Patriot Capital 2025 Review: Everything You Need to Know

Executive Summary

Patriot Capital is an established investment firm. The company has over 22 years of experience in the financial markets, specifically focusing on providing debt capital and minority equity investments to small and medium-sized privately held companies. Based in Dunwoody, Georgia, this Patriot Capital review reveals a company that has built its reputation around responsible investing principles and job creation initiatives.

The firm manages over $1 billion in invested capital across multiple funds. This impressive portfolio spans 140+ platform investments across 6 different funds. What sets Patriot Capital apart is its commitment to supporting businesses in lower-income markets, with 39% of portfolio company employees located in Low-to-Moderate Income zones and maintaining a 47% ethnically diverse workforce across their investments.

Available data from their 2021 annual report shows Patriot Capital maintains 32 active portfolio companies employing 9,711 individuals. The firm's investment strategy aligns with Small Business Investment Company program objectives, emphasizing job creation and providing access to funding for lower middle market businesses. User feedback indicates an 82% recommendation rate, suggesting strong client satisfaction with their investment approach and partnership model.

Important Disclaimer

Investors should exercise caution when evaluating Patriot Capital. Specific regulatory status and detailed trading conditions are not clearly outlined in available public information. This Patriot Capital review is based on publicly available company reports and limited user feedback data.

The lack of comprehensive regulatory information and detailed trading platform specifications requires potential clients to conduct thorough due diligence before engaging with their services. Cross-regional regulatory differences and potential risks associated with investment activities should be carefully assessed by prospective investors, particularly given the limited transparency regarding specific compliance frameworks and operational jurisdictions.

Rating Framework

Broker Overview

Patriot Capital has operated in the investment sector for more than 22 years. The company has established itself as a specialized provider of debt capital and minority equity investments. The company's headquarters in Dunwoody, Georgia, serves as the central hub for managing over $1 billion in invested capital across six distinct funds.

Their business model focuses specifically on small and medium-sized privately held companies. The firm places particular emphasis on supporting enterprises that create employment opportunities in underserved markets. According to their portfolio information as of December 31, 2021, Patriot Capital has facilitated employment for nearly 10,000 individuals across their portfolio companies, demonstrating their commitment to economic development beyond traditional financial returns.

However, specific information regarding trading platforms, asset classes, and regulatory oversight remains limited in available documentation. The company appears to operate primarily as an investment fund rather than a traditional forex or CFD broker, which may explain the absence of typical retail trading platform features and regulatory disclosures commonly associated with online trading brokers.

Regulatory Region: Available information does not specify particular regulatory jurisdictions or oversight bodies governing Patriot Capital's operations. This represents a significant information gap for potential investors.

Deposit and Withdrawal Methods: Specific deposit and withdrawal procedures are not detailed in publicly available information. This suggests these arrangements may be handled on a case-by-case basis through direct client consultation.

Minimum Deposit Requirements: No standardized minimum deposit amounts are specified in available documentation. This indicates potential flexibility in investment thresholds or customized arrangements for different client types.

Bonus and Promotions: Current promotional offerings or bonus structures are not mentioned in available materials. This suggests the firm may not employ traditional retail trading incentives.

Tradeable Assets: The company focuses on debt capital and equity investments in private companies. However, specific tradeable instruments for individual investors are not clearly outlined in available information.

Cost Structure: Detailed fee schedules, management costs, or transaction expenses are not transparently disclosed in publicly accessible documentation. This requires direct inquiry for comprehensive cost analysis.

Leverage Options: Information regarding leverage availability or margin requirements is not provided in current documentation.

Platform Selection: No specific trading platforms or technological infrastructure details are mentioned in available materials.

Geographic Restrictions: Regional limitations or availability restrictions are not specified in current documentation.

Customer Service Languages: Supported languages for customer service are not detailed in available information.

This Patriot Capital review highlights significant information gaps that potential investors should address through direct communication with the firm.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The evaluation of Patriot Capital's account conditions faces significant limitations due to insufficient publicly available information. Traditional account types such as standard, premium, or VIP tiers are not documented in accessible materials, making it difficult to assess the variety and characteristics of available account options.

Minimum deposit requirements are not specified in current documentation. These requirements typically serve as a crucial factor in broker selection. This absence of transparent pricing information creates uncertainty for potential investors attempting to evaluate accessibility and entry barriers.

