Is Prince Markets safe?

Business

License

Is Prince Markets Safe or Scam?

Introduction

Prince Markets is an online trading platform that positions itself within the competitive landscape of the forex market, offering a variety of trading instruments, including forex, commodities, and cryptocurrencies. As the popularity of forex trading continues to rise, it becomes increasingly essential for traders to meticulously evaluate the brokers they choose to work with. This scrutiny is crucial not only for protecting their investments but also for ensuring a transparent and fair trading environment. In this article, we will investigate whether Prince Markets is a legitimate trading platform or a potential scam. Our assessment will be based on a combination of regulatory analysis, company background checks, trading conditions, client feedback, and risk evaluations.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is safe is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect investors. Unfortunately, Prince Markets operates as an unregulated broker, which raises significant concerns about its legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Prince Markets is not held accountable by any recognized financial authority. This lack of oversight can result in a higher likelihood of fraudulent activities, as unregulated brokers are free to operate without stringent compliance requirements. Additionally, the company is based in Seychelles, a region known for its lax regulatory environment, further heightening concerns about its operations. The lack of regulatory history or compliance records for Prince Markets is a significant red flag for potential investors, leading us to question whether is Prince Markets safe for trading.

Company Background Investigation

Prince Markets is operated by Prince Markets International Ltd, but detailed information about its ownership structure and management team remains largely undisclosed. The company claims to have been established in 2021, which places it in the relatively new category of forex brokers. A brief history reveals that the broker has not built a proven track record in the market, which is often a vital indicator of reliability.

The lack of transparency regarding the management team is another concern. A reputable broker typically provides information about its executives and their professional backgrounds, which helps establish credibility. However, Prince Markets fails to disclose any verifiable information about its leadership, leaving potential investors in the dark regarding who is handling their funds. This level of anonymity is often associated with fraudulent operations, prompting many to ask, is Prince Markets safe to trade with?

Trading Conditions Analysis

When evaluating a broker, it's essential to consider the trading conditions they offer. Prince Markets provides various account types, each with different minimum deposit requirements and leverage options. However, the overall fee structure and trading costs remain ambiguous.

| Fee Type | Prince Markets | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Varies | 1.0 - 2.0 pips |

| Commission Structure | None | $5 - $10 per lot |

| Overnight Interest Range | Varies | 1.5% - 3.0% |

While the absence of commissions may seem appealing, traders should be aware of potential hidden fees that could erode their profits. The lack of transparency in fee disclosure is concerning, as it may lead to unexpected charges that clients are unaware of. This raises the question of whether is Prince Markets safe for traders who are looking for clear and straightforward trading conditions.

Client Funds Security

The safety of client funds is paramount in the trading industry, and Prince Markets' measures in this regard are questionable. The broker does not provide sufficient information about its fund protection policies, such as whether client funds are kept in segregated accounts or if there are any investor protection schemes in place.

Given the unregulated nature of Prince Markets, there is a heightened risk of funds being misappropriated or lost. Historical data on similar unregulated brokers indicates that many have faced issues regarding fund security, leading to significant losses for clients. This raises a critical concern: is Prince Markets safe for investors who prioritize the security of their capital?

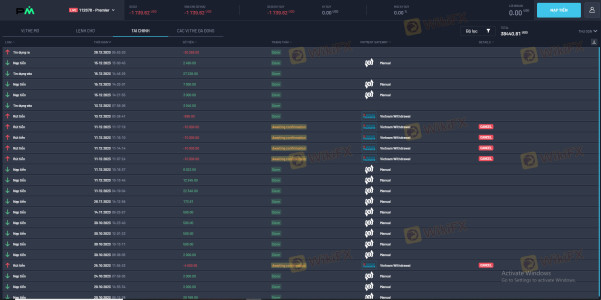

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding a broker's reliability. A review of online forums and complaint boards reveals a troubling pattern of negative experiences among Prince Markets' clients. Many users report difficulties in withdrawing their funds, unresponsive customer service, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Delays | Medium | Slow Response |

| Misleading Promotions | High | No Acknowledgment |

Typical complaints include lengthy delays in processing withdrawal requests and claims that the broker imposes excessive fees. Such issues are often indicative of a scam, where brokers utilize tactics to retain client funds. The prevalence of these complaints raises serious questions about the integrity of Prince Markets and whether is Prince Markets safe for potential investors.

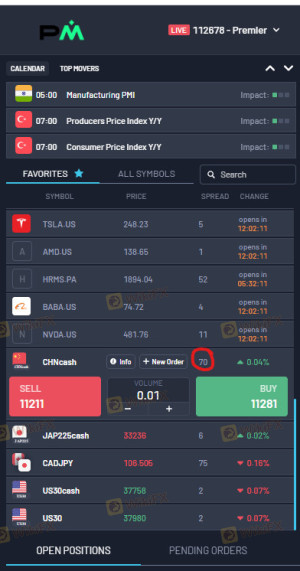

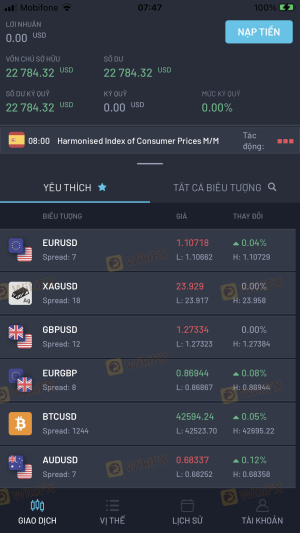

Platform and Trade Execution

The trading platform offered by Prince Markets is another area of concern. While the broker claims to provide a proprietary trading platform with advanced features, user reviews suggest that the platform may experience stability issues, including slow execution speeds and occasional slippage.

Additionally, there are reports of potential manipulation, where clients have experienced unusual trading conditions that do not align with market prices. These factors contribute to a negative trading experience and further exacerbate concerns about the broker's reliability. Traders must consider whether they can trust Prince Markets for their trading activities, especially when asking, is Prince Markets safe for executing trades.

Risk Assessment

Given the findings thus far, it is crucial to assess the overall risk of using Prince Markets. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no accountability |

| Financial Risk | High | Potential loss of funds without recourse |

| Operational Risk | Medium | Platform stability and execution issues |

| Customer Service Risk | High | Poor response to client complaints |

To mitigate these risks, potential investors are advised to conduct thorough due diligence, seek out regulated alternatives, and consider using smaller amounts for initial trades. Understanding the risks involved is essential for any trader considering whether is Prince Markets safe for their trading endeavors.

Conclusion and Recommendations

In conclusion, the evidence suggests that Prince Markets poses significant risks for potential investors. The lack of regulation, transparency issues, and numerous client complaints indicate that this broker may not provide a safe trading environment. While the platform may offer appealing trading conditions, the associated risks outweigh the benefits.

For traders considering their options, it is advisable to explore reputable and regulated alternatives. Brokers that are overseen by established financial authorities can provide a greater level of security and trust. In light of the findings, it is clear that is Prince Markets safe is a question that many should approach with caution, as the potential for financial loss remains high.

Is Prince Markets a scam, or is it legit?

The latest exposure and evaluation content of Prince Markets brokers.

Prince Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Prince Markets latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.