RT Review 2

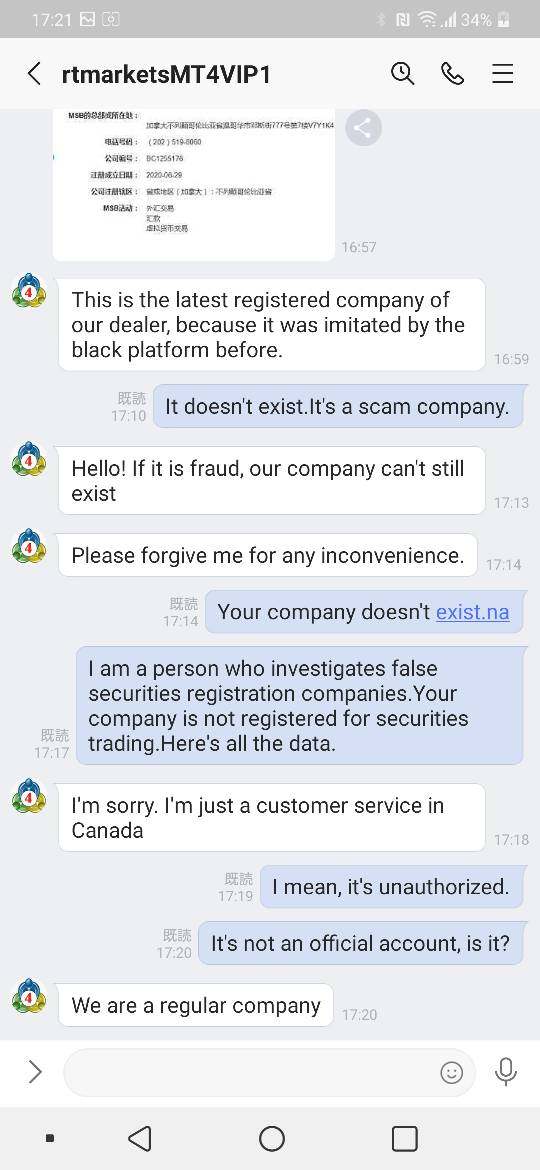

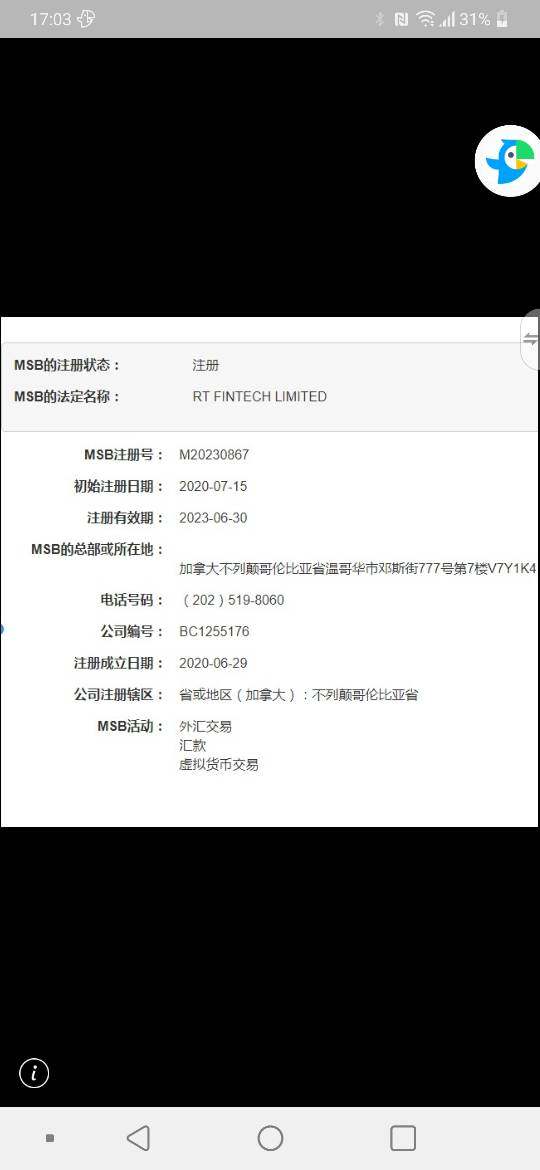

