onfin 2025 Review: Everything You Need to Know

Abstract

The onfin review shows a young forex broker that started in 2015. MISA regulates this broker under license number BFX2024038, and onfin offers clear trading conditions with spreads that start from 0 points while using ECN technology for quick order execution. The broker provides 24/7 technical support to help traders who want low trading costs and high transparency. Despite these good features, its trust score stays low and user reviews are mixed, which means potential investors should be careful. This review uses public information and user feedback to focus on key features like competitive spreads and fast trade processing. Onfin targets experienced investors who feel comfortable with higher minimum deposit requirements and the risks that come with a broker that hasn't built a strong reputation yet.

Notice

Investors should know that MISA regulates onfin with license number BFX2024038. The legal standing and investor protection levels may change across different regions, so this evaluation uses publicly available data and user feedback to give potential clients an informed view of the broker's operations. Cross-regional regulations can affect both service delivery and legal options for investors. While onfin offers transparent trading conditions and advanced execution technology, some details like specific deposit and withdrawal methods haven't been fully shared in available resources. We recommend that potential users check local regulatory requirements before moving forward.

Scoring Framework

Broker Overview

Onfin entered the forex market in 2015 as a new player that wanted to provide cutting-edge trading solutions using ECN technology. The broker focuses on offering transparent trading conditions and low spreads that start from 0 points, which appeals to traders who want to keep costs low. Onfin emphasizes rapid order execution and provides 24/7 technical support to position itself as a reliable partner for active traders. Despite these strengths, the broker's overall trust score stays modest, and several users have expressed concerns about certain undisclosed elements and potential risks with its operations. Onfin markets itself to experienced investors who understand ECN-based platforms and feel comfortable navigating a market with changing regulatory views. Information from regulatory bodies and user feedback shows that onfin commits to transparency, though areas like commission structures need more clarification. This onfin review highlights both the broker's innovative trading environment and the caution advised for prospective users.

Onfin's operational backbone is built around the trusted MetaTrader 4 platform. Many traders worldwide recognize this platform for its robust functionality and ease of use, making it a solid choice for the broker's technical foundation. The broker offers access to various financial instruments, though the exact range of asset classes isn't fully detailed in available documentation. Since onfin operates under MISA regulation with license number BFX2024038, clients can expect regulatory oversight, even with reports of a lower overall trust rating compared to established peers. The broker's business model emphasizes ECN technology, which provides high liquidity and reduced delays during trade executions. This approach combines modern technological infrastructure with transparency in trading costs to serve traders who have prior market experience and want optimized order processing speeds. While there are notable strengths in onfin's value proposition, the mixed user sentiments and undisclosed details in some areas show that potential clients should carefully evaluate all available data before engaging in live trading.

-

Regulatory Region :

Onfin operates under MISA regulation and holds license number BFX2024038. This regulatory oversight provides some investor protection and legal legitimacy for the broker's operations. However, users should know that the level of protection and regulatory framework may vary across different regions and jurisdictions. MISA confirms that onfin follows the regulatory standards expected in its region, though specifics on cross-border compliance aren't fully documented in available resources.

