Is PATRIOT CAPITAL safe?

Business

License

Is Patriot Capital Safe or Scam?

Introduction

Patriot Capital is a relatively new player in the forex market, claiming to offer a wide range of trading services across multiple asset classes. As the financial landscape becomes increasingly crowded with brokers, traders must exercise caution when selecting a trading partner. The potential for scams and unregulated entities poses significant risks to investors, making it essential to conduct thorough due diligence. This article aims to provide an objective assessment of Patriot Capital's legitimacy, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and overall risk profile. The information presented here is derived from various online reviews and regulatory databases, ensuring a comprehensive evaluation.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining a broker's trustworthiness. A well-regulated broker is typically subject to stringent oversight, which can help protect clients' funds and ensure fair trading practices. Unfortunately, Patriot Capital operates without any valid regulatory licenses. The following table summarizes its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns about the safety of client funds and the integrity of trading operations. Many reviews indicate that Patriot Capital falsely claims to be licensed in the United States, specifically mentioning affiliations with the National Futures Association (NFA). However, upon investigation, it becomes evident that the broker is not listed as an NFA member, nor does it have the necessary licenses to operate as a forex broker in the U.S. This lack of regulatory oversight is a red flag that potential investors should carefully consider.

Company Background Investigation

Patriot Capital's company history and ownership structure are also vital to understanding its legitimacy. The broker claims to be operated by Patriot Capital Pty Ltd, but there is little information available regarding its establishment, management team, or operational history. Transparency is a critical aspect of any financial institution, and the lack of information raises questions about the broker's accountability.

The management team behind Patriot Capital appears to be anonymous, which further complicates the assessment of its credibility. A reputable broker typically provides information about its founders and key personnel, showcasing their qualifications and experience. The absence of such details can be indicative of a lack of transparency, which is concerning when evaluating whether Patriot Capital is safe or a scam.

Trading Conditions Analysis

An essential aspect of any forex broker is its trading conditions, including fees, spreads, and commissions. A thorough examination of Patriot Capital's fee structure reveals several concerning elements. The following table illustrates the core trading costs:

| Fee Type | Patriot Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

The lack of specific information regarding spreads and commissions is a significant red flag. Traders should be wary of brokers that do not disclose their fee structures upfront, as this can lead to unexpected costs that erode profitability. Additionally, many reviews highlight that Patriot Capital employs high leverage ratios, which can amplify both profits and losses. While high leverage may appeal to some traders, it also increases the risk of significant financial loss, raising further concerns about the safety of trading with this broker.

Client Fund Safety

Client fund safety is paramount when evaluating a forex broker. A reputable broker will implement robust measures to protect client funds, including segregated accounts and investor protection schemes. Unfortunately, Patriot Capital does not appear to offer any such protections. The broker lacks segregated accounts, meaning client funds may be co-mingled with the company's operational funds, posing a significant risk in the event of financial difficulties.