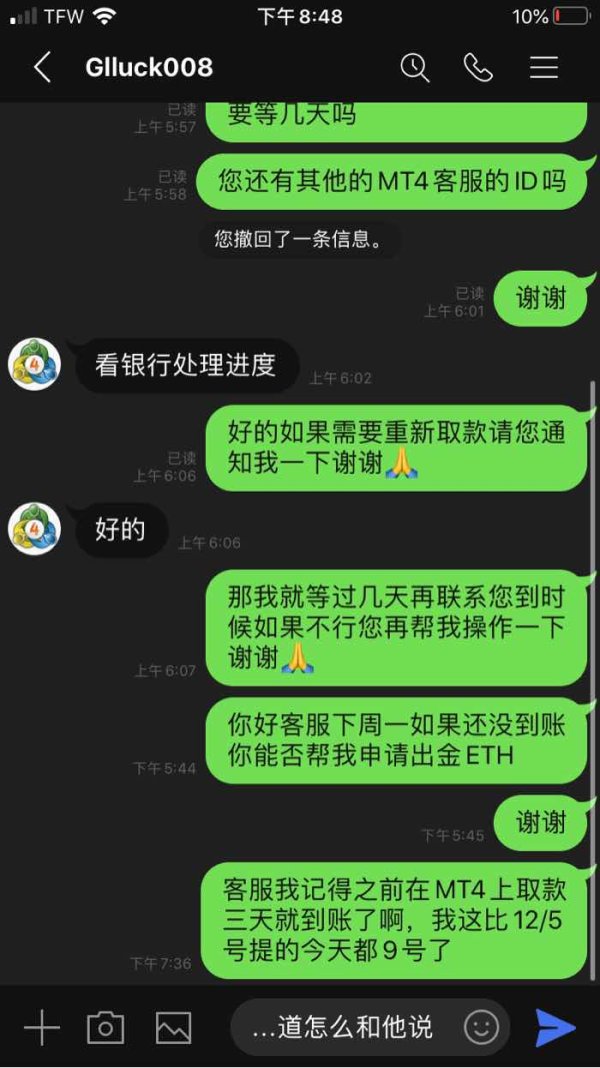

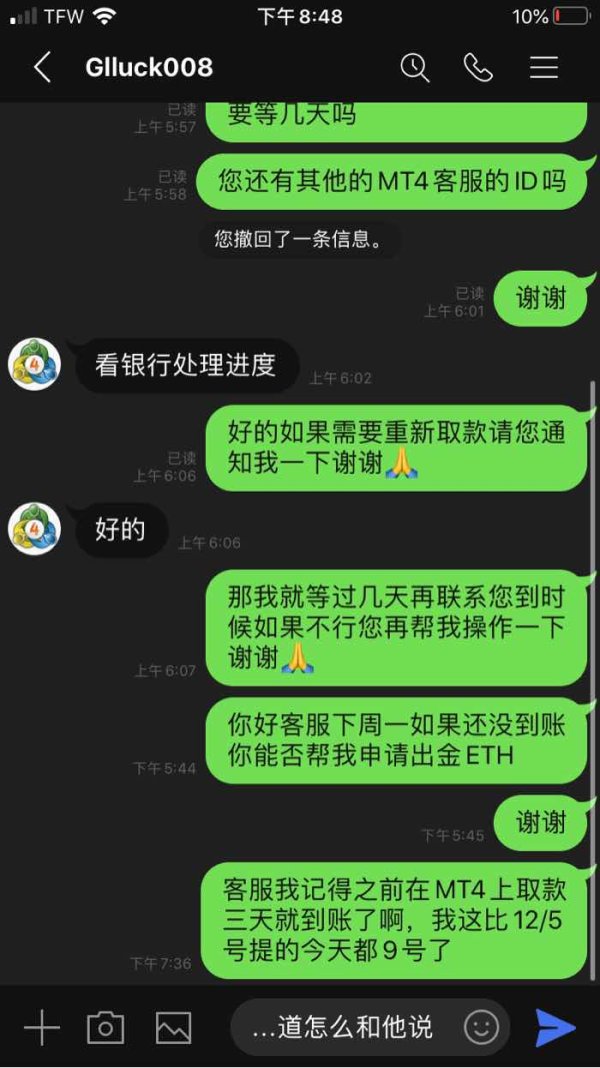

