Is LPL Trade safe?

Business

License

Is LPL Trade a Scam?

Introduction

LPL Trade is a relatively new player in the forex market, established in 2021 and offering a range of trading services, including forex, commodities, and stocks. As the trading landscape becomes increasingly competitive, it is essential for traders to assess the credibility and reliability of their chosen brokers. The rise of unregulated and potentially fraudulent brokers poses significant risks to traders' investments. This article aims to provide a comprehensive analysis of LPL Trade, focusing on its regulatory status, company background, trading conditions, client experiences, and overall safety. The evaluation is based on a review of various online sources, user feedback, and regulatory databases to ascertain whether LPL Trade is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that influences its legitimacy. Regulated brokers are subject to strict oversight, which helps protect traders' funds and ensures fair trading practices. In the case of LPL Trade, it is noteworthy that the broker claims to be registered in Saint Lucia and lists the SVG FSA as its regulatory authority. However, the SVG FSA does not regulate forex trading activities, raising significant concerns about the validity of LPL Trade's claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 1345 | Saint Vincent and the Grenadines | Not Validated |

The absence of a credible regulatory framework means that traders with LPL Trade do not have the same protections as those trading with regulated brokers. Furthermore, the lack of transparency regarding the broker's compliance history and regulatory adherence is alarming. Traders should be cautious when dealing with unregulated entities, as they may engage in unethical practices without accountability.

Company Background Investigation

LPL Trade was founded in 2021, and its operational headquarters is reportedly located in Saint Lucia, with additional offices in Bulgaria. However, details regarding the ownership structure and management team are limited, which raises questions about the company's transparency. A thorough background check reveals that LPL Trade does not provide adequate information about its founders or key personnel, making it difficult for potential clients to assess the expertise and reliability of the management team.

The lack of transparency is a significant red flag. A reputable broker typically discloses information about its leadership, including professional backgrounds and industry experience. The absence of such information at LPL Trade may indicate a lack of commitment to regulatory compliance and ethical business practices. This opacity is concerning for potential investors who rely on transparency to gauge a broker's trustworthiness.

Trading Conditions Analysis

LPL Trade offers a variety of trading instruments, including forex pairs, commodities, and stocks. However, the overall cost structure and trading conditions provided by the broker require careful examination. Traders have reported that the fees associated with trading on LPL Trade can be ambiguous and not inline with industry standards.

| Fee Type | LPL Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 - 1.8 pips | 0.5 - 1.0 pips |

| Commission Model | Varies | Standardized |

| Overnight Interest Range | Not Disclosed | 2% - 5% |

The spreads offered by LPL Trade appear higher than those of many regulated brokers, which could significantly impact trading profitability. Additionally, the lack of clear information regarding commissions and overnight fees raises concerns about hidden costs that could affect traders' overall returns. Traders should be aware of these potential pitfalls when considering LPL Trade as their broker.

Client Fund Safety

The safety of client funds is paramount in the trading industry. LPL Trade has not provided sufficient information regarding its fund security measures. There is no indication of segregated accounts, investor protection schemes, or negative balance protection policies.

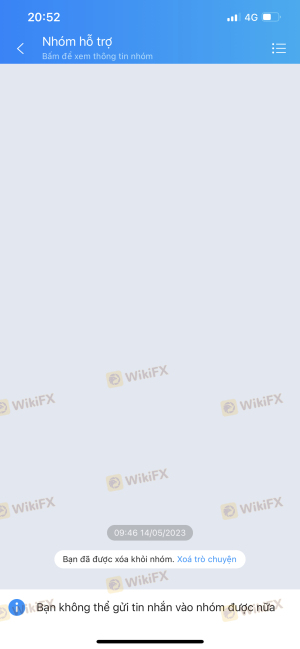

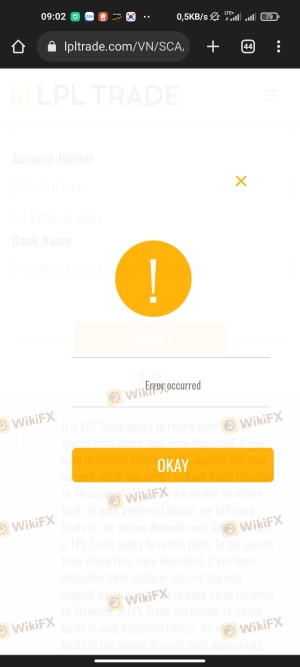

Without these critical safeguards, traders face the risk of losing their investments without any recourse. Reports from users suggest that withdrawal difficulties are common, with many clients experiencing delays or outright refusals when attempting to access their funds. This lack of security and transparency surrounding fund management is a significant concern and raises the question: Is LPL Trade safe?

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability. Reviews of LPL Trade reveal a pattern of complaints related to withdrawal issues, poor customer service, and a lack of transparency. Users have reported that their withdrawal requests are often met with delays, and in some cases, they are pressured to make additional trades before being allowed to withdraw funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Limited |

| Customer Service Issues | High | Unresponsive |

One notable case involved a user who reported being unable to withdraw their funds despite multiple requests, leading to frustration and a sense of being scammed. Such experiences are alarming and indicative of deeper issues within the company's operational practices.

Platform and Trade Execution

LPL Trade utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its advanced trading features and user-friendly interface. However, the effectiveness of the platform is undermined by reports of execution issues, including slippage and rejected orders.

The quality of trade execution is a critical aspect of a successful trading experience. Traders have expressed dissatisfaction with the order execution speed and reliability on the LPL Trade platform, which can detract from the overall trading experience. If traders cannot trust the platform to execute their orders accurately and efficiently, it raises further concerns about the broker's integrity.

Risk Assessment

Engaging with LPL Trade entails several risks due to its unregulated status and reported operational issues.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | Lack of investor protection |

| Withdrawal Risk | High | Common issues reported |

To mitigate these risks, traders should consider using stringent risk management strategies, such as limiting their exposure and only investing funds they can afford to lose. Additionally, seeking out regulated brokers with transparent practices may provide a more secure trading environment.

Conclusion and Recommendations

In summary, the evidence suggests that LPL Trade poses significant risks to potential investors. The lack of regulation, transparency issues, and negative client experiences raise serious concerns about whether LPL Trade is safe or a potential scam.

Traders should exercise extreme caution when considering LPL Trade as their broker. For those seeking reliable trading options, it is advisable to explore alternative brokers that are regulated and have a proven track record of customer satisfaction. Regulated brokers not only provide better security for client funds but also ensure compliance with industry standards, offering a safer trading environment.

In conclusion, the potential risks associated with LPL Trade far outweigh any perceived benefits, making it prudent for traders to seek out more reputable options in the market.

Is LPL Trade a scam, or is it legit?

The latest exposure and evaluation content of LPL Trade brokers.

LPL Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LPL Trade latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.