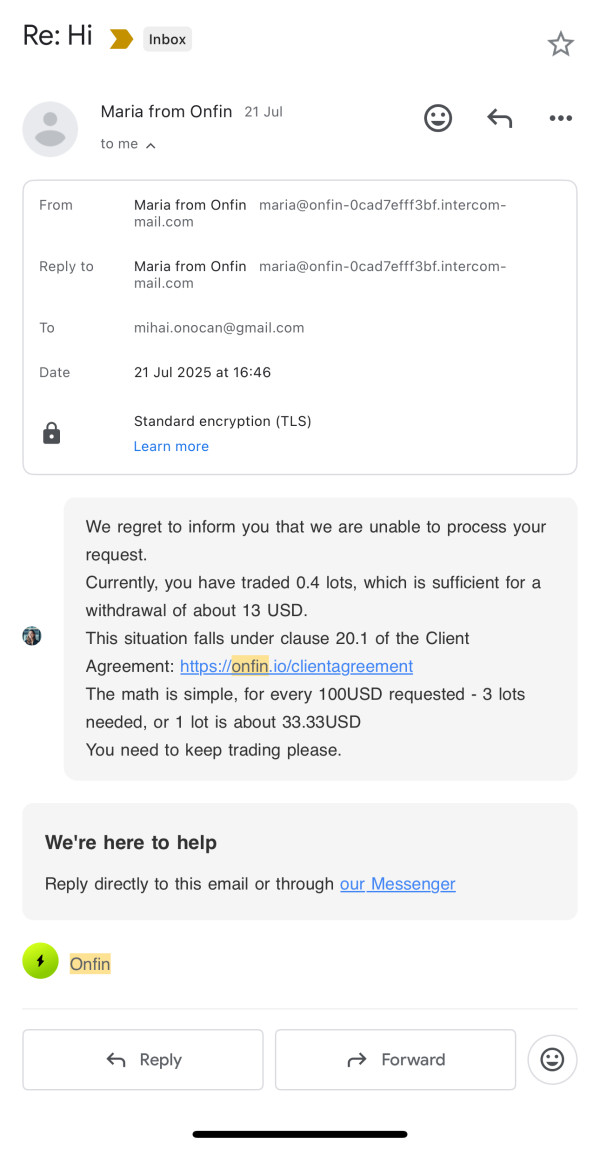

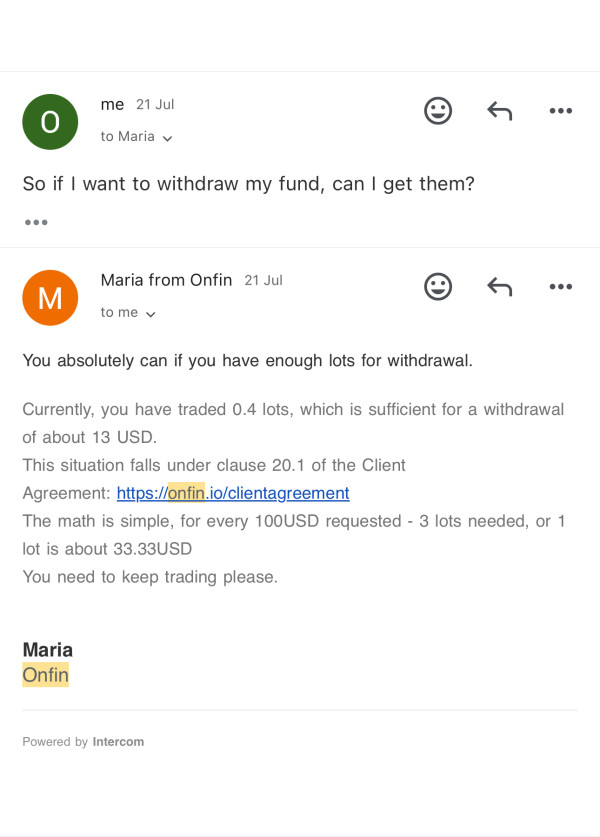

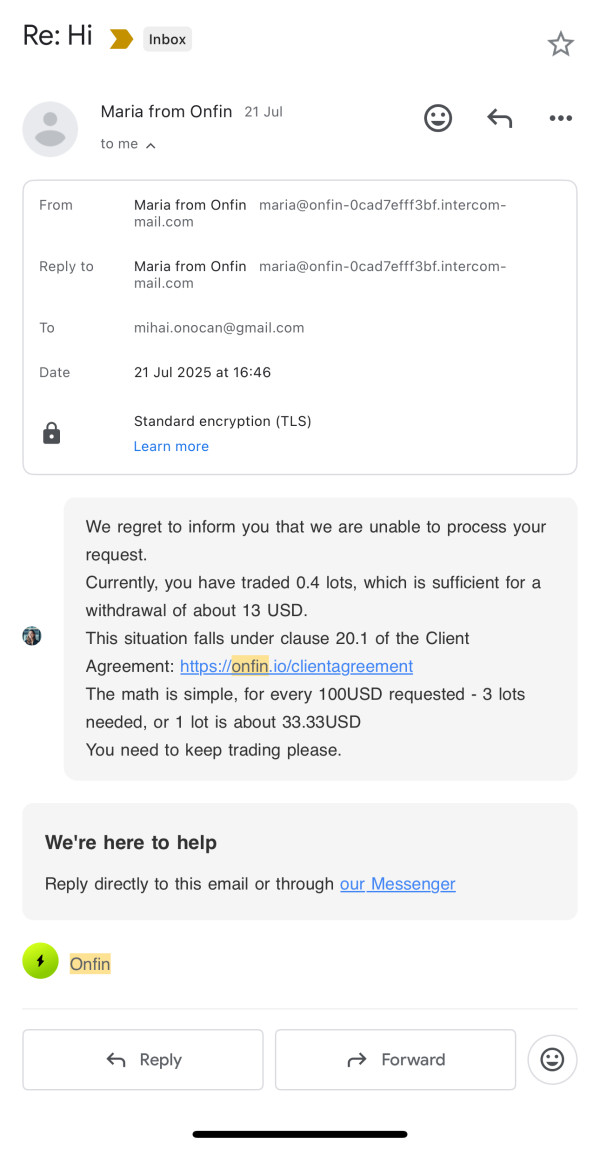

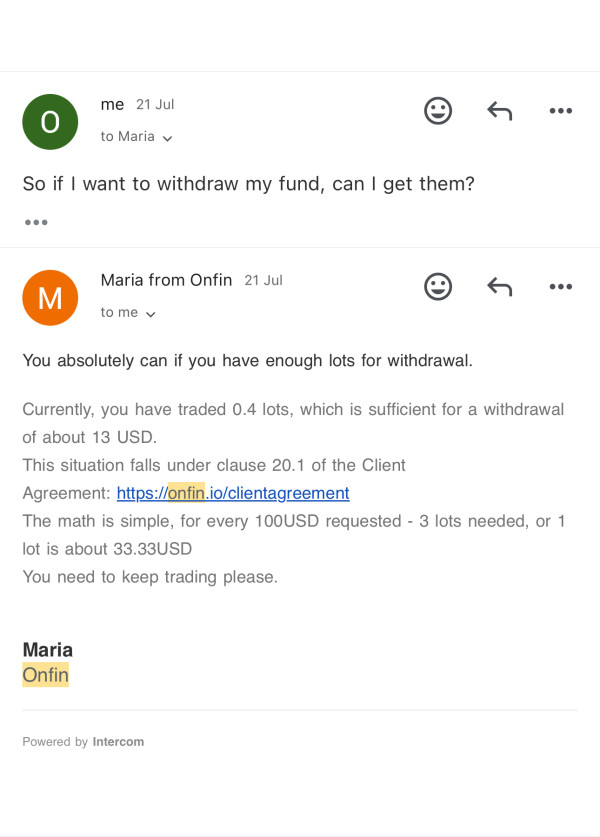

Deposit and Withdrawal Methods :

The summary doesn't detail specific deposit and withdrawal methods for onfin. The broker is known for offering transparent trading conditions, but the available information doesn't include a complete explanation of the payment systems used. Users should contact onfin's customer support or visit their official website for more detailed information about the methods available for transactions.

