Quotex 2025 Review: Everything You Need to Know

Executive Summary

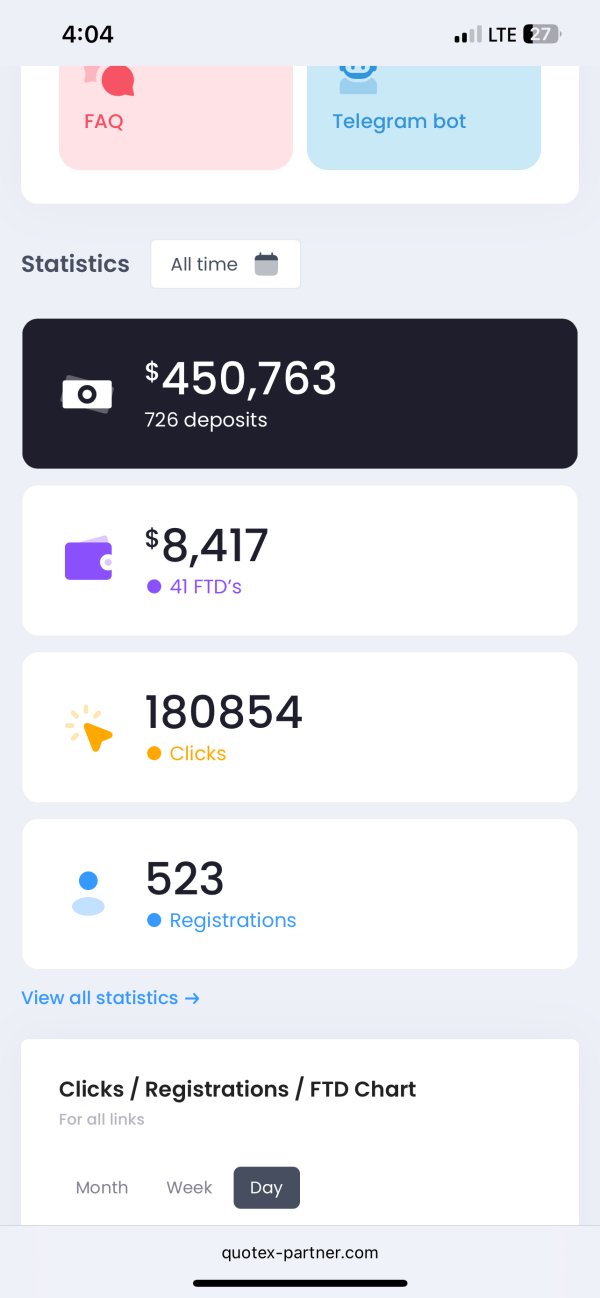

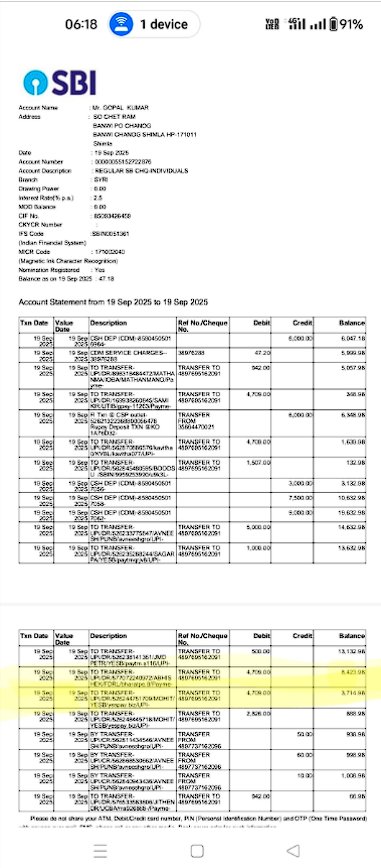

This Quotex review shows a trading platform that gets lots of user attention but has serious rule problems. Quotex has 73,071 user reviews and a 99% recommendation rate according to Reviews.io, which means users seem happy with it. But under these good numbers, there are big problems with rules and taking out money that traders need to think about carefully.

Quotex says it is easy to use and made for fast trading across many types of assets. The platform appeals to people because it is simple to access and has a clean design that makes trading quick and easy to understand. Even though users give mostly good feedback, careful study shows worrying patterns of withdrawal problems and fake rule claims that hurt the platform's trust.

The platform mainly targets traders who care more about ease of use and many assets than rule protection. Quotex might appeal to people who want quick market access and different trading choices, but users must think about these benefits against the big risks of using a platform without proper rules. The gap between happy user scores and rule warnings makes it hard to judge and requires careful thought about personal risk levels and trading goals.

Important Disclaimers

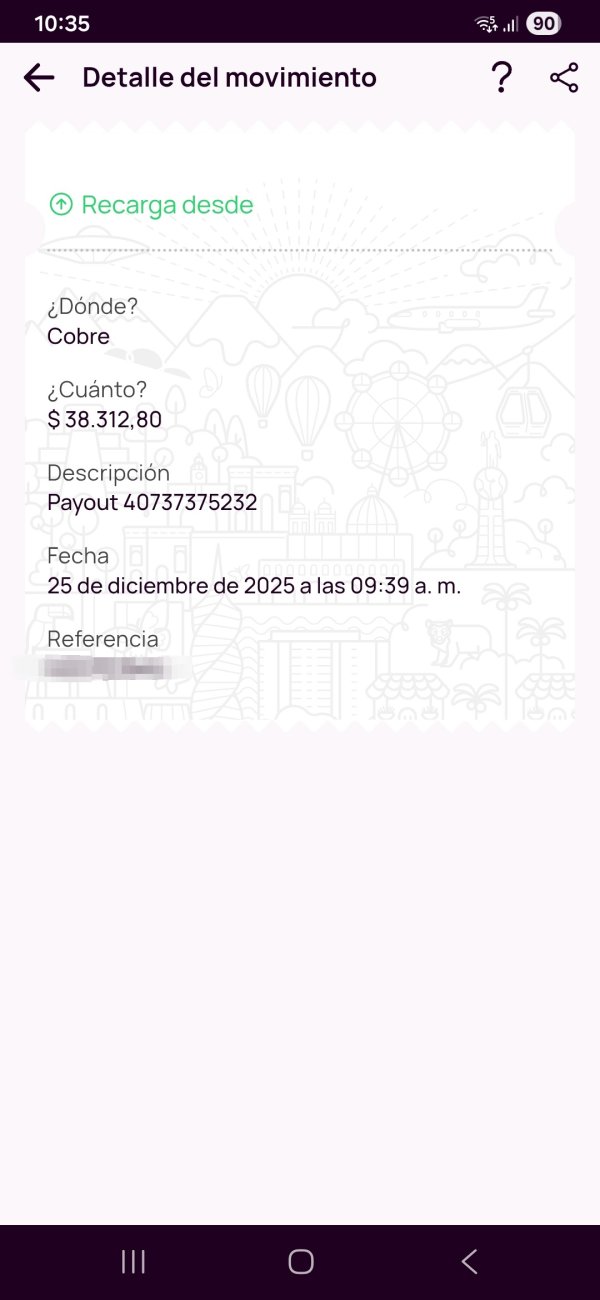

This Quotex review uses information that anyone can find and user feedback from different online sources. Quotex works without clear rule oversight, and users in different places may have different levels of legal protection. The Spanish money regulator has given specific warnings about Quotex's work, showing how important it is to understand local rule effects before using the platform.

