Executive Summary

Master Trade International is an unregulated forex broker that poses significant fraud risks to potential investors. This master trade international review reveals concerning patterns that warrant serious consideration before engaging with this platform. According to WikiFX reports, the broker has been accused of fraudulent activities by Spain's financial regulatory authority CNMV.

This raises immediate red flags about its legitimacy. While the platform has received minimal positive user feedback, the overwhelming evidence suggests substantial risks. The broker operates without proper regulatory oversight from major financial authorities. This creates an environment where investor protection is virtually non-existent.

Our analysis indicates that Master Trade International primarily targets forex traders seeking online trading opportunities. However, the potential risks far outweigh any perceived benefits. The available data shows one positive review against two exposure reports. This highlights a concerning pattern of user experiences.

The lack of transparent information about trading conditions, regulatory status, and operational details further compounds the risk profile. Potential clients should exercise extreme caution and consider regulated alternatives that offer proper investor protection and transparent business practices.

Important Disclaimers

Master Trade International operates without regulation from any major financial regulatory institutions. This creates significant legal and financial risks for investors. The absence of regulatory oversight means that standard investor protection mechanisms are not available.

Fund recovery options may be severely limited or non-existent. This review is based on available user feedback and industry reports, which may not encompass all aspects of the broker's operations. The information presented reflects publicly available data and should not be considered as comprehensive financial advice.

Potential investors should conduct independent research and consider consulting with licensed financial advisors before making any investment decisions.

Rating Framework

Broker Overview

Master Trade International operates as an online forex broker. However, critical information about its establishment date and company background remains undisclosed in available documentation. The platform positions itself as a forex trading service provider, but the lack of fundamental company information raises immediate concerns about transparency and legitimacy.

The absence of clear corporate history, founding details, and operational timeline creates an information vacuum that potential clients should find troubling. The broker's primary business model appears focused on forex trading services, though specific details about trading instruments, platform capabilities, and service offerings remain largely undocumented. This master trade international review reveals that the company operates without proper regulatory authorization.

This fundamentally undermines its credibility and operational legitimacy. The platform's approach to client acquisition and service delivery lacks the transparency typically expected from reputable financial service providers. Available information indicates that Master Trade International primarily offers forex trading opportunities.

However, comprehensive details about asset classes, trading platform types, and specific service features are notably absent. The broker's unregulated status, as highlighted in various industry reports, represents a critical risk factor that potential clients must carefully consider before engaging with the platform.

Regulatory Status

Master Trade International operates without oversight from major financial regulatory bodies. Spain's CNMV specifically identified the entity as fraudulent. This regulatory void means investors lack standard protections typically available through licensed brokers, including compensation schemes and dispute resolution mechanisms.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods is not detailed in available documentation. This creates uncertainty about fund management procedures and potential restrictions on client money access.

Minimum Deposit Requirements

The platform has not disclosed minimum deposit requirements in available materials. This makes it impossible for potential clients to understand entry-level investment thresholds.

No information about bonus promotions or special offers is mentioned in current documentation. This suggests either absence of such programs or lack of transparency in marketing practices.

Tradeable Assets

The platform primarily focuses on forex assets. However, specific currency pairs, exotic options, and trading instruments available to clients remain unspecified in accessible documentation.

Cost Structure

Critical information about spreads, commissions, overnight fees, and other trading costs is not provided in available materials. This prevents informed cost-benefit analysis for potential clients.

Leverage Ratios

Leverage options and maximum ratios offered by the platform are not specified in current documentation. This leaves clients uninformed about risk management parameters.

Specific trading platform software, mobile applications, and technological infrastructure details are not mentioned in available materials. This creates uncertainty about trading environment quality. This master trade international review highlights significant information gaps that would typically be readily available from legitimate, regulated brokers.

Comprehensive Rating Analysis

Account Conditions Analysis

The account conditions offered by Master Trade International remain largely undisclosed. This represents a significant transparency issue for potential clients. Available documentation fails to specify account types, their distinctive features, or the benefits associated with different service tiers.

