Regarding the legitimacy of Goldenway Global forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Goldenway Global safe?

Business

License

Is Goldenway Global markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

Goldenway Global Investments (UK) Limited

Effective Date:

2001-12-01Email Address of Licensed Institution:

tim.liu@gwguk.comSharing Status:

No SharingWebsite of Licensed Institution:

www.gwguk.comExpiration Time:

2023-04-05Address of Licensed Institution:

New Broad Street House 35 New Broad Street London EC2M 1NH UNITED KINGDOMPhone Number of Licensed Institution:

442079596800Licensed Institution Certified Documents:

Is Goldenway Global A Scam?

Introduction

Goldenway Global is an online forex broker that positions itself as a provider of various trading products, including forex, precious metals, and indices. Established in the UK, it aims to attract both novice and experienced traders with its claimed regulatory compliance and competitive trading conditions. However, the forex market is notorious for its complexities and potential risks, making it crucial for traders to conduct thorough evaluations of brokers before investing their hard-earned money. This article aims to provide a comprehensive analysis of Goldenway Global, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The information compiled here is based on a review of multiple sources, including regulatory bodies, customer feedback, and financial analysis platforms.

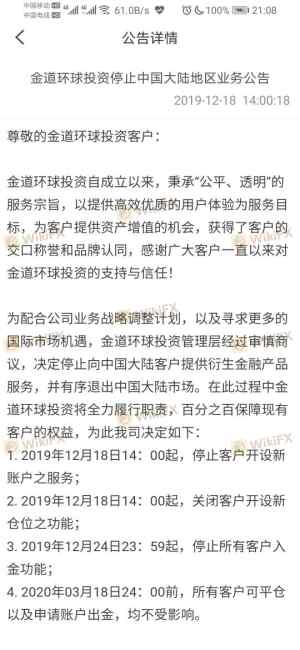

Regulation and Legitimacy

One of the most critical factors to consider when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards of conduct and financial practices. In the case of Goldenway Global, the broker claims to be regulated by the Financial Conduct Authority (FCA) in the UK. However, recent findings indicate that the FCA license held by Goldenway Global has been revoked, raising serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 185223 | United Kingdom | Revoked |

The revocation of the FCA license signifies a significant lapse in compliance, which is a red flag for potential investors. Without regulatory oversight, traders are left vulnerable to potential fraud and mismanagement. The lack of a valid regulatory framework raises questions about the safety of funds and the overall reliability of Goldenway Global.

Company Background Investigation

Goldenway Global Investments (UK) Limited, the entity behind Goldenway Global, was established with the intent of providing a reliable trading platform for forex enthusiasts. However, the company's history is marred by a lack of transparency. Information regarding its ownership structure and management team is scarce, making it difficult to assess the credibility of its leadership.

Furthermore, the company's claims about being based in the UK have been called into question, as several sources suggest that it may not be registered in the region at all. This ambiguity surrounding its operational base and ownership structure contributes to the overall perception of risk associated with this broker. The absence of clear and accessible information about the company's history and management further complicates the evaluation of whether Goldenway Global is safe or a scam.

Trading Conditions Analysis

When assessing a broker, understanding its trading conditions is vital. Goldenway Global offers two types of accounts: standard and VIP. The minimum deposit for a standard account is set at $200, while the VIP account requires a hefty $50,000. The broker claims to provide a maximum leverage of 1:500, which can be attractive to traders but also poses significant risks.

However, the cost structure appears less favorable when scrutinized. The average spread for major currency pairs is reported to be around 1.8 pips, which is higher than the industry average. Additionally, there are no commissions on forex trading, but traders should be cautious of hidden fees that may arise during the withdrawal process.

| Fee Type | Goldenway Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

These trading conditions raise questions about the overall competitiveness of Goldenway Global in the forex market. Traders must weigh these factors carefully to determine if the potential returns justify the associated risks.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Goldenway Global claims to implement measures to protect client funds, such as segregated accounts and investor protection policies. However, the lack of regulatory oversight raises significant concerns about the effectiveness of these measures.

Reports from various sources indicate that clients have faced difficulties withdrawing their funds, a common issue with unregulated brokers. The absence of a robust regulatory framework means that traders have limited recourse in case of disputes or financial mismanagement. Furthermore, the historical context surrounding Goldenway Global suggests that there have been instances of clients being unable to access their capital, contributing to the perception that Goldenway Global may not be safe.

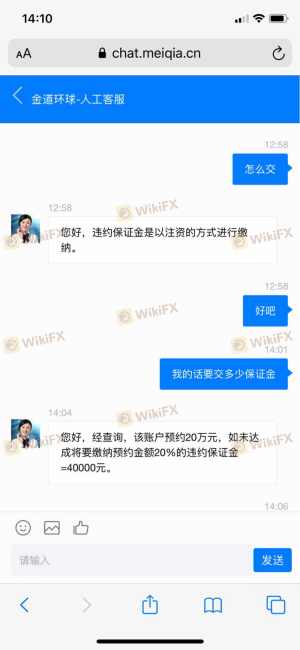

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Unfortunately, Goldenway Global has received numerous complaints from clients, particularly regarding withdrawal issues. Many users have reported that their requests for fund withdrawals were denied or delayed, leading to frustration and distrust.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Average |

| Transparency Concerns | High | Poor |

For instance, one typical case involved a trader who reported being unable to withdraw their funds despite multiple requests. This highlights a troubling pattern of complaints related to the broker's operational practices. The company's response to these issues has often been deemed inadequate, further exacerbating customer dissatisfaction.

Platform and Trade Execution

The trading platform offered by Goldenway Global is based on the widely-used MetaTrader 4 (MT4). While MT4 is known for its user-friendly interface and robust features, users have reported issues with execution quality, including slippage and order rejections. Such performance inconsistencies can significantly impact trading outcomes, especially for those employing high-frequency trading strategies.

Moreover, there have been allegations of price manipulation, where users claim that the platform displayed price trends inconsistent with the broader market. These issues raise concerns about the integrity of trade execution on the Goldenway Global platform, further questioning the broker's overall safety.

Risk Assessment

Engaging with Goldenway Global carries inherent risks, particularly due to its unregulated status and the numerous complaints from customers. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | License revoked, no oversight |

| Fund Withdrawal Issues | High | Frequent complaints from clients |

| Trading Platform Integrity | Medium | Reports of slippage and manipulation |

To mitigate these risks, potential investors should exercise extreme caution. It is advisable to start with a demo account, if available, before committing real funds. Additionally, traders should consider diversifying their investments across multiple platforms to reduce exposure to a single broker.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Goldenway Global. The broker's unregulated status, coupled with numerous customer complaints regarding fund withdrawals and trading execution issues, suggests that it may not be a safe choice for traders.

For those considering trading with Goldenway Global, it is crucial to weigh the risks carefully. If you are a novice trader or someone looking for a reliable trading partner, it may be wise to explore alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some recommended alternatives include brokers like IG Group, OANDA, and Forex.com, which offer robust regulatory frameworks and favorable trading conditions.

In summary, while Goldenway Global may present itself as an attractive option, the potential risks associated with trading through this broker cannot be ignored. Always prioritize safety and due diligence when selecting a forex broker.

Is Goldenway Global a scam, or is it legit?

The latest exposure and evaluation content of Goldenway Global brokers.

Goldenway Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Goldenway Global latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.