Our review method uses user stories, platform feature study, and rule database searches rather than testing the platform directly. Readers should know that trading conditions, policies, and platform features may change without warning, and this review shows information available when it was written. Given the rule uncertainties around Quotex, potential users should strongly consider talking with money advisors and checking current rule status in their area before making any trading decisions.

Rating Framework

Broker Overview

Quotex works as a trading platform that focuses on being easy to access and fast. Specific details about when it started and how the company is set up remain unclear in available papers. The platform has built a large user base, as shown by the big review collection with over 73,000 individual reviews.

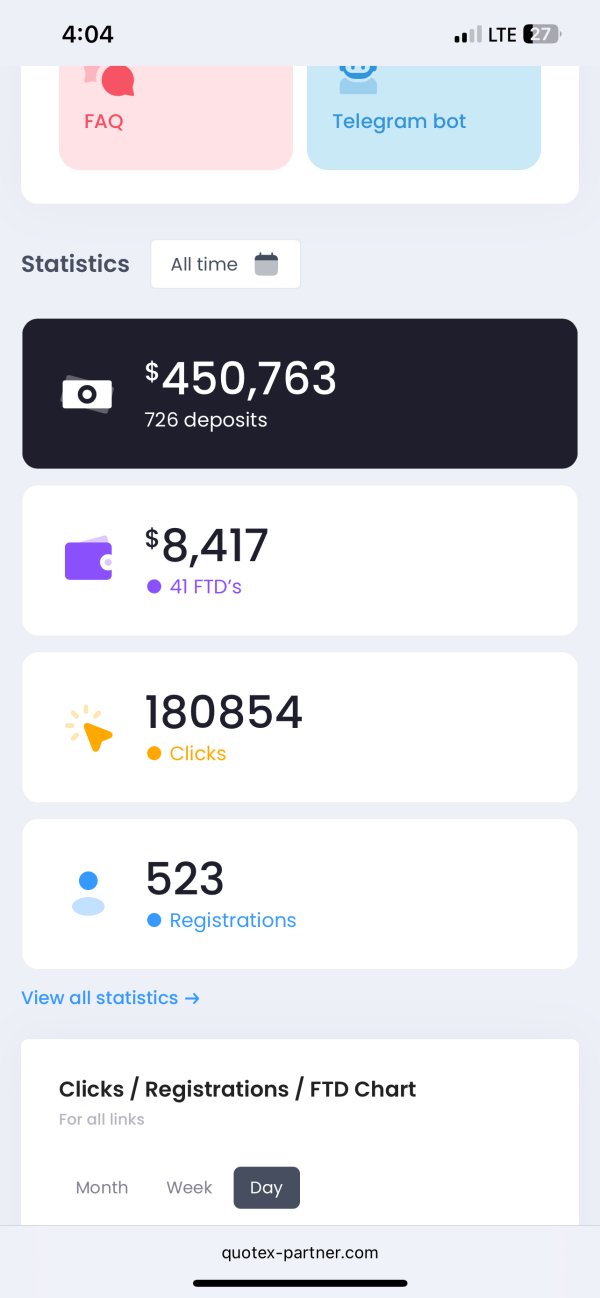

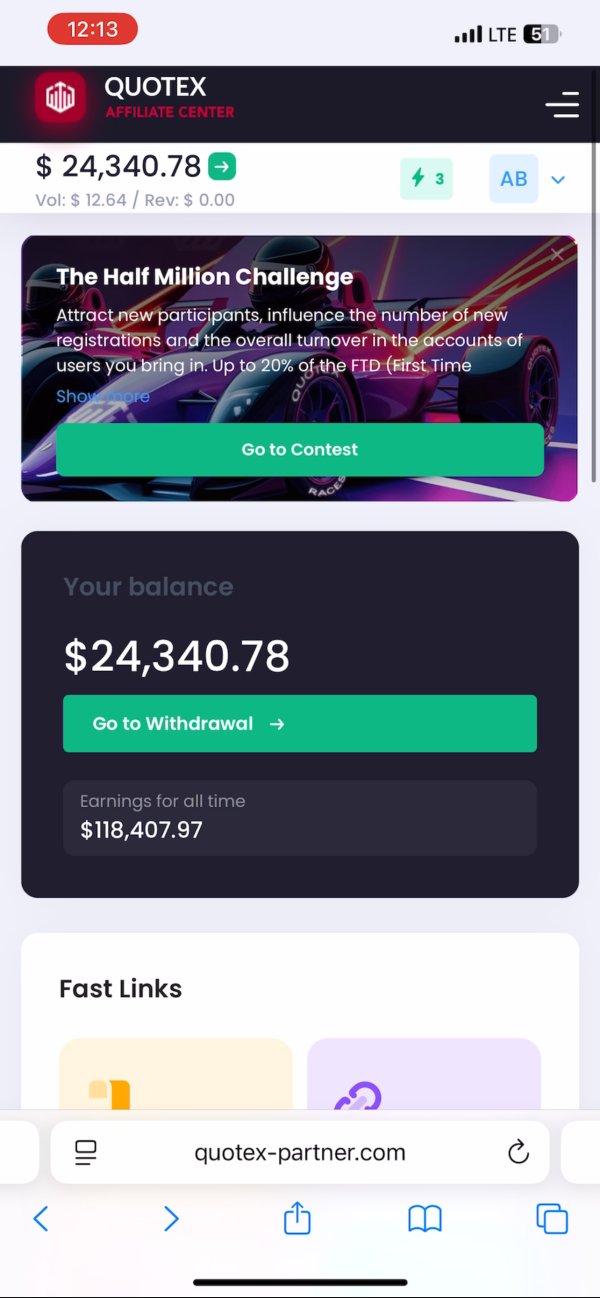

This large user engagement suggests the platform reaches many people, though the lack of clear company information raises questions about how open they are about their work. The platform's business plan centers on giving fast trading access across multiple asset types. According to user feedback, Quotex has built a reputation for platform simplicity and execution speed, which has made it appealing to traders who want immediate market access.