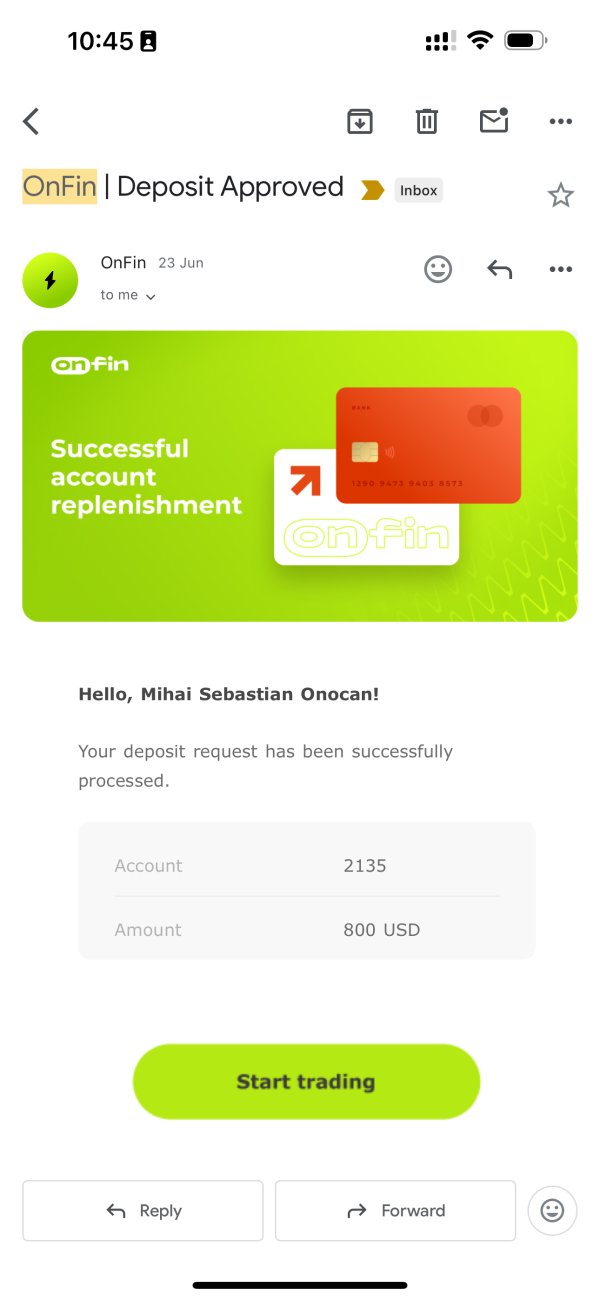

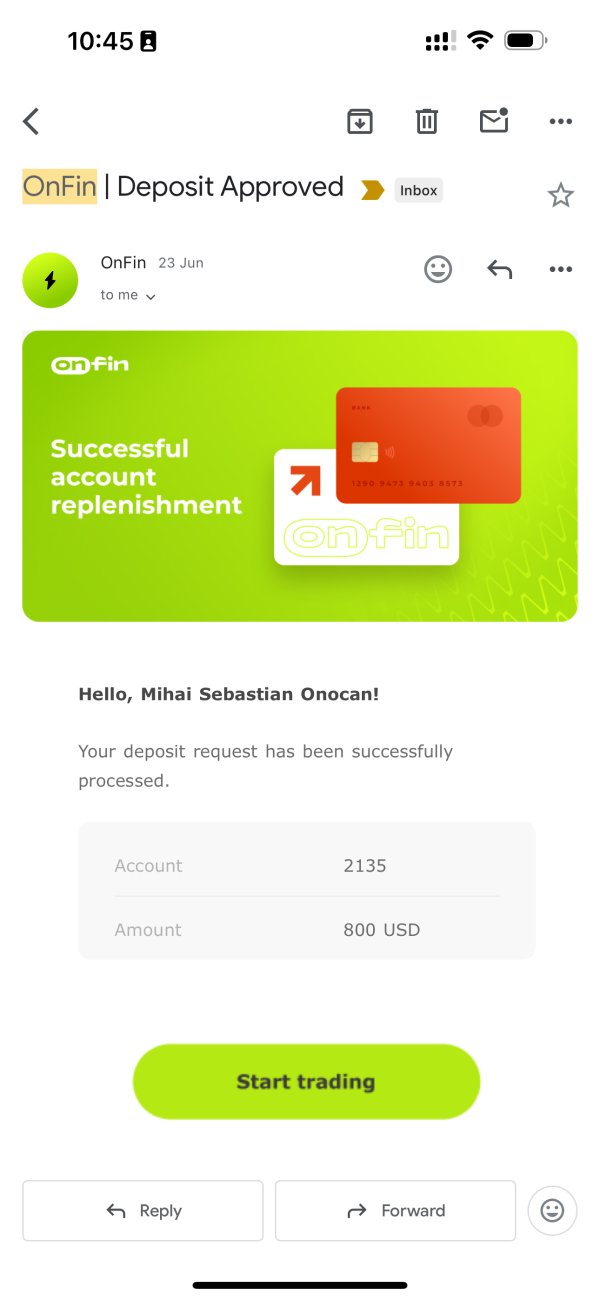

Minimum Deposit Requirement :

Onfin requires a minimum deposit of $1000 to open an account. This threshold targets traders with sufficient capital and may be less accessible for beginners, which aligns more with the needs of experienced investors who can commit to higher initial investments.

