PT 2025 Review: Everything You Need to Know

In the world of online trading, PT has garnered attention, but not all of it is positive. This review synthesizes various insights from multiple sources, highlighting significant concerns about its legitimacy, regulatory status, and user experiences. Key findings reveal that PT lacks proper regulation, which raises red flags for potential investors.

Attention: It's essential to note that PT operates under different entities across regions, which can lead to confusion. The information presented here is based on a thorough review of available resources to ensure fairness and accuracy.

Ratings Overview

How We Rated the Broker: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's operations.

Broker Overview

Established within the past few years, PT is a forex broker that claims to offer trading services across various asset classes, including forex, cryptocurrencies, and CFDs. The platform primarily utilizes the popular MetaTrader 4 (MT4) for trading. However, it has come under scrutiny for its lack of regulatory oversight, as it operates from jurisdictions known for lax regulations, such as the Marshall Islands.

Detailed Section

Regulatory Status

PT is not regulated by any major financial authority, which is a significant concern for potential traders. According to the Luxembourg regulator CSSF and the UK's FCA, PT has been flagged for operating without proper authorization, leading to warnings against its activities. This lack of oversight means that users have little recourse in the event of disputes or issues with withdrawals.

Deposit/Withdrawal Methods

Users have reported difficulties in withdrawing funds, with some claiming that excessive fees or conditions were imposed. The absence of clear information on accepted currencies further complicates the situation. While the broker claims to support various payment methods, user reviews indicate a lack of transparency regarding these options.

Minimum Deposit

The minimum deposit requirement for opening an account with PT is notably high, starting at $1,000 for the basic account. This is significantly higher than many other regulated brokers, which typically allow users to start trading with much lower amounts.

PT offers various bonuses that can be as high as 100% of the initial deposit. However, these promotions often come with stringent conditions that may be difficult for users to meet, raising concerns about their legitimacy.

Asset Classes

Traders can access a range of asset classes, including forex pairs, cryptocurrencies, and commodities. However, the quality of trading conditions, such as spreads and execution times, has been called into question by users.

Costs (Spreads, Fees, Commissions)

The costs associated with trading on PT are not clearly defined in the available literature. Users have reported wide spreads, which can lead to higher costs in the long run. Additionally, the lack of transparency regarding commissions and fees is a significant drawback.

Leverage

PT offers high leverage ratios, which can attract traders looking for substantial returns. However, this also increases the risk of significant losses, particularly for inexperienced traders.

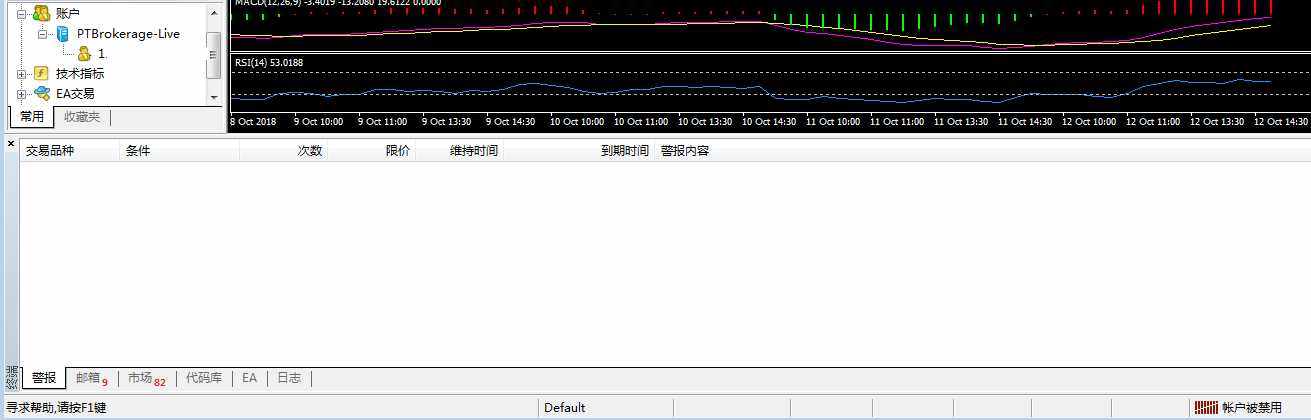

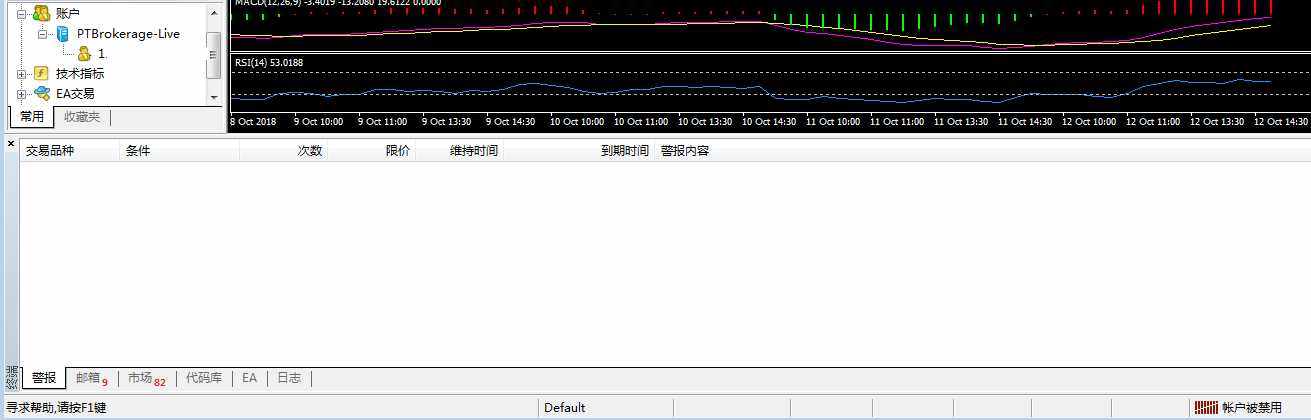

PT primarily uses MetaTrader 4, a widely recognized trading platform. However, users have noted that the platform lacks some advanced features found in other brokers, which can limit trading capabilities.

Restricted Regions

Due to its regulatory status, PT is likely restricted in several jurisdictions. Users are advised to check local regulations before engaging with the platform.

Available Customer Service Languages

Customer support appears to be limited, with users reporting long response times and inadequate assistance. The primary language offered for support is English, which may pose challenges for non-English speaking users.

Reiterated Ratings Overview

Detailed Breakdown

- Account Conditions: The high minimum deposit and lack of transparency about account features contribute to a low rating.

- Tools and Resources: While MT4 is a standard tool, the absence of advanced features limits its effectiveness for traders.

- Customer Service and Support: User experiences indicate significant issues with responsiveness and helpfulness, leading to frustration.

- Trading Setup: The overall trading experience is marred by high costs and limited resources, making it less appealing for traders.

- Trustworthiness: The lack of regulation and multiple warnings from financial authorities significantly undermine PT's credibility.

- User Experience: Overall, user reviews suggest dissatisfaction with the platform, primarily due to withdrawal issues and high costs.

In conclusion, the PT review paints a concerning picture for potential traders. The lack of regulation, high minimum deposits, and reported difficulties in withdrawing funds are significant drawbacks. Prospective users are strongly advised to consider these factors carefully before engaging with PT or to explore more reputable and regulated alternatives.