Regarding the legitimacy of Renhe forex brokers, it provides SCB and WikiBit, (also has a graphic survey regarding security).

Is Renhe safe?

Business

License

Is Renhe markets regulated?

The regulatory license is the strongest proof.

SCB Derivatives Trading License (STP)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

Renhe Financial Services Limited

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Sea Sky Lane, Sandyport, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Renhe Safe or Scam?

Introduction

Renhe is a financial brokerage firm that has emerged in the forex market, primarily targeting traders seeking access to various financial instruments. Established in 2018 and based in the Bahamas, Renhe claims to provide a user-friendly trading environment through the popular MetaTrader 4 platform. However, the rise of online trading has also brought about a surge in fraudulent activities, making it crucial for traders to carefully evaluate the credibility of brokers like Renhe. This article aims to investigate whether Renhe is a legitimate broker or a potential scam. Our evaluation is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory status of a broker is paramount for traders, as it directly affects the safety of their funds and the overall trading environment. Renhe is purportedly regulated by the Securities Commission of the Bahamas (SCB), which is a recognized regulatory authority. However, it is essential to note that not all regulators offer the same level of protection. While the SCB provides some oversight, it is often considered less stringent compared to regulators in regions like the UK or the EU.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities Commission of the Bahamas | SIA-F 211 | Bahamas | Verified |

A closer look at Renhe's regulatory history reveals a mixed compliance record. Although there have been no significant negative disclosures reported during the evaluation period, the overall low score of 1.54 on platforms like WikiFX raises concerns about the broker's credibility. The lack of comprehensive regulatory oversight might expose traders to risks, including potential fund mismanagement and inadequate investor protection.

Company Background Investigation

Renhes establishment in 2018 marks it as a relatively new player in the forex brokerage industry. The company operates under the name Ren He Technology (Hong Kong) Limited, with its registered address in the United Arab Emirates. However, the opacity surrounding its ownership structure and the management team raises questions about accountability and transparency.

While the company claims to have a professional team, specific details regarding their qualifications and experiences remain scarce. This lack of information can be alarming for potential clients, as a strong management team is often indicative of a broker's reliability. Furthermore, Renhe's website does not provide adequate disclosures about its operational framework, which is a common red flag among potentially fraudulent brokers.

Trading Conditions Analysis

When evaluating whether Renhe is safe for trading, it is essential to consider its trading conditions, including fees and spreads. Renhe promotes a zero-commission trading model, which can be appealing to traders. However, the absence of detailed information regarding spreads and other trading costs raises eyebrows.

| Fee Type | Renhe | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not disclosed | 1.0 - 1.5 pips |

| Commission Model | Zero commission | Varies by broker |

| Overnight Interest Range | Not specified | Typically 2% - 5% |

The lack of transparency in Renhe's fee structure could lead to unexpected costs for traders. Additionally, the absence of a minimum deposit requirement might attract inexperienced traders, further complicating the risk landscape. Overall, the trading conditions at Renhe suggest a need for caution.

Client Fund Safety

The safety of client funds is a critical aspect when assessing a broker's reliability. Renhe claims to keep client funds in tier-one banking institutions; however, there is no independent verification of this claim. Moreover, the broker does not provide details about segregated accounts or investor protection schemes, which are essential for safeguarding traders' capital.

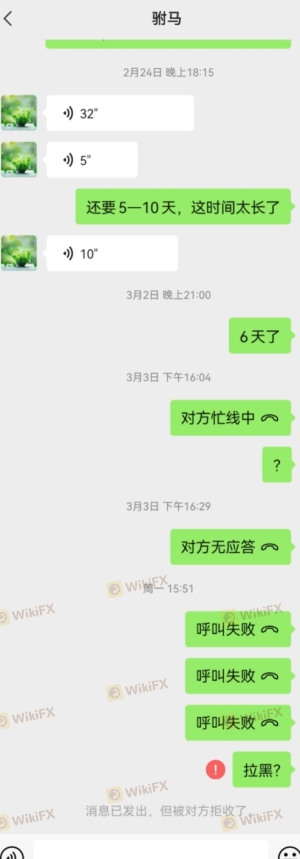

The absence of negative balance protection is another significant concern. In volatile markets, traders can incur losses that exceed their account balances, leading to additional financial burdens. Historical disputes regarding fund withdrawals and account access have also been reported, further questioning whether Renhe is indeed safe for traders.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's legitimacy. Reviews about Renhe indicate a mixed bag of experiences, with some users praising its trading platform and customer support, while others report significant issues with fund withdrawals and account access.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Access Issues | Medium | Unresolved queries |

| High-Pressure Sales Tactics | High | Aggressive follow-ups |

For instance, some traders have reported being unable to withdraw their funds for extended periods, raising alarms about Renhe's operational integrity. These complaints highlight the importance of verifying a broker's reliability before committing funds.

Platform and Trade Execution

The performance and stability of the trading platform are crucial for a seamless trading experience. Renhe utilizes the MetaTrader 4 platform, widely recognized for its user-friendly interface and robust features. However, there are concerns regarding order execution quality, including instances of slippage and rejected orders.

The lack of advanced trading features, such as two-factor authentication, further complicates the security landscape. Traders should be wary of any signs of platform manipulation, as these can indicate deeper issues within the brokerage.

Risk Assessment

Using Renhe poses several risks that traders should consider before opening an account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a less stringent regulator |

| Fund Safety Risk | High | No clear investor protection measures |

| Operational Risk | Medium | Complaints regarding withdrawals and access |

To mitigate these risks, traders are advised to conduct thorough research, limit their exposure, and consider using risk management tools to protect their investments.

Conclusion and Recommendations

In conclusion, the investigation into Renhe's operations raises several red flags that suggest it may not be a safe trading environment. While it is regulated by the Securities Commission of the Bahamas, the level of oversight is not robust enough to guarantee the safety of client funds or ensure fair trading practices. The lack of transparency, coupled with numerous complaints regarding fund withdrawals and account access, indicates that traders should exercise caution when considering this broker.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by stricter authorities, such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These brokers typically offer better protection and more transparent trading conditions, enhancing overall trading security. Always prioritize safety and due diligence when selecting a forex broker.

Is Renhe a scam, or is it legit?

The latest exposure and evaluation content of Renhe brokers.

Renhe Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Renhe latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.