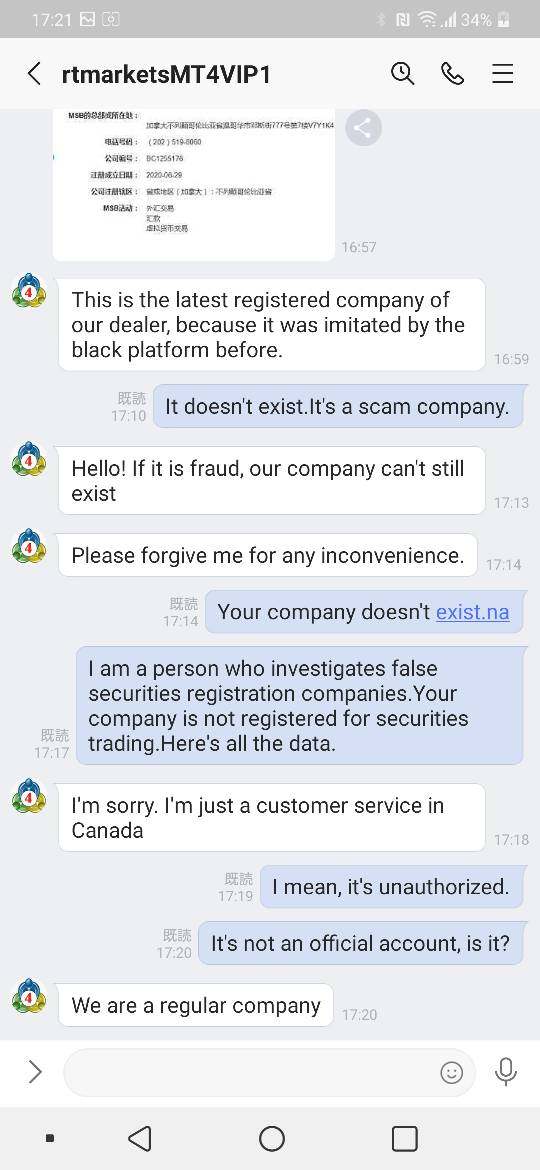

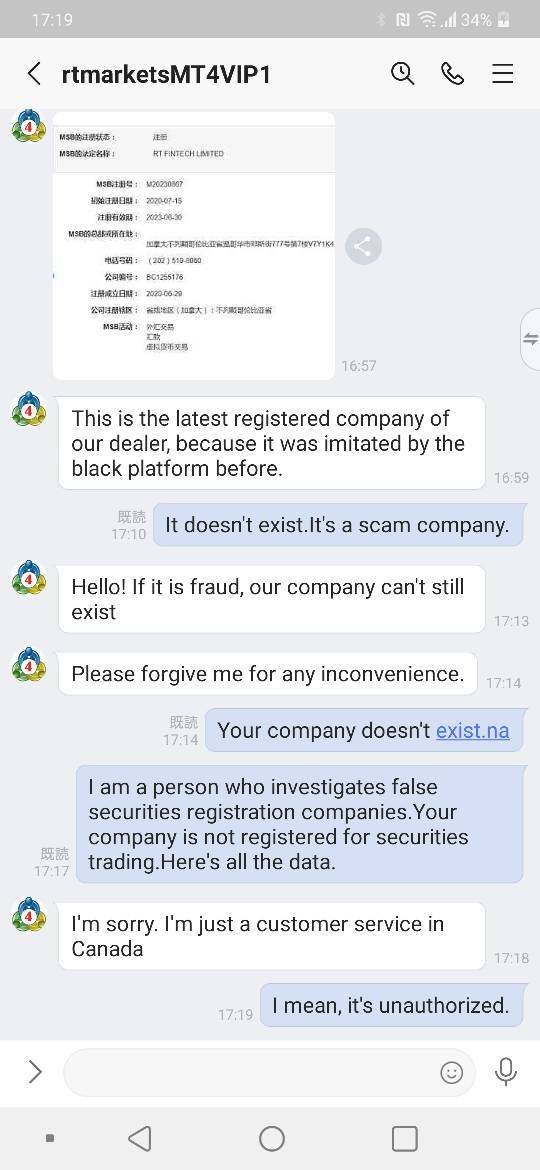

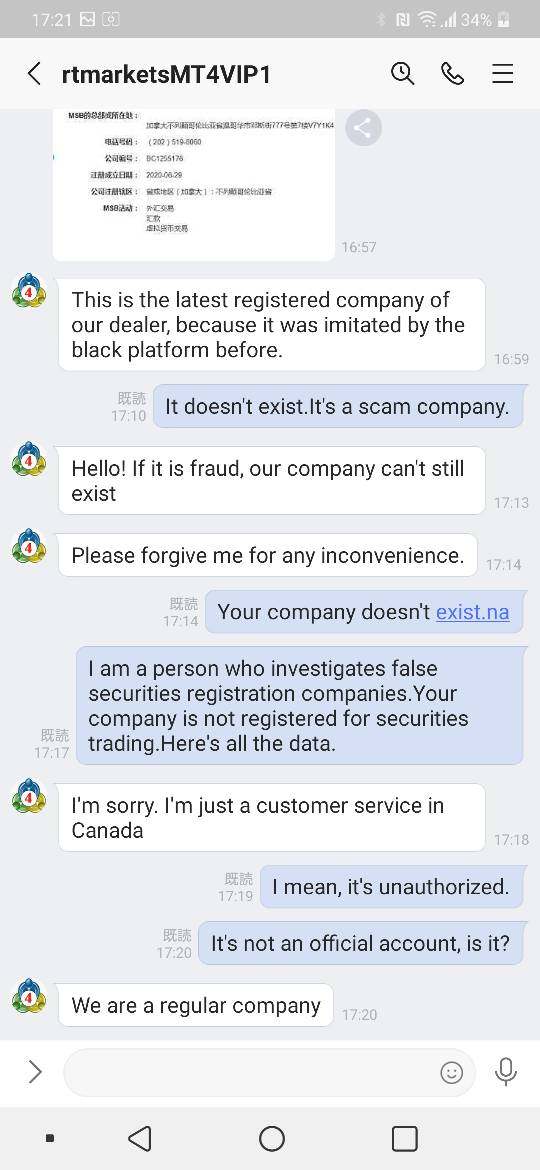

