Is on fin safe?

Pros

Cons

Is OnFin A Scam?

Introduction

OnFin is an online forex and CFD broker that has positioned itself as a viable option for traders seeking a platform with competitive trading conditions and diverse investment opportunities. Established in 2015 and operating from the island of Mohéli in the Comoros, OnFin offers a range of services, including access to over 260 trading instruments and high leverage options. However, the forex market is notorious for its risks, and traders must exercise caution when evaluating brokers. The importance of due diligence cannot be overstated, as choosing an unreliable broker can lead to significant financial losses.

This article aims to provide an objective analysis of OnFin, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The investigation is based on a comprehensive review of multiple online resources, including user reviews, regulatory information, and financial assessments.

Regulation and Legitimacy

The regulatory environment is a crucial factor when assessing the reliability of any broker. Regulation serves as a protective mechanism for traders, ensuring that brokers adhere to specific standards of conduct and financial integrity. In the case of OnFin, it operates under the license of the Mwali International Services Authority (MISA), which is considered an offshore regulatory body.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mwali International Services Authority (MISA) | BF X 2024038 | Comoros | Valid, but considered low-tier |

While OnFin does possess a license, the quality and robustness of MISA's regulatory framework have raised concerns among traders and industry experts. Offshore regulations often lack the stringent oversight found in jurisdictions with top-tier regulators such as the FCA (UK) or ASIC (Australia). Consequently, trading with OnFin may expose clients to higher risks, particularly in terms of fund security and dispute resolution.

Furthermore, there have been reports indicating that OnFin has not been in operation for a long period, which can add to the uncertainty surrounding its legitimacy. Traders should be cautious and consider the implications of engaging with a broker that operates under less stringent regulatory oversight.

Company Background Investigation

OnFin Ltd. was registered in 2015, with its headquarters located in Fomboni, Comoros. The company has made strides to establish itself in the global trading landscape, but its relatively recent inception raises questions about its operational history and long-term sustainability. The ownership structure of OnFin is not extensively documented, which can be a red flag when assessing transparency.

The management team behind OnFin appears to have a mix of experience in the financial sector, but specific details regarding their backgrounds are limited. This lack of information can hinder potential clients' ability to gauge the competence and reliability of the management team.

Transparency is a vital component when evaluating a broker, and OnFin's limited disclosure on its operational practices and management can lead to skepticism among potential clients. A broker that is open about its ownership, management, and operational history is generally viewed as more trustworthy.

Trading Conditions Analysis

OnFin offers a variety of trading accounts, catering to different trader profiles. The broker claims to provide competitive trading conditions, including high leverage of up to 1:1000 and spreads starting from 0.0 pips. However, it is essential to analyze the overall fee structure to determine the true cost of trading.

| Fee Type | OnFin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 - 2.0 pips |

| Commission Model | $4 per lot (ECN account) | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spread may appear attractive, the commission structure for ECN accounts could be a potential drawback, as it is higher than the industry average. Additionally, the minimum deposit requirement is relatively low, starting at just $1 for a mini account, making it accessible for novice traders.

However, traders should be wary of any hidden fees or unfavorable trading conditions that may not be immediately apparent. The absence of comprehensive educational resources and support for traders can also be a concern, especially for those new to the forex market.

Customer Funds Safety

The safety of customer funds is paramount when selecting a broker. OnFin states that it employs various measures to secure client funds, including segregated accounts. However, the specifics of these measures are not extensively detailed, raising concerns about the effectiveness of their fund protection policies.

Moreover, the lack of a robust regulatory framework can further complicate the safety of client funds. Traders should inquire about the measures OnFin has in place to protect against negative balance scenarios and whether there are any investor protection schemes available.

Historically, there have been no major reported issues regarding fund security with OnFin, but the absence of a solid regulatory foundation may leave clients vulnerable in the event of disputes or operational failures.

Customer Experience and Complaints

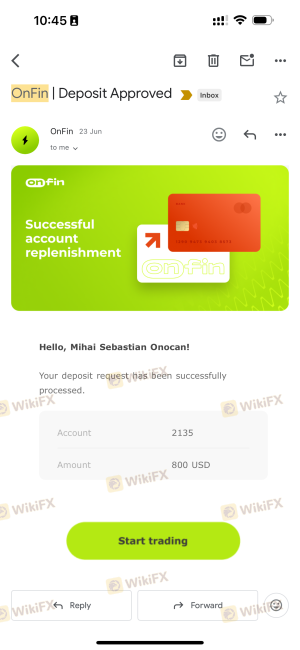

User feedback is an essential component of evaluating a broker's reliability. OnFin has garnered mixed reviews from clients, with some praising its trading conditions and customer service, while others have reported issues related to withdrawals and account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Account Management Issues | Medium | Generally responsive |

| Customer Support Quality | Low | Generally positive |

Common complaints include withdrawal delays and difficulties in account management, which can be particularly concerning for traders who prioritize quick access to their funds. While OnFin's customer service has received praise for its responsiveness, the resolution of complaints appears inconsistent.

For instance, one user reported a smooth withdrawal process, while another experienced significant delays without satisfactory communication from the broker. Such discrepancies highlight the importance of assessing user experiences before committing to a broker.

Platform and Trade Execution

OnFin utilizes the popular MetaTrader 4 platform, which is known for its user-friendly interface and robust trading tools. However, the performance of the platform in terms of stability and execution quality is critical for traders.

Users have reported varying experiences with order execution, with some noting quick and efficient processing, while others have experienced slippage and issues with order rejections. The presence of slippage can be a significant concern, particularly in volatile market conditions where timely execution is crucial.

Risk Assessment

Using OnFin presents several risks that traders should be aware of. The lack of stringent regulation, coupled with mixed customer feedback, raises concerns about the overall reliability of the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under a low-tier regulator |

| Fund Security Risk | Medium | Limited details on fund protection measures |

| Execution Risk | Medium | Reports of slippage and execution issues |

To mitigate these risks, traders should consider starting with a small investment and thoroughly researching the broker's practices. Additionally, diversifying trading accounts and utilizing risk management strategies can help minimize potential losses.

Conclusion and Recommendations

In conclusion, while OnFin presents itself as a competitive option for forex traders, several factors warrant caution. The broker operates under a low-tier regulatory body, which could expose clients to higher risks. Additionally, the mixed customer experiences and limited transparency regarding fund safety measures raise concerns about its reliability.

Traders are advised to conduct thorough due diligence before engaging with OnFin. For those seeking alternatives, it may be prudent to consider brokers regulated by top-tier authorities, offering more robust investor protection and a transparent operational framework.

Is on fin a scam, or is it legit?

The latest exposure and evaluation content of on fin brokers.

on fin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

on fin latest industry rating score is 2.01, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.01 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.