Prince Markets 2025 Review: Everything You Need to Know

Summary

This Prince Markets review shows concerning findings about this new forex broker that started in 2022. The company operates without regulation from the Seychelles and targets traders who want to trade forex, metals, oils, and CFDs across more than 600 instruments. Prince Markets offers a low minimum deposit of $100 and supports multiple deposit methods including MasterCard, Visa, Skrill, Neteller, and bank transfers, but our overall assessment reveals major red flags.

Multiple review sources show that Prince Markets has received extremely negative user feedback. Cyber scam recovery services actively warn traders against this provider. The broker lacks regulatory oversight, and widespread user complaints plus warnings from industry watchdogs suggest that potential traders should be very careful. Prince Markets offers multi-language support in English, Japanese, Chinese, Korean, Malay, Indonesian, French, Dutch, Spanish, Portuguese, Vietnamese, and Russian, but these conveniences cannot fix the fundamental trust issues. This Prince Markets review strongly advises traders to consider regulated alternatives with proven track records and positive user feedback before putting money into this platform.

Important Notice

Prince Markets operates without regulation or oversight from recognized financial authorities. Investors must do their own thorough risk assessment before using this broker. The information in this review comes from available public sources, user feedback, and industry reports. Given the conflicting information about Prince Markets and serious warnings from multiple review platforms, traders should be especially careful and consider getting advice from licensed financial professionals before making investment decisions.

Rating Framework

Broker Overview

Prince Markets appeared in the forex trading world in 2022. The company positions itself as a multi-asset broker with headquarters in the Seychelles. This relatively new company immediately raises questions about its market credibility and operational stability. Prince Markets operates without regulatory oversight from recognized financial authorities and has tried to attract traders through low entry requirements and extensive language support. However, the broker's short history and lack of regulatory compliance create significant concerns for potential investors who want reliable trading partners.

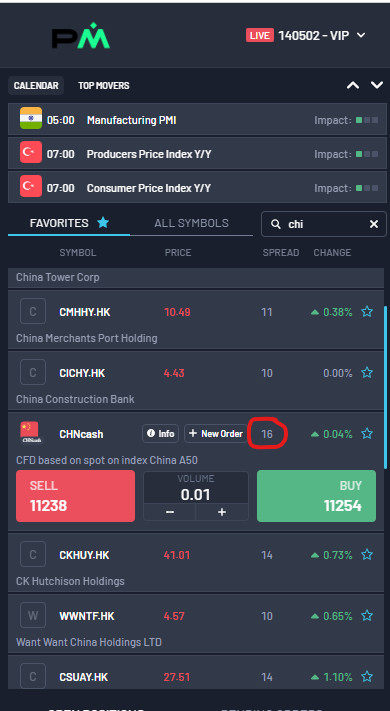

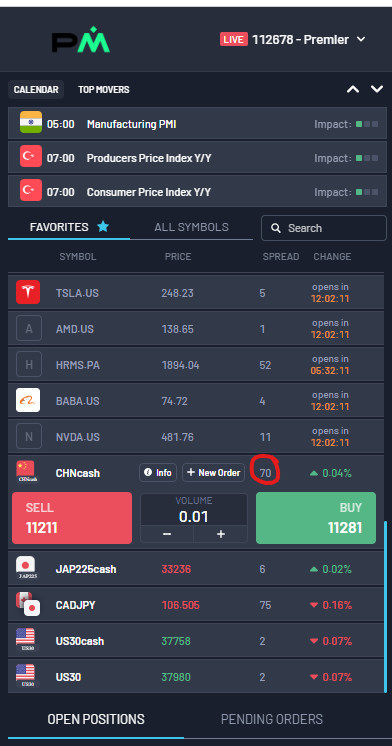

The company focuses on providing access to over 600 trading instruments across forex, metals, oils, and CFD markets. Prince Markets appears to offer a comprehensive asset selection, but the absence of proper regulatory framework and mounting negative feedback from users suggest that the broker may not deliver on its promises. The broker's structure in the Seychelles is legally allowed but often indicates an attempt to avoid strict regulatory requirements that protect trader interests. This Prince Markets review must emphasize the substantial risks associated with unregulated trading environments, particularly for inexperienced traders who may not fully understand the implications of trading with non-regulated entities.

Regulatory Status: Prince Markets operates without regulation or oversight from recognized financial authorities such as FCA, CySEC, or ASIC. This lack of regulatory compliance represents a significant risk factor for potential traders.

