Is LEADING ALLIANCE safe?

Business

License

Is Leading Alliance A Scam?

Introduction

Leading Alliance is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a range of financial instruments including forex, commodities, and indices. As with any broker, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money. The forex market is notorious for its volatility and the presence of unregulated brokers, making it essential for traders to assess the legitimacy and reliability of any trading platform. In this article, we will investigate whether Leading Alliance is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulation is a critical aspect of any financial service provider, as it ensures that the broker adheres to specific standards of conduct and provides a level of protection for traders. Leading Alliance claims to operate under various regulatory frameworks; however, a closer examination reveals