Account opening procedures and required documentation are not detailed in available materials. This prevents a comprehensive assessment of the onboarding process efficiency. Additionally, specialized account features such as Islamic accounts or other religious compliance options are not mentioned in current documentation.

The lack of detailed account condition information significantly impacts the user experience and decision-making process for potential clients. This Patriot Capital review emphasizes the need for direct communication with the firm to obtain comprehensive account-related information before making investment decisions.

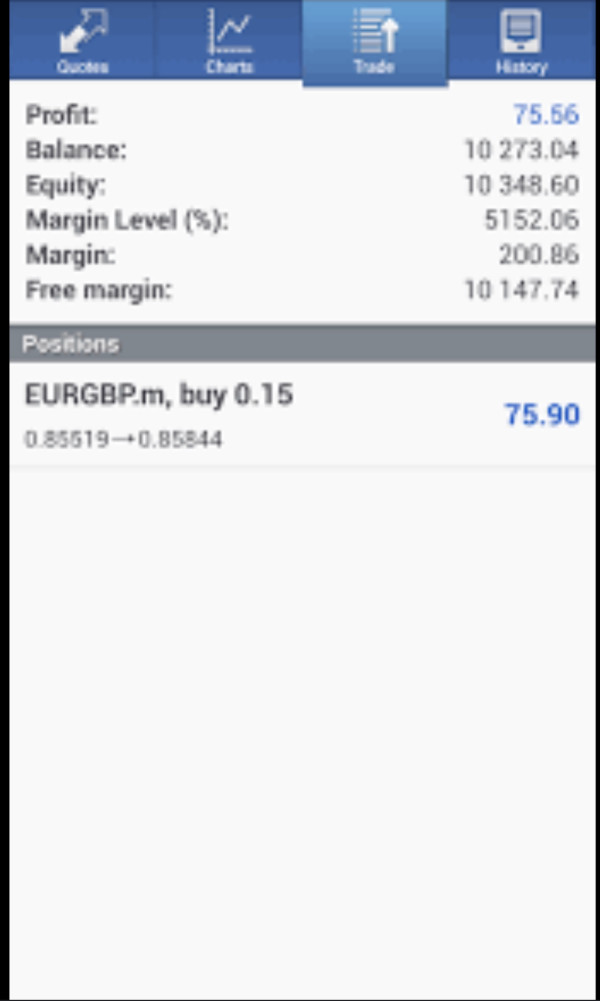

Assessment of Patriot Capital's trading tools and resources reveals substantial information gaps in publicly available documentation. Traditional trading tools such as technical analysis software, charting packages, or market research platforms are not specifically mentioned in current materials.

Research and analytical resources lack detailed description in available information. These resources typically form a cornerstone of professional investment services. The absence of educational resource documentation makes it challenging to evaluate the firm's commitment to client development and market education.

Automated trading support, algorithmic trading capabilities, or API access for institutional clients are not addressed in current documentation. This represents a significant information void for technologically-oriented investors seeking advanced trading infrastructure.

The firm's focus on private equity and debt capital investments may explain the absence of traditional retail trading tools. Their business model appears oriented toward institutional-style investments rather than active trading platforms.

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation for Patriot Capital shows mixed results due to limited available information about support infrastructure. Basic contact information is available through their corporate website, though detailed service level agreements and response time commitments are not publicly documented.

Available communication channels appear limited to traditional business contact methods. There is no specific mention of live chat, dedicated trading support, or 24/7 availability that characterizes modern retail trading platforms. The absence of detailed customer service hours and multilingual support information creates uncertainty about accessibility for international clients.

Service quality assessment relies primarily on limited user feedback suggesting an 82% recommendation rate. This indicates generally positive client experiences. However, specific case studies or detailed customer service reviews are not available in current documentation.

The professional investment focus of Patriot Capital may result in more personalized, relationship-based customer service rather than standardized retail support structures. However, this cannot be confirmed without additional information.