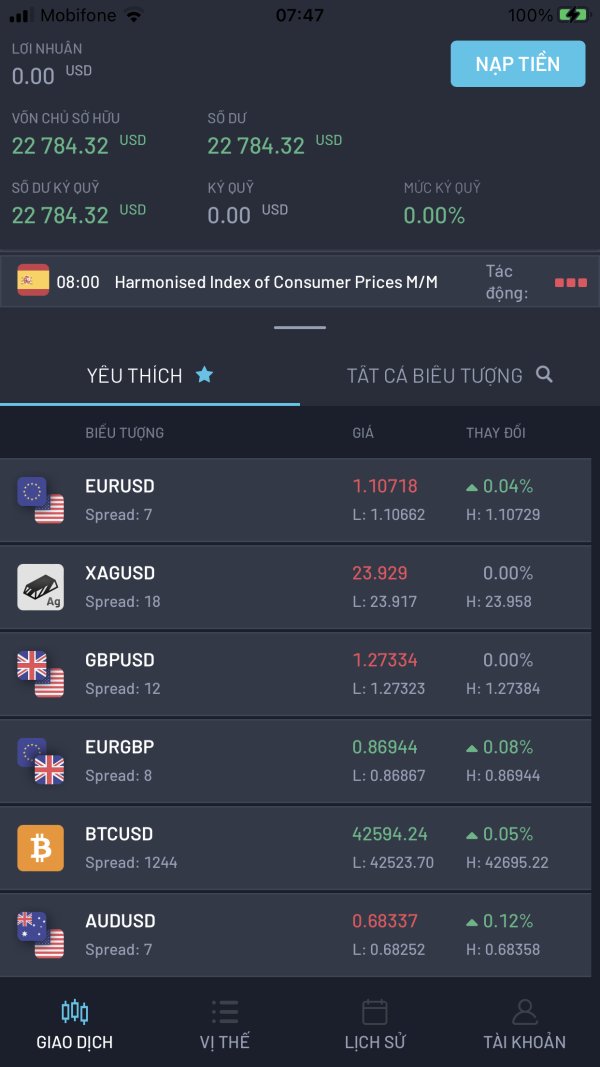

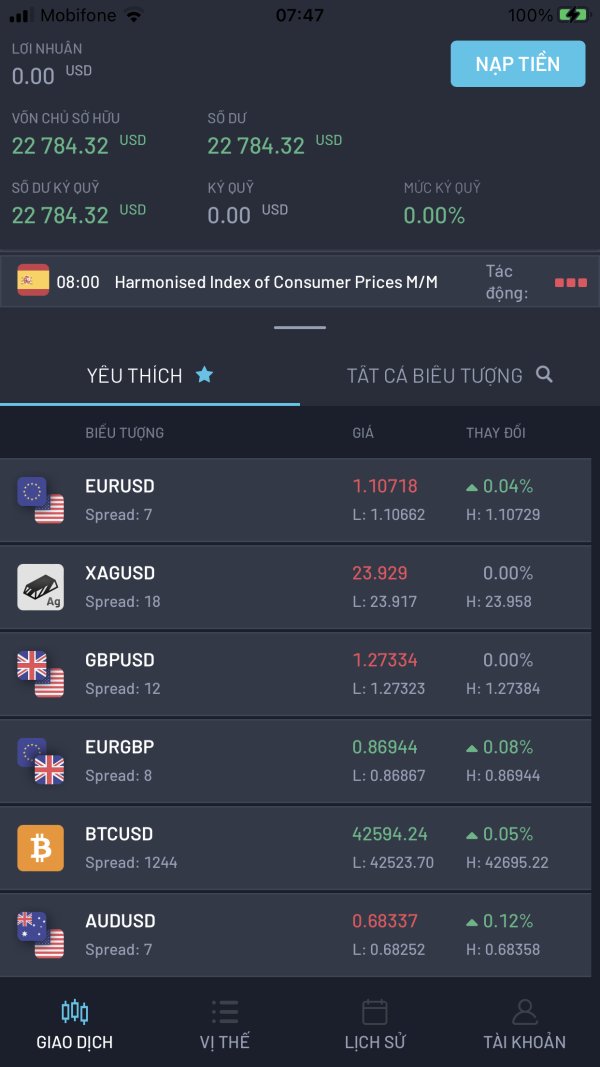

Deposit and Withdrawal Methods: The broker supports multiple funding options including MasterCard, Visa, Skrill, Neteller, and traditional bank transfers. This provides reasonable accessibility for international clients.

Minimum Deposit Requirement: Prince Markets sets a relatively low minimum deposit of $100. This makes it accessible to entry-level traders, though this low barrier may also attract less experienced investors to a potentially risky platform.

Promotional Offers: Specific information about bonuses and promotional campaigns is not detailed in available sources. This suggests limited marketing incentives or poor transparency in promotional terms.

Tradeable Assets: The platform offers access to 600+ instruments spanning forex pairs, precious metals, oil commodities, and CFD products. This represents a broad but unverified asset selection.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not comprehensively disclosed in available materials. This indicates poor transparency in pricing mechanisms that could lead to unexpected trading costs.

Leverage Options: Specific leverage ratios and margin requirements are not clearly specified in available documentation. This creates uncertainty about trading conditions and risk parameters.