I suspect it’s a fraud platform. Be careful. It’s my personal experience

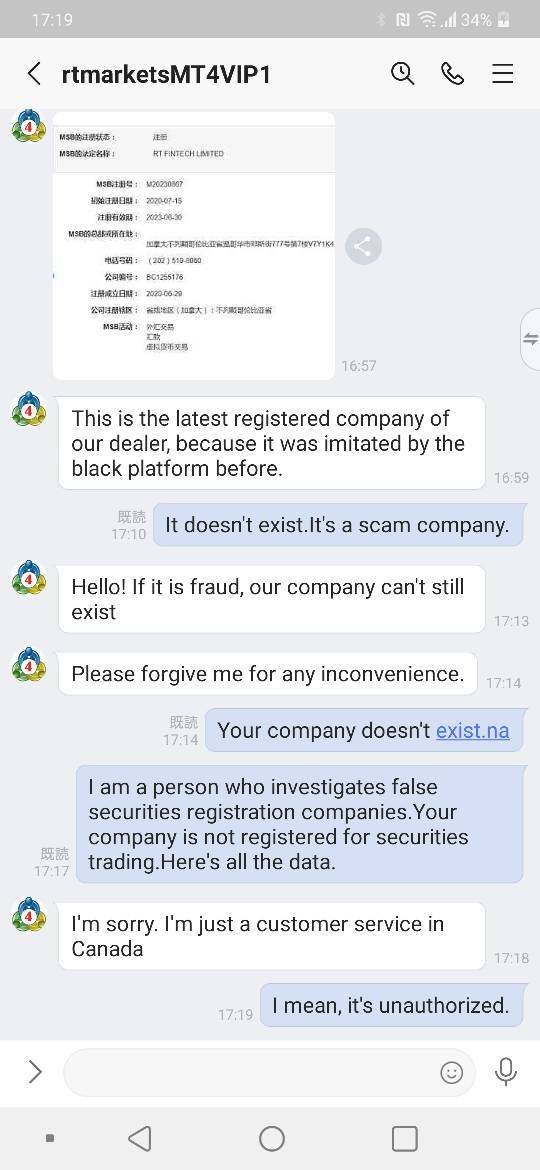

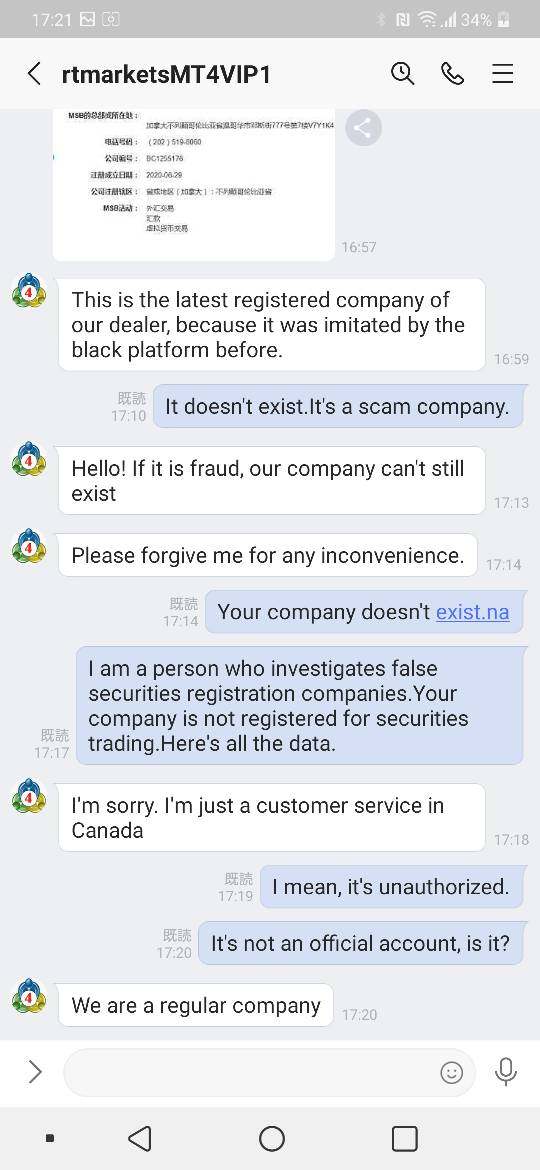

It is not a legal platform.