This lack of clarity prevents informed decision-making and suggests poor operational transparency standards. Minimum deposit requirements, typically a fundamental piece of information for forex brokers, are not specified in accessible materials. This absence creates uncertainty about entry barriers and suggests inadequate client communication standards.

Legitimate brokers typically provide clear, accessible information about account opening requirements and associated conditions. The account opening process details are not documented in available sources, leaving potential clients uninformed about verification requirements, documentation needs, and approval timelines. Additionally, specialized account options such as Islamic accounts, professional trader accounts, or institutional services are not mentioned.

This suggests either limited offerings or poor information disclosure practices. This master trade international review reveals that the broker's approach to account condition transparency falls significantly below industry standards, creating additional risk factors for potential clients considering engagement with the platform.

Master Trade International's trading tools and resources remain largely undocumented in available materials. This raises concerns about the platform's technological capabilities and client support infrastructure. The absence of information about analytical tools, charting software, and technical indicators suggests either limited offerings or poor transparency in communicating available resources to potential clients.

Research and analysis resources, which are typically cornerstone offerings for legitimate forex brokers, are not detailed in accessible documentation. This includes market analysis, economic calendars, news feeds, and expert commentary that traders rely on for informed decision-making. The lack of such information creates uncertainty about the broker's commitment to client education and market insight provision.

Educational resources, including webinars, tutorials, trading guides, and market education materials, are not mentioned in available sources. This absence is particularly concerning as reputable brokers typically invest significantly in client education to improve trading outcomes and client retention. Automated trading support, including Expert Advisor compatibility, algorithmic trading options, and API access, remains unspecified.

The lack of information about these advanced trading features suggests potential limitations in platform sophistication and technological infrastructure.

Customer Service and Support Analysis

Customer service channels and availability information are not detailed in accessible documentation. This creates uncertainty about support accessibility and responsiveness. Legitimate brokers typically provide multiple contact methods including phone, email, live chat, and support ticket systems, with clear availability schedules and response time commitments.

Response time standards and service quality metrics are not specified in available materials. This prevents assessment of support effectiveness. Professional forex brokers typically provide service level agreements and performance standards that clients can rely on for issue resolution and general inquiries.

Multilingual support capabilities, which are crucial for international forex brokers, remain undocumented. The absence of language support information suggests potential communication barriers for non-English speaking clients and indicates limited international service capabilities. Customer service hours and time zone coverage are not specified, creating uncertainty about support availability across different global markets.

This lack of information is particularly problematic for forex trading, which operates across multiple time zones and requires responsive support during active trading sessions.

Trading Experience Analysis

Platform stability and execution speed information are not provided in available documentation. This creates uncertainty about core trading infrastructure quality. These factors are crucial for forex trading success, as poor execution can significantly impact trading outcomes and client profitability.

Order execution quality, including slippage rates, rejection frequencies, and fill accuracy, remains undocumented. Professional traders require detailed information about execution standards to assess platform suitability for their trading strategies and risk management approaches. Platform functionality completeness, including advanced order types, risk management tools, and analytical capabilities, is not detailed in accessible materials.

This information gap prevents assessment of whether the platform meets professional trading requirements and sophisticated strategy implementation needs. Mobile trading experience details are not specified, despite mobile trading being increasingly important for modern forex traders. The absence of mobile platform information suggests either limited mobile capabilities or poor communication about available mobile trading solutions.

This master trade international review indicates significant deficiencies in trading experience transparency, which should concern potential clients considering platform engagement.

Trust Level Analysis

Master Trade International's trust level is severely compromised by accusations from Spain's financial regulatory authority CNMV. The authority has specifically identified the entity as fraudulent. This regulatory warning represents a critical red flag that potential clients must seriously consider before engaging with the platform.