However, the absence of clear rule framework creates a work environment that puts accessibility over traditional money safeguards. Quotex's main trading structure consists of a proprietary platform designed for quick order execution and streamlined user interaction. While specific asset categories are not detailed in available sources, user feedback shows access to diverse trading opportunities.

The platform's rule status remains problematic, with Spanish money authorities specifically warning against Quotex operations. This indicates potential compliance issues that extend beyond single-area concerns.

Regulatory Status: Available information does not specify particular rule authorities overseeing Quotex operations. Spanish money regulators have issued warnings regarding the platform, suggesting rule compliance issues that potential users should carefully consider before engagement.

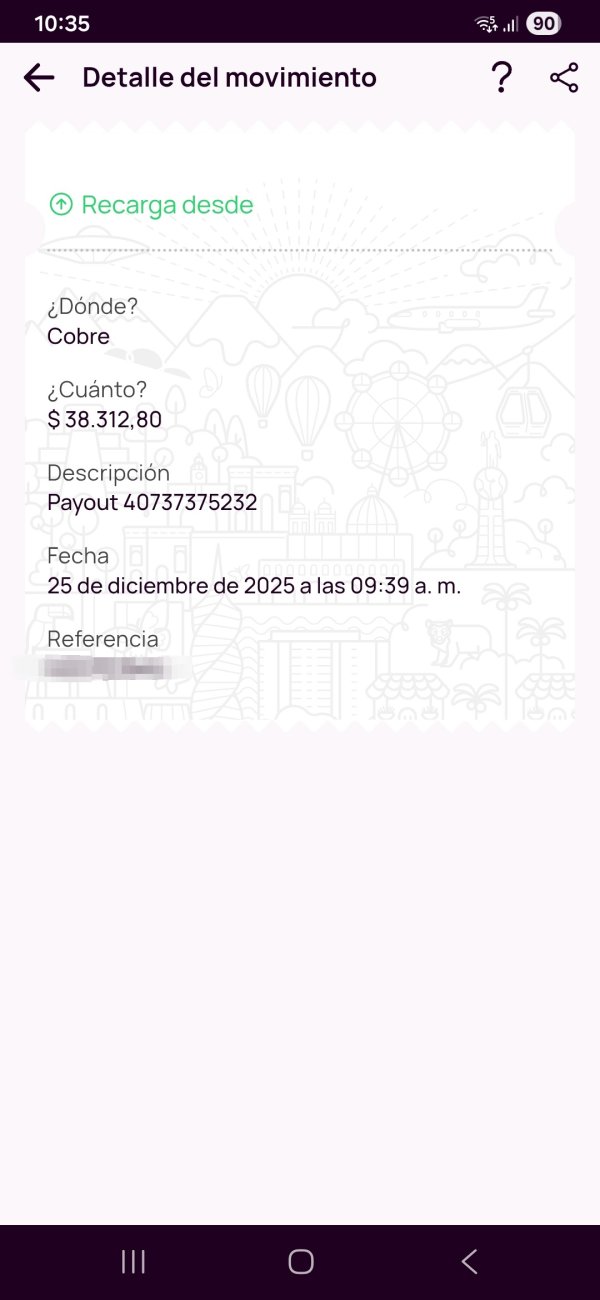

Deposit and Withdrawal Methods: Specific information regarding supported payment methods and processing procedures is not detailed in available source materials. This lack of openness regarding money transactions represents a significant information gap for potential users.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in the available documentation. This leaves potential users without clear entry-level investment guidance.

Promotional Offerings: Details regarding bonus structures, promotional campaigns, or incentive programs are not provided in the source materials reviewed for this Quotex review.

Available Trading Assets: User feedback indicates access to diverse trading opportunities, but specific asset categories, instrument types, and market coverage details are not explicitly outlined in available information.

Cost Structure: Complete information regarding spreads, commissions, overnight fees, and other trading costs is not available in the reviewed materials. This represents a significant openness gap for cost-conscious traders.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in the available source documentation.

Platform Technology: Quotex uses a proprietary trading platform that users consistently describe as intuitive and optimized for rapid trade execution. Technical specifications and advanced features are not detailed though.

Geographic Restrictions: Specific information regarding regional availability and access limitations is not provided in available materials.

Customer Support Languages: Details regarding multilingual support options and communication channels are not specified in the reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Quotex account conditions faces big limitations due to not enough information in available source materials. Traditional account analysis typically looks at account tier structures, minimum balance requirements, and special account features, but these details remain undisclosed in publicly available documentation.

This information gap prevents complete assessment of whether Quotex offers different account levels or maintains uniform conditions across all users. Account opening procedures and verification requirements are similarly undocumented in available sources. The absence of clear account condition information creates uncertainty for potential users attempting to understand entry requirements and ongoing obligations.

Without detailed account specifications, traders cannot adequately assess whether Quotex account structures align with their trading volume expectations and capital allocation strategies. The lack of information regarding specialized account options, such as Islamic accounts or professional trader designations, further limits the ability to evaluate Quotex's accommodation of diverse user needs. This openness deficit represents a significant concern for traders who require specific account configurations to meet rule or personal requirements.

Given the substantial information gaps in account condition documentation, potential users should exercise particular caution and seek direct clarification from Quotex representatives before committing funds. The absence of publicly available account details contradicts standard industry practices and raises questions about operational openness that extend beyond simple marketing preferences.

Assessment of Quotex trading tools and educational resources encounters significant limitations due to sparse information availability in reviewed materials. Complete platform evaluation typically examines charting capabilities, technical analysis tools, and research resources, but specific details regarding these features remain undocumented in available sources.

Educational resource availability, including tutorials, market analysis, and trading guides, cannot be adequately assessed based on current information availability. The absence of detailed tool descriptions prevents evaluation of whether Quotex provides sufficient resources for trader development and skill enhancement, particularly important for platforms targeting diverse user experience levels.

Automated trading support and algorithmic trading capabilities are not addressed in available documentation. This information gap is particularly significant given the platform's emphasis on rapid execution, as traders seeking automated solutions require clear understanding of supported technologies and integration possibilities.

Research and analysis resources, including market commentary, economic calendars, and fundamental analysis tools, remain unspecified in reviewed materials. The lack of information regarding analytical support tools creates uncertainty about Quotex's commitment to providing complete trading environments beyond basic order execution capabilities.

Customer Service and Support Analysis

Evaluation of Quotex customer service capabilities faces substantial limitations due to not enough information in available source materials. Standard customer support assessment examines communication channels, response times, and service quality, but these critical details remain largely undocumented in publicly available information.

Response time expectations and service availability hours cannot be determined from current information sources. This uncertainty creates potential concerns for traders who require reliable support access, particularly during volatile market conditions when timely assistance becomes crucial for risk management and technical issue resolution.