RT Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

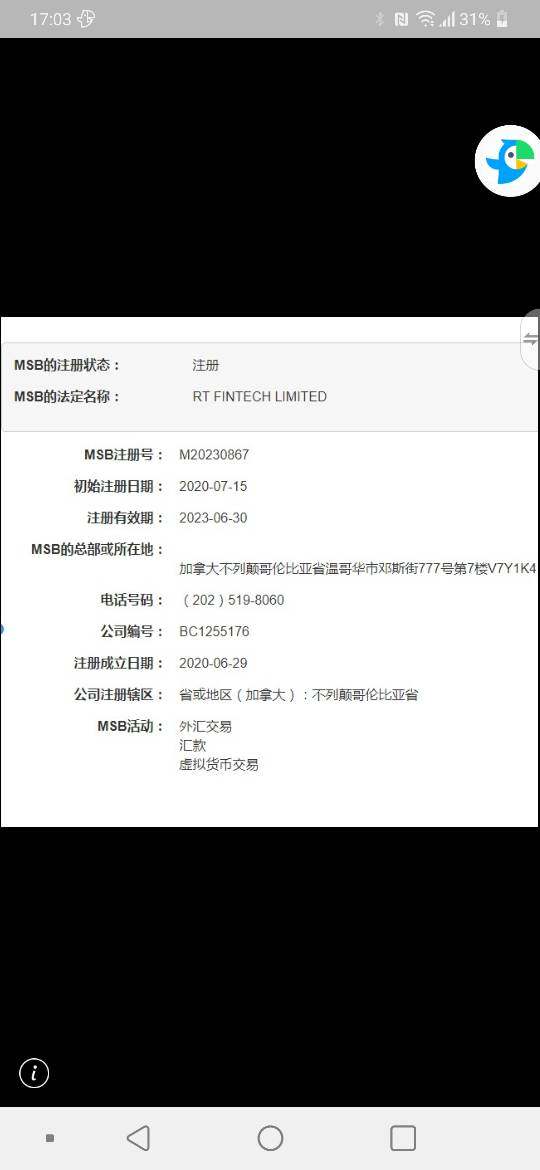

License

I suspect it’s a fraud platform. Be careful. It’s my personal experience

It is not a legal platform.

This comprehensive rt review examines RT Specialty. RT Specialty is a wholesale brokerage division of Ryan Specialty Group that focuses on specialized insurance products and services. Based on available information, RT Specialty positions itself as a leader in the wholesale insurance brokerage industry. The company offers coverage across property, casualty, professional lines, transportation, personal lines, and workers' compensation insurance products.

RT Specialty defines itself through superior execution on behalf of clients. This approach establishes a strong presence as an industry leader. The company operates through a national wholesale brokerage platform with offices throughout the United States. This platform is backed by established relationships, resources, and marketplace trust. The company primarily targets companies and institutions requiring specialized insurance solutions rather than individual retail clients.

User feedback from available sources indicates a user-friendly platform. These sources show positive experiences regarding trades and withdrawals, though comprehensive user data remains limited. This rt review provides an objective analysis based on available information. However, certain operational details require further investigation for a complete assessment.

This evaluation is based on available information from multiple sources. Readers should note that different regulatory frameworks may apply across various jurisdictions where RT operates. The company's focus on wholesale insurance brokerage means that services may differ significantly from traditional retail financial services.

Our review methodology incorporates available user feedback, company information, and industry analysis. However, due to limited publicly available data on certain operational aspects, some sections of this review may require updates as more comprehensive information becomes available.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available sources |

| Tools and Resources | N/A | Platform tools and resources not comprehensively documented |

| Customer Service | N/A | Limited customer service data available for evaluation |

| Trading Experience | N/A | Trading experience metrics not specified in available information |

| Trustworthiness | N/A | Regulatory and trust indicators require additional verification |

| User Experience | N/A | Comprehensive user experience data not available in sources |

RT Specialty operates as the wholesale brokerage division of Ryan Specialty Group. The company specializes in wholesale brokerage, MGU underwriting companies, and other professional services. RT Specialty has established itself as a significant player in the specialized insurance sector. The company focuses on delivering measurable value to the insurance industry through comprehensive coverage solutions.

The company's business model centers on providing specialized insurance products and services across multiple categories. These categories include property, liability, professional lines, transportation, personal lines, and workers' compensation insurance products. This diverse portfolio positions RT Specialty to serve a wide range of commercial and institutional clients seeking specialized coverage solutions.

