Meta-Traders Review 10

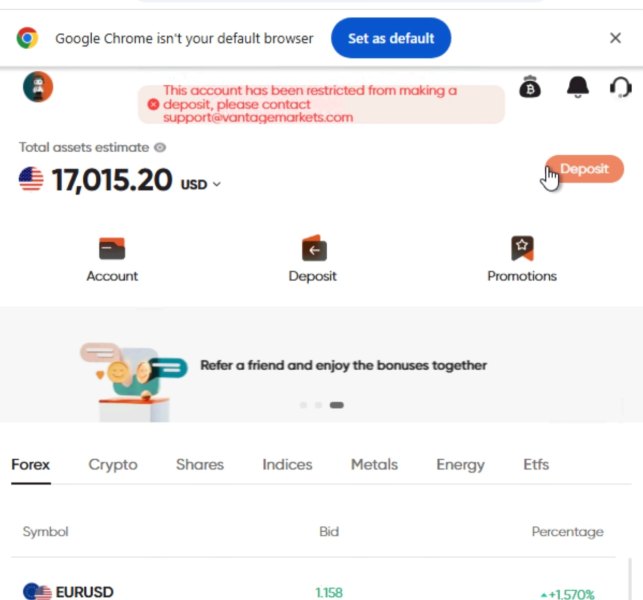

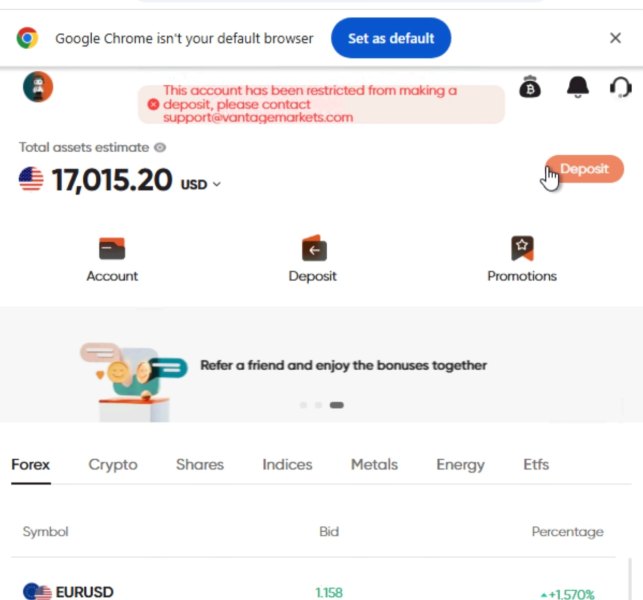

I am writing to express my serious concern regarding your refusal to process my withdrawal request. I deposited funds via bank transfer, and all my account activity is fully documented, transparent, and legitimate. Despite this, my funds have been blocked without a valid reason or timely explanation. I consider this a violation of fair trading practices and client fund protection, and I will not tolerate this unjustified delay any further. If my withdrawal is not processed within the next 2 working days, I will proceed with the following actions: File a formal complaint with your primary regulators, including ASIC, FCA, and any other authorities where your entity operates. Report your operations to MetaQuotes (MetaTrader platform provider) for abuse of trading practices. Submit evidence and a complaint to my local financial regulator and police, including details of the money changer/bank transfer intermediary used for the deposit. Leave public warnings and reviews on community s

