Is Roalke safe?

Business

License

Is Roalke Safe or a Scam?

Introduction

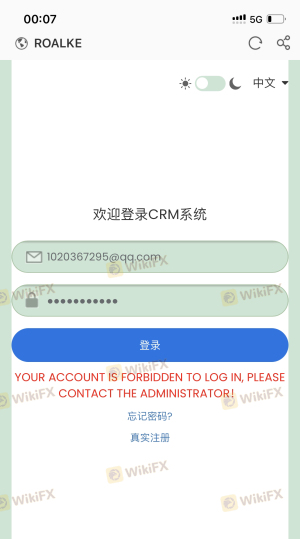

Roalke is a forex broker that has emerged in the trading landscape since its establishment in 2021. Operating primarily in China, it aims to attract traders with its various trading offerings. However, as the forex market continues to evolve, traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities makes it imperative for traders to conduct thorough evaluations of any trading platform before engaging. This article investigates whether Roalke is safe or a scam by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

The methodology for this investigation includes a comprehensive review of online resources, user testimonials, and expert analysis. Data from reputable financial websites, such as WikiFX and user forums, were utilized to provide a balanced view of Roalke's credibility in the forex market.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety of any forex broker. A regulated broker is typically subject to stringent oversight, ensuring that it adheres to industry standards and protects its clients' interests. In the case of Roalke, it has been noted that the broker is not regulated by any recognized financial authority, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation means that Roalke does not have to comply with the same rules and standards that licensed brokers must follow. This lack of oversight can lead to increased risks for traders, as they may not have access to legal protections in case of disputes or issues with the broker. Additionally, the lack of regulatory history raises questions about the broker's compliance and ethical practices. Given these factors, it is essential for traders to proceed with caution when considering Roalke, as the question of "Is Roalke safe?" remains significantly unanswered.

Company Background Investigation

Roalke was founded in 2021 and operates out of China. The relatively short history of the broker is a red flag for potential investors, as established brokers often have a more extensive track record of overcoming financial challenges and maintaining stable operations. The ownership structure of Roalke is not well-documented, leading to further ambiguity regarding its management and accountability.

The management teams background is crucial in determining the broker's reliability. However, information about the individuals running Roalke is scarce, which can hinder potential clients from making informed decisions. Transparency in a broker's operations is vital, as it builds trust and confidence among traders. Unfortunately, Roalke's lack of clear information about its management and operations does not inspire confidence.

In summary, the limited company history and lack of transparency raise serious concerns about the credibility of Roalke. The absence of regulatory oversight and insufficient information about its management team contribute to the ongoing question of whether "Is Roalke safe?" remains a valid concern for potential traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital. Roalke's fee structure and trading policies have been scrutinized by users and experts alike. The broker's overall cost model, including spreads, commissions, and overnight fees, can significantly impact a trader's profitability.

| Fee Type | Roalke | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-3 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | 2-5% |

While Roalke does not provide clear information about its fee structure, the lack of transparency regarding trading costs is concerning. Traders should be wary of any hidden fees or unusual policies that could affect their trading experience. The absence of detailed information makes it challenging to assess whether Roalke offers competitive trading conditions compared to industry standards.

In conclusion, the lack of clarity surrounding Roalke's trading conditions further complicates the question of whether "Is Roalke safe?" Traders may find themselves facing unexpected costs that could hinder their trading success.

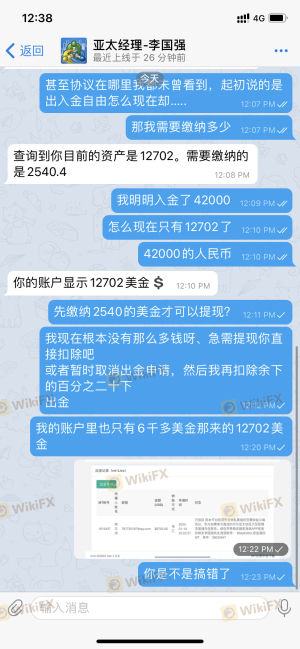

Customer Funds Security

The security of customer funds is paramount when selecting a forex broker. Roalke's measures to protect client funds have come under scrutiny, especially given its lack of regulatory oversight. A reputable broker typically implements several safeguards, including segregated accounts, investor protection schemes, and negative balance protection.