According to company information, RT Specialty's platform operates through a national network. This network includes offices distributed throughout the United States. The company emphasizes superior execution on behalf of clients, which has contributed to its leadership position in the wholesale insurance brokerage industry. This rt review indicates that the platform's strength lies in its established marketplace relationships and resource availability.

The available information suggests that RT Specialty's primary focus differs from traditional financial trading platforms. Instead, the company concentrates on insurance brokerage services. This specialization means that potential users should understand the company's specific service offerings before engagement.

Regulatory Regions: Specific regulatory information for RT Specialty was not detailed in available sources. However, the company operates throughout the United States under applicable insurance industry regulations.

Deposit and Withdrawal Methods: Payment processing information indicates that clients can make payments through the company's platform. However, specific deposit and withdrawal methods for trading accounts are not detailed in available sources.

Minimum Deposit Requirements: Minimum deposit requirements for RT Specialty services are not specified in available information sources.

Bonuses and Promotions: Current promotional offers or bonus structures are not mentioned in available company information.

Tradeable Assets: The company focuses on insurance products across property, casualty, professional lines, transportation, personal lines, and workers' compensation. However, specific tradeable financial assets are not detailed in available sources.

Cost Structure: Detailed fee structures and cost information for RT Specialty services are not comprehensively outlined in available sources.

Leverage Ratios: Leverage information is not applicable or specified for RT Specialty's insurance brokerage services.

Platform Options: The company operates a user-friendly platform according to available user feedback. However, specific platform details and options are not comprehensively documented.

Regional Restrictions: Specific regional restrictions are not detailed in available sources.

Customer Service Languages: Available customer service language options are not specified in current information sources. This rt review notes that additional details would enhance understanding of service accessibility.

The account conditions for RT Specialty require further clarification based on available information sources. As a wholesale insurance brokerage platform, the company's account structure likely differs significantly from traditional financial trading platforms. Available sources do not provide comprehensive details about account types, minimum requirements, or specific features. These details would typically be associated with trading accounts.

The company's focus on wholesale brokerage suggests that account conditions may be tailored to institutional and commercial clients. This approach differs from serving individual retail traders. This specialization could mean that account opening procedures and requirements are customized based on specific insurance needs and client profiles.

User feedback indicates positive experiences with the platform's functionality. This feedback suggests that whatever account conditions exist are generally acceptable to current users. However, prospective clients would benefit from direct communication with RT Specialty to understand specific account requirements and conditions. These requirements apply to their particular needs.

The absence of detailed account condition information in public sources may reflect the company's focus on personalized service delivery. This approach differs from standardized account offerings. This rt review recommends that potential clients inquire directly about account conditions that would apply to their specific requirements.

Available information about RT Specialty's tools and resources focuses primarily on the company's wholesale brokerage capabilities. The company also emphasizes its national platform infrastructure. RT Specialty emphasizes its relationships, resources, and marketplace trust as key differentiators. However, specific trading tools and analytical resources are not detailed in available sources.

The platform's user-friendly nature, as mentioned in available feedback, suggests that RT Specialty has invested in accessible technology solutions. However, comprehensive information about specific tools, research resources, educational materials, or automated services is not available in current sources.

Given RT Specialty's focus on insurance brokerage rather than financial trading, the tools and resources likely center on insurance product analysis. They also focus on risk assessment and coverage optimization rather than traditional trading tools. This specialization may provide significant value for clients seeking insurance solutions while being less relevant for financial trading purposes.

The company's national platform with offices throughout the United States suggests substantial infrastructure resources. However, specific technological capabilities and tool offerings require direct inquiry for detailed understanding.

Customer service information for RT Specialty is limited in available sources. However, the company's emphasis on superior execution for clients suggests a focus on service quality. The platform's user-friendly reputation and positive user feedback regarding platform functionality indicate acceptable service levels. However, comprehensive service metrics are not available.

