Is Master trade International safe?

Business

License

Is Master Trade International A Scam?

Introduction

Master Trade International is a forex broker that has been operating for approximately 2 to 5 years, primarily targeting traders interested in foreign exchange and various market instruments. However, potential investors are often advised to exercise caution when evaluating forex brokers, as the industry can be rife with scams and unregulated entities. In this article, we will conduct a thorough investigation into Master Trade International, focusing on its regulatory status, company background, trading conditions, customer safety, and client experiences. Our assessment will be based on various credible sources, user reviews, and regulatory information to provide a balanced view of whether Master Trade International is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in assessing its legitimacy. Regulation serves as a protective measure for investors, ensuring that brokers adhere to specific standards and practices. Unfortunately, Master Trade International is classified as a non-regulated entity, meaning it operates without oversight from any recognized financial authority. This lack of regulation raises significant concerns regarding the safety of clients' funds and the overall legitimacy of the brokers operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulatory oversight can lead to a higher risk of fraudulent activities and unethical practices. Historical compliance issues further complicate the situation, as potential investors may find it challenging to trust a broker that lacks a transparent regulatory framework. Therefore, it is crucial to consider these factors when determining if Master Trade International is safe for trading.

Company Background Investigation

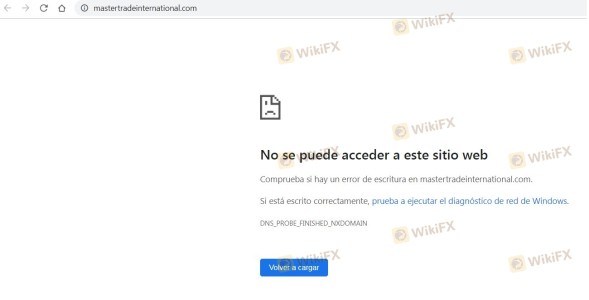

Master Trade International is reported to be registered in China, with operations that span multiple years. However, detailed information about its ownership structure and management team remains scarce. Such opacity raises questions about the broker's credibility and reliability. A thorough background check reveals that the company's official website is currently non-functional, further limiting access to essential information regarding its operations and services.

The lack of transparency in ownership and management can be a red flag for potential investors. A well-established broker typically provides clear information about its team, including professional experience and qualifications. Unfortunately, Master Trade International does not meet these standards, which may lead to skepticism about its legitimacy. This lack of transparency is a crucial aspect to consider when evaluating whether Master Trade International is safe for potential investors.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is vital. Master Trade International claims to provide competitive trading conditions, but the absence of clear information regarding its fee structure raises concerns.

| Fee Type | Master Trade International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2% |

The lack of transparency in fees and commissions can lead to unexpected costs for traders, making it difficult to assess the overall profitability of trading with this broker. Moreover, if the fees are significantly higher than the industry average, it could further indicate that Master Trade International is not safe for traders.

Client Funds Safety

The safety of client funds is paramount when considering a forex broker. Master Trade International does not provide clear information regarding its measures for safeguarding client funds. There are no indications of segregated accounts, investor protection schemes, or negative balance protection policies in place.

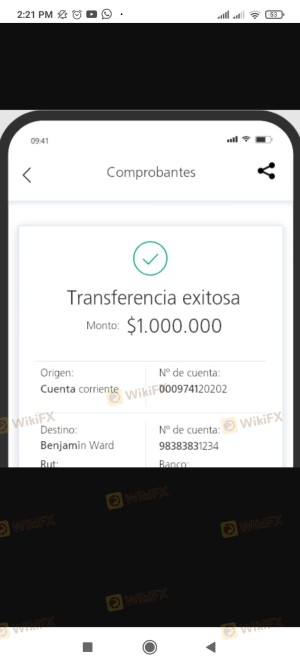

The absence of these essential safety measures can expose clients to significant risks, particularly in the event of the broker's insolvency or financial mismanagement. Additionally, historical reports of clients facing difficulties in withdrawing funds raise further concerns about the broker's reliability. Therefore, it is vital to question whether Master Trade International is safe for managing your investments.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's trustworthiness. Reviews of Master Trade International reveal a pattern of negative experiences, particularly concerning withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

Many users report being unable to withdraw their funds, which is a significant concern for any investor. One user mentioned that after initially profitable trades, they encountered issues when trying to withdraw their earnings. This kind of feedback raises serious questions about whether Master Trade International is safe to trade with, as it suggests potential fraudulent activity.

Platform and Execution

The trading platform offered by Master Trade International is reportedly designed for ease of use, yet there is limited information available regarding its performance and reliability. Users have raised concerns about order execution quality, including instances of slippage and rejected orders.

A stable and efficient trading platform is crucial for successful trading, and any signs of manipulation or poor execution can severely impact a trader's experience. Thus, the lack of concrete information about the platform's performance further complicates the assessment of whether Master Trade International is safe.

Risk Assessment

In summary, the overall risk associated with trading through Master Trade International is significant. The absence of regulatory oversight, coupled with negative client experiences and unclear trading conditions, creates a high-risk environment for potential investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized bodies |

| Financial Risk | High | Lack of transparency and withdrawal issues |

| Operational Risk | Medium | Unclear trading conditions |

To mitigate these risks, potential investors should conduct thorough research, consider investing smaller amounts initially, and be cautious about the broker's practices.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that Master Trade International raises several red flags that warrant concern. The broker's lack of regulation, negative customer feedback, and insufficient transparency all contribute to a perception of risk. Therefore, it is prudent to approach this broker with caution.

For traders seeking reliable options, it is advisable to consider well-regulated brokers with positive reputations and transparent operations. Some alternatives include brokers regulated by top-tier authorities, which can provide a safer trading environment. Ultimately, the question of whether Master Trade International is safe leans towards a cautious "no," as the risks outweigh the potential benefits of engaging with this broker.

Is Master trade International a scam, or is it legit?

The latest exposure and evaluation content of Master trade International brokers.

Master trade International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Master trade International latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.