Is PT safe?

Business

License

Is PT Safe or a Scam?

Introduction

In the dynamic world of foreign exchange trading, brokers play a crucial role in facilitating trades between buyers and sellers. One such broker is PT, which positions itself as a player in the forex market. However, with the rise of online trading platforms, the need for traders to exercise caution has never been more critical. Many brokers, including PT, often lack regulatory oversight, which raises questions about their legitimacy and the safety of traders' funds. This article aims to provide an objective analysis of whether PT is a scam or a safe trading option by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

To conduct this investigation, we utilized a comprehensive evaluation framework that includes regulatory insights, financial safety measures, user feedback, and market comparisons. By synthesizing information from various reputable sources, we aim to give potential traders a clear picture of PT's standing in the forex market.

Regulation and Legitimacy

The regulatory environment for forex brokers is paramount in determining their legitimacy and the safety of traders' funds. PT claims to operate under certain regulatory frameworks; however, scrutiny reveals a lack of robust oversight. Below is a table summarizing the core regulatory information regarding PT:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | Marshall Islands | Unverified |

The absence of a reputable regulatory authority raises significant concerns about PT's operations. Many reputable brokers are regulated by top-tier authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). In contrast, PT's registration in the Marshall Islands, known for its lenient regulations, does not provide adequate protection for traders. The lack of oversight can lead to issues such as unfair pricing, lack of transparency, and potential fraud. Furthermore, warnings issued by various regulatory bodies highlight the risks associated with trading with PT, emphasizing the need for traders to be cautious.

Company Background Investigation

Understanding the company behind a broker is essential in assessing its credibility. PT appears to have a limited history, with scant information available about its ownership structure and management team. The company's website does not disclose significant details about its founders or executive team, which raises transparency concerns.

Moreover, the lack of a clear corporate structure and the absence of verifiable information about its operational history contribute to the perception that PT may not be a trustworthy broker. A reputable broker typically provides comprehensive information about its management team, including professional backgrounds and experience in the financial services industry. Without this transparency, it becomes challenging for potential clients to gauge the broker's reliability.

In summary, the insufficient information regarding PT's company history and management raises red flags about its legitimacy and whether it can be considered safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, examining the trading conditions is crucial. PT offers a range of trading accounts with varying minimum deposit requirements and potential bonuses. However, the overall fee structure lacks clarity, which can be concerning for traders. Below is a comparison of PT's core trading costs against industry averages:

| Fee Type | PT | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Model | Unclear | Transparent |

| Overnight Interest Range | Variable | Standardized |

The high spreads on major currency pairs may indicate that PT is not competitive compared to other brokers. Additionally, the lack of transparency regarding commissions and overnight interest rates can lead to unexpected costs for traders. Many reputable brokers provide clear and detailed information about their fee structures, enabling traders to make informed decisions. The ambiguity surrounding PT's trading conditions raises concerns about potential hidden fees, which could further diminish the overall trading experience.

Customer Funds Security

The safety of customer funds is one of the most critical aspects of any broker's operations. PT's website does not provide sufficient information about its fund security measures. Key considerations include whether client funds are kept in segregated accounts, the presence of investor protection schemes, and any negative balance protection policies.

Without clear information on these safety measures, traders may be at risk if the broker encounters financial difficulties. Furthermore, historical incidents involving fund security issues can serve as a warning sign. Reports of traders losing their deposits or facing challenges in withdrawing funds from PT have surfaced, indicating a potential lack of financial stability and security.

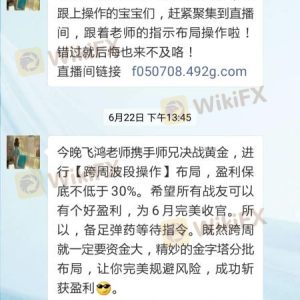

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of PT reveal a mixed bag of experiences, with several users reporting issues related to withdrawal difficulties and poor customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresolved |

| Unclear Fee Structure | High | No clarification |

Typical cases include traders who have struggled to withdraw their funds after multiple attempts, leading to frustration and distrust. The slow response times from PT's customer service team further exacerbate these issues, leaving clients feeling unsupported. A broker's ability to address customer complaints effectively is a crucial aspect of its credibility, and PT's performance in this area raises concerns about its commitment to client satisfaction.

Platform and Execution

The trading platform's performance, stability, and user experience are essential components of any trading operation. PT's platform has received mixed reviews regarding its functionality, with some users reporting issues related to order execution quality and slippage. These problems can significantly impact traders' experiences, particularly in a fast-moving market environment.

Additionally, any signs of platform manipulation, such as frequent rejections of orders or significant slippage, can indicate untrustworthy practices. A reliable broker should provide a seamless trading experience, characterized by minimal slippage and high execution quality. Unfortunately, reports from PT users suggest that these standards may not be consistently met.

Risk Assessment

Using PT as a trading broker presents several risks that potential clients should consider. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight by reputable authorities |

| Financial Stability Risk | High | Reports of withdrawal issues and fund security concerns |

| Customer Service Risk | Medium | Poor response times and unresolved complaints |

To mitigate these risks, traders should conduct thorough due diligence before engaging with PT. It is advisable to start with a small deposit, monitor the trading experience closely, and remain vigilant regarding any unusual activities.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is clear that PT raises several concerns regarding its safety and legitimacy. The absence of regulatory oversight, lack of transparency in company operations, unfavorable trading conditions, and negative customer feedback collectively suggest that PT may not be a safe option for traders.

For those considering forex trading, it is crucial to prioritize brokers that are regulated by reputable authorities and demonstrate a commitment to customer service and transparency. Alternatives such as eToro or IG, which offer robust regulatory frameworks and positive user experiences, are recommended for traders seeking safer trading environments.

In conclusion, while PT may present itself as a viable trading option, the risks associated with using this broker warrant significant caution. It is essential for traders to remain informed and make decisions based on thorough research and risk assessment. Is PT safe? Given the evidence, potential traders should exercise caution and consider more reputable alternatives.

Is PT a scam, or is it legit?

The latest exposure and evaluation content of PT brokers.

PT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PT latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.