Regarding the legitimacy of WWF forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is WWF safe?

Business

Risk Control

Is WWF markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Wise Wolves Finance Ltd

Effective Date:

2017-09-25Email Address of Licensed Institution:

wwf@wise-wolves.comSharing Status:

No SharingWebsite of Licensed Institution:

www.wise-wolves.financeExpiration Time:

--Address of Licensed Institution:

66-68 Archiepiskopou Makariou & Markou Drakou Street, 2nd Floor, Mesa Geitonia, 4003 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 366 336Licensed Institution Certified Documents:

Is WWF Safe or Scam?

Introduction

WWF, also known as Wise Wolves Finance, is a forex broker that has been operating since 2016 and is based in Cyprus. It positions itself as a financial services provider, offering various trading opportunities in the forex and CFD markets. As the forex market continues to grow, traders must be cautious when selecting a broker, as the industry is rife with both legitimate firms and scams. This article aims to evaluate whether WWF is a safe option for traders or if it exhibits characteristics of a scam. Our investigation is based on a comprehensive analysis of regulatory compliance, company history, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and safety for traders. WWF is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a mid-tier regulator. While CySEC is recognized for enforcing certain standards, it does not have the same level of authority as top-tier regulators such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the United States.

Regulatory Information Table

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 337/17 | Cyprus | Verified |

WWFs CySEC license is essential as it indicates a level of oversight and compliance with financial regulations. However, it is worth noting that WWF was previously authorized by the FCA as a European authorized representative, but this license expired in July 2022. The expiration raises concerns about its current operational status, especially for traders in jurisdictions where FCA oversight is deemed critical.

Company Background Investigation

WWF, or Wise Wolves Finance, was established in 2016 and has since aimed to provide a range of financial services, including forex trading and investment services. The company is incorporated in Cyprus, a popular jurisdiction for financial firms due to its favorable regulatory environment. WWF is owned by a group of financial professionals with varying backgrounds in finance and trading, which adds a layer of credibility to its operations.

The management team at WWF comprises individuals with extensive experience in the financial sector. However, the company‘s transparency regarding its ownership structure and management team could be improved, as detailed information is not readily available on its website. This lack of transparency may raise questions for potential clients regarding the firm’s stability and governance.

Trading Conditions Analysis

When evaluating whether WWF is safe, it is important to analyze its trading conditions, including fees, spreads, and account types. WWF requires a minimum deposit of $10,000, which is significantly higher than the industry average, potentially limiting access for smaller retail traders. The broker claims to offer competitive spreads, with rates as low as 0 pips, but specifics about commission structures are not clearly outlined.

Trading Costs Comparison Table

| Cost Type | WWF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0 pips | 1-2 pips |

| Commission Structure | Unclear | Varies |

| Overnight Interest Range | Not specified | 0.5%-1.5% |

The high minimum deposit requirement and lack of clarity around commission structures could be red flags for potential traders. It is essential for traders to inquire directly with the firm to understand all applicable fees and charges before committing funds.

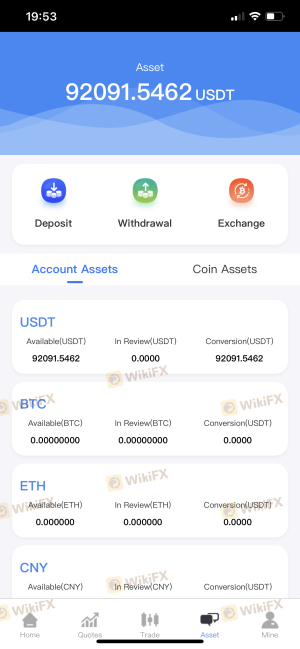

Client Fund Safety

Client fund safety is a critical aspect of evaluating whether WWF is a scam. The broker claims to implement various safety measures, including segregating client funds from its operational funds. This practice is standard in the industry and is a requirement for regulated brokers. However, there is limited information available regarding any investor protection mechanisms or negative balance protection policies in place at WWF.

Historically, there have been no significant reports of fund security issues or disputes involving WWF, but the lack of comprehensive information on this topic may cause concern for potential clients. Traders should always prioritize brokers that provide clear and detailed information about their fund safety measures.

