Is INFINITAS safe?

Pros

Cons

Is Infinitas A Scam?

Introduction

Infinitas is an online trading platform that positions itself in the forex market, aiming to provide a range of trading services to retail clients. With the proliferation of online brokers, traders must exercise caution when selecting a platform to ensure their investments are secure. The forex market is rife with potential pitfalls, including scams and unregulated entities that can jeopardize traders' funds. Therefore, it is imperative for traders to conduct thorough due diligence before engaging with any broker. In this article, we will investigate whether Infinitas is a safe trading option or if it exhibits characteristics typical of a scam. Our evaluation will be based on regulatory status, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the legitimacy of a brokerage. Infinitas claims to be registered with the Vanuatu Financial Services Commission (VFSC); however, reports indicate that its license has been revoked. This lack of valid regulation raises significant concerns about the broker's credibility and the protection it offers to its clients.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | Not Applicable | Vanuatu | Revoked |

The absence of a valid regulatory license means that Infinitas is not subject to oversight by a reputable authority, which is essential for ensuring fair trading practices and investor protection. Regulated brokers must adhere to strict compliance standards, including maintaining client funds in segregated accounts and providing transparent reporting. The revocation of Infinitas's license is a major red flag, indicating that the broker may have engaged in practices that warranted regulatory action.

Company Background Investigation

Infinitas was established in 2018 and has since aimed to cater to retail clients seeking forex and CFD trading options. The company's headquarters are located in Vanuatu, a jurisdiction often favored by brokers for its lax regulatory environment. While this may provide operational flexibility, it also raises questions about the broker's commitment to transparency and accountability.

The management team behind Infinitas has not been extensively detailed in available resources, leaving potential clients with limited information regarding their qualifications and experience in the financial markets. A lack of transparency concerning the management team can be indicative of deeper issues within the company. Moreover, the overall information disclosure level is inadequate, which further erodes trust and confidence in the broker.

Trading Conditions Analysis

When evaluating whether Infinitas is safe, it is essential to analyze its trading conditions, including fees and spreads. Infinitas offers a standard account with a minimum deposit requirement of $500 and a premium account requiring a $100,000 minimum deposit. The spreads on the standard account start from 1.7 pips, while the premium account offers more competitive spreads beginning at 0.5 pips.

| Fee Type | Infinitas | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips (Standard) | 1.5 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The trading cost structure appears to be somewhat competitive; however, the lack of clarity regarding commission models and overnight interest rates is concerning. In the absence of clearly defined costs, traders may encounter unexpected fees that can significantly impact their profitability. This ambiguity raises questions about the broker's transparency and whether it operates with the best interests of its clients in mind.

Client Fund Safety

Client fund safety is paramount when considering whether Infinitas is a safe broker. Reports indicate that Infinitas does not provide substantial information regarding the measures it employs to protect client funds. While the broker claims to maintain segregated accounts for client funds, the lack of regulatory oversight diminishes the reliability of these claims.

Additionally, the absence of investor protection schemes or negative balance protection policies raises further concerns. In the event of financial distress or misconduct, clients may find themselves without recourse to recover their investments. The historical context of any past funding safety issues or disputes involving Infinitas is also critical to assess the overall risk associated with trading on this platform.

Customer Experience and Complaints

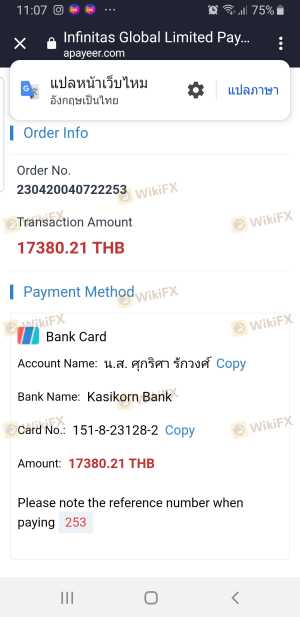

Customer feedback serves as a valuable indicator of a broker's reliability. In the case of Infinitas, numerous negative reviews and complaints have surfaced, suggesting widespread dissatisfaction among clients. Common complaints include slow customer service response times, difficulties in fund withdrawals, and a lack of transparency regarding fees and trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Fee Transparency | High | Unresponsive |

For instance, several users have reported challenges in withdrawing their funds, often experiencing delays that can extend for weeks. Such issues not only indicate operational inefficiencies but also suggest that Infinitas may not prioritize client satisfaction or transparency. This pattern of complaints raises significant concerns about whether Infinitas is a trustworthy broker.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for ensuring a positive trading experience. Infinitas utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, reports of order execution issues, including slippage and order rejections, have been noted by users.

The quality of trade execution is essential for traders, as delays or errors can lead to significant financial losses. Any signs of platform manipulation, such as consistent slippage during high volatility periods, should raise alarms for potential traders. The lack of transparency regarding the broker's execution policies further complicates the assessment of whether Infinitas is a safe trading option.

Risk Assessment

Using Infinitas as a trading platform entails inherent risks, especially given its unregulated status. Traders should consider several risk factors before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation, license revoked. |

| Fund Safety Risk | High | Lack of investor protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Service Risk | Medium | Slow response times and withdrawal issues. |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers that offer robust regulatory oversight and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the investigation into Infinitas reveals several concerning factors that lead to the conclusion that it may not be a safe trading platform. The lack of valid regulation, negative customer feedback, unclear fee structures, and potential fund safety issues are significant red flags.

For traders seeking a reliable broker, it is advisable to consider alternatives with established regulatory credentials and positive customer reviews. Brokers such as XTB, Admiral Markets, and IG Group offer robust regulatory frameworks and transparent trading conditions, making them more suitable options for traders looking to safeguard their investments.

In summary, traders should exercise extreme caution and carefully evaluate whether Infinitas is a safe platform before committing any funds.

Is INFINITAS a scam, or is it legit?

The latest exposure and evaluation content of INFINITAS brokers.

INFINITAS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INFINITAS latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.