LPL Trade 2025 Review: Everything You Need to Know

Executive Summary

LPL Trade operates under LPL Financial and stands as one of the largest independent broker-dealers in the United States. The company has been building its market presence since 1989. This lpl trade review looks at a platform that came from the merger of Linsco and Private Ledger, which created a strong foundation for independent financial advisory services. The company has built its reputation by supporting over 29,000 financial advisors while managing hundreds of billions of dollars in assets.

The platform stands out through its commitment to independence. LPL Trade notably avoids selling proprietary investment products. Instead, LPL Trade focuses on providing complete access to diverse asset classes including mutual funds, exchange-traded funds, stocks, bonds, certain option strategies, unit investment trusts, and institutional money managers. The Blaze Portfolio platform serves as the primary trading infrastructure and offers sophisticated tools designed mainly for professional investors and financial advisors.

LPL Trade's business model centers on empowering financial advisors with extensive investment choices and strong technological support. This positions the company as a complete solution for professional wealth management services.

Important Notice

This review is based on publicly available information and user feedback compiled from various sources. Investors should note that specific regulatory requirements and service availability may vary depending on their geographic location. While LPL Financial operates as a major independent broker-dealer, potential users should independently verify the specific regulatory framework applicable to their jurisdiction before engaging with the platform. The evaluation presented here reflects information available at the time of writing and should be supplemented with direct consultation with LPL Trade representatives for the most current terms and conditions.

Rating Framework

Broker Overview

LPL Financial, the parent company of LPL Trade, was established in 1989 through the strategic merger of Linsco and Private Ledger. This merger created what would become one of America's most significant independent broker-dealers. The company has grown to support an extensive network of over 29,000 financial advisors across the United States, facilitating the management of hundreds of billions of dollars in client assets. This substantial scale shows LPL's established position within the financial services industry and its capacity to serve a diverse range of investment needs.

The company's business philosophy centers on independence and choice. LPL deliberately avoids selling proprietary investment products that might create conflicts of interest. Instead, LPL Trade focuses on providing financial advisors and their clients with access to a wide range of third-party investment options and technological tools designed to enhance the advisory relationship.