Multilingual support capabilities and regional service variations are not specified in available documentation. Given Quotex's apparent international user base, the absence of clear language support information represents a significant service openness gap that could impact user experience across different geographic markets.

Problem resolution procedures and escalation processes remain unclear based on available information. While user reviews indicate substantial engagement with the platform, specific feedback regarding customer service quality and effectiveness is not detailed in the materials reviewed for this analysis, preventing complete support quality assessment.

Trading Experience Analysis

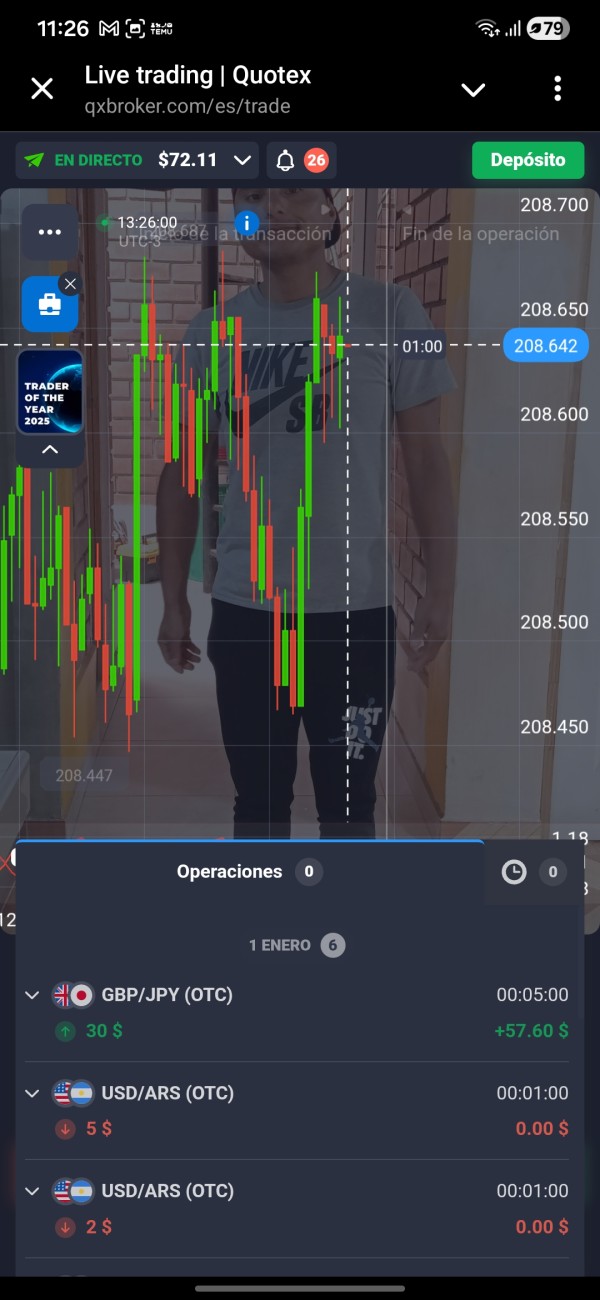

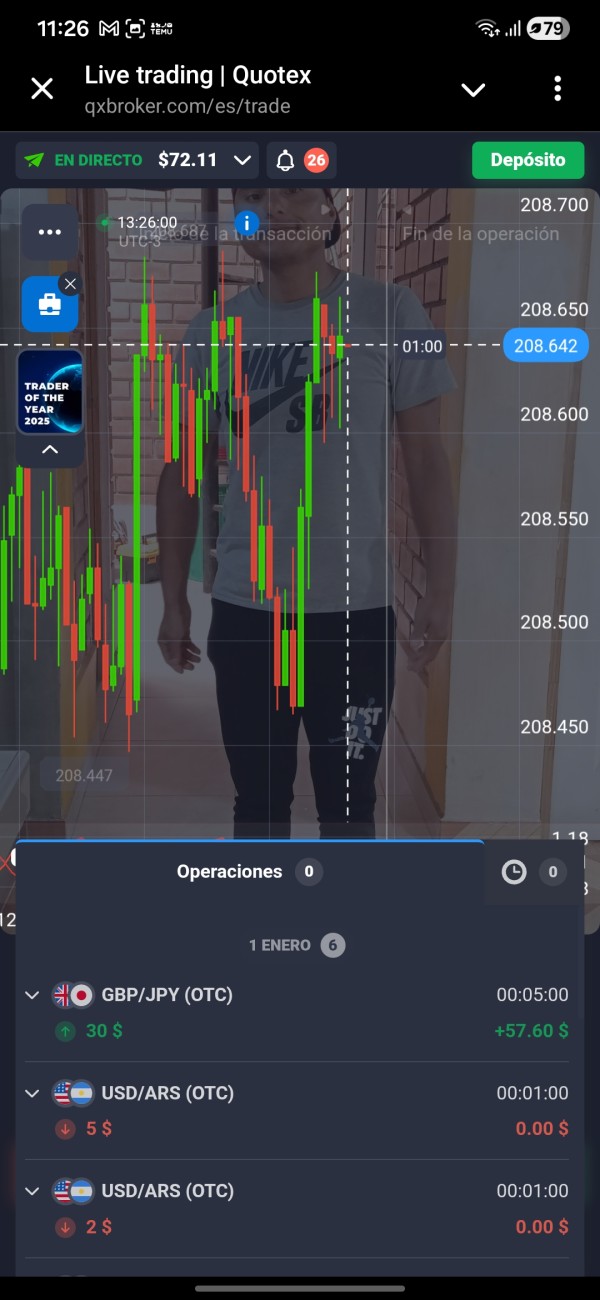

The trading experience evaluation reveals Quotex's strongest performance area, with user feedback consistently highlighting platform usability and execution speed. According to available user testimonials, the platform delivers on its promise of rapid trade execution and intuitive navigation, characteristics that have contributed significantly to its positive user reception.

Platform stability and execution quality receive positive user feedback, though specific technical performance data regarding slippage rates, requote frequency, and system uptime are not available in reviewed materials. User comments emphasize the platform's ability to facilitate quick trading decisions and seamless order placement, suggesting robust technical infrastructure despite the absence of detailed performance metrics.

The user interface design appears optimized for efficiency and ease of use, with multiple users specifically mentioning the platform's accessibility for both novice and experienced traders. This positive feedback regarding usability represents a significant strength in Quotex's overall offering, particularly for traders prioritizing operational simplicity over advanced analytical features.

Mobile trading capabilities and cross-device functionality are not specifically detailed in available sources, though the emphasis on rapid execution suggests mobile optimization. The absence of specific mobile platform information represents a minor evaluation gap in an increasingly mobile-centric trading environment where seamless device integration has become essential for active traders.