Unfortunately, Roalke has not provided sufficient information regarding its fund security measures. The absence of clear policies on fund segregation and protection raises significant concerns. Traders must be cautious, as the lack of safeguards could lead to substantial financial losses in case of broker insolvency or fraudulent activities.

Additionally, any historical issues related to fund security or controversies surrounding Roalke could further impact its credibility. Without transparency in this area, potential clients may question whether their funds would be safe with Roalke. The ongoing uncertainty surrounding fund security only deepens the inquiry into "Is Roalke safe?" for prospective traders.

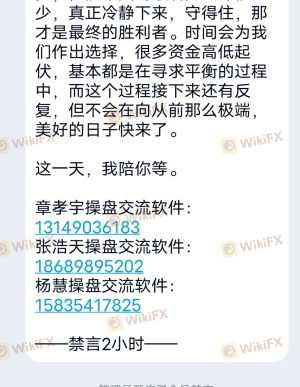

Customer Experience and Complaints

Customer feedback and complaints are valuable indicators of a broker's reliability and service quality. In the case of Roalke, user experiences have been mixed, with several complaints surfacing on various platforms. Common issues reported by users include difficulties in withdrawing funds, poor customer service, and lack of communication from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Account Suspension | High | Poor |

The severity of complaints indicates that many users have faced significant challenges when dealing with Roalke. The company's response to these complaints has been largely inadequate, leading to frustration among traders. Such patterns of negative feedback raise serious questions about the broker's commitment to customer service and its overall legitimacy.

In summary, the customer experience surrounding Roalke is concerning, with numerous complaints pointing to issues that could impact traders' financial security and peace of mind. This further complicates the question of "Is Roalke safe?" for potential clients.

Platform and Trade Execution

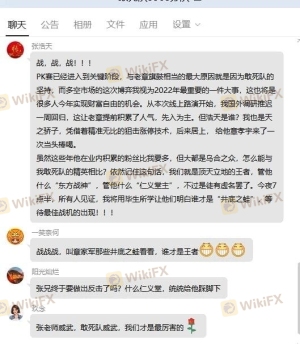

The performance and reliability of a broker's trading platform are critical factors in determining its overall trustworthiness. Roalke's platform has faced criticism regarding its stability, execution quality, and user experience. Traders have reported instances of slippage, order rejections, and platform downtime, which can severely affect trading performance.

A reliable trading platform should provide seamless execution, minimal slippage, and robust support. However, Roalke's performance in these areas has raised concerns among users. Reports of platform manipulation or unfair practices have also surfaced, further complicating the broker's reputation.

In conclusion, the platform's performance and execution quality are essential components of assessing whether "Is Roalke safe?" The ongoing issues related to these aspects suggest that potential traders should approach Roalke with caution.

Risk Assessment

Using Roalke as a forex broker presents several risks that traders must consider. The absence of regulation, lack of transparency, and numerous customer complaints contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight available. |

| Financial Risk | High | Potential loss of funds due to fraud. |

| Operational Risk | Medium | Issues with platform stability. |

Given these risks, traders should take proactive measures to mitigate potential issues. Conducting thorough research, utilizing demo accounts, and starting with small investments can help minimize exposure to risk.

In conclusion, the comprehensive risk profile associated with Roalke raises significant concerns about its safety and reliability. The question "Is Roalke safe?" remains largely unanswered, urging traders to consider alternative options.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Roalke presents several red flags that potential traders should be wary of. The lack of regulatory oversight, poor customer feedback, and unresolved complaints indicate that there may be significant risks associated with trading through this broker.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers with established regulatory frameworks and positive user experiences can provide a more secure trading environment.

In conclusion, the question "Is Roalke safe?" leans towards a negative response, and traders are encouraged to exercise caution when considering this broker for their trading needs.

Is Roalke a scam, or is it legit?

The latest exposure and evaluation content of Roalke brokers.

Roalke Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Roalke latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.