Is Nuoying safe?

Business

License

Is Nuoying Safe or a Scam?

Introduction

Nuoying is an emerging player in the forex market, positioning itself as a competitive broker for retail traders. As the forex market continues to grow, the importance of selecting a reliable broker cannot be overstated. Traders need to be vigilant and conduct thorough evaluations of forex brokers to avoid potential scams and ensure the safety of their investments. This article aims to provide an objective analysis of Nuoying, assessing its legitimacy, regulatory status, company background, trading conditions, client safety, and overall user experience. Our investigation is based on a comprehensive review of online resources, user testimonials, and regulatory information.

Regulation and Legitimacy

Regulatory oversight is crucial in determining the safety and reliability of a forex broker. Nuoying's regulatory status has raised concerns, as it lacks proper licensing from recognized financial authorities. Below is a summary of the key regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulatory oversight can be a significant red flag for potential investors. Regulatory bodies are essential in ensuring that brokers adhere to strict standards, promoting transparency and protecting investors from fraud. Nuoying's lack of regulation suggests that traders may be exposing themselves to higher risks, including potential misuse of funds and lack of recourse in case of disputes. This raises the question: Is Nuoying safe? Without a regulatory framework, the answer remains uncertain.

Company Background Investigation

Nuoying's history and ownership structure are vital components in assessing its credibility. The company appears to have been established several years ago, but detailed information regarding its founders, management team, and operational history is scarce. The lack of transparency surrounding the company's ownership may lead to concerns about accountability.

In the absence of a well-documented management team with relevant experience in the financial sector, potential investors may question the firm's operational integrity. A strong management team typically enhances a broker's reputation and trustworthiness. Unfortunately, without clear information, it is challenging to gauge Nuoying's commitment to ethical practices and customer service. This lack of transparency further complicates the question of whether Nuoying is safe for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Nuoying's fee structure and trading conditions appear to be competitive, yet specific details remain vague. Below is a comparison of core trading costs:

| Fee Type | Nuoying | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | Typically 1-3 pips |

| Commission Model | Not specified | Varies, often around $5 per lot |

| Overnight Interest Range | Not specified | Typically 0.5% - 1% |

The lack of clarity regarding fees and commissions can be concerning for traders, as unexpected charges can significantly impact profitability. Additionally, if the broker's fees are higher than industry standards, it could indicate a potential profit motive at the expense of clients. Therefore, prospective traders should exercise caution and conduct further research to determine if Nuoying is safe in terms of trading costs.

Client Fund Safety

A broker's approach to client fund safety is paramount in assessing its reliability. Nuoying's measures regarding fund security remain unclear, raising concerns about the safety of client deposits. Key aspects to consider include fund segregation, investor protection, and negative balance protection.

Without proper segregation of client funds, there is a risk that a broker could misuse or misappropriate deposits for operational expenses. Furthermore, the absence of investor protection mechanisms could leave clients vulnerable in case of broker insolvency. Historical issues surrounding fund safety, if any, could further complicate the assessment of whether Nuoying is safe for traders.

Customer Experience and Complaints

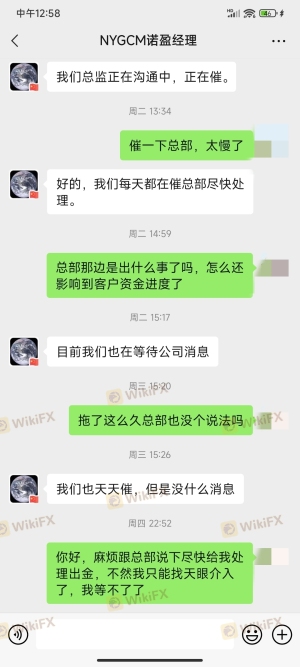

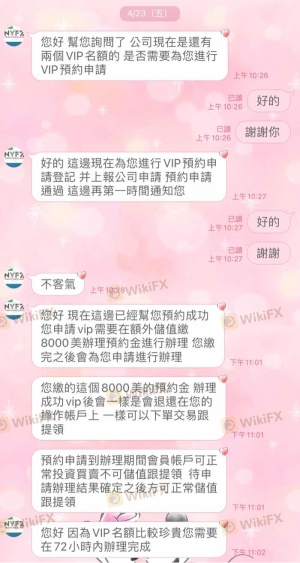

Customer feedback offers valuable insights into a broker's reliability and responsiveness. An analysis of user experiences with Nuoying reveals mixed reviews, with some clients expressing dissatisfaction with the broker's communication and withdrawal processes. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | Unresponsive |

Two notable cases highlight the challenges faced by clients. In one instance, a trader reported difficulty withdrawing funds, which took weeks to resolve. In another case, a client expressed frustration over the lack of clear communication regarding account status. These complaints raise significant concerns about the overall client experience and whether Nuoying is safe for traders seeking reliable support.

Platform and Trade Execution

The quality of a broker's trading platform and execution is crucial for a seamless trading experience. Reviews of Nuoying's platform indicate that while it offers a range of trading tools, users have reported occasional stability issues and slippage during high volatility periods.

Order execution quality is a critical factor for traders, as delays or rejections can result in missed opportunities and financial losses. If users frequently experience slippage or rejected orders, it may indicate underlying issues with the broker's infrastructure. Therefore, traders must consider these factors when evaluating whether Nuoying is safe for their trading activities.

Risk Assessment

Using Nuoying as a forex broker entails certain risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases vulnerability to fraud. |

| Financial Stability Risk | Medium | Limited transparency regarding the company's financial health. |

| Customer Service Risk | High | Poor response to customer complaints could lead to unresolved issues. |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a small deposit, and monitor their trading activities closely. Understanding these risks is essential in answering the question of whether Nuoying is safe for potential investors.

Conclusion and Recommendations

In conclusion, the analysis of Nuoying raises several concerns regarding its safety and legitimacy. The lack of regulatory oversight, combined with limited transparency surrounding the company's operations and customer experiences, suggests that traders should approach this broker with caution. While some aspects of Nuoying's trading conditions may appear competitive, the absence of clear information on fees and customer support issues further complicates the assessment.

For traders seeking reliable forex brokers, it is advisable to consider alternatives that are well-regulated and have established reputations for customer service and fund safety. Brokers such as OANDA, IG, or Forex.com may offer more security and peace of mind. Ultimately, while the question of Is Nuoying safe? remains open, the available evidence suggests that potential clients should exercise caution before committing their funds.

Is Nuoying a scam, or is it legit?

The latest exposure and evaluation content of Nuoying brokers.

Nuoying Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nuoying latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.