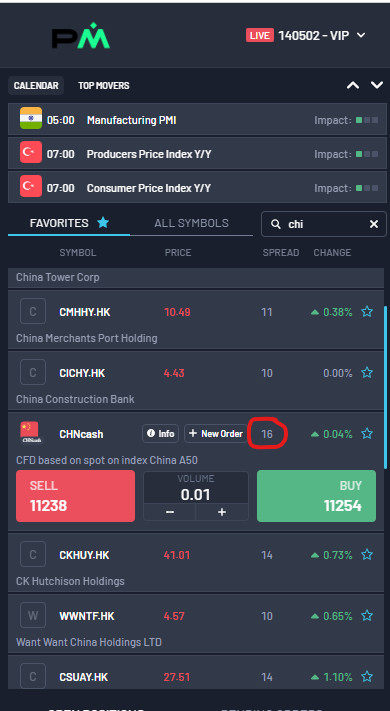

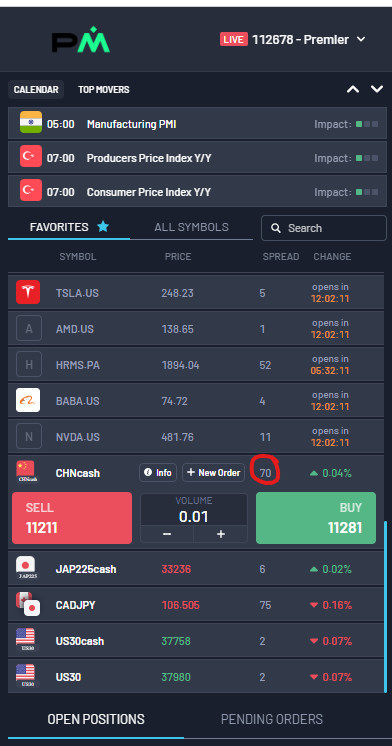

Platform Technology: The trading platform specifications and technological infrastructure details are not adequately disclosed. This raises questions about execution quality and system reliability.

Geographic Restrictions: Information about jurisdictional limitations and restricted territories is not clearly communicated in available sources.

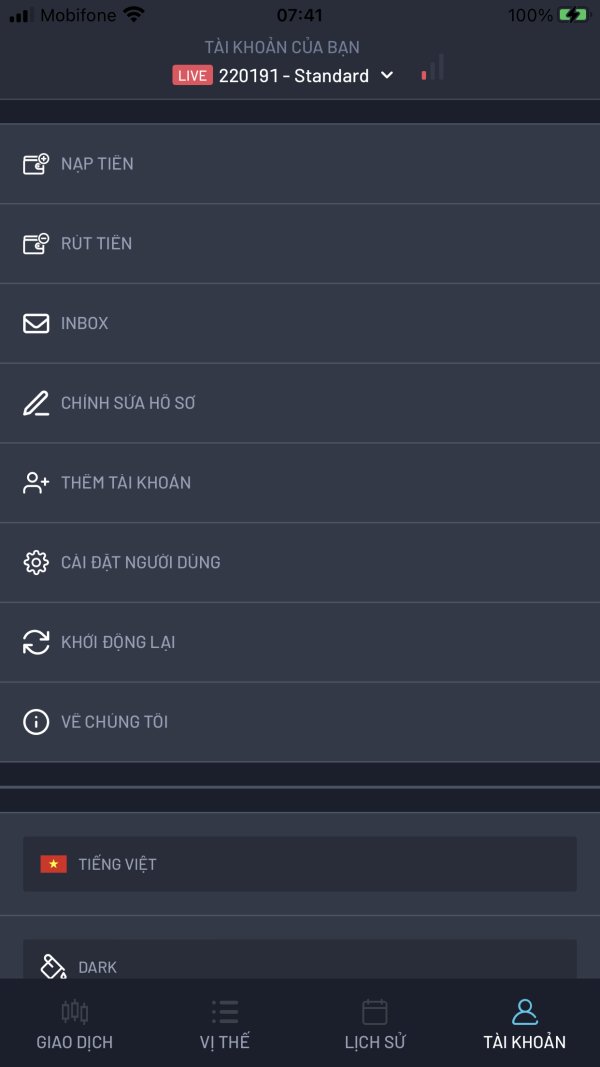

Customer Support Languages: The broker provides multilingual support in English, Japanese, Chinese, Korean, Malay, Indonesian, French, Dutch, Spanish, Portuguese, Vietnamese, and Russian. This demonstrates broad international accessibility. This Prince Markets review notes that while language support is comprehensive, it cannot compensate for fundamental regulatory and trust issues.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

Prince Markets' account conditions present a mixed picture that ultimately disappoints due to lack of transparency and comprehensive information. The $100 minimum deposit requirement appears attractive for entry-level traders, but this low threshold often serves as a red flag in the industry and potentially indicates targeting of inexperienced investors who may not fully understand the risks involved. The absence of detailed account type specifications, trading conditions, and fee structures in readily available materials suggests poor operational transparency.