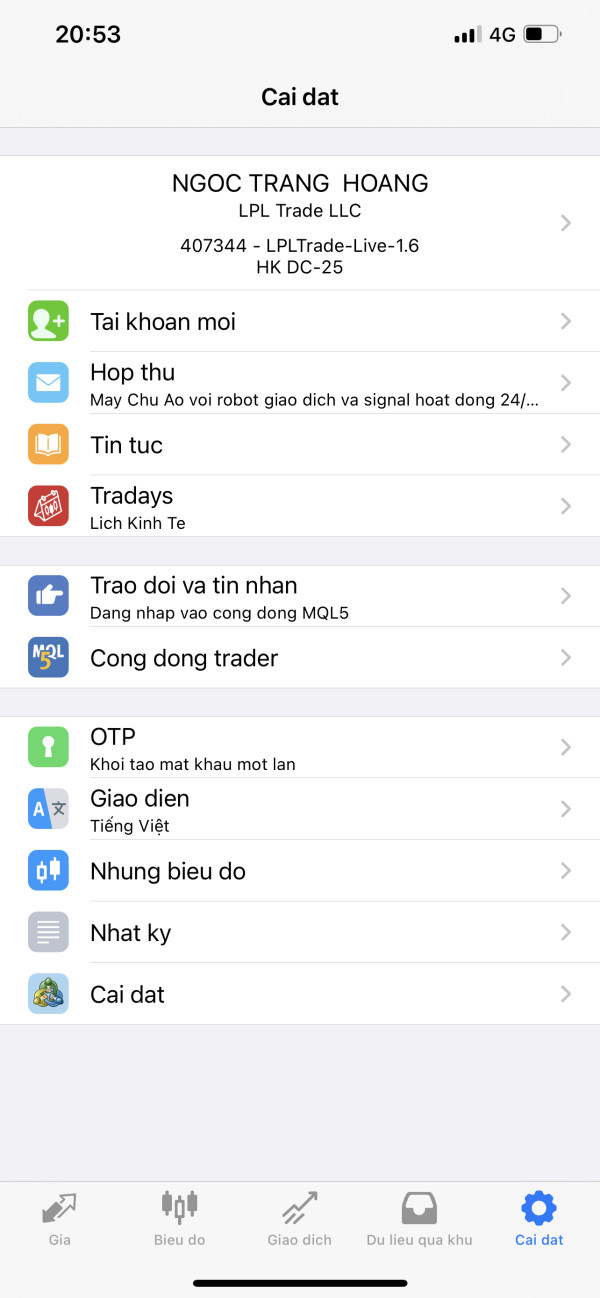

LPL Trade operates through the Blaze Portfolio platform, which represents a significant technological investment acquired by LPL Financial to enhance its service capabilities. This lpl trade review notes that the platform provides access to multiple asset classes including mutual funds, exchange-traded funds, stocks, bonds, certain option strategies, unit investment trusts, and institutional money managers. The platform also offers access to no-load multi-manager variable annuities, expanding the range of investment vehicles available to users. The company's integrated approach combines brokerage and investment advisory services, creating a comprehensive platform designed primarily for independent financial advisors and enterprise-level financial advisory services.

Regulatory Jurisdiction: Specific regulatory authority information is not detailed in available documentation, though the company operates as a major independent broker-dealer in the United States market.