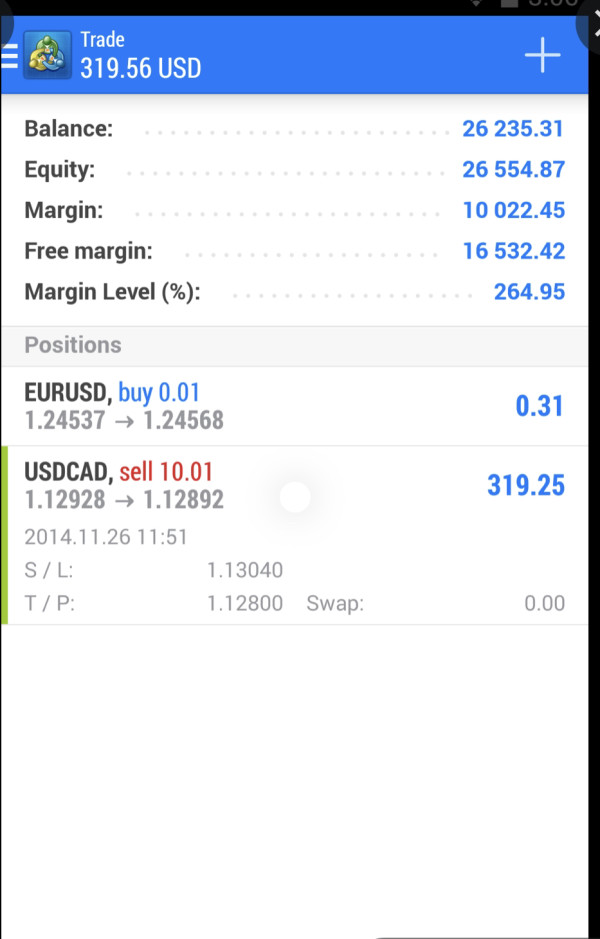

Trading Experience Analysis (Score: 4/10)

Trading experience evaluation for Patriot Capital faces significant challenges due to the apparent absence of traditional trading platform infrastructure. Platform stability, execution speed, and order processing quality cannot be assessed based on available information.

The firm's business model appears focused on private equity and debt investments rather than active trading. This may explain the lack of typical trading platform features such as real-time market data, order management systems, or mobile trading applications.

Order execution quality, slippage rates, and market access cannot be evaluated without specific trading platform documentation. The absence of technical performance metrics makes it impossible to compare trading conditions with industry standards.

Mobile trading experience and cross-platform compatibility are not addressed in available materials. This represents a significant gap for modern investors expecting comprehensive digital access to their investments.

Trust and Security Analysis (Score: 6/10)

Trust and security assessment for Patriot Capital shows moderate confidence based on the firm's established operational history of over 22 years. The company's longevity in the investment sector provides some credibility, though specific regulatory oversight information remains unclear.

Fund security measures, client asset protection protocols, and segregation policies are not detailed in publicly available documentation. This represents a significant transparency gap for security-conscious investors seeking comprehensive asset protection information.

Company transparency regarding investment performance, portfolio composition, and operational procedures shows mixed results. Annual reports provide some portfolio statistics, though detailed operational transparency remains limited.

Industry reputation appears positive based on the firm's sustained operations and reported client recommendation rates. However, independent third-party verification of performance claims is not readily available in current documentation.

User Experience Analysis (Score: 6/10)

User experience evaluation reveals limited but generally positive feedback regarding Patriot Capital's services. The reported 82% recommendation rate suggests satisfactory client relationships, though detailed user experience documentation is scarce.

Interface design and platform usability cannot be assessed due to the absence of specific trading platform information. Registration and account verification processes are not detailed in available materials, preventing comprehensive onboarding experience evaluation.

Fund management and investment tracking experiences are not specifically documented. However, the firm's focus on institutional-style investments may provide more personalized account management rather than self-service platforms.

Common user complaints or recurring issues are not documented in available information. This makes it difficult to identify potential service weaknesses or areas for improvement. This Patriot Capital review suggests that prospective clients should seek detailed user testimonials through direct inquiry.

Conclusion

This comprehensive Patriot Capital review reveals a well-established investment firm with over two decades of operational experience. However, significant information limitations prevent a complete evaluation of their services. The company's focus on responsible investing and job creation through private equity and debt investments demonstrates a commitment to impactful financial services.

Patriot Capital appears most suitable for investors seeking institutional-style investment opportunities in small and medium-sized private companies. The firm particularly appeals to those interested in socially responsible investing with measurable community impact. The firm's track record of managing over $1 billion in capital and maintaining 32 active portfolio companies suggests operational competency.

However, the primary disadvantages include limited transparency regarding regulatory oversight, absence of detailed trading platform information, and insufficient documentation of specific terms and conditions. Potential investors should conduct thorough due diligence and direct communication with the firm to address these information gaps before making investment decisions.