Is MX Bitcoin Investment safe?

Business

License

Is MX Bitcoin Investment a Scam?

Introduction

MX Bitcoin Investment is an online trading platform that positions itself within the forex and cryptocurrency markets. It claims to offer a variety of trading options, including commodities, forex, CFDs, cryptocurrencies, and ETFs. However, as the popularity of online trading platforms has surged, so too have concerns regarding their legitimacy and safety. Traders must exercise caution when selecting a broker, as the landscape is rife with scams and unregulated entities. This article aims to thoroughly evaluate MX Bitcoin Investment, assessing its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and associated risks. The evaluation is based on a comprehensive review of multiple sources, including user feedback and regulatory warnings.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy. A regulated broker is typically subject to strict oversight that helps protect traders' funds and ensures fair trading practices. In the case of MX Bitcoin Investment, the company has not provided any clear information regarding its regulatory status.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Unverified |

The absence of regulation raises significant red flags. According to various reviews, MX Bitcoin Investment has been flagged by the UK Financial Conduct Authority (FCA) for operating without authorization, which is a serious concern for potential investors. Such warnings indicate that the platform may not adhere to the necessary standards of operation, putting traders at risk. The lack of regulatory oversight can lead to issues such as unprotected funds and difficulty in resolving disputes. As a result, it is prudent for traders to be highly cautious when considering whether “Is MX Bitcoin Investment safe?”

Company Background Investigation

Understanding the background of a trading platform is essential for assessing its reliability. MX Bitcoin Investment claims to operate from the United Kingdom, with an address listed as 128 High St, Three Holes, PE14 8 DU. However, this address does not correspond to any legitimate financial institution, which raises questions about the company's transparency and authenticity.

The ownership structure of MX Bitcoin Investment is also unclear, with no information provided about the individuals or entities behind the platform. This lack of transparency can be a warning sign, as reputable brokers typically disclose information about their management team and ownership. Furthermore, the absence of a well-established history or track record suggests that traders may be dealing with a relatively new entity lacking the necessary experience to operate effectively in the financial markets. Therefore, potential clients should carefully consider whether “Is MX Bitcoin Investment safe?” given its dubious background.

Trading Conditions Analysis

When evaluating a trading platform, an understanding of its fee structure is crucial. MX Bitcoin Investment presents several account types, each with varying minimum deposit requirements. However, the overall fee structure lacks clarity, and potential hidden fees could pose additional risks for traders.

| Fee Type | MX Bitcoin Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information about spreads, commissions, and other trading costs can be a potential red flag. Traders should be wary of platforms that do not provide transparent fee structures, as this may indicate a lack of integrity. Additionally, any unusual fees or charges can significantly impact a trader's profitability, further complicating the question of whether “Is MX Bitcoin Investment safe?”

Client Funds Security

The safety of client funds is of paramount importance in the trading world. MX Bitcoin Investment has not provided sufficient information regarding its security measures for client funds. Key aspects such as fund segregation, investor protection, and negative balance protection are critical for safeguarding traders' investments.

The absence of clear policies on these matters raises concerns about the potential for fund mismanagement or loss. Without adequate measures in place, traders may find themselves vulnerable to financial risks. Historical issues regarding fund safety could further exacerbate this situation, as clients may have previously faced difficulties in retrieving their funds. Therefore, the question of whether “Is MX Bitcoin Investment safe?” remains highly pertinent.

Customer Experience and Complaints

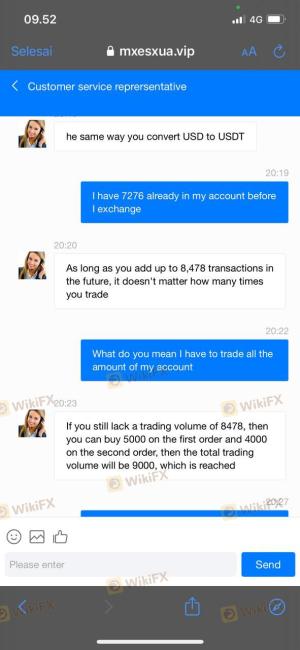

Customer feedback is a valuable resource for assessing the reliability of a trading platform. Reviews of MX Bitcoin Investment indicate a pattern of negative experiences among users, with many reporting issues related to fund withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Poor |

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and overall dissatisfaction with the trading experience. In some cases, users have reported feeling misled by the platform's marketing claims. Such complaints can be indicative of broader systemic issues within the company, leading to the conclusion that potential clients should consider whether “Is MX Bitcoin Investment safe?” before engaging with the platform.

Platform and Trade Execution

The performance of a trading platform is a crucial element for traders. An evaluation of MX Bitcoin Investment's platform reveals concerns regarding its stability and user experience. Traders have reported issues with order execution quality, including slippage and rejected orders, which can significantly affect trading outcomes.

An unreliable trading platform can lead to missed opportunities and increased frustration for traders. The presence of any signs of platform manipulation further complicates the assessment of the platform's integrity. Therefore, potential investors must consider the platform's performance when deliberating whether “Is MX Bitcoin Investment safe?”

Risk Assessment

Engaging with MX Bitcoin Investment carries inherent risks that must be carefully evaluated. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to complaints. |

| Platform Reliability | High | Issues with execution and stability. |

Given these risks, it is advisable for potential clients to implement strategies to mitigate exposure. This may include conducting thorough research, utilizing demo accounts, and starting with smaller investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that MX Bitcoin Investment exhibits several red flags that warrant caution. The lack of regulation, unclear company background, and numerous customer complaints raise serious questions about the platform's legitimacy. Therefore, it is essential for traders to approach this platform with skepticism.

Given the findings, it is recommended that traders seek alternative, regulated brokers with a proven track record of reliability and customer satisfaction. Some reputable alternatives include established platforms that are well-regulated and have demonstrated a commitment to client security and transparency. Ultimately, the question of “Is MX Bitcoin Investment safe?” leans heavily towards a negative response, and potential investors should prioritize their financial safety when considering their trading options.

Is MX Bitcoin Investment a scam, or is it legit?

The latest exposure and evaluation content of MX Bitcoin Investment brokers.

MX Bitcoin Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MX Bitcoin Investment latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.