Regarding the legitimacy of leo forex brokers, it provides VFSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is leo safe?

Pros

Cons

Is leo markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

LEO PRIME SERVICES LIMITED

Effective Date:

2017-06-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

LEO PRIME SERVICES LIMITED

Effective Date: Change Record

--Email Address of Licensed Institution:

mft@leoprime.comSharing Status:

No SharingWebsite of Licensed Institution:

www.leoprime.comExpiration Time:

--Address of Licensed Institution:

GS Complex, 1st floor, Office Number 12, Providence, Mahé, SeychellesPhone Number of Licensed Institution:

2484374755Licensed Institution Certified Documents:

Is LeoPrime A Scam?

Introduction

LeoPrime is a forex broker that positions itself as a multi-asset trading platform, catering to both retail and institutional clients. Established in 2016, the broker claims to offer a user-friendly trading environment with competitive spreads and a wide range of financial instruments, including forex, commodities, and indices. However, with the rise of online trading, it is crucial for traders to exercise caution and thoroughly evaluate any broker before committing their funds. The forex market is rife with unregulated entities, and understanding the credibility of a broker can significantly impact a trader's financial security. This article aims to provide an objective analysis of LeoPrime through a comprehensive investigation of its regulatory status, company background, trading conditions, customer experience, and overall safety.

Regulatory and Legality

The regulatory framework is a vital aspect of any trading broker, as it serves as a safeguard for traders' investments. LeoPrime operates under the jurisdiction of the Seychelles Financial Services Authority (FSA) and claims to be regulated, but the quality of this regulation is questionable. The Seychelles FSA is known for its lenient requirements, making it a popular choice for many offshore brokers.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 032 | Seychelles | Active |

The significance of regulation cannot be overstated; it ensures that brokers adhere to certain standards, which can protect traders from fraud and malpractice. However, the absence of stringent regulatory oversight raises concerns about LeoPrime's credibility. Additionally, LeoPrime is registered in both Seychelles and Hong Kong, but it does not hold a license from the Hong Kong Securities and Futures Commission (SFC), further complicating its regulatory status. This lack of robust regulation can lead to potential risks for traders, making it essential to consider whether Is LeoPrime safe for trading.

Company Background Investigation

LeoPrime is operated by Leo Prime Services Limited, which is registered in Seychelles. The company has been in operation since 2016 and has expanded its services across various regions, including Asia. However, the lack of transparency regarding its ownership and management structure raises flags.

The management team‘s experience and qualifications are crucial for assessing the broker’s reliability. Unfortunately, there is limited information available about the team behind LeoPrime, which hinders a thorough evaluation of their expertise. Furthermore, the company's transparency in disclosing critical information about its operations and financial health is lacking. This raises concerns about its commitment to ethical trading practices and accountability.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure is essential. LeoPrime offers various account types, including Classic, Pro, ECN, and Cent accounts, each with different fee structures. The overall trading costs can significantly impact a trader's profitability.

| Fee Type | LeoPrime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $3 (Pro), $6 (ECN) | $3 - $5 |

| Overnight Interest Range | Varies | Varies |

While the spreads on major currency pairs appear competitive, the commission fees, particularly on the ECN account, are on the higher side. Additionally, the broker's bonus policies and withdrawal conditions have been criticized for being convoluted, potentially leading to unexpected costs for traders. This raises questions about whether Is LeoPrime safe when it comes to hidden fees and charges.

Customer Funds Safety

The safety of customer funds is paramount when considering a broker. LeoPrime claims to implement various security measures, including segregated accounts to protect clients' funds. However, the effectiveness of these measures is questionable given the broker's offshore status.

There is no clear information regarding investor protection schemes or negative balance protection, which are critical aspects of safeguarding traders' investments. The lack of a robust regulatory framework and the history of offshore brokers being less stringent in their security measures add to the concerns regarding LeoPrime's commitment to fund safety. Therefore, potential clients must carefully assess whether Is LeoPrime safe for their financial resources.

Customer Experience and Complaints

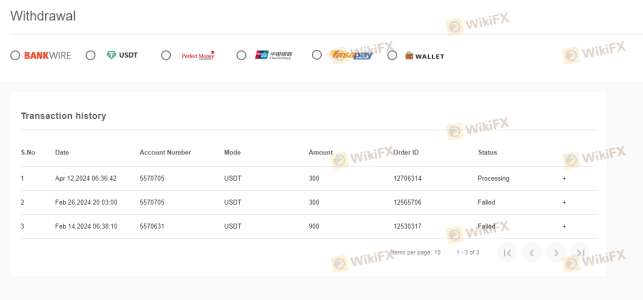

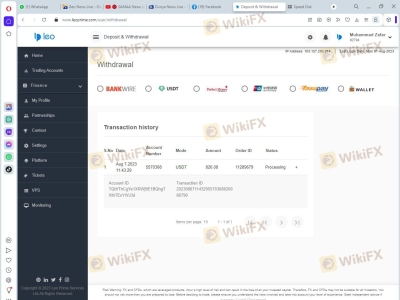

Customer feedback is a valuable resource for evaluating a broker's reliability. Reviews of LeoPrime reveal a mix of positive and negative experiences. Many users praise the trading platform's functionality and customer support, while others report significant issues, particularly with withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow and unresponsive |

| Poor Customer Support | Medium | Mixed responses |

| Account Verification Issues | High | Lengthy process |

Common complaints include difficulties in withdrawing funds, which has been a recurring theme in user reviews. Some traders have reported waiting weeks or even months for their withdrawals to be processed, leading to frustration and distrust. These experiences raise concerns about LeoPrime's operational integrity and whether it is truly a safe broker.

Platform and Execution

LeoPrime offers its clients access to the widely used MetaTrader 4 and MetaTrader 5 platforms, known for their reliability and advanced trading features. However, the execution quality and potential slippage issues have been points of contention among users.

Traders have reported instances of slippage during high volatility periods, which can significantly affect trading outcomes. The broker's ability to provide consistent and reliable execution is critical for traders, especially in a fast-paced market. This raises further questions about whether Is LeoPrime safe for those looking to engage in serious trading activities.

Risk Assessment

Evaluating the risks associated with trading through LeoPrime is essential for potential clients. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Fund Safety Risk | High | Lack of investor protection measures |

| Withdrawal Risk | High | Reports of significant withdrawal delays |

Given these identified risks, it is advisable for traders to proceed with caution when engaging with LeoPrime. Implementing risk mitigation strategies, such as starting with a smaller investment and thoroughly researching the trading environment, can help safeguard against potential pitfalls.

Conclusion and Recommendations

In conclusion, while LeoPrime presents itself as a competitive option in the forex trading landscape, several red flags warrant caution. The lack of stringent regulation, combined with numerous customer complaints regarding withdrawals and transparency, raises serious concerns about its reliability. Traders must carefully consider these factors before deciding whether to engage with LeoPrime.

If you are looking for a safer trading environment, it may be prudent to explore alternative brokers with robust regulatory frameworks, such as those regulated by the FCA or ASIC. Ultimately, ensuring the safety of your investments should be a top priority, and thorough due diligence is essential in making informed trading decisions.

Is leo a scam, or is it legit?

The latest exposure and evaluation content of leo brokers.

leo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

leo latest industry rating score is 1.69, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.69 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.