The broker fails to provide clear information about account tiers, benefits, or specific trading conditions. This makes it impossible for potential clients to make informed decisions. Cyber Scam Recovery reports show that traders have expressed frustration with unclear account terms and unexpected conditions that only become apparent after funding accounts. The lack of a free demo account offering further compounds the poor account conditions by forcing traders to risk real money without adequate testing opportunities.

Regulated brokers provide comprehensive account documentation, transparent fee schedules, and clear terms of service. Prince Markets falls significantly short of industry standards. This Prince Markets review emphasizes that the superficially attractive minimum deposit requirement cannot compensate for the fundamental lack of transparency and proper account condition disclosure that professional traders expect from legitimate brokers.

The trading tools and resources offered by Prince Markets represent one of the most concerning aspects of this broker's service offering. Available information reveals a stark absence of professional trading tools, analytical resources, or educational materials that modern traders expect from legitimate brokers. The lack of detailed platform specifications, analytical tools, or research resources suggests that Prince Markets operates with minimal infrastructure investment and potentially compromises the trading experience for clients.

Industry-standard features such as advanced charting packages, technical analysis tools, economic calendars, market research, or automated trading support appear to be absent or inadequately documented. This absence of professional-grade tools places traders at a significant disadvantage, particularly in volatile markets where access to real-time analysis and sophisticated trading instruments can determine success or failure. User feedback compiled by various review platforms indicates frustration with the limited functionality and poor quality of available trading resources.

The educational component appears virtually non-existent based on available information. This component is crucial for developing trader skills and market understanding. Reputable brokers typically invest heavily in educational content, webinars, tutorials, and market analysis to support client success. The absence of these resources suggests that Prince Markets prioritizes client acquisition over client success, which is a concerning business model that often characterizes problematic brokers in the industry.

Customer Service and Support Analysis (3/10)

Prince Markets' customer service capabilities present a paradox of extensive language support coupled with concerning service quality issues. The broker offers support in twelve languages including English, Japanese, Chinese, Korean, Malay, Indonesian, French, Dutch, Spanish, Portuguese, Vietnamese, and Russian, but the quality and effectiveness of this support remain questionable based on user feedback and available information.

The multilingual approach suggests an attempt to serve diverse international markets. This could be viewed positively if supported by competent service delivery. However, reports from various review platforms indicate significant issues with response times, problem resolution effectiveness, and overall service quality. The absence of clearly specified contact methods, support hours, or escalation procedures in readily available information suggests poor service infrastructure organization.

User testimonials compiled by industry watchdogs reveal patterns of delayed responses, inadequate problem resolution, and difficulty reaching qualified support representatives when issues arise. The lack of comprehensive contact information or transparent support policies makes it challenging for traders to understand what level of assistance they can expect when problems occur. While the language diversity is commendable, it cannot compensate for fundamental service quality issues that appear to plague this broker's customer support operations.

Trading Experience Analysis (2/10)