Bonus and Promotions :

Details about bonus promotions or special incentive offers aren't provided in the available information. The onfin review shows that while the broker focuses on transparent pricing and low spreads, no specific promotional campaigns or bonus incentives have been openly advertised. Prospective traders may need to inquire directly for any current offers or updates from the company.

Tradable Assets :

Onfin offers access to multiple financial instruments, though the specific asset classes haven't been fully detailed. The broker appears to provide a range of instruments that typically include major currency pairs and possibly other forex-related products. However, exact information about stocks, indices, commodities, or cryptocurrencies isn't explicitly mentioned in the reviewed documentation, which leaves some uncertainty about the full scope of tradable assets.

Cost Structure :

One of the primary highlights noted in the onfin review is the competitive cost structure offered by the broker. Trading costs begin at a spread of 0 points, which significantly lowers transaction expenses for active traders who execute frequent trades. However, while the spread data is clearly outlined, details about any commission fees aren't mentioned in the available resources. Additionally, there's no evidence of hidden fees or additional charges that might surprise traders later. This transparent approach to cost is attractive to users who prioritize low trading expenses, yet the absence of complete fee structure details calls for further clarification from the broker.

Leverage Ratio :

Information about the available leverage ratios on onfin hasn't been detailed in the accessible resources. Prospective clients are advised to verify directly with the broker for the latest leverage offerings and any associated conditions that may apply to their trading accounts.

Platform Selection :

Onfin uses the widely recognized MetaTrader 4 platform, which is a favorite among forex traders for its reliability and extensive functionality. This choice appeals to traders who are already familiar with the platform's interface and analytical tools that come built-in. The availability of MetaTrader 4 ensures a stable trading environment, though the review doesn't mention any additional proprietary platforms or mobile applications available from onfin.

Regional Restrictions :

The reviewed summary doesn't specify any regional restrictions on onfin's services. Investors should check local regulations and confirm with the broker whether there are any limitations for clients from their specific jurisdiction before proceeding.

Customer Service Languages :

The onfin review doesn't include detailed information on the languages supported by its customer service. Traders are recommended to contact the broker directly to determine the available language options for support.

Detailed Scoring Analysis

1. Account Conditions Analysis

The account conditions at onfin have been given a score of 7 out of 10. The broker requires a minimum deposit of $1000 to start trading, which may seem relatively high for new traders but aligns with the needs of more experienced investors who have sufficient capital. The available data confirms that the trading conditions are transparent, with clear information about spreads starting from 0 points. However, key details such as commission structures or the availability of different account types—including any specialized accounts like Islamic accounts—aren't provided in the accessible information. This lack of complete detail warrants some caution from potential users who want to understand all costs upfront. Users have noted that while the overall setup is straightforward, the inability to see whether additional benefits or account variants exist puts onfin at a relative disadvantage compared to competitors with more diverse account options. Overall, from this onfin review, the emphasis on transparency is evident but limited by the scarcity of detailed account diversification.

Onfin's provision of trading tools and resources gets a score of 5 out of 10. The broker relies primarily on the popular MetaTrader 4 platform, which is known for its robust charting tools, automated trading capabilities, and extensive community support from users worldwide. However, the review's available information doesn't describe any additional proprietary tools, research reports, or educational materials that could further enhance a trader's experience. There's a noticeable absence of detailed descriptions about advanced analytical resources or in-depth market research support that many modern brokers offer to their clients. The reliance solely on a standard trading platform suggests that onfin may not be investing significantly in value-added tools beyond basic execution functionality. This limited suite of resources means that while the platform is reliable and familiar to many traders, those looking for a richer offering of trading aids and research tools might find onfin's offerings somewhat sparse.