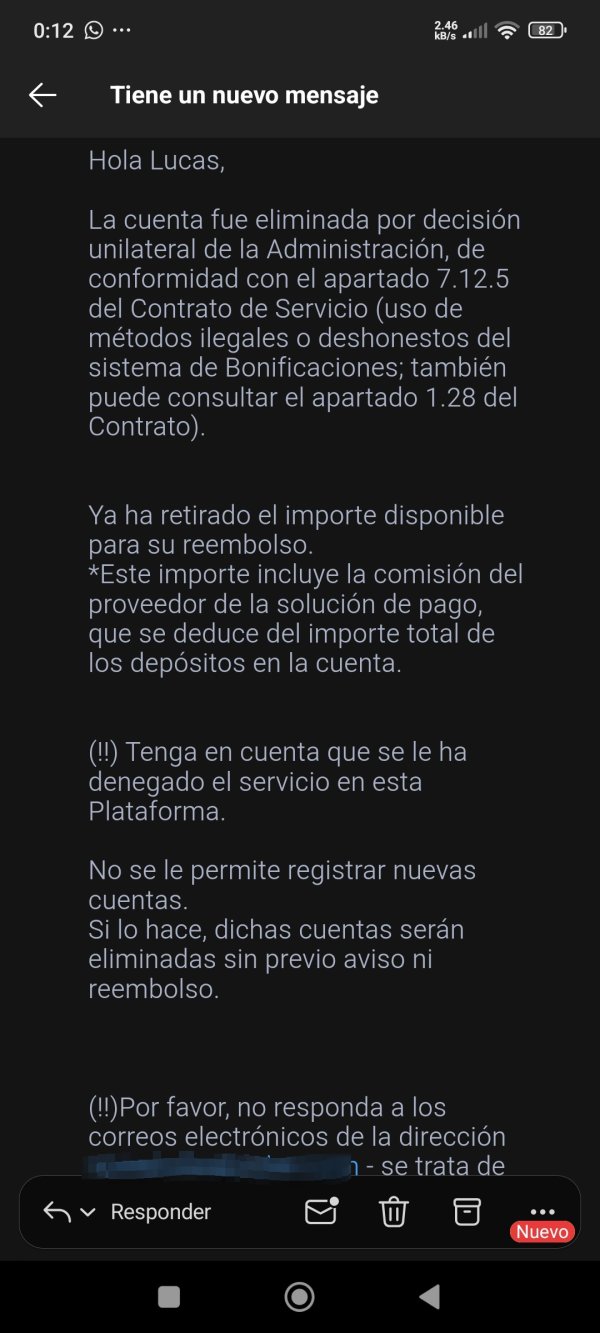

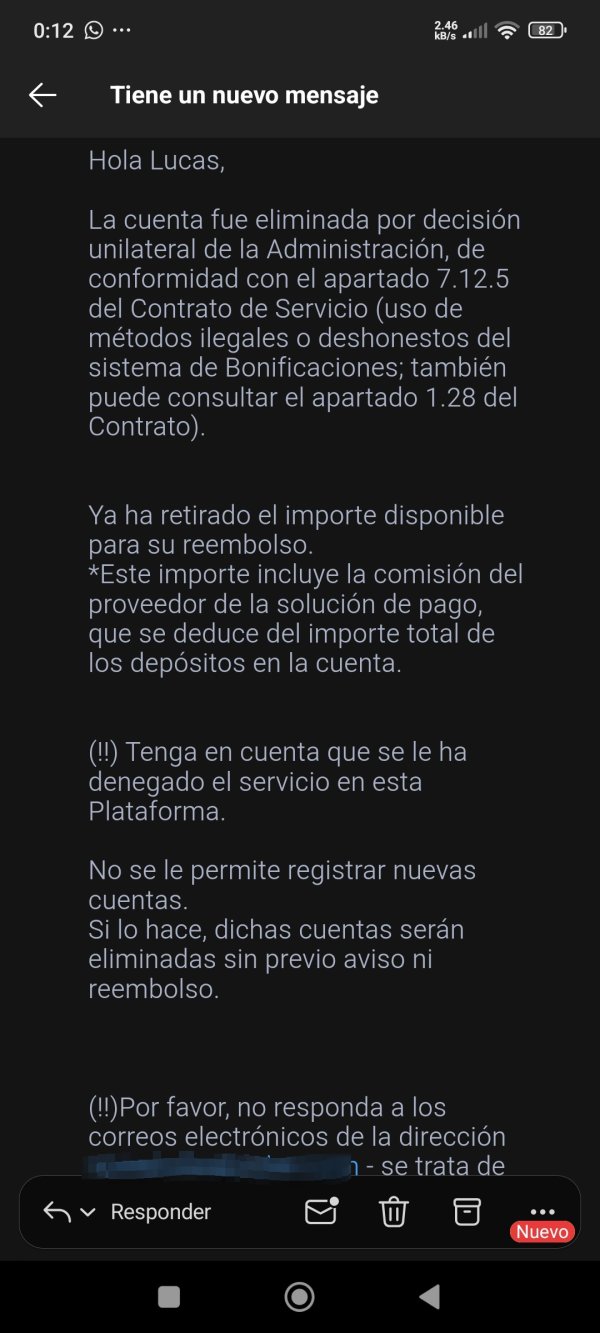

Trust and Security Analysis

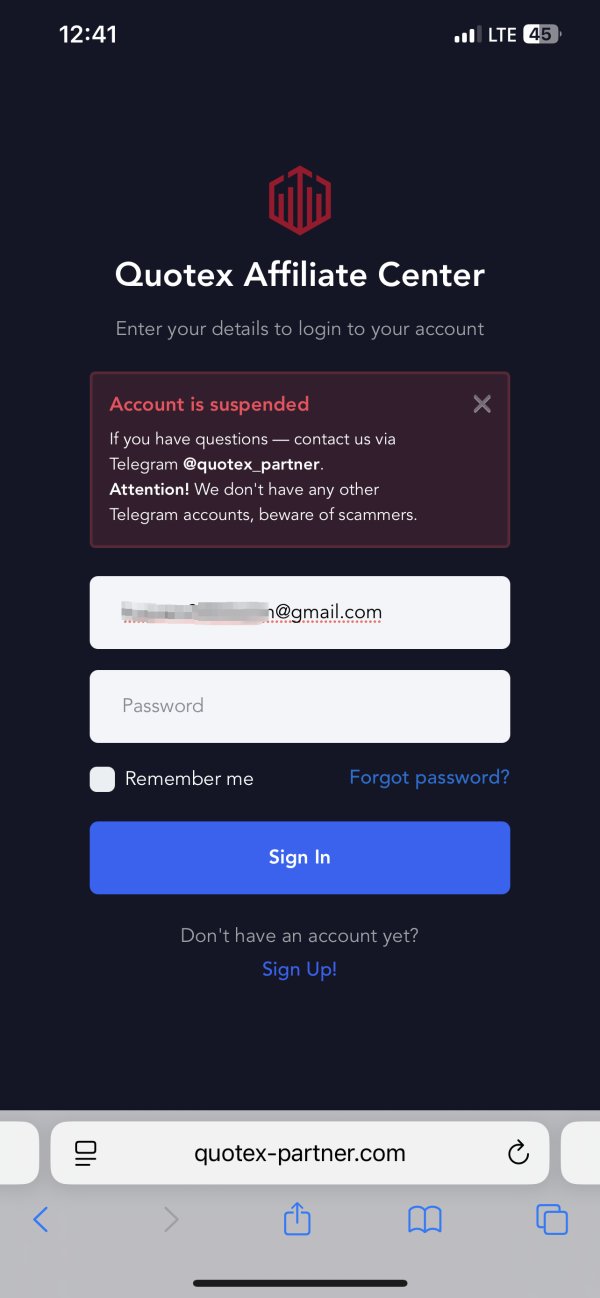

Trust and security evaluation reveals the most concerning aspects of Quotex operations, with rule status representing the primary area of concern. The platform operates without clear rule oversight from recognized money authorities, creating significant uncertainty regarding user protection and operational standards compliance.

Spanish money regulators have specifically issued warnings regarding Quotex operations, indicating rule compliance concerns that extend beyond administrative oversights. These official warnings represent serious red flags that potential users must carefully consider, as rule warnings typically indicate identified risks to consumer protection and money security.