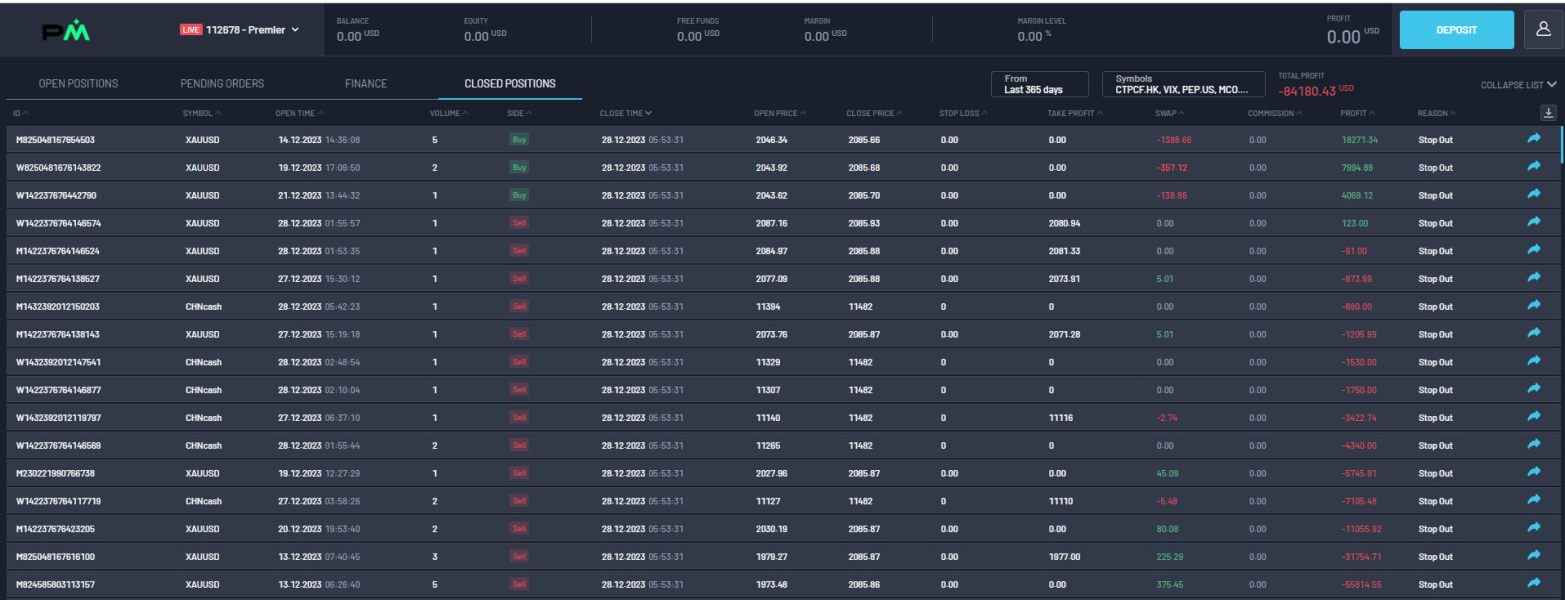

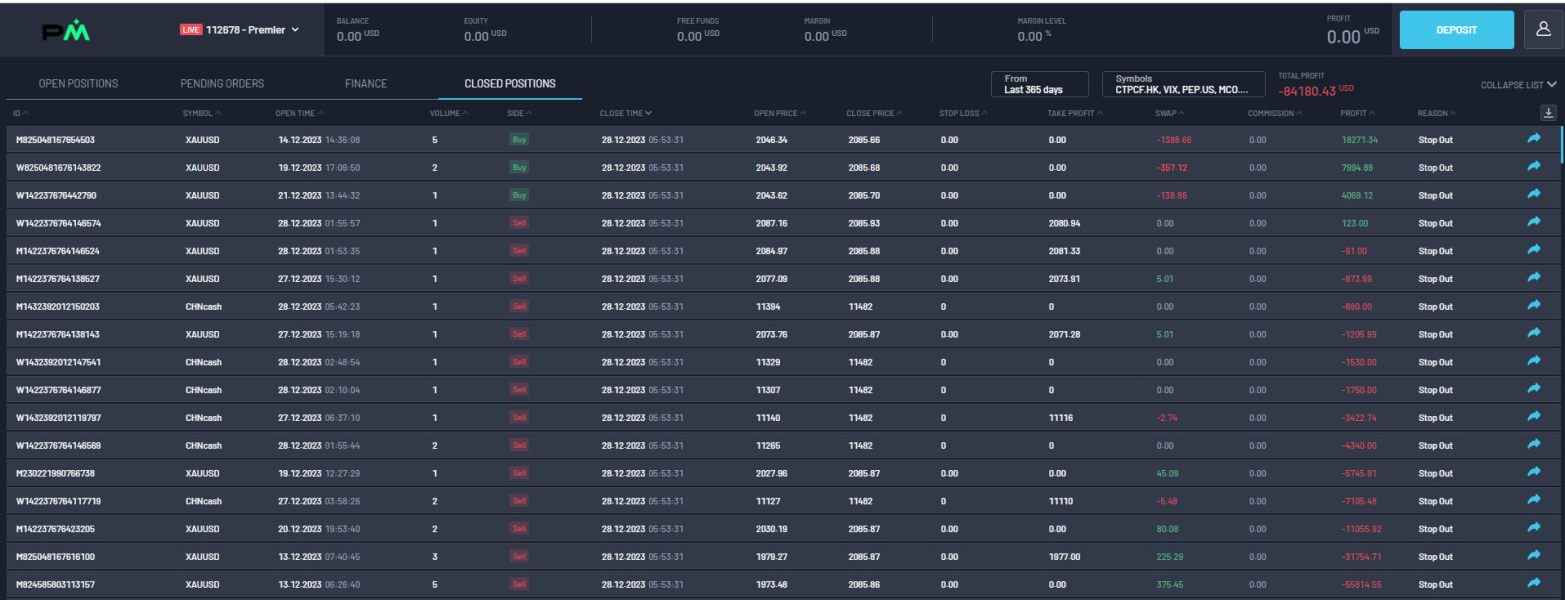

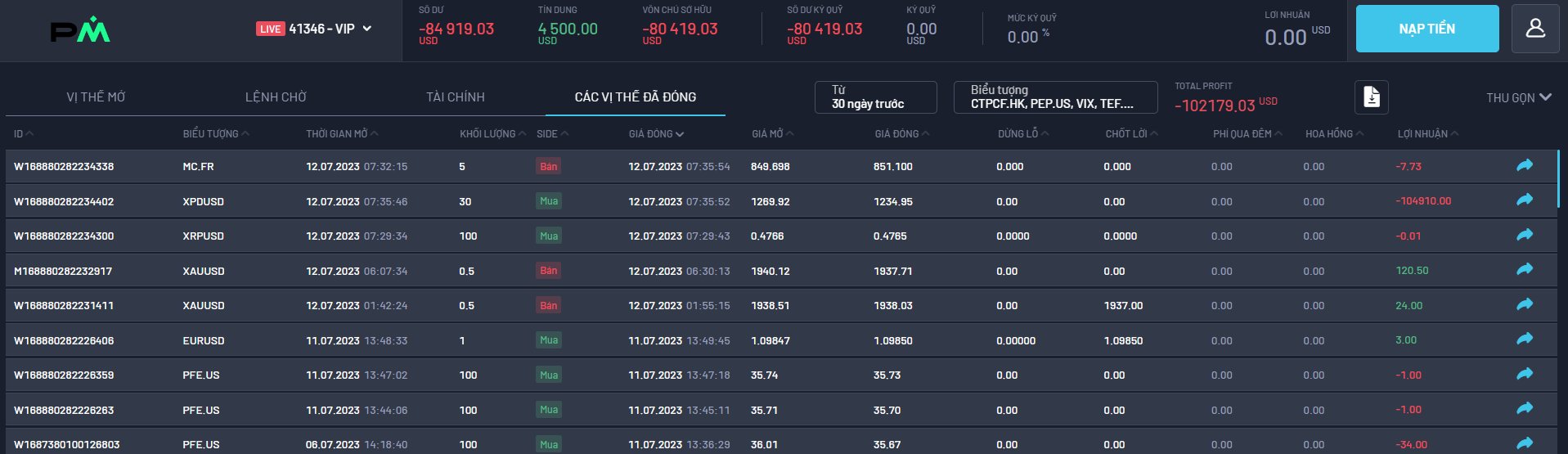

The trading experience offered by Prince Markets raises serious concerns about platform reliability, execution quality, and overall user satisfaction. Available user feedback and industry reports show that traders have encountered significant issues with platform stability, order execution, and general trading environment quality. The absence of detailed platform specifications or performance metrics in available documentation makes it difficult to assess the technical capabilities of the trading infrastructure.

Reports from various review sources indicate problems with trade execution, platform downtime, and unexpected trading conditions that differ from initially presented terms. The lack of transparent information about execution speeds, slippage rates, or platform uptime statistics suggests poor operational transparency that professional traders require for informed decision-making. User experiences documented by industry watchdogs reveal frustration with platform functionality and reliability issues that can significantly impact trading outcomes.

The absence of a demo account offering forces traders to evaluate platform performance with real money at risk. This creates an unfair and potentially costly assessment environment. Legitimate brokers typically provide comprehensive demo environments that allow thorough platform testing before financial commitment. This Prince Markets review emphasizes that the poor trading experience reports, combined with lack of proper testing opportunities, create an environment where trader success becomes unlikely regardless of market knowledge or trading skills.

Trustworthiness Analysis (1/10)