RT Specialty's national presence with offices throughout the United States suggests multiple contact points. This presence also indicates potentially robust support infrastructure. However, specific information about customer service channels, response times, availability hours, or multilingual support is not detailed in current sources.

The company's focus on building marketplace trust and maintaining client relationships implies a commitment to customer service excellence. However, quantitative measures of service quality are not available for evaluation. User feedback mentioning no issues with platform operations suggests adequate support for technical matters.

For a comprehensive understanding of customer service capabilities, potential clients would need to engage directly with RT Specialty. This engagement would help assess service levels, response times, and support channel availability that meet their specific requirements.

The trading experience evaluation for RT Specialty requires clarification regarding the nature of trading activities available through the platform. Available user feedback mentions positive experiences with trades and withdrawals. This feedback suggests functional transaction capabilities, though specific details about trading infrastructure are not comprehensively documented.

Platform stability appears adequate based on user reports of no issues with platform operations. The user-friendly interface mentioned in feedback suggests attention to user experience design. However, specific performance metrics, execution speeds, or trading environment details are not available in current sources.

Given RT Specialty's primary focus on insurance brokerage services, the trading experience may differ significantly from traditional financial trading platforms. The company's emphasis on superior execution for clients suggests competency in transaction processing. However, this may relate more to insurance transactions than financial trading.

Mobile platform capabilities and advanced trading features are not specifically addressed in available information. This rt review notes that potential users should clarify the nature and scope of trading activities available through RT Specialty's platform. This clarification should be based on their specific requirements.

Trustworthiness assessment for RT Specialty is based on limited available information. However, several factors suggest a legitimate business operation. The company's association with Ryan Specialty Group and its established presence in the insurance industry provide some credibility indicators. However, specific regulatory details are not comprehensively documented.

The company's emphasis on marketplace trust and established relationships suggests a focus on reputation management and client satisfaction. Positive user feedback regarding platform functionality and transaction processing indicates adequate operational reliability. However, comprehensive trust metrics are not available.

RT Specialty's national platform with multiple offices throughout the United States suggests substantial business infrastructure and investment. This infrastructure typically correlates with legitimate business operations. However, specific regulatory compliance information, licensing details, or third-party verification data are not available in current sources.

For a complete trustworthiness assessment, potential clients should verify regulatory status, licensing information, and compliance credentials directly with RT Specialty. They should also check with relevant regulatory authorities based on their specific jurisdiction and service requirements.

User experience evaluation for RT Specialty is based on limited but positive available feedback. Users report a user-friendly platform with no issues regarding trades or withdrawals. This feedback suggests adequate attention to user interface design and functionality. However, comprehensive user satisfaction data is not available in current sources.

The platform's ease of use appears to be a strength based on available feedback. However, specific details about registration processes, verification procedures, or account management features are not documented in available sources. The positive user experience reports suggest that current users find the platform accessible and functional for their needs.

Interface design and navigation capabilities are not specifically detailed. However, the user-friendly characterization implies adequate design standards. Mobile accessibility, feature completeness, and user workflow optimization details are not available for evaluation.

Common user complaints or areas for improvement are not documented in available sources. This absence may indicate either limited user feedback availability or generally satisfactory user experience levels. Prospective users should consider engaging with current users or requesting platform demonstrations to assess user experience suitability for their specific requirements.

This rt review reveals RT Specialty as a specialized wholesale insurance brokerage platform operating as part of Ryan Specialty Group. While the company demonstrates strengths in specialized insurance products and maintains a national presence with positive user feedback, the limited availability of comprehensive operational information prevents a complete evaluation across traditional trading platform criteria.

RT Specialty appears most suitable for companies and institutions requiring specialized insurance brokerage services. The company is less suitable for individual financial traders seeking traditional trading platforms. The company's focus on superior execution and established marketplace relationships suggests value for appropriate client types.

The main advantages include specialization in professional insurance products and national platform infrastructure. However, the primary limitation involves insufficient public information about detailed operational aspects, regulatory compliance, and comprehensive service offerings.

FX Broker Capital Trading Markets Review