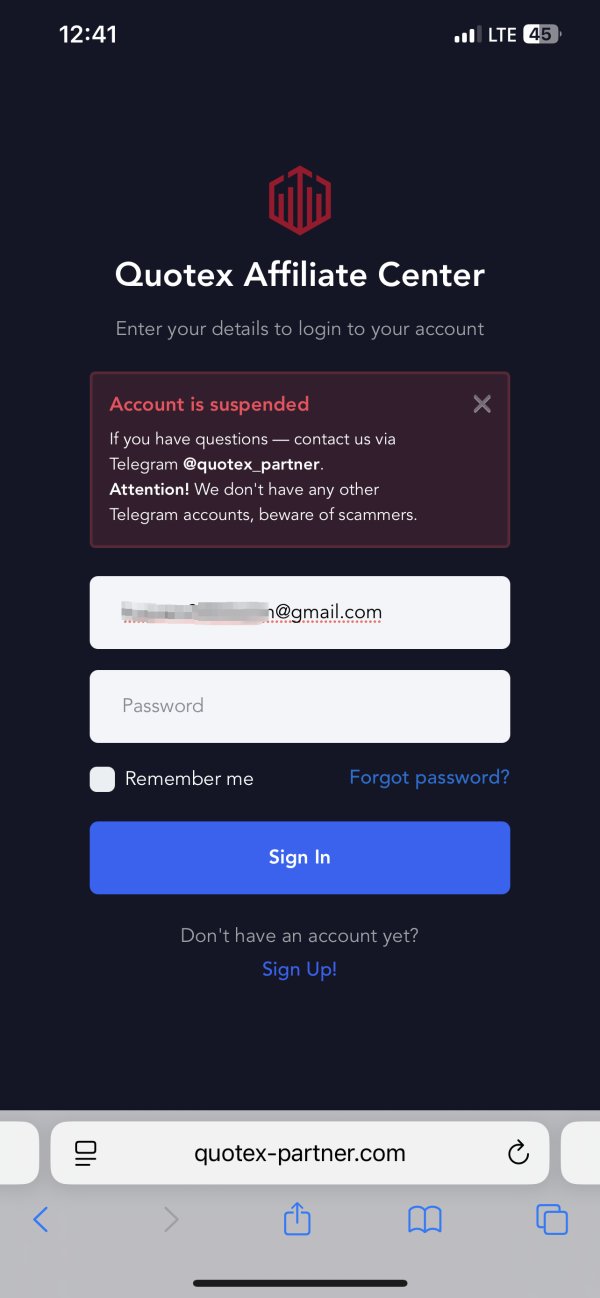

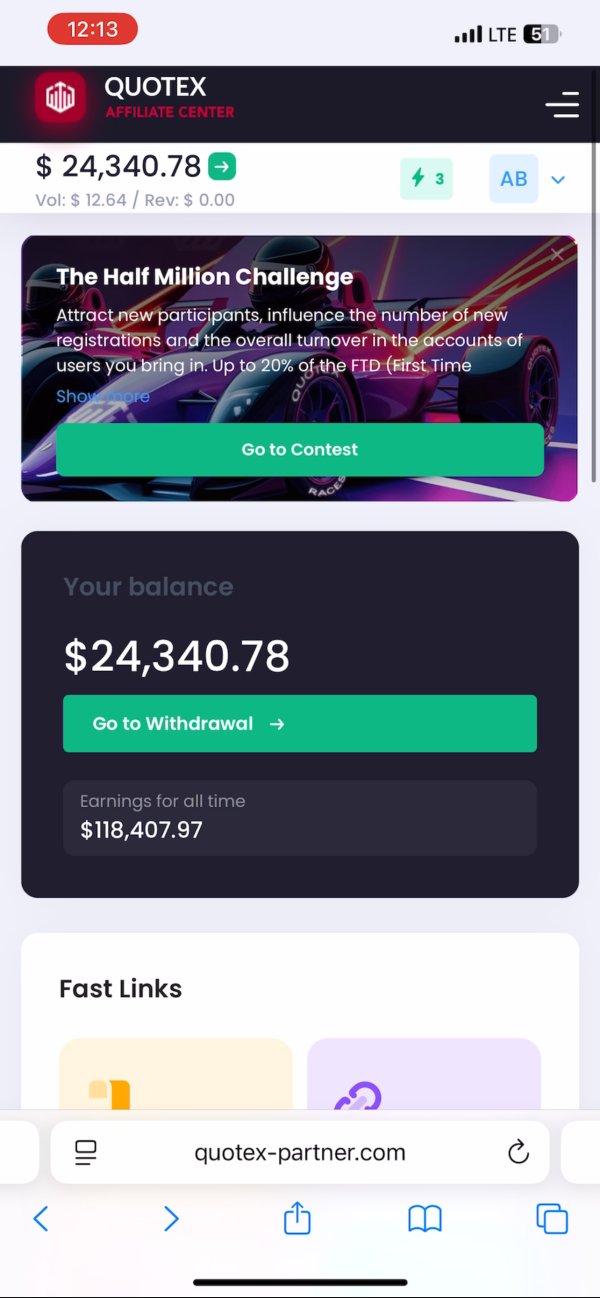

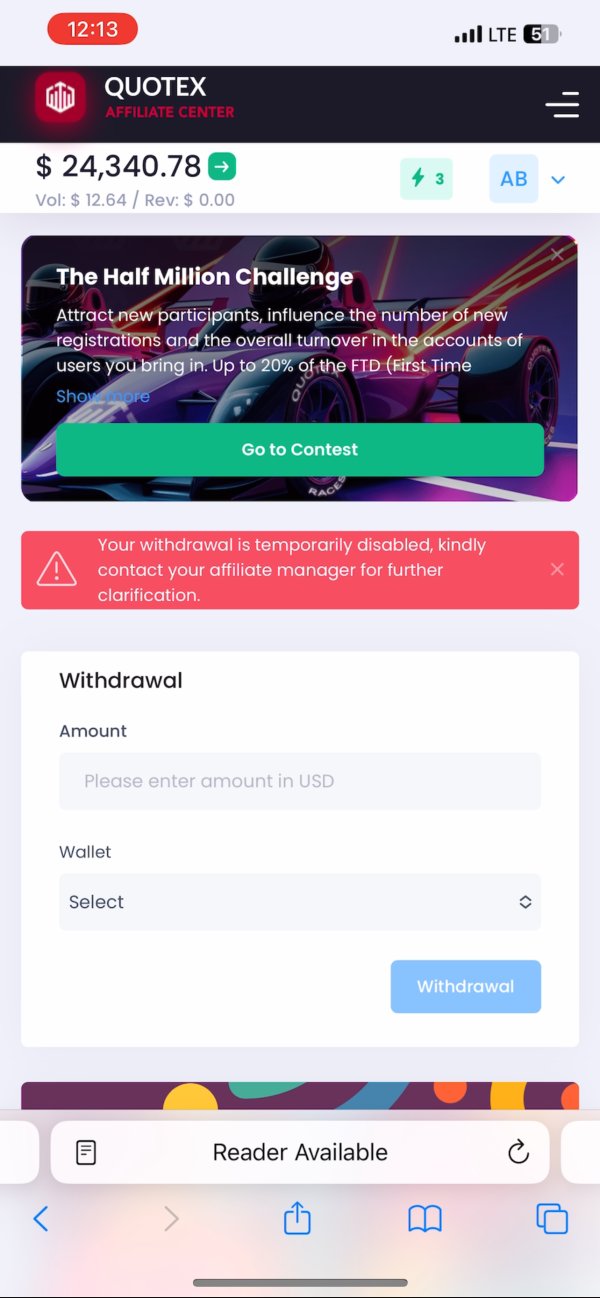

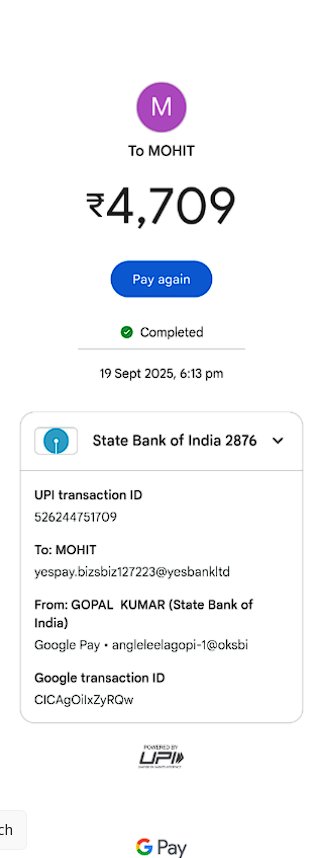

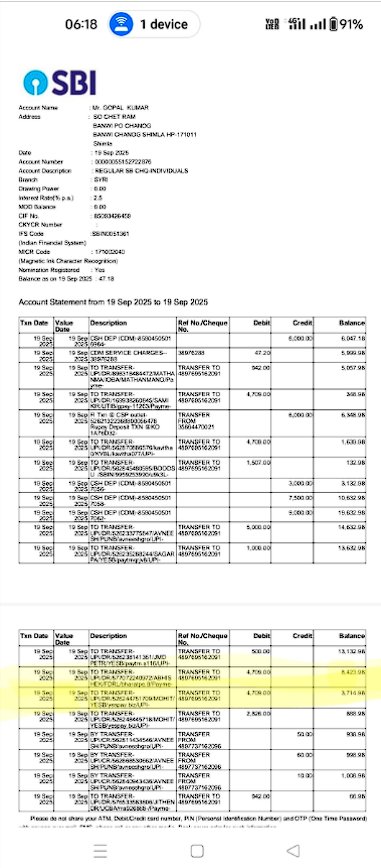

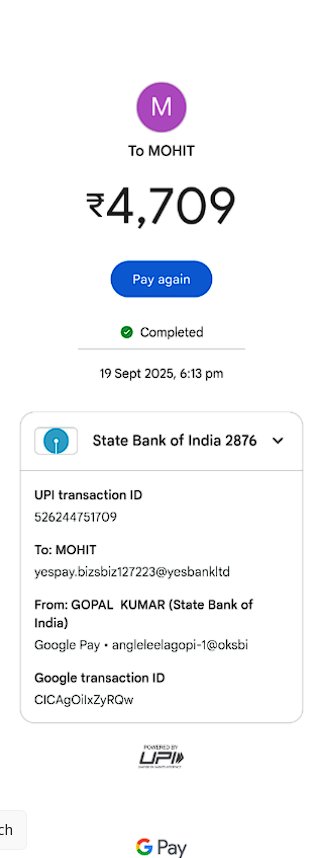

User feedback includes documented complaints regarding withdrawal difficulties and fraud allegations, creating additional trust concerns beyond rule issues. While the majority of user reviews remain positive, the presence of serious withdrawal complaints suggests potential operational issues that could impact user fund security and platform reliability.

Company openness and operational disclosure fall short of industry standards, with limited information available regarding corporate structure, money backing, and operational procedures. This openness deficit compounds rule concerns and creates additional uncertainty regarding platform stability and long-term operational viability.