Prince Markets' trustworthiness represents the most critical concern in this review. Multiple red flags indicate significant risks for potential traders. The broker's status as an unregulated entity immediately places it outside the protective framework that legitimate financial authorities provide to traders. Operating without oversight from recognized regulators such as FCA, CySEC, ASIC, or other reputable authorities means that traders have no recourse through official channels if disputes arise.

The company's establishment in 2022 provides insufficient operational history to assess reliability and stability over time. More concerning are the active warnings from cyber scam recovery services and the negative ratings from industry watchdogs that specifically advise against trading with this provider. These warnings, combined with user complaints documented across multiple review platforms, create a pattern of concern that cannot be ignored by potential investors.

The absence of proper regulatory licensing, transparent ownership information, or verifiable business credentials further undermines trustworthiness. Legitimate brokers typically provide comprehensive regulatory documentation, clear ownership structures, and transparent business operations that can be independently verified. The lack of such transparency, combined with active industry warnings, suggests that Prince Markets operates outside acceptable industry standards for trustworthiness and client protection.

User Experience Analysis (2/10)

User experience with Prince Markets has been predominantly negative according to available feedback from multiple review platforms and industry monitoring services. Traders report significant dissatisfaction with various aspects of the service, from initial account setup through ongoing trading operations and customer service interactions. The pattern of negative feedback suggests systemic issues rather than isolated incidents and indicates fundamental problems with the broker's operational approach.