3. Customer Service and Support Analysis

Customer service at onfin has been highly rated, earning an 8 out of 10. The broker provides 24/7 technical support, which ensures that traders across different time zones can receive timely assistance with technical or account-related issues whenever they arise. According to user feedback, the support team is responsive and effective in resolving inquiries, which contributes to a generally positive impression among clients who have used the service. However, while the continuous availability of support is a positive feature, there remains a gap regarding the specifics of support channels such as live chat, phone, or email and the range of languages offered. The onfin review highlights that although service quality is commendable, further clarity about multilingual support would be advantageous, particularly for a global clientele that speaks different languages. The overall performance in this aspect reinforces that onfin places significant emphasis on customer support, which is a critical component in trading environments where issues can arise unexpectedly.

4. Trading Experience Analysis

The overall trading experience with onfin scores a 7 out of 10. Users have reported that order execution is notably fast, which is a key benefit attributed to the broker's use of ECN technology that reduces delays and slippage. This results in minimal delays and reduced slippage, especially valuable in volatile market conditions where speed can make a significant difference in trade outcomes. Despite the efficiency in trade execution, the review points out that the platform's comprehensive functionality remains somewhat under-documented in available resources. There's limited commentary on aspects such as mobile trading experience, integrated technical analysis tools, or the customization options available on the platform for different trader preferences. Additionally, while the instant order execution adds to the platform's appeal, details about issues like re-quotes or occasional technical glitches haven't been elaborated upon in user feedback. In summary, while the rapid and stable execution performance reinforces the broker's technical strengths, the overall trading experience could be enhanced with more information on additional platform features that cater to a diverse range of trader needs.

5. Trust Analysis

Trust remains a critical concern for onfin, reflected by a score of only 4 out of 10. Despite being regulated by MISA with license number BFX2024038, which provides a necessary layer of oversight, the broker's trust rating is notably low at 28 points out of 100. This low score is mainly driven by the absence of detailed disclosures about financial stability measures, such as fund segregation or periodic independent audits that would reassure investors. Additionally, there's limited information on the company's management transparency and how negative incidents have been addressed in the past. Reports from various sources indicate that users are cautious due to the broker's relatively brief market history and inconsistent feedback from different clients. While regulatory oversight by MISA does lend some credibility to the operation, potential investors should be aware of the significant risks associated with a trust score that lags behind industry norms. This aspect of onfin calls for enhanced transparency and improved communication of risk mitigation strategies to build stronger investor confidence.

6. User Experience Analysis

The user experience at onfin is evaluated at 6 out of 10 due to a mixture of positive and negative feedback. While some clients praise the broker for its fast execution and accessible 24/7 support, others remain uncertain about the ease of use of the platform interface and the overall account management journey from start to finish. The registration and verification processes aren't described in detail, leaving room for questions about the simplicity and efficiency of onboarding new clients who want to start trading quickly. Moreover, although no apparent fees are charged for fund transfers, users have reported occasional concerns about transparency in cost structures and order execution that could affect their trading results. The diversity in user opinion underscores the need for onfin to address inconsistencies in service delivery and interface design to improve overall satisfaction. The mixed reactions suggest that while the broker meets certain expectations, there remains significant scope for enhancements in user-friendliness and transparency, which are crucial for building lasting client trust.

Conclusion

In summary, onfin emerges as a broker that offers competitive, transparent trading conditions supported by advanced ECN technology and 24/7 technical support. However, its low trust score and mixed user feedback highlight the need for caution among prospective clients who are considering this broker. The platform is most suitable for experienced traders who are comfortable with a higher minimum deposit and seeking low-cost trade execution for their trading strategies. While the strengths lie in fast order processing and favorable cost structures, notable gaps such as incomplete details on deposit methods, account types, and risk mitigation measures indicate that further improvements are necessary for the broker to compete effectively. This onfin review encourages investors to perform their own due diligence before engaging with the broker to ensure it meets their specific trading needs.