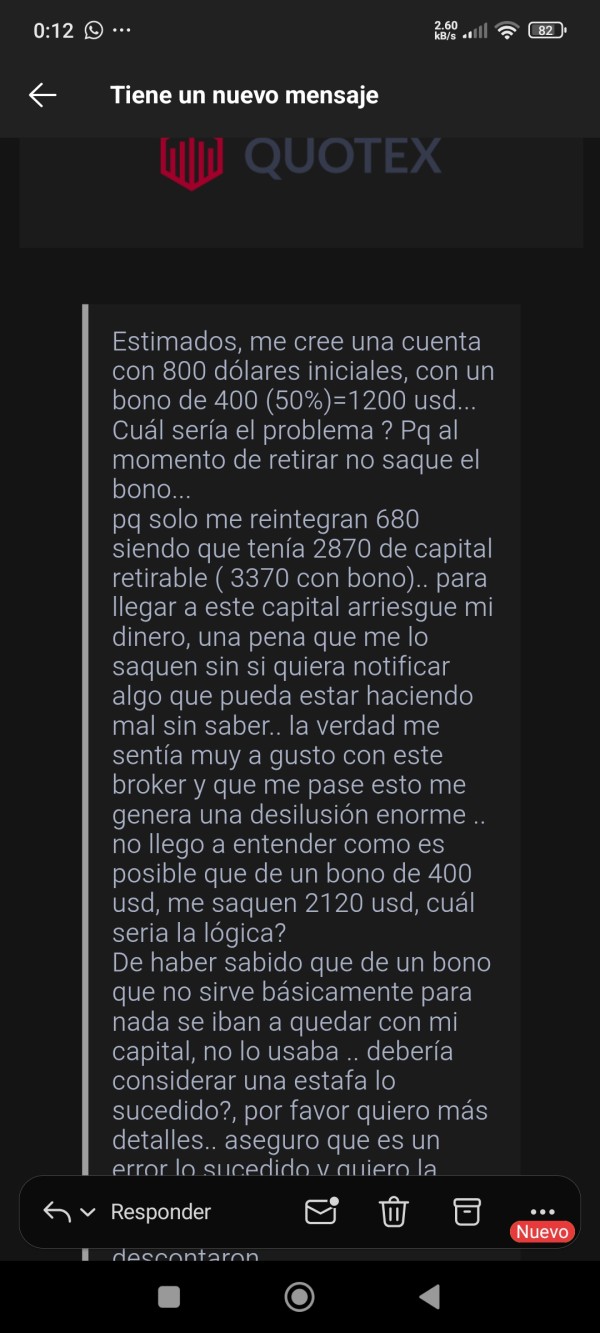

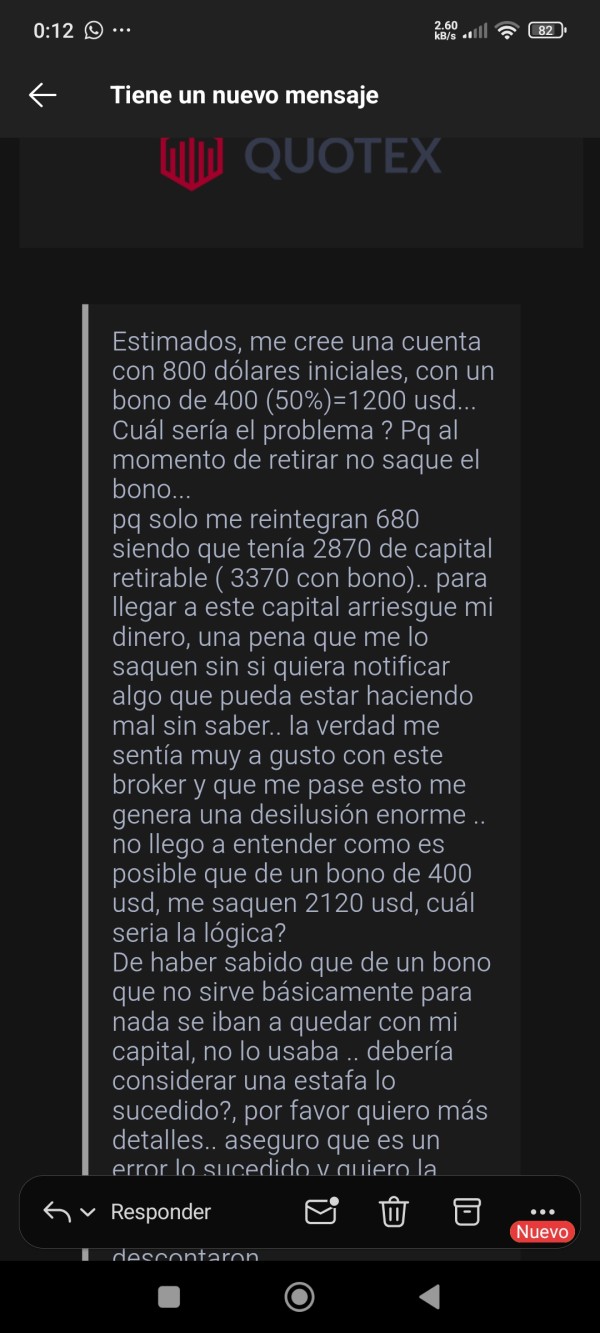

User Experience Analysis

User experience assessment reveals a complex picture combining high satisfaction rates with concerning negative feedback patterns. The 73,071 user reviews with 99% recommendation rates suggest substantial positive user engagement, though the presence of withdrawal complaints and fraud allegations indicates significant negative experiences for some users.

Interface design and navigation receive consistently positive feedback, with users frequently mentioning the platform's intuitive layout and efficient operation. This positive reception regarding usability represents a significant strength that has contributed to Quotex's ability to attract and retain users despite rule concerns and negative feedback from some users.

Registration and verification processes are not specifically detailed in available materials, preventing complete assessment of user onboarding experience. The absence of clear information regarding account setup procedures creates uncertainty about platform accessibility and verification requirements that potential users should clarify before engagement.

Common user complaints center on withdrawal processing and fund access issues, representing the most significant negative user experience pattern identified in available feedback. These withdrawal concerns create substantial user experience risks that potential users must carefully consider, as fund access difficulties can significantly impact overall platform satisfaction regardless of trading experience quality.

Conclusion

This Quotex review reveals a platform that excels in user interface design and execution speed while facing serious challenges in rule compliance and user trust. The impressive user engagement statistics, including over 73,000 reviews with 99% recommendation rates, demonstrate Quotex's ability to deliver satisfactory trading experiences for many users.

However, the absence of rule oversight and documented withdrawal issues create substantial risks that potential users cannot ignore. Quotex may appeal to traders prioritizing platform simplicity and rapid execution over rule protection, particularly those comfortable with higher risk tolerance levels. However, the combination of rule warnings, withdrawal complaints, and openness deficits makes Quotex unsuitable for risk-averse traders or those requiring guaranteed fund security and rule protection.

The platform's primary strengths lie in user experience and execution efficiency, while its critical weaknesses involve trust, security, and rule compliance. Potential users must carefully weigh these competing factors against their individual risk tolerance and trading priorities before making engagement decisions.