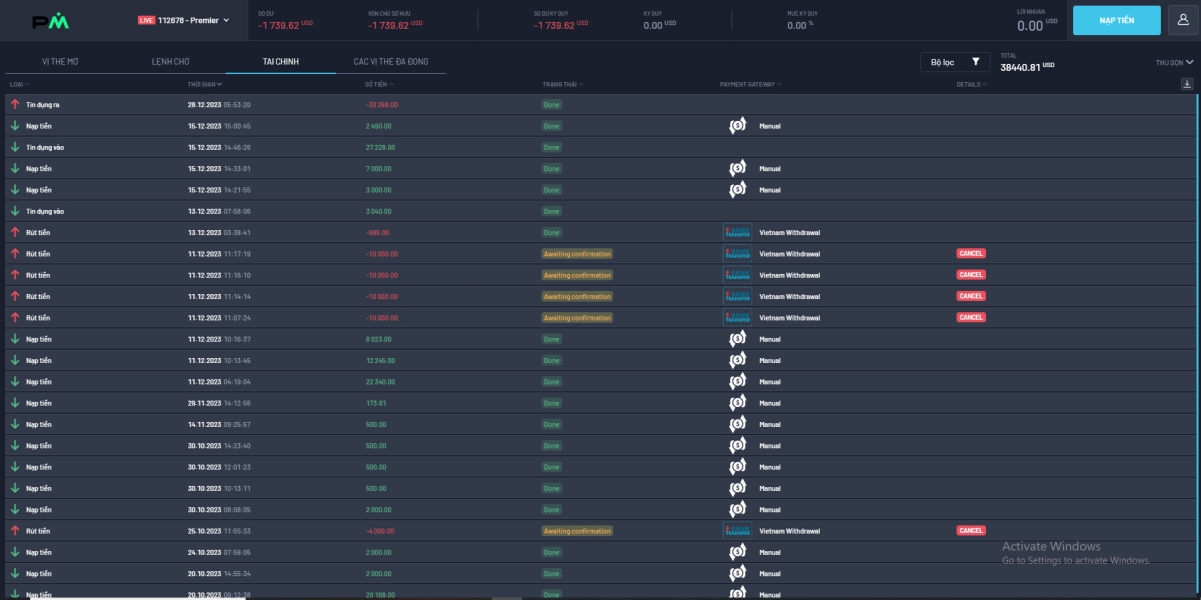

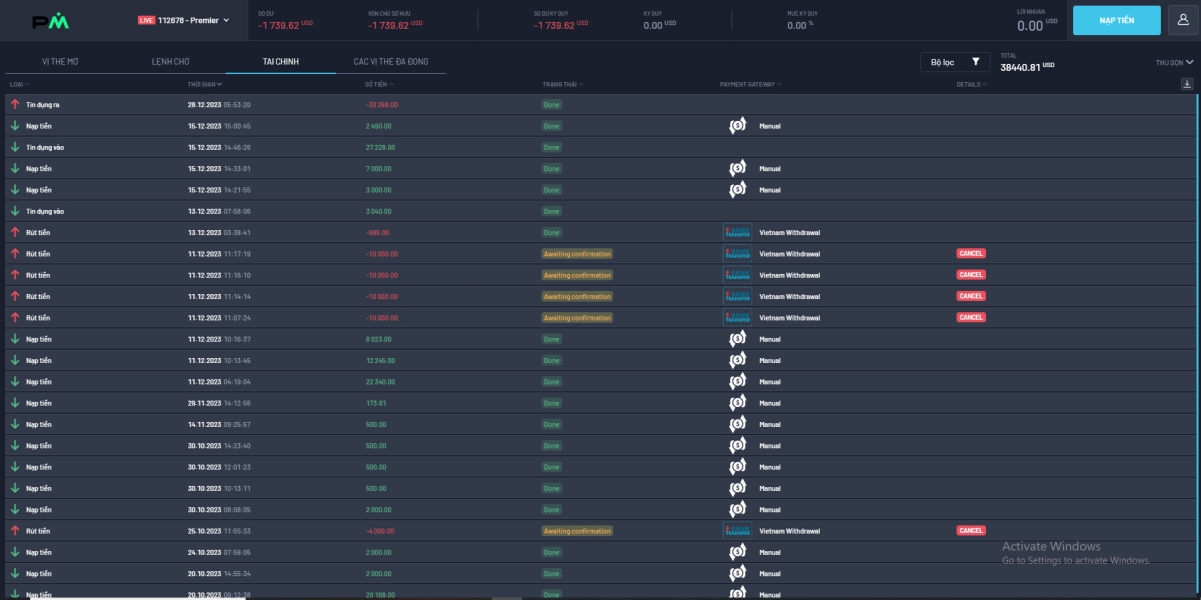

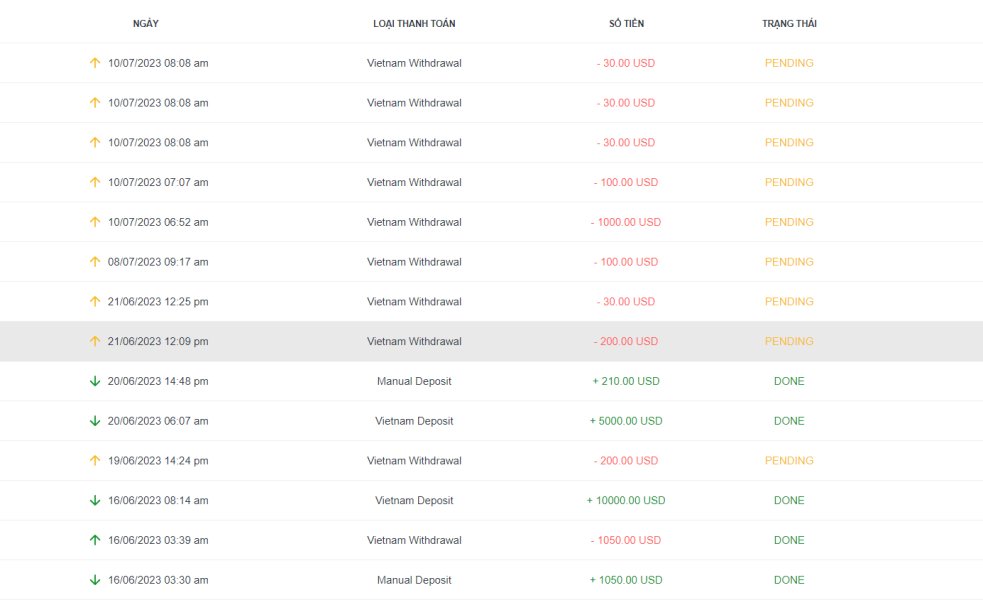

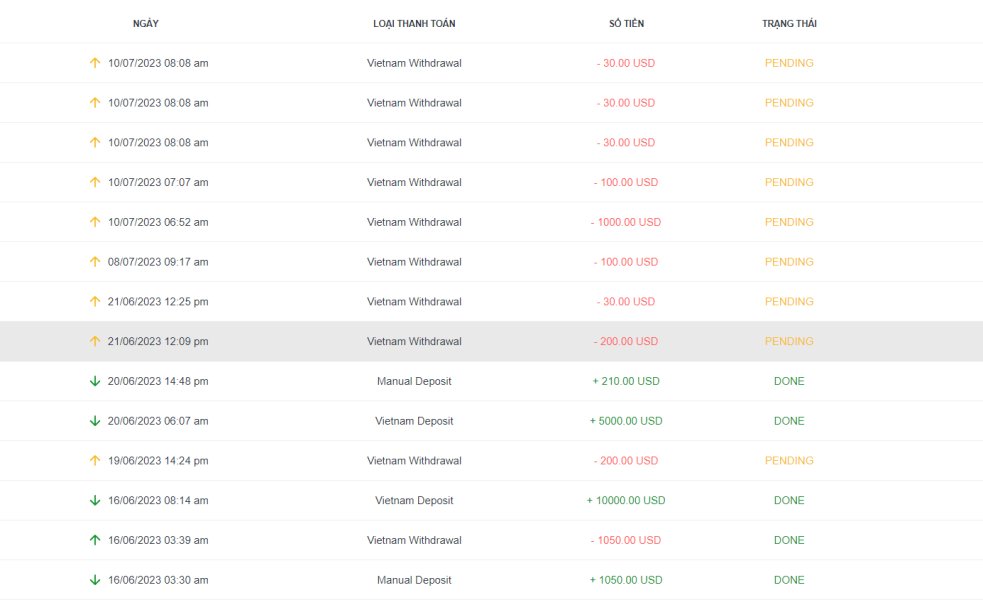

Common user complaints include unclear terms and conditions that only become apparent after account funding, poor platform performance, difficulties with withdrawal processes, and inadequate customer support responses. The absence of proper onboarding procedures, educational resources, and transparent operational policies creates confusion and frustration for users attempting to navigate the platform effectively.

The overall user satisfaction appears to be extremely low based on available feedback. Many users express regret about choosing this broker and recommend that others avoid the platform. The lack of positive user testimonials or success stories in available sources further reinforces concerns about the quality of user experience. For traders seeking reliable and user-friendly trading environments, the consistently negative feedback patterns suggest that Prince Markets fails to meet basic expectations for professional forex broker services.

Conclusion

This comprehensive Prince Markets review reveals a broker that presents significant risks and fails to meet industry standards across multiple critical areas. Prince Markets demonstrates concerning deficiencies in trustworthiness, regulatory compliance, and user satisfaction that make it unsuitable for serious traders with an overall rating of 1.8/10. The combination of unregulated status, negative user feedback, and active warnings from industry watchdogs creates a risk profile that far outweighs any potential benefits.

The low minimum deposit and multilingual support might initially appear attractive, but these features cannot compensate for the fundamental issues of regulatory non-compliance and poor operational standards. Traders seeking reliable forex brokers should prioritize regulated entities with proven track records, transparent operations, and positive user feedback over providers that operate outside established industry safeguards.