusion and Recommendation

Based on the evidence presented, RT raises several red flags regarding its safety and legitimacy. The lack of regulation, transparency, and customer support issues suggest that traders should exercise extreme caution.

In conclusion, it is advisable for traders to avoid RT until it can demonstrate a commitment to regulatory compliance and customer service. For those seeking reliable alternatives, consider brokers that are well-regulated and have a proven track record in the forex market. Always prioritize safety and due diligence when selecting a trading partner to ensure your investments are protected.

In summary, the question "Is RT safe?" remains largely unanswered in the affirmative, and potential traders should proceed with caution.

Is RT a scam, or is it legit?

The latest exposure and evaluation content of RT brokers.

RT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RT latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.