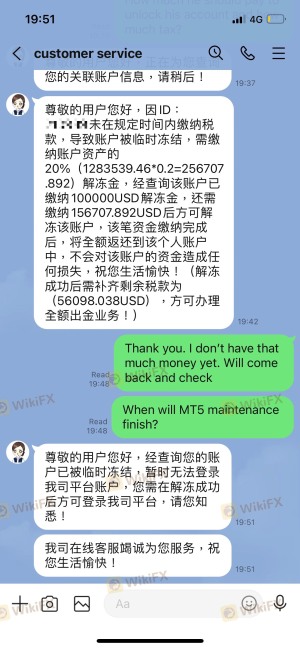

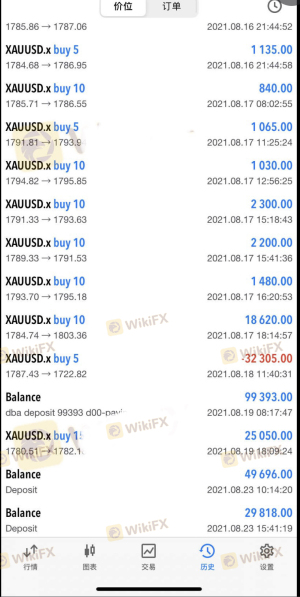

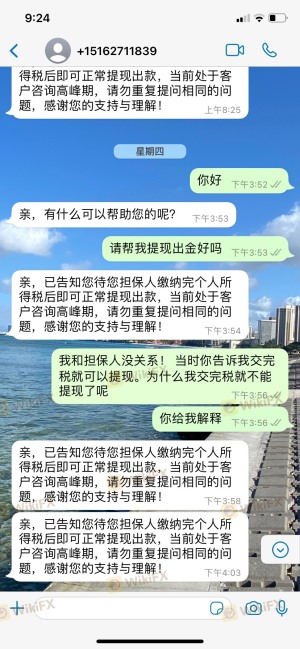

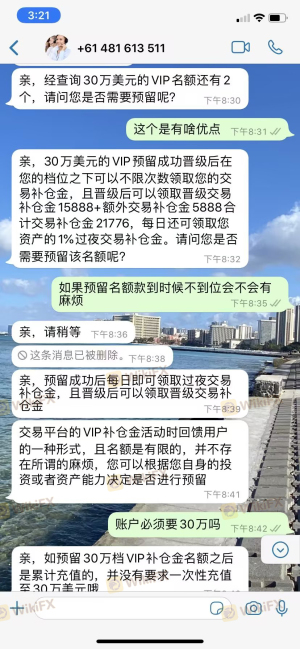

Moreover, there are no indications that Patriot Capital provides negative balance protection, which could leave traders liable for losses exceeding their account balance. Historical complaints about withdrawal issues further exacerbate concerns about fund safety. Many users report being unable to withdraw their funds, suggesting that the broker may engage in practices that prevent clients from accessing their money. This combination of factors raises serious questions about whether Patriot Capital is safe for traders.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of Patriot Capital reveal a pattern of dissatisfaction among users, with many citing issues related to withdrawals and customer support. The following table summarizes the primary types of complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include delayed withdrawal requests, unresponsive customer service, and misleading information about trading conditions. Users have reported that their accounts were blocked or that they were pressured to deposit more funds before being allowed to withdraw their initial investments. These patterns of behavior are characteristic of fraudulent brokers, leading to the conclusion that Patriot Capital may not be a trustworthy option for traders.

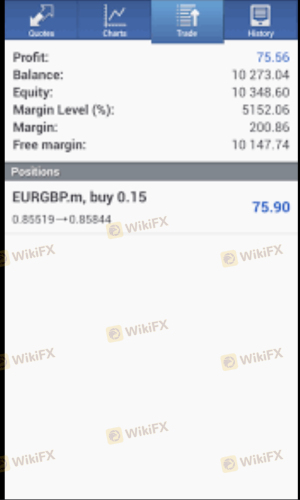

Platform and Trade Execution

The trading platform's performance and reliability are crucial for a positive trading experience. Users have reported mixed experiences with Patriot Capital's platform, with some noting issues related to stability and execution speed. Effective trade execution is vital for capitalizing on market opportunities, and any delays or slippage can significantly impact trading outcomes.

Many reviews suggest that Patriot Capital's platform lacks the features and tools commonly found in reputable trading software, such as MetaTrader 4 or MetaTrader 5. The absence of established platforms raises concerns about the broker's commitment to providing a high-quality trading environment. Additionally, reports of order rejections and execution delays further emphasize the potential risks associated with trading through this broker.

Risk Assessment

Using Patriot Capital carries several inherent risks, primarily due to its unregulated status and negative user feedback. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Fund Safety Risk | High | Lack of segregated accounts and withdrawal issues. |

| Trading Risk | Medium | High leverage and unclear fee structure. |

| Customer Support Risk | High | Poor response to user complaints. |

Given these factors, it is crucial for potential traders to approach Patriot Capital with caution. Seeking alternative brokers with robust regulatory oversight and positive user feedback is advisable to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Patriot Capital exhibits several red flags that indicate it may not be a safe trading option. The lack of regulation, transparency, and consistent user complaints about withdrawal issues raise significant concerns about the broker's legitimacy. Traders should be particularly wary of engaging with a broker that lacks the necessary oversight and has a history of negative user experiences.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with positive reputations in the industry. Look for brokers that offer transparent fee structures, robust customer support, and a proven track record of fund safety. By making informed decisions and prioritizing safety, traders can better protect their investments and enhance their trading experiences.

Is PATRIOT CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of PATRIOT CAPITAL brokers.

PATRIOT CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PATRIOT CAPITAL latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.