The broker operates without proper regulatory authorization from major financial authorities. This eliminates standard investor protection mechanisms including compensation schemes, dispute resolution procedures, and regulatory oversight. This unregulated status creates substantial risks for client fund security and legal recourse options.

Company transparency levels are extremely poor, with fundamental business information including establishment dates, corporate structure, and operational history remaining undisclosed. Legitimate financial service providers typically maintain high transparency standards to build client confidence and meet regulatory requirements. Industry reputation assessment is further complicated by limited third-party verification and the presence of fraud allegations.

The combination of regulatory warnings and unregulated status creates a highly concerning risk profile that potential clients should carefully evaluate. Negative event handling capabilities remain untested and undocumented, as the broker has not demonstrated effective responses to regulatory concerns or client complaints through established, transparent procedures.

User Experience Analysis

Overall user satisfaction levels cannot be accurately assessed due to limited available feedback and the concerning regulatory environment surrounding the broker. The available information suggests mixed experiences, but the small sample size and fraud allegations significantly impact reliability assessments. Interface design and usability information are not detailed in accessible documentation.

This prevents assessment of platform user-friendliness and navigation efficiency. Modern forex traders expect intuitive, responsive interfaces that support efficient trading and account management activities. Registration and verification process details remain undocumented, creating uncertainty about account opening procedures and compliance requirements.