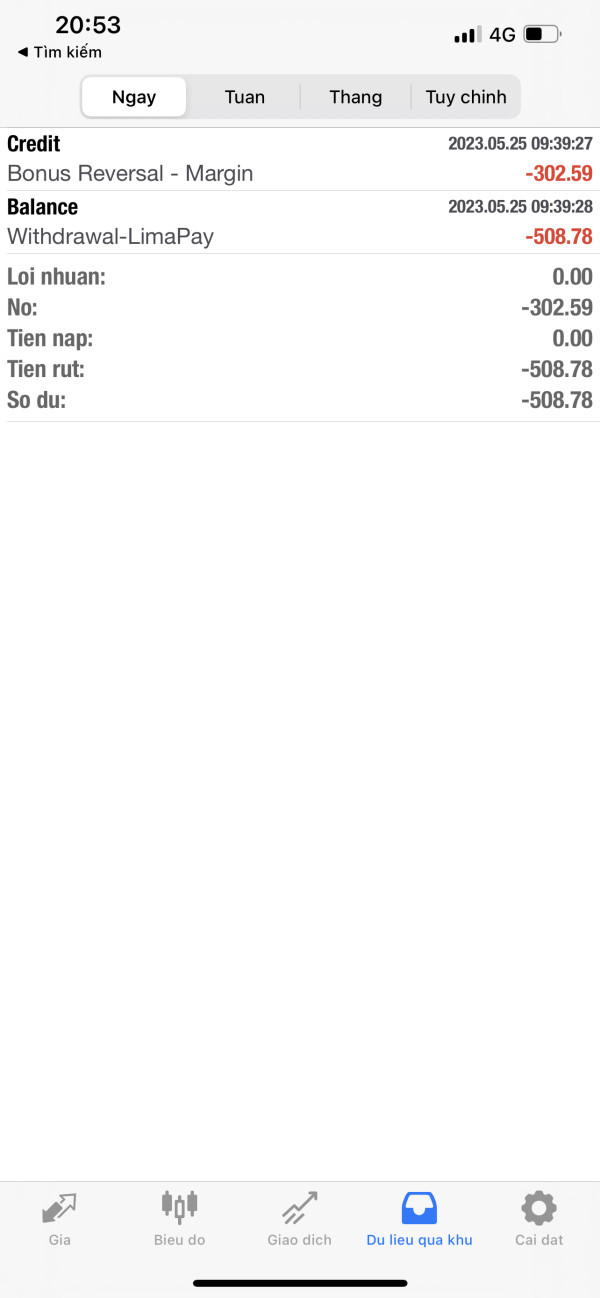

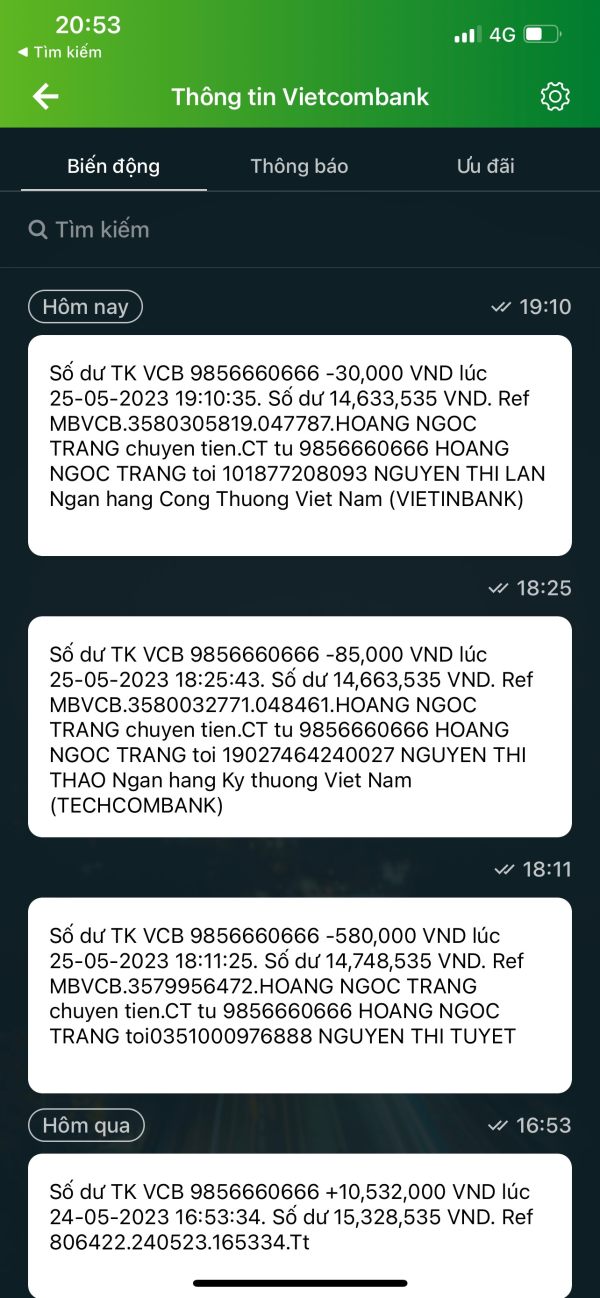

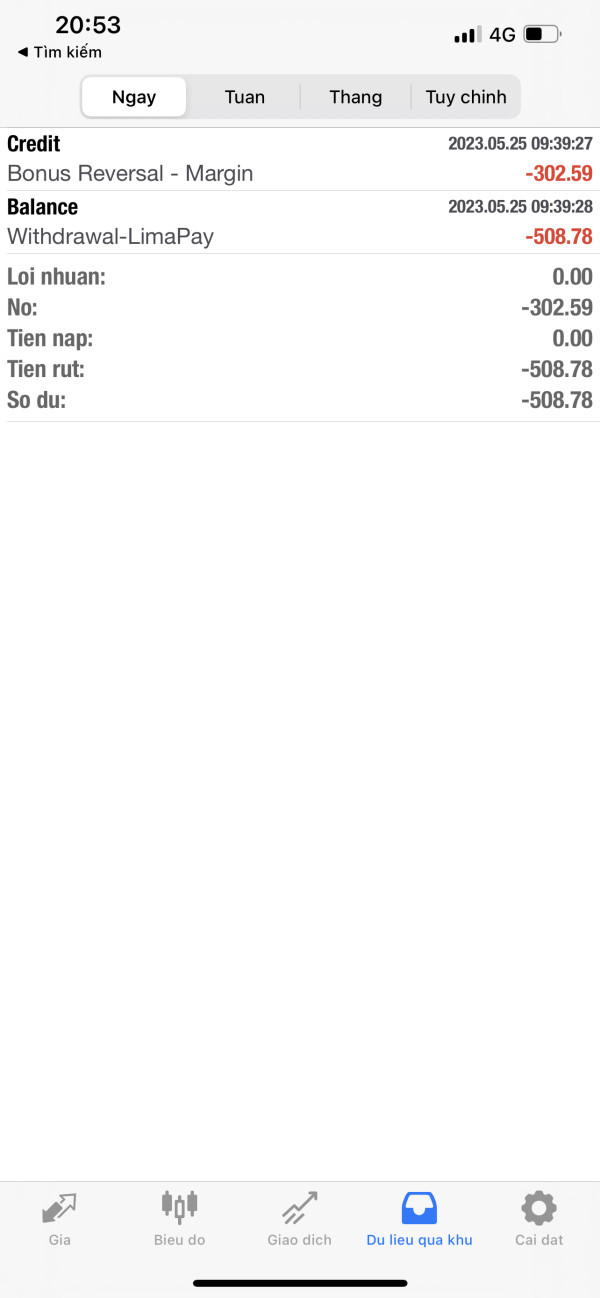

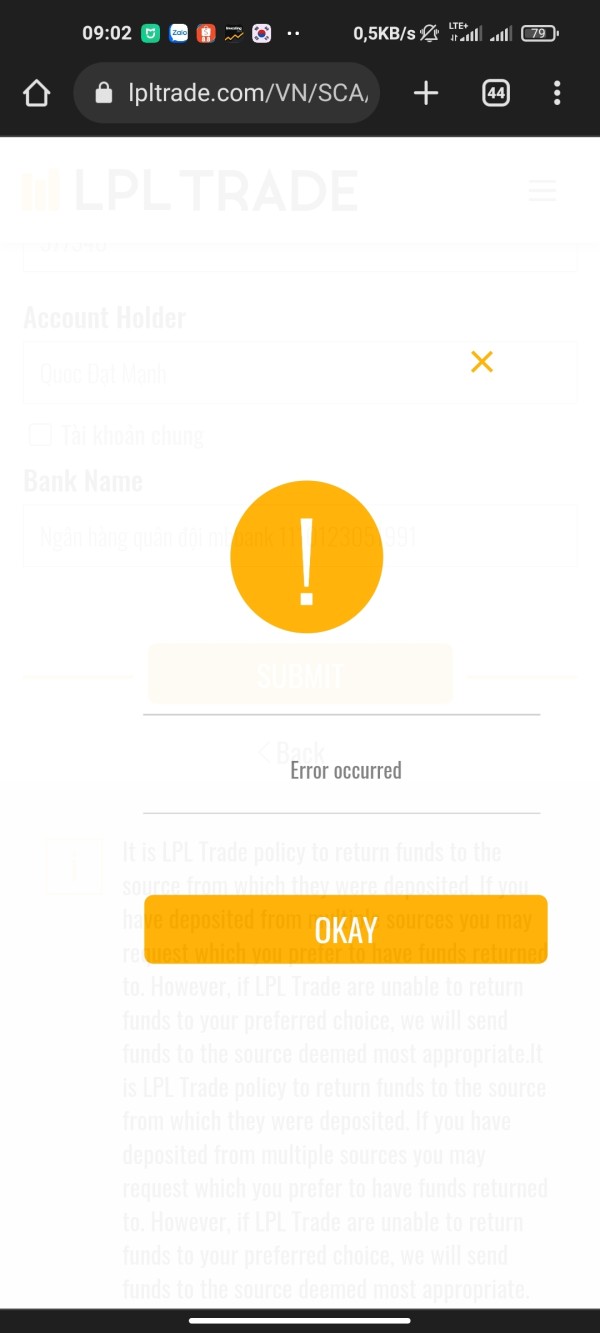

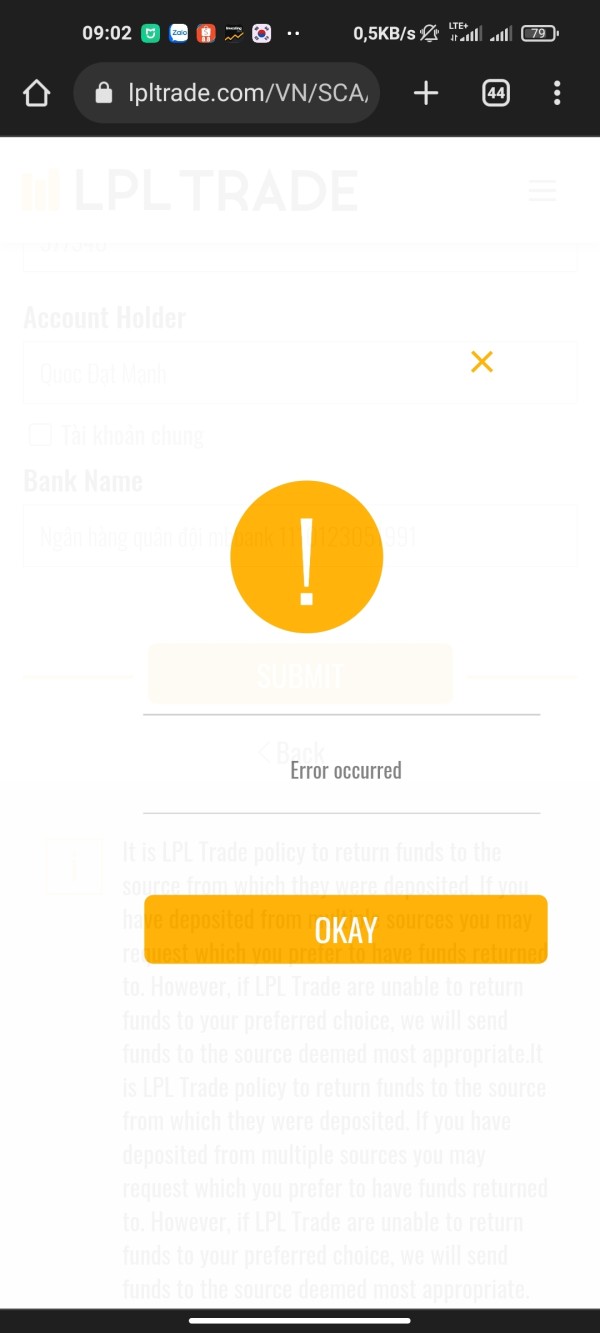

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal mechanisms is not detailed in available materials. Users need direct consultation with the platform for current procedures.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in available information and would need to be confirmed directly with LPL Trade representatives.

Bonus Promotions: Current promotional offerings and bonus structures are not detailed in available documentation.

Tradeable Assets: The platform provides comprehensive access to mutual funds, exchange-traded funds, stocks, bonds, certain option strategies, unit investment trusts, institutional money managers, and no-load multi-manager variable annuities. This offers significant diversification opportunities.

Cost Structure: Specific fee schedules, spread information, and commission structures are not detailed in available materials and would require direct inquiry for current pricing.

Leverage Ratios: Leverage specifications are not provided in available documentation.

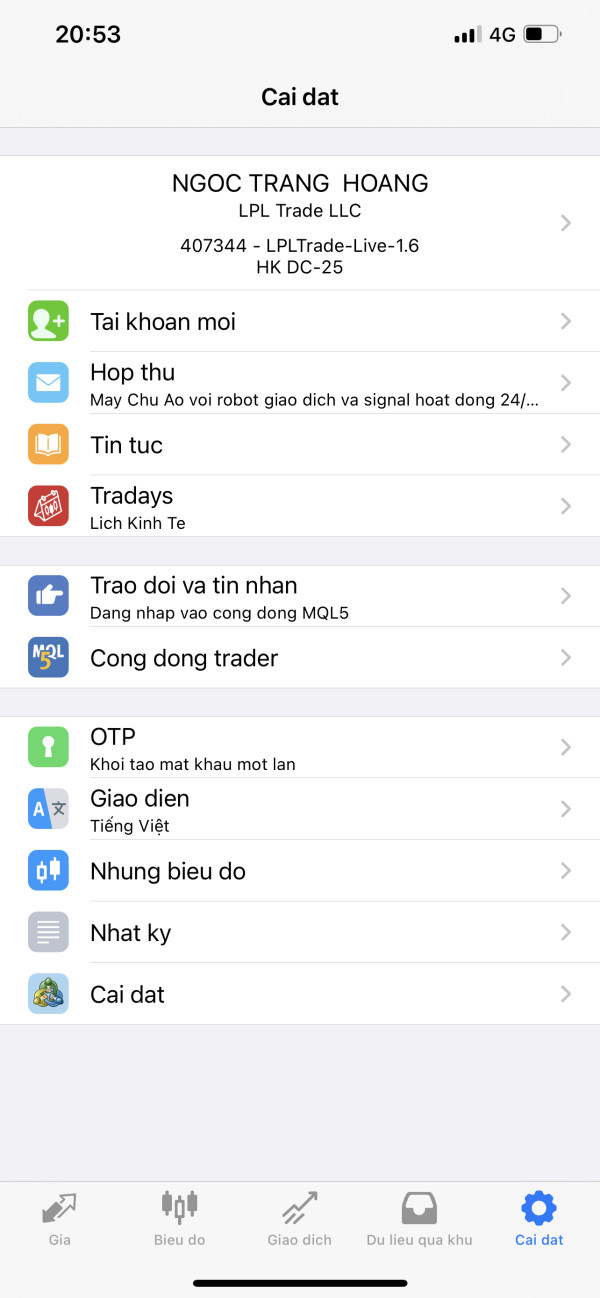

Platform Options: The primary trading platform is Blaze Portfolio, though additional platform options are not specified in available information. This lpl trade review notes the platform's focus on serving professional advisors and institutional clients.

Geographic Restrictions: Specific geographic limitations are not detailed in available documentation.

Customer Service Languages: Supported customer service languages are not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The specific account conditions offered by LPL Trade are not detailed in available documentation. This makes a comprehensive evaluation of this category challenging. Traditional broker-dealer services typically offer various account types designed to serve different client segments, from individual investors to institutional clients, but the exact structure of LPL Trade's account offerings requires direct consultation with the platform.

Account opening procedures, minimum balance requirements, and account maintenance fees represent critical factors for potential users but are not specified in available materials. The platform's focus on serving financial advisors suggests that account structures may be designed primarily for professional use rather than direct retail access.

Given the company's substantial scale and established market presence, it's reasonable to expect competitive account conditions, but potential users should directly verify current terms and requirements. This lpl trade review emphasizes the importance of understanding specific account features before making investment decisions.

The absence of detailed account condition information in public materials may reflect the platform's business-to-business focus. Terms are typically customized based on individual advisor or institutional needs rather than standardized retail offerings.

LPL Trade demonstrates significant strength in its tools and resources offering, primarily through the Blaze Portfolio platform. This sophisticated trading infrastructure represents a substantial technological investment designed to serve professional financial advisors and their clients effectively. The platform provides access to a comprehensive range of asset classes, enabling diversified portfolio construction across multiple investment categories.

The integration of brokerage and investment advisory services through a single platform creates operational efficiencies for financial advisors while providing clients with streamlined access to various investment options. The platform's capability to handle mutual funds, exchange-traded funds, stocks, bonds, option strategies, unit investment trusts, and institutional money managers demonstrates its comprehensive scope.

However, specific details regarding research capabilities, analytical tools, educational resources, and automated trading features are not detailed in available information. The quality and depth of these additional resources would significantly impact the overall value proposition for users, particularly those requiring sophisticated analysis and decision-support tools.

The platform's focus on serving over 29,000 financial advisors suggests robust backend infrastructure capable of handling significant transaction volumes and complex portfolio management requirements. Specific performance metrics are not publicly available though.

Customer Service and Support Analysis

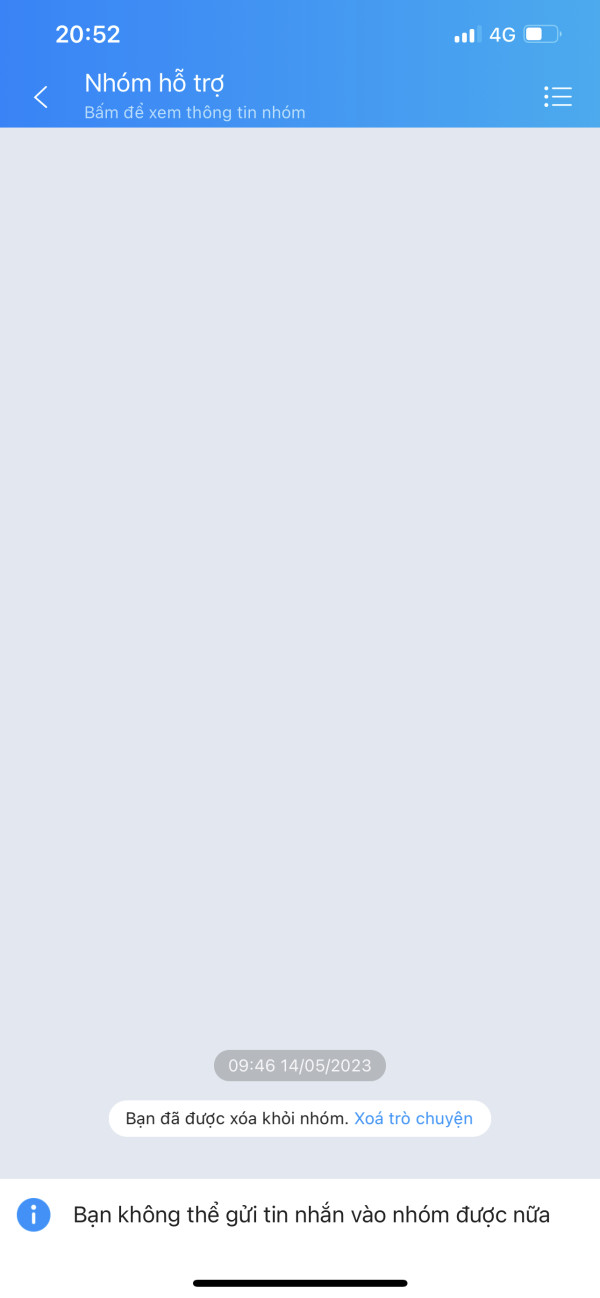

Customer service and support details are not specified in available documentation for LPL Trade. This makes it difficult to evaluate this crucial aspect of the platform's offering. Given the company's focus on serving financial advisors and managing hundreds of billions in assets, it's reasonable to expect professional-grade support services, but specific service level commitments are not publicly detailed.

The scale of LPL Financial's operations, supporting over 29,000 advisors, suggests the existence of substantial customer support infrastructure. Details regarding response times, available communication channels, service hours, and multi-language support are not specified in available materials though.

Professional financial services typically require high-quality customer support given the complexity of investment products and the critical nature of financial transactions. However, without specific information about LPL Trade's customer service protocols, potential users cannot adequately assess this important aspect of the platform.

The business-to-business nature of LPL Trade's primary market may mean that support services are structured differently from retail-focused platforms. This could potentially offer more specialized assistance for professional users but requires direct consultation to understand specific service levels and availability.

Trading Experience Analysis

The trading experience offered by LPL Trade through the Blaze Portfolio platform represents a significant component of the service. Specific performance metrics and user experience details are not provided in available documentation though. The platform's design for professional financial advisors suggests sophisticated functionality capable of handling complex trading requirements and portfolio management tasks.

Platform stability and execution quality are critical factors for professional users managing substantial client assets. Specific performance data regarding order execution speed, system uptime, and trading reliability are not detailed in available materials though. The integration of multiple asset classes within a single platform suggests comprehensive trading capabilities, but user interface design and ease of use details are not specified.

Mobile trading capabilities, which have become increasingly important for modern financial services, are not detailed in available information. Given the professional focus of the platform, mobile access may be structured differently from retail-oriented applications, potentially emphasizing portfolio monitoring and client communication over active trading functionality.

This lpl trade review notes that the absence of specific trading experience details makes it challenging for potential users to evaluate whether the platform meets their operational requirements. This necessitates direct consultation with LPL Trade representatives for comprehensive platform demonstrations.

Trustworthiness Analysis

LPL Financial's established market presence since 1989 and its position as one of the largest independent broker-dealers in the United States provides a foundation for trustworthiness evaluation. The company's substantial scale, supporting over 29,000 financial advisors and managing hundreds of billions in assets, demonstrates significant market confidence and operational stability.

However, specific regulatory information is not detailed in available documentation, which impacts the ability to fully assess regulatory compliance and oversight mechanisms. The company's commitment to independence, particularly its policy of not selling proprietary investment products, suggests a client-focused approach that may reduce potential conflicts of interest.

The absence of specific information regarding fund protection measures, segregation of client assets, and detailed regulatory compliance frameworks limits the comprehensive evaluation of trustworthiness factors. Professional financial services typically operate under strict regulatory oversight, but specific regulatory authorities and compliance measures are not detailed in available materials.

Third-party ratings, industry recognition, and independent assessments of LPL Financial's operations are not included in available information. These would provide additional perspective on the company's reputation and standing within the financial services industry.

User Experience Analysis

User experience evaluation for LPL Trade is limited by the absence of specific information regarding platform interface design, usability features, and user feedback in available documentation. The platform's focus on serving professional financial advisors suggests that user experience design priorities may differ from retail-oriented platforms, potentially emphasizing functionality and efficiency over simplified interfaces.

The integration of brokerage and investment advisory services through the Blaze Portfolio platform suggests a comprehensive user experience. Specific details regarding navigation, customization options, reporting capabilities, and overall user satisfaction are not provided in available materials though.

Registration and account verification processes, which significantly impact initial user experience, are not detailed in available information. Similarly, the experience of conducting deposits, withdrawals, and ongoing account management is not described in accessible documentation.

The absence of user testimonials, satisfaction surveys, or detailed user experience descriptions makes it challenging to assess how well the platform serves its intended professional audience. Potential users would need to request platform demonstrations or trial access to properly evaluate the user experience offered by LPL Trade.

Conclusion

LPL Trade operates as part of a well-established financial services organization with significant market presence and substantial assets under management. The platform's foundation through LPL Financial provides credibility and scale, while the Blaze Portfolio technology platform offers access to diverse asset classes suitable for professional investment management.

The platform appears most suitable for professional financial advisors and institutional clients seeking comprehensive access to multiple investment vehicles through a single integrated platform. The company's commitment to independence and avoidance of proprietary product sales may appeal to advisors prioritizing client interests over product sales incentives.

However, the limited availability of specific information regarding regulatory oversight, fee structures, customer service protocols, and user experience details represents a significant limitation for potential users seeking to make informed decisions. Prospective users should conduct direct consultation with LPL Trade representatives to obtain comprehensive information about current terms, conditions, and service capabilities before making platform selection decisions.