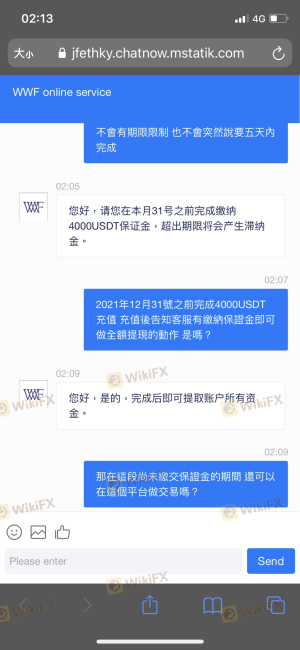

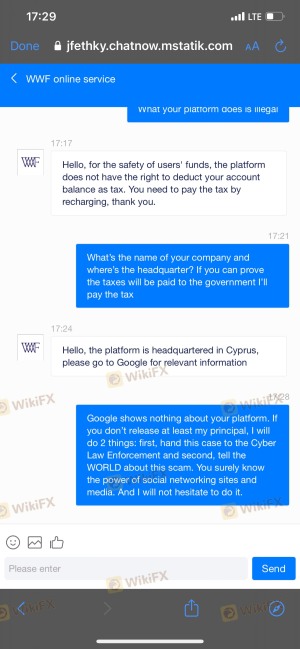

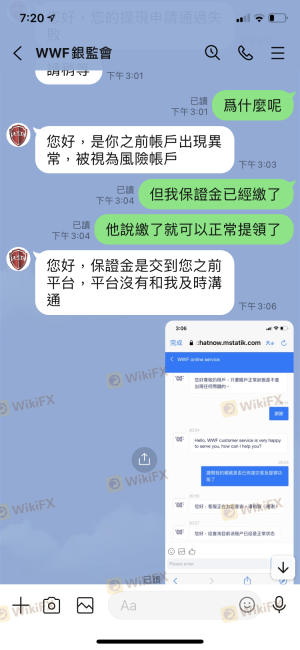

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing whether WWF is safe. Reviews from users indicate a mixed experience, with some traders praising the platform's features and customer support, while others have raised concerns about high minimum deposits and limited trading options. Common complaints include the lack of clarity regarding fees and slow response times from customer support.

Complaint Types and Severity Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| High Minimum Deposit | Medium | Limited |

| Fee Transparency | High | Slow |

| Customer Support Quality | Medium | Mixed |

A few notable cases involve clients expressing frustration over unexpected fees and the lack of timely responses to inquiries. These complaints indicate areas where WWF could improve its service and transparency to enhance customer satisfaction.

Platform and Trade Execution

The trading platform offered by WWF is another crucial factor in determining its safety. The broker provides access to popular trading platforms like MetaTrader 4 and MetaTrader 5, which are known for their robust functionality and user-friendly interfaces. However, reports of execution quality and slippage vary, with some users experiencing delays during high volatility periods.

Despite these concerns, there have been no significant indications of platform manipulation or unethical practices. However, traders should remain vigilant and monitor their trade execution experiences closely.

Risk Assessment

Using WWF entails certain risks that traders must be aware of. The combination of a high minimum deposit, mixed customer feedback, and the expiration of its FCA authorization raises questions about the overall risk profile of the broker.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | CySEC regulation, but FCA license expired |

| Fund Safety | Medium | Segregated accounts, but limited info |

| Customer Service Quality | High | Mixed reviews and slow responses |

To mitigate risks, traders are advised to conduct thorough due diligence, remain informed about the broker's regulatory status, and consider starting with a demo account to assess the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, while WWF is regulated by CySEC, the expiration of its FCA authorization and the high minimum deposit requirement may raise concerns about its safety and reliability. The mixed customer feedback further complicates the assessment of whether WWF is a scam. Traders should proceed with caution and consider their individual risk tolerance when dealing with this broker.

For those seeking alternative options, it may be beneficial to explore brokers with established reputations, transparent fee structures, and strong regulatory oversight, such as those regulated by top-tier authorities like the FCA or ASIC. Ultimately, the decision to trade with WWF should be made with careful consideration of the outlined risks and the trader's specific needs.

Is WWF a scam, or is it legit?

The latest exposure and evaluation content of WWF brokers.

WWF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WWF latest industry rating score is 5.90, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.90 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.