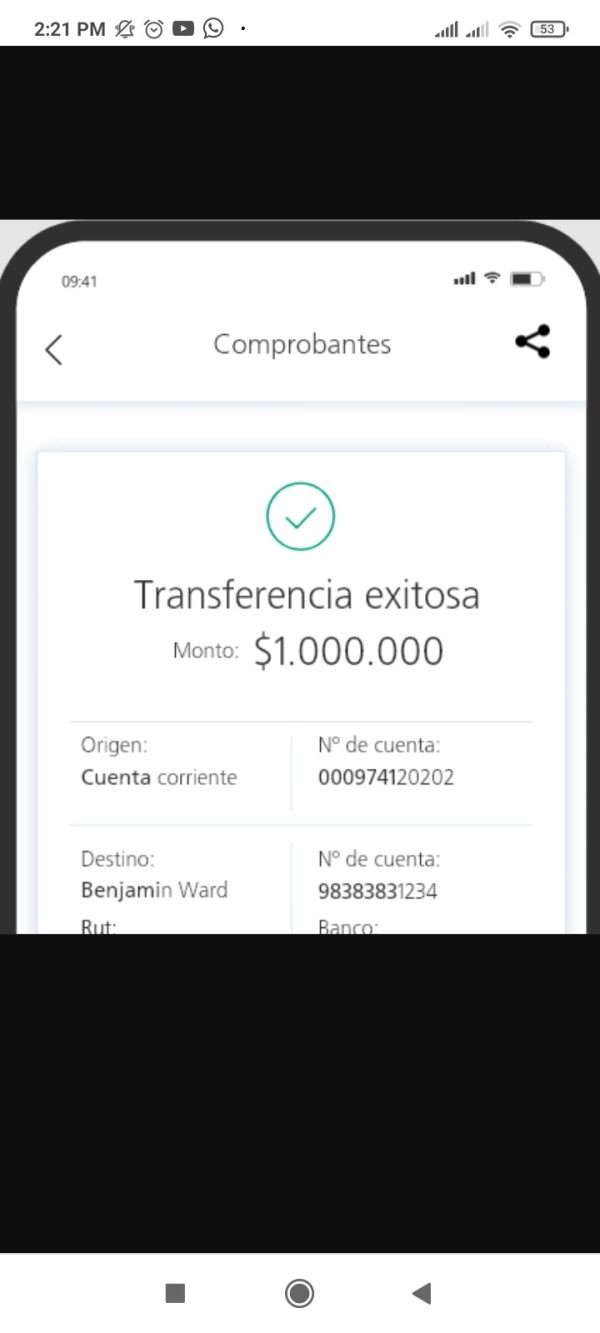

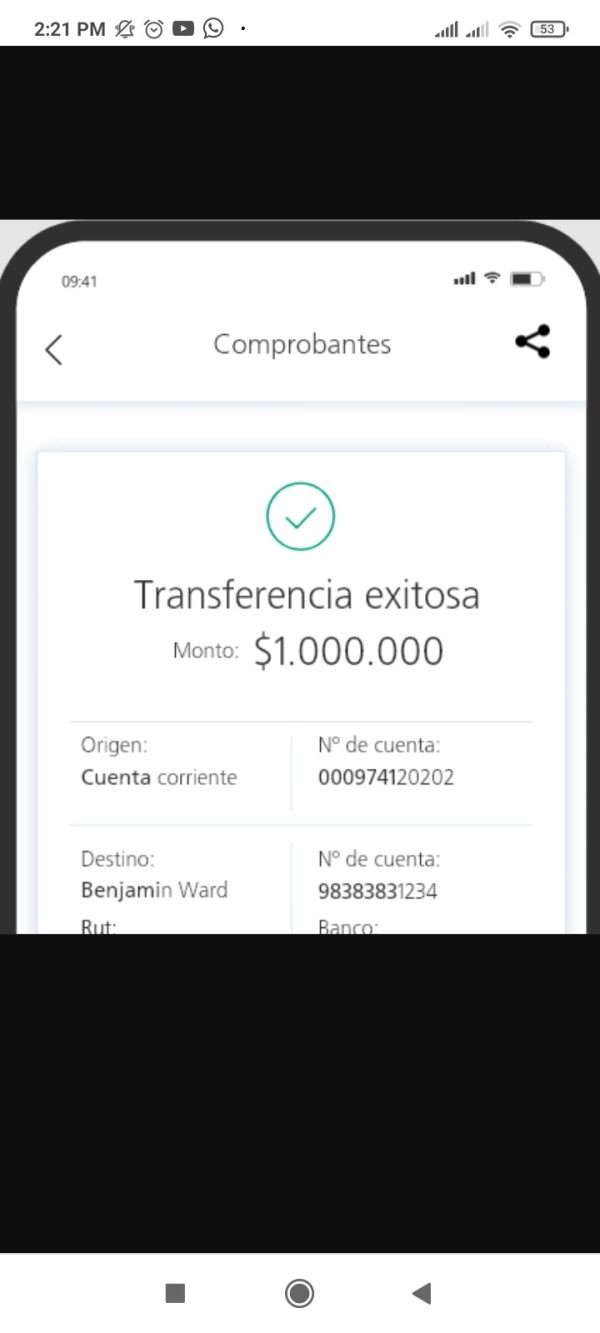

Legitimate brokers typically provide clear guidance about documentation needs and approval timelines to set appropriate client expectations. Fund operation experiences, including deposit and withdrawal procedures, processing times, and potential restrictions, are not detailed in available materials. This information gap is particularly concerning given the regulatory warnings and unregulated status of the platform.

Common user complaints and resolution procedures are not documented. This suggests either absence of formal complaint handling systems or poor transparency in client issue management. Professional brokers typically maintain clear complaint procedures and resolution timelines.

Conclusion

Master Trade International represents a high-risk forex broker with significant fraud concerns that potential investors should approach with extreme caution. The combination of regulatory warnings from Spain's CNMV, unregulated operational status, and severe transparency deficiencies creates a risk profile that is unsuitable for investors seeking secure trading environments. The broker is not recommended for any investors prioritizing fund security, regulatory protection, or transparent business practices.

The minimal positive feedback available is substantially outweighed by fraud allegations and the absence of proper regulatory oversight that would provide standard investor protections. The primary disadvantages include unregulated status, fraud accusations from regulatory authorities, and severe lack of transparency regarding operational details, trading conditions, and corporate structure. Any perceived advantages are negligible compared to these substantial risk factors that could result in complete loss of invested funds.