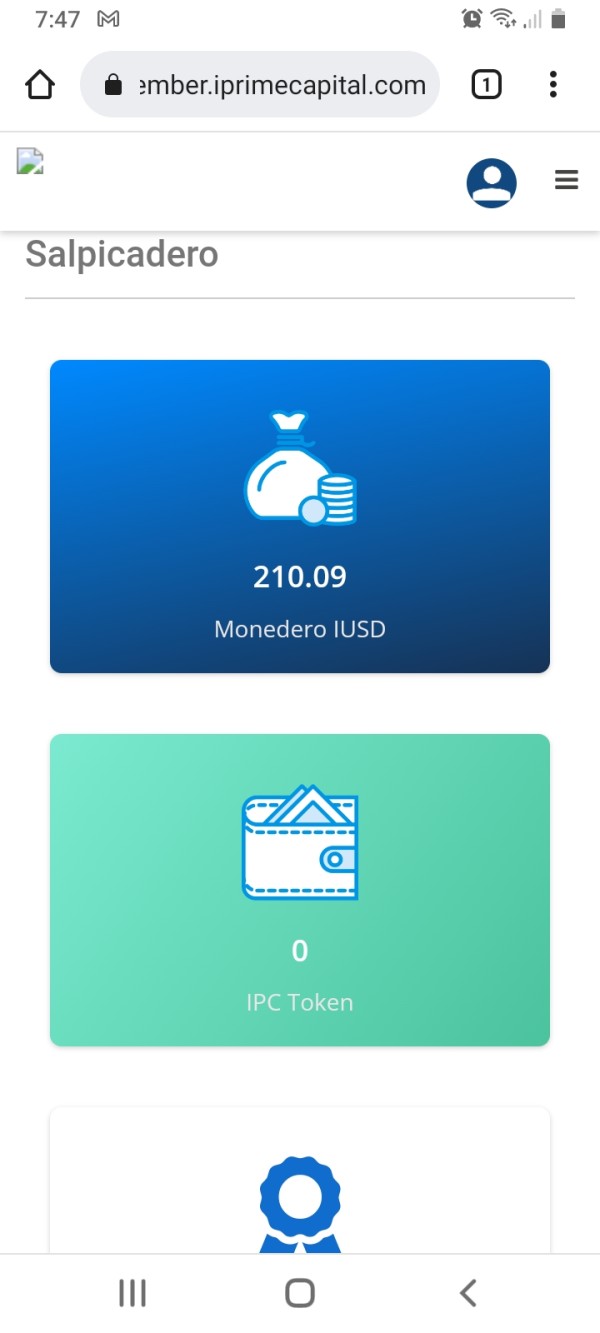

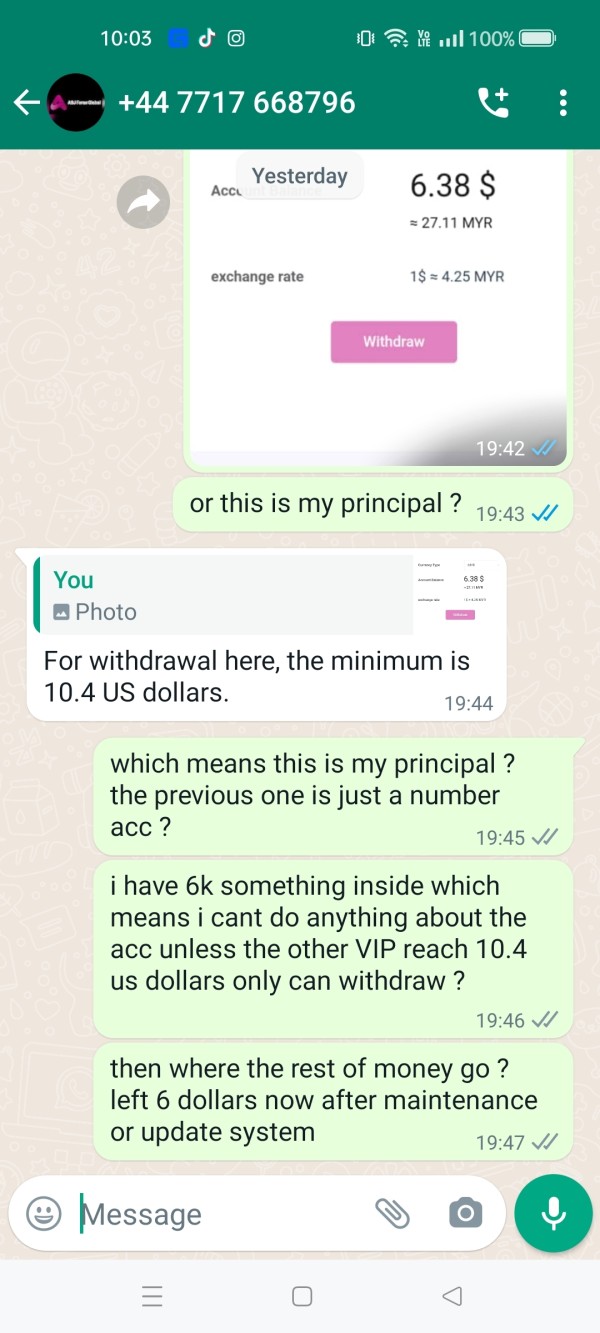

I could not withdraw from ipcapital

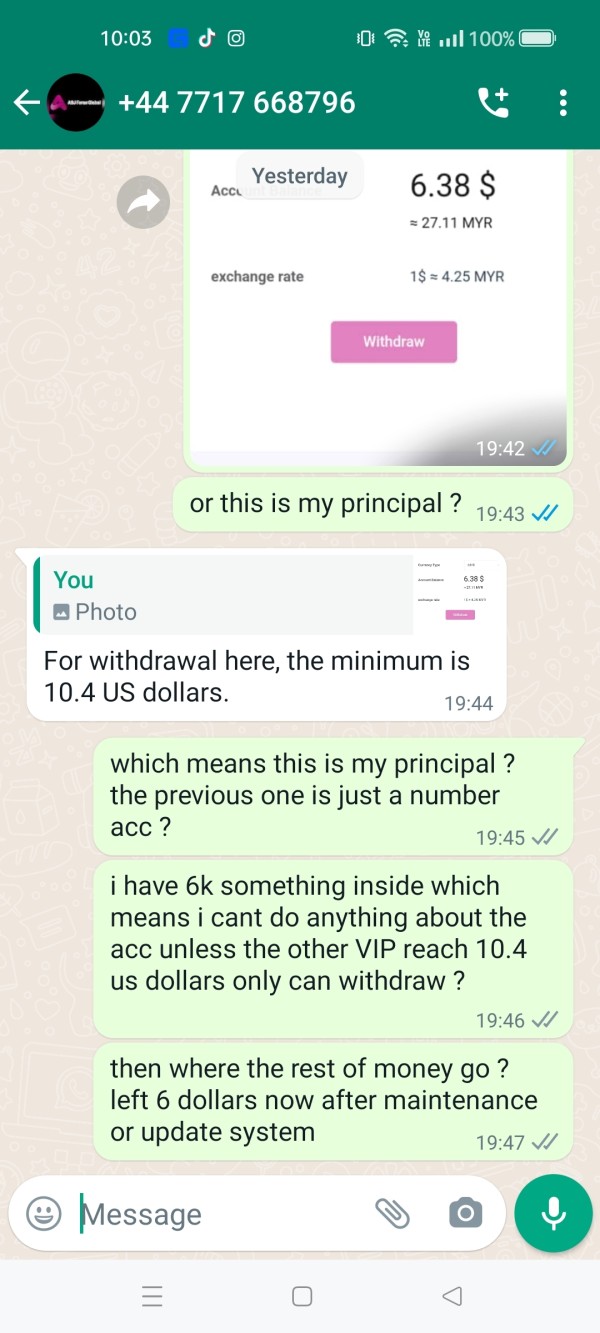

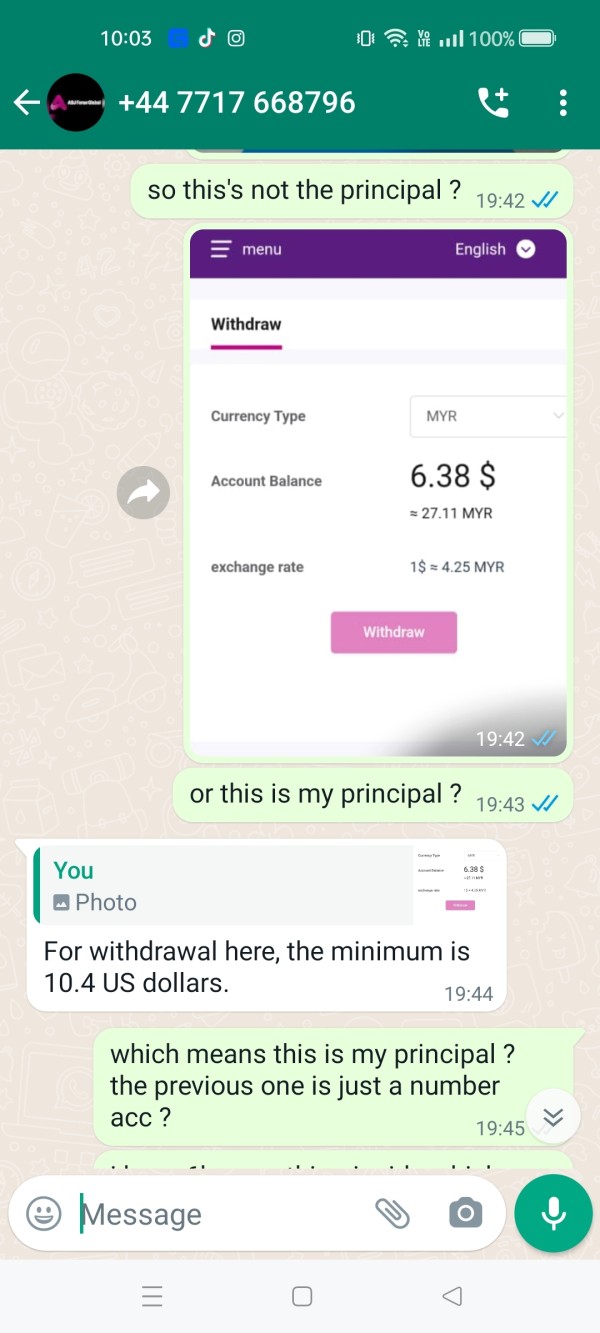

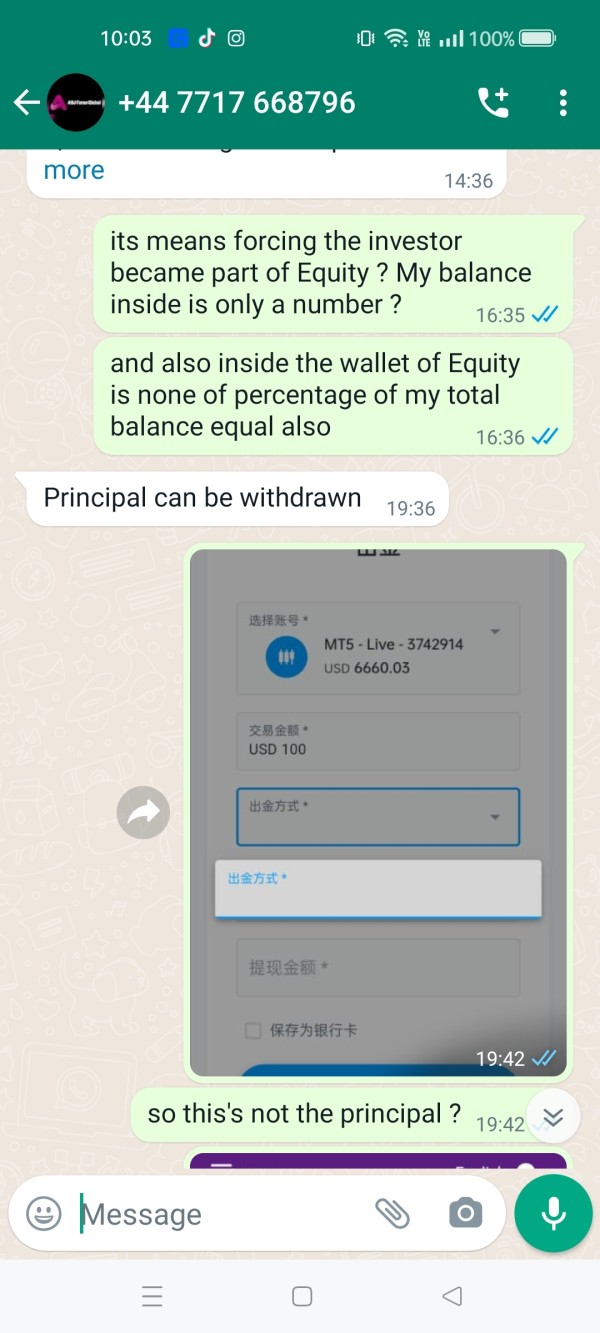

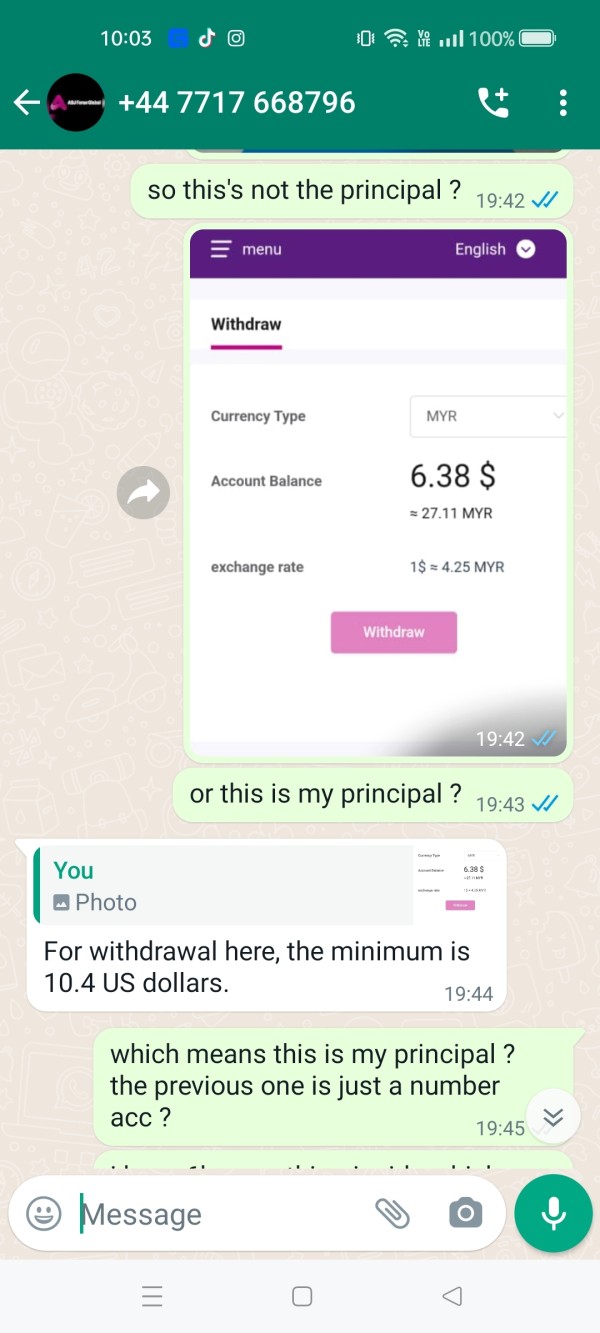

The ASJ company starting run a Equity system and forcing investor became part of it , and the calculate the precentage perday not only reach a 10 dollars , althought the acc has 7k something but cant withdraw the main account money , so what does the main account money use for ? just a number ?

Meta-Traders's web platform is great. I can check my trades, open new positions, and manage my account easily.

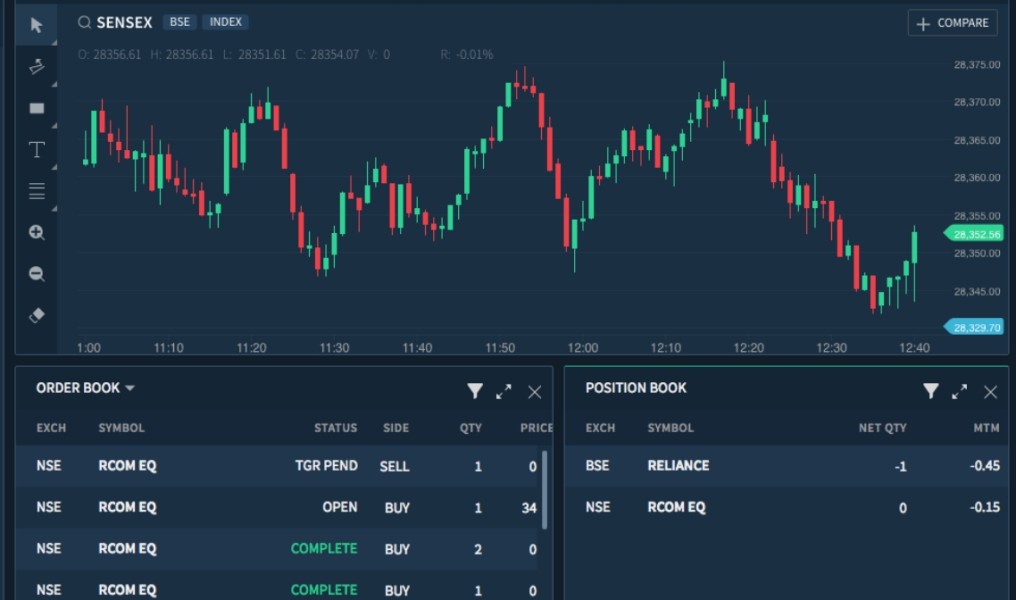

Don’t use this broker they are the worst the candles are fixed it moves like crazy compared to trading view their candles are long and you can lose all your account money from one candle move

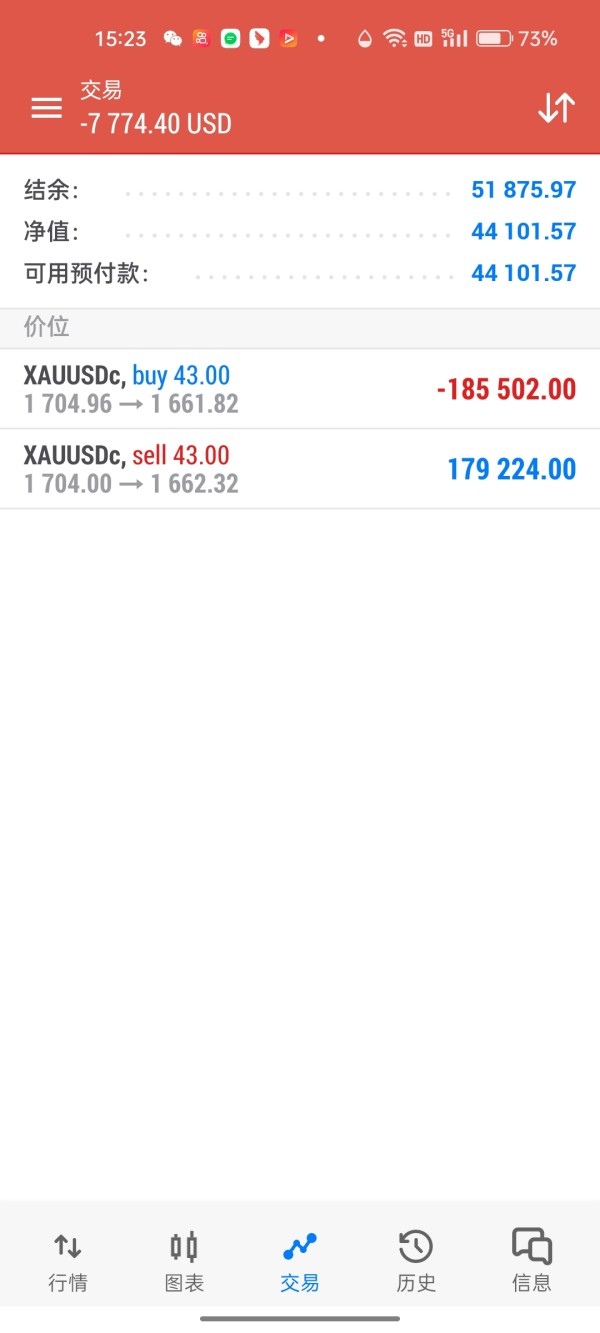

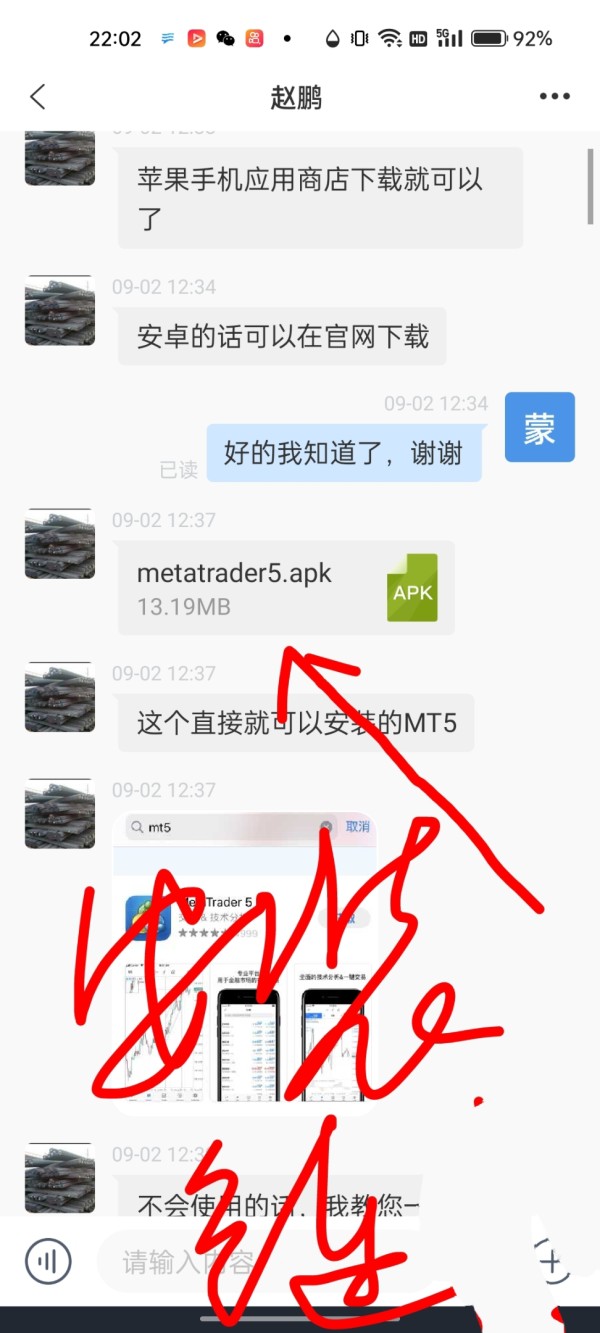

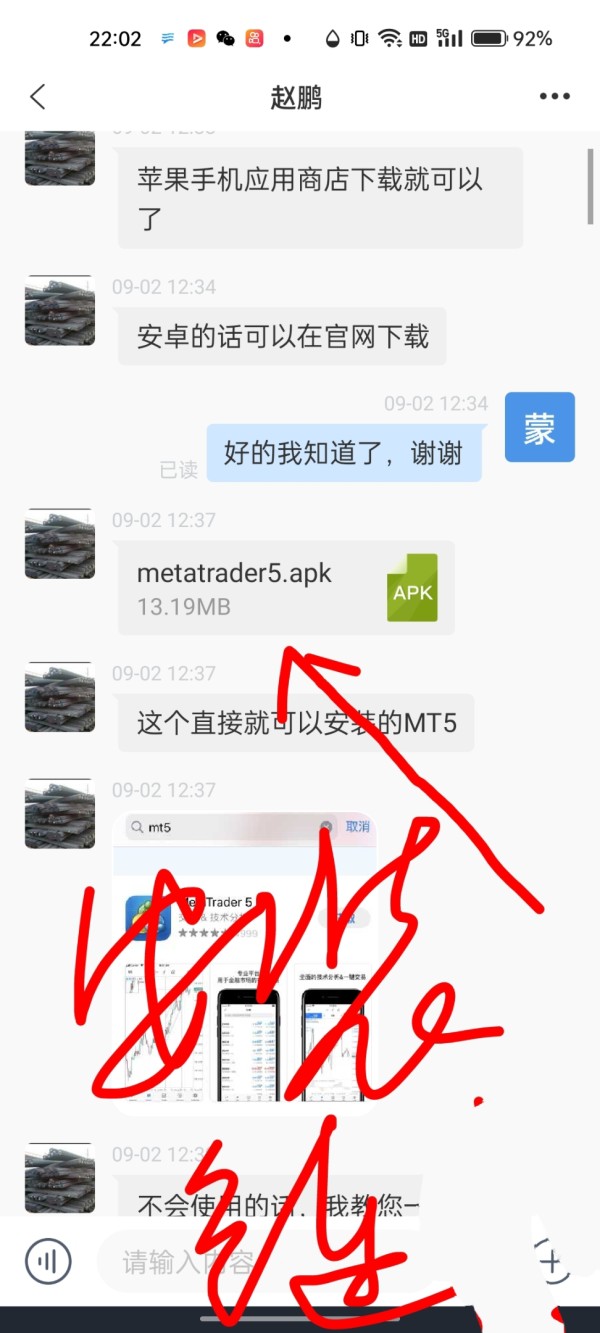

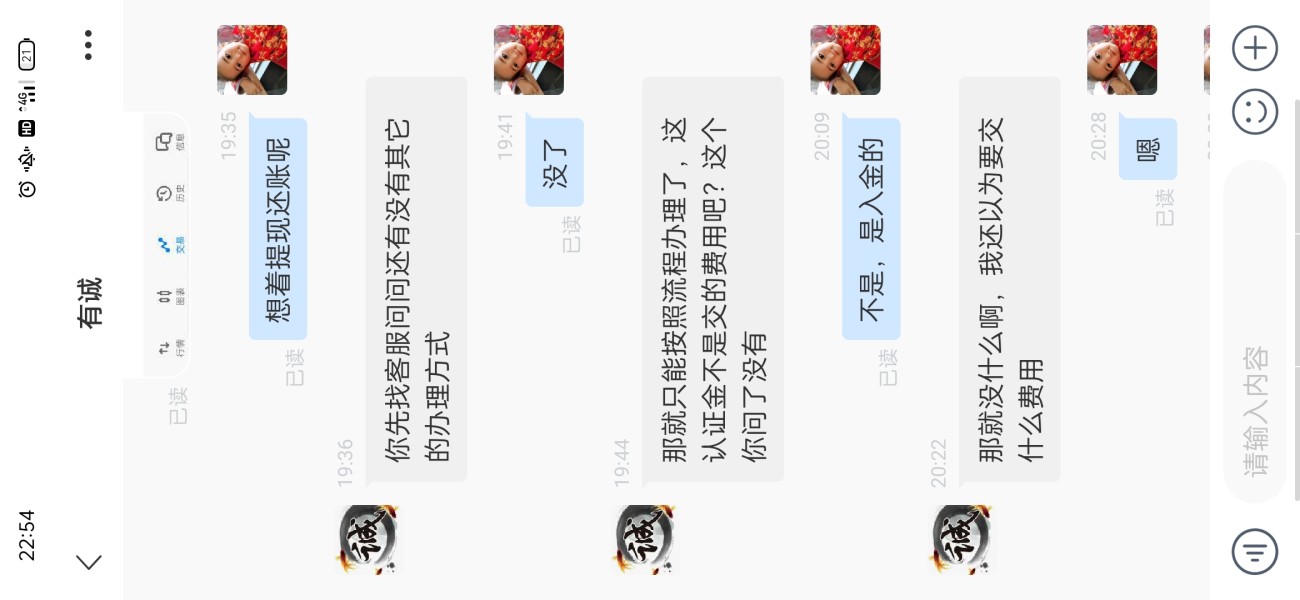

Xu Youcheng, Chang Xiaosa, Zhao Peng, An Zhiruosu, and Miss Jin deceived people to deposit on MT5, and then locked their positions and could not withdraw

The Jianchao account was blocked, Xu Youcheng, Li Yong, Chang Chisa, and others, Ms. Jin, the customer service manager, are all liars, and Ru Liu also blocked me! Don't deposit anymore! Waiting for people to help me get principle back!

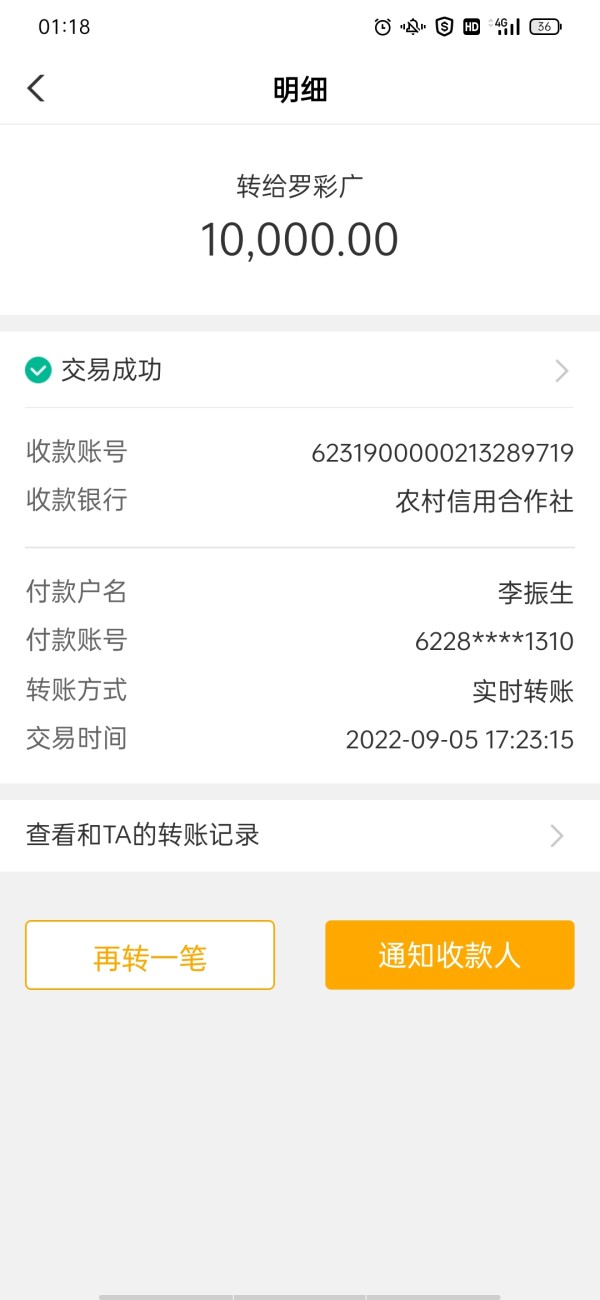

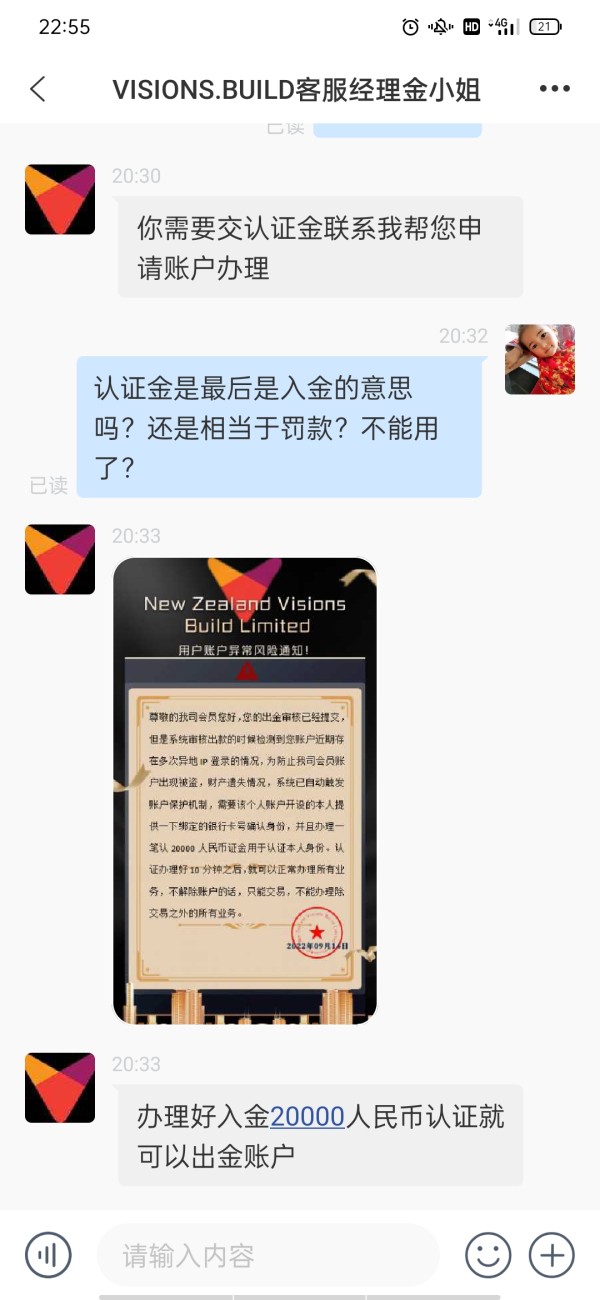

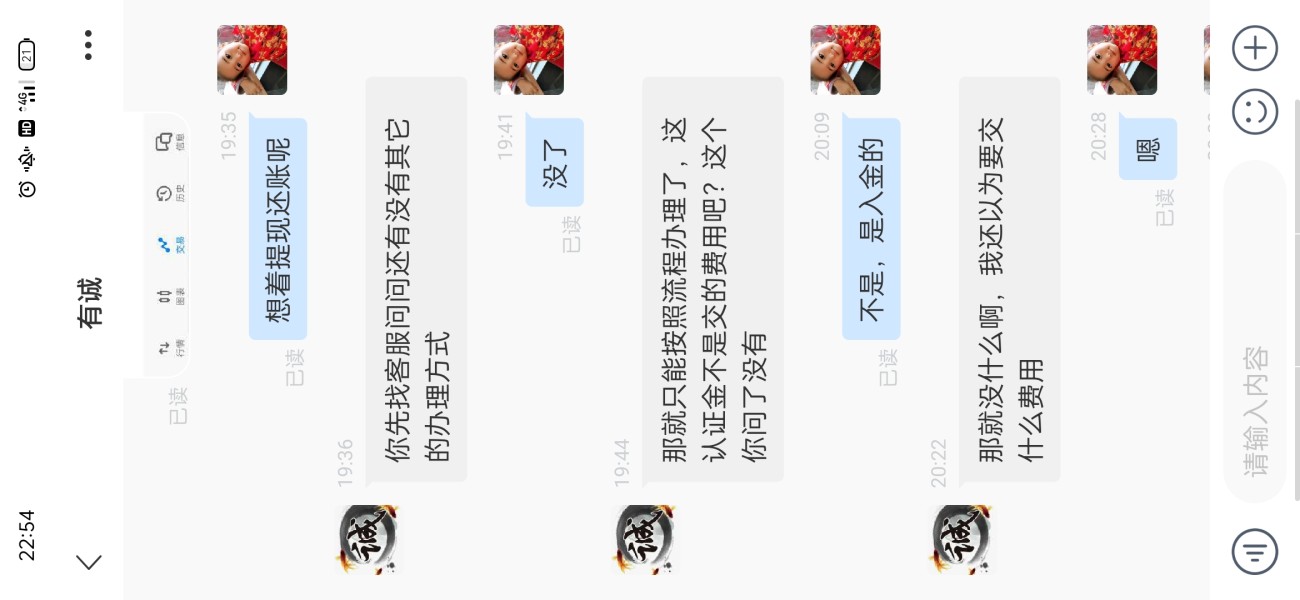

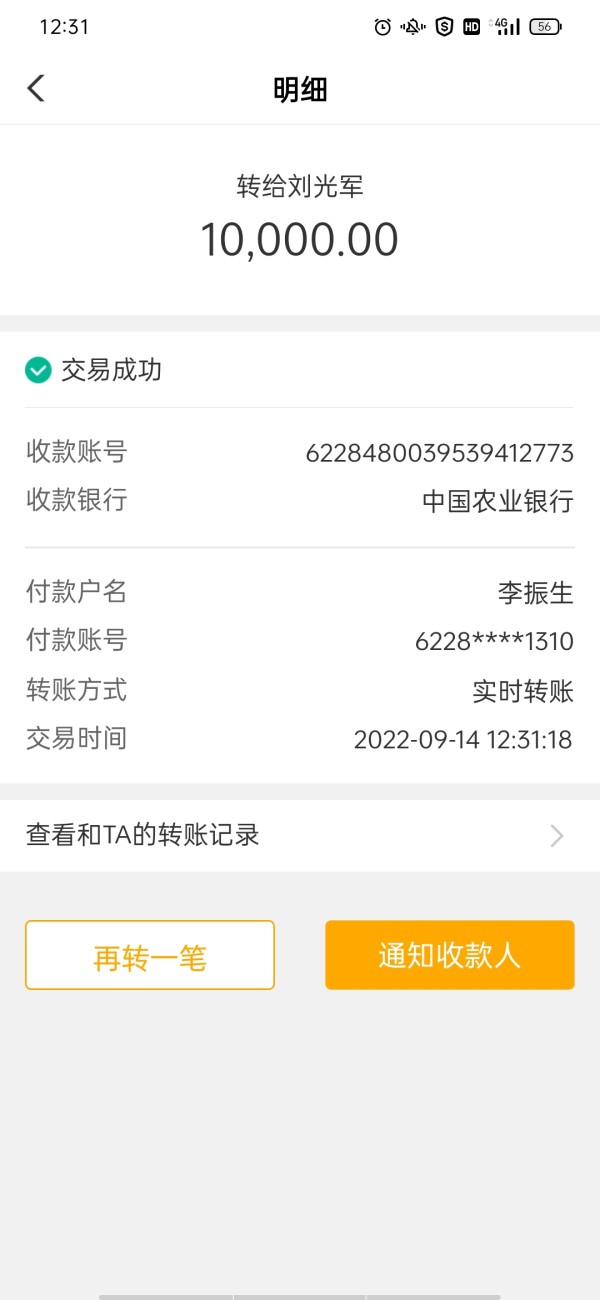

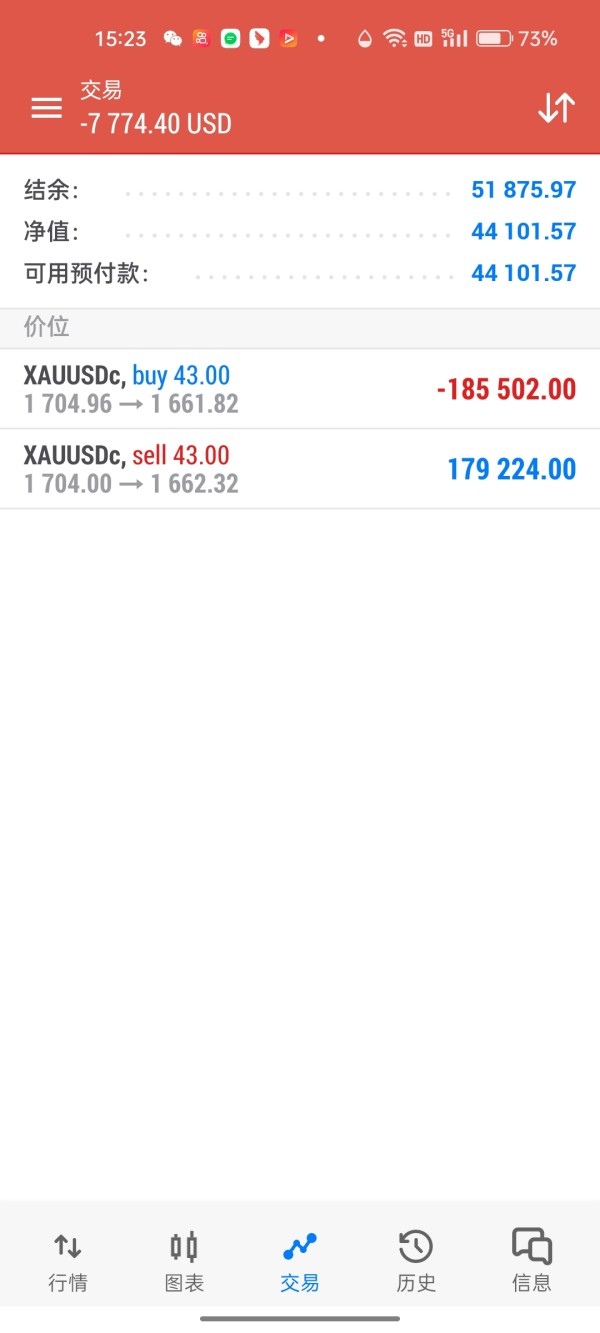

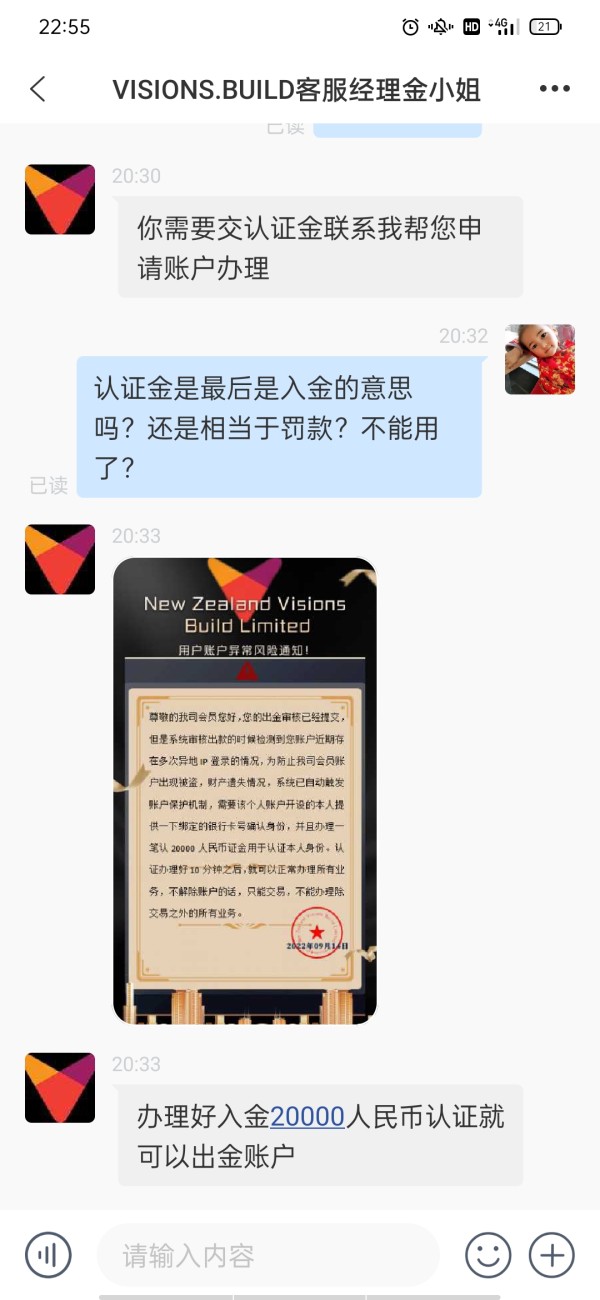

Since September 5th, they have officially entered their trap. They have begun to look like Luo Caiguang, Xu Zaiyou, Yin Changyao, Liu Guangjun, and the four have successively transferred 50,000 yuan, deposited funds, and released the warehouse. Now they have to pay 20,000 yuan in certification before they can withdraw money. ! I felt that I had been scammed, so I called the police, and it really happened! They are a gang, namely, Xu Youcheng and Chang Chisa, who call themselves teachers, Liu Jiaxin, who brought me in to be fooled by the first acquaintance. And the customer service Miss Jin is responsible for guiding us to transfer and deposit money! There is also Li Yong, when you lose money, come out to help you make a profit and even double your profit, and then do a hedging transaction to deliberately lock your position, so that Miss Jin from customer service will say that your position is locked and you need to How many dollars to unwind! After unloading the warehouse, he said that he needs to pay 20,000 authentication funds, otherwise he can only operate transactions, and cannot withdraw funds! Just like this step by step, through network friendship, double reeds, etc., to lure you into the game! I hope that everyone will not be cheated of hard-earned money, and these people who have lost their conscience can be vigorously punished by the law! On September 15, 2022, a worker, Li Zhensheng, made a real-name report exposed! The police have been called, Kunshan City Bacheng Town Police Station! I don't know if I can get my money back