Is TOP500 safe?

Pros

Cons

Is Top500 A Scam?

Introduction

Top500 is a forex brokerage that has gained attention in the online trading community for its promises of attractive trading conditions and a wide range of financial instruments. However, as with any forex broker, it is essential for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with both legitimate brokers and scams, making it crucial for potential investors to discern which brokers are trustworthy. This article aims to investigate the legitimacy of Top500 by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile. The evaluation will utilize a combination of qualitative analysis and quantitative data to provide a comprehensive overview of whether Top500 is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure fair practices and protects client funds. In contrast, unregulated brokers can operate without oversight, increasing the risk of fraud.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

Upon examining Top500, it becomes evident that the broker is not regulated by any recognized financial authority. This lack of oversight is a significant red flag for potential investors. Regulatory bodies like the FCA (UK), ASIC (Australia), and CySEC (Cyprus) enforce strict rules to protect traders. The absence of such regulation raises concerns about the safety of client funds and the transparency of trading practices.

Furthermore, the quality of regulation is paramount. Brokers regulated by top-tier authorities are held to rigorous standards, which include maintaining a minimum capital requirement, providing investor protection schemes, and undergoing regular audits. In contrast, brokers without regulation may face minimal scrutiny, leading to potential misconduct. Given that Top500 is not regulated, it is advisable for traders to approach this broker with caution.

Company Background Investigation

Understanding the companys history, ownership structure, and management team is essential to assess its reliability. Top500 claims to operate in the forex market, but detailed information about its founding, ownership, and operational history is scarce.

The broker's website provides limited insights into its background, which raises questions about its transparency. A reputable broker typically offers a clear history of its establishment, growth, and operational milestones. Additionally, the absence of information about the management team and their professional backgrounds is concerning. Experienced management can indicate a broker's credibility and commitment to ethical practices.

Moreover, transparency in information disclosure is crucial for establishing trust. A reliable broker should openly communicate its business model, fee structures, and any potential conflicts of interest. Unfortunately, Top500 does not provide sufficient information in these areas, which further complicates the assessment of its legitimacy.

Trading Conditions Analysis

An essential aspect of evaluating a forex broker is understanding its trading conditions, including fees, spreads, and commissions. Top500 markets itself as offering competitive trading conditions, but traders must scrutinize these claims carefully.

| Fee Type | Top500 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific details regarding spreads and commissions on the Top500 website raises concerns about potential hidden fees or unfavorable trading conditions. In the forex industry, transparency about fees is vital for traders to make informed decisions. If a broker does not disclose this information, it could indicate a lack of integrity.

Moreover, any unusual or excessive fees can significantly impact a trader's profitability. It is essential for potential clients to be aware of all costs associated with trading on the platform. Given the lack of clarity in Top500's fee structure, it is prudent for traders to consider this a potential warning sign.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Traders need to ensure that their investments are secure and that the broker has measures in place to protect their money.

Top500's website does not provide adequate information regarding its client fund security measures. A reputable broker typically segregates client funds from company funds, ensuring that traders' money is protected in case of insolvency. Additionally, many regulated brokers offer investor protection schemes, which compensate clients in the event of the broker's failure.

Furthermore, negative balance protection is a critical feature that prevents traders from losing more money than they have deposited. The absence of such protections can expose traders to significant financial risks. Unfortunately, Top500 does not appear to offer any of these essential safeguards, which is a significant concern for potential investors.

Customer Experience and Complaints

Analyzing customer feedback and user experiences can provide valuable insights into a broker's reliability. Reviews and testimonials can reveal common issues faced by clients and how the broker responds to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Misleading Information | High | Unresponsive |

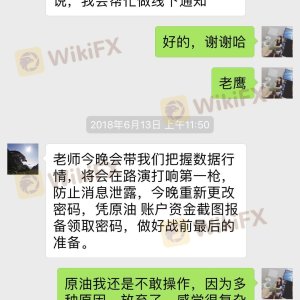

Many users have reported difficulties in withdrawing funds from their accounts with Top500, which is a serious concern. Withdrawal issues are among the most common complaints in the forex industry and can indicate potential fraud. Additionally, the quality of customer support is crucial for resolving issues promptly. If a broker is unresponsive or provides inadequate support, it can exacerbate client frustrations.

Several reviews highlight that Top500 has not effectively addressed complaints, leading to a lack of trust among users. These patterns of complaints should raise alarm bells for prospective clients.

Platform and Trade Execution

The performance of a trading platform is vital for a smooth trading experience. Traders rely on the platform for executing orders, monitoring their accounts, and analyzing market conditions.

Top500 claims to offer a user-friendly trading platform, but the lack of detailed information on its execution quality, slippage rates, and order rejection instances is concerning. A reliable broker should ensure fast and accurate order execution without excessive slippage, which can erode profits.

Moreover, any signs of platform manipulation, such as frequent order rejections or unexplained price changes, are significant warning signs. Traders should be wary of platforms that do not provide transparency in their execution processes. Unfortunately, Top500 does not provide sufficient evidence to support its claims of reliable execution, making it difficult for traders to trust the platform.

Risk Assessment

Using Top500 poses several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases fraud risk. |

| Financial Risk | High | Lack of fund protection measures raises concerns. |

| Execution Risk | Medium | Unclear execution quality could impact trades. |

The absence of regulation and client fund protection measures significantly heightens the risks associated with using Top500. Traders should be particularly cautious about the potential for fraud and the lack of recourse in the event of issues.

To mitigate these risks, it is advisable for traders to conduct thorough research, consider alternative brokers with strong regulatory oversight, and start with a small investment to test the waters.

Conclusion and Recommendations

In conclusion, the investigation into Top500 reveals several concerning factors that suggest it may not be a safe broker for traders. The lack of regulatory oversight, insufficient transparency regarding fees and trading conditions, and negative customer feedback all point to potential risks associated with this broker.

Given these findings, it is prudent for traders to approach Top500 with caution. If you are considering forex trading, it is advisable to choose brokers that are regulated by reputable authorities and offer robust client fund protection.

For those seeking reliable alternatives, consider brokers such as OANDA, IG, or Forex.com, which are well-regulated and have positive reputations in the trading community. Always remember that thorough research and due diligence are essential to ensure a safe trading experience.

Is TOP500 a scam, or is it legit?

The latest exposure and evaluation content of TOP500 brokers.

TOP500 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TOP500 latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.