Is PILOTFX safe?

Business

License

Is PilotFX Safe or a Scam?

Introduction

PilotFX is a relatively new player in the forex trading market, having been established in 2022. It claims to offer a wide array of trading services, including forex, CFDs, and commodities. However, the rise of online trading has been accompanied by a surge in fraudulent activities, making it imperative for traders to exercise caution and thoroughly evaluate the credibility of forex brokers. In this article, we will investigate the legitimacy of PilotFX by examining its regulatory status, company background, trading conditions, and customer experiences. Our assessment is based on a review of multiple sources, including user feedback and industry analyses, to provide a comprehensive evaluation of whether PilotFX is safe.

Regulation and Legitimacy

One of the most critical factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a form of oversight that helps protect traders from potential fraud and misconduct. PilotFX claims to be registered in the Marshall Islands, a location often associated with lax regulatory standards. It does not hold licenses from any major financial authority, which raises significant concerns regarding its legitimacy. Below is a summary of the regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Marshall Islands FSC | N/A | Marshall Islands | Unverified |

The absence of a license from a reputable regulatory body is a major red flag. While it claims to be regulated by the Marshall Islands Financial Services Commission (FSC), this regulator is not known for its investor protection measures. Furthermore, the lack of oversight could mean that PilotFX may engage in practices that are not in the best interest of its clients. Therefore, it is crucial to question is PilotFX safe given its regulatory shortcomings.

Company Background Investigation

PilotFX's company background is another area that warrants scrutiny. The broker was founded in 2022 and is registered in the Marshall Islands, a well-known tax haven. Unfortunately, there is limited information available about its ownership structure and management team. This lack of transparency raises questions about the broker's accountability and reliability.

The absence of a well-defined corporate structure can lead to issues regarding the broker's operational integrity. A reputable broker typically provides detailed information about its management team, including their qualifications and experience in the financial sector. In the case of PilotFX, the lack of such information makes it challenging to assess the competence of those running the firm. This opacity contributes to the concern surrounding is PilotFX safe for potential investors.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its reliability and transparency. PilotFX offers various trading instruments and claims to have competitive spreads and leverage options. However, the overall fee structure appears to be less favorable compared to industry standards. Below is a comparison of core trading costs:

| Fee Type | PilotFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Unclear | 0.5% - 2% |

The high spreads reported by users indicate that trading with PilotFX may be more costly than with other brokers. Additionally, the unclear commission structure can lead to unexpected charges, which is a common tactic used by less trustworthy brokers. These factors contribute to the question of is PilotFX safe, as traders may find themselves facing higher costs than anticipated.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. PilotFX claims to implement certain security measures, but there is little evidence to substantiate these claims. The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection. Without these safeguards, traders are at risk of losing their entire investment if the broker encounters financial difficulties.

Historically, unregulated brokers have been known to mismanage client funds, leading to significant financial losses for traders. The lack of transparency surrounding PilotFX's fund security measures raises alarms about is PilotFX safe for customers looking to protect their investments.

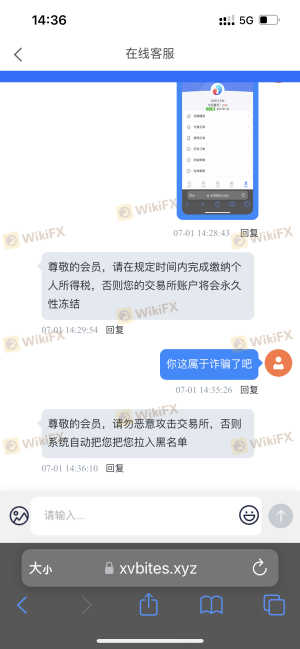

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Unfortunately, PilotFX has garnered numerous negative reviews from users, particularly concerning withdrawal issues and poor customer service. Common complaints include high spreads, difficulties in withdrawing funds, and a lack of responsive support. Below is a summary of the primary complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Spreads | Medium | Unresponsive |

| Customer Support | High | Poor |

Many users have reported that their requests for withdrawals were either denied or met with excessive delays, which is a significant red flag. Such behavior is often indicative of a scam, leading to the question of is PilotFX safe for potential investors.

Platform and Execution

The trading platform offered by PilotFX is another critical aspect to consider. While it claims to utilize popular trading software, user experiences indicate that the platform may not be stable. Issues such as slippage and order rejections have been reported, which can severely impact trading performance. The quality of order execution is essential for traders, and any signs of manipulation or poor performance can lead to significant financial losses.

Risk Assessment

Using PilotFX comes with inherent risks, primarily due to its unregulated status and negative user feedback. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No major regulation |

| Financial Risk | High | Potential fund mismanagement |

| Operational Risk | Medium | Platform stability issues |

To mitigate these risks, traders should consider using regulated brokers with a proven track record and transparent operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that PilotFX is not a safe broker. Its lack of regulation, negative user feedback, and questionable trading conditions raise serious concerns about its legitimacy. Potential investors should exercise extreme caution and consider alternative options. For those seeking reliable forex brokers, it is advisable to choose companies that are regulated by reputable authorities, offer transparent trading conditions, and have a history of positive customer experiences.

In summary, if you are contemplating trading with PilotFX, it would be prudent to reconsider and explore more reputable alternatives that prioritize the safety and security of their clients.

Is PILOTFX a scam, or is it legit?

The latest exposure and evaluation content of PILOTFX brokers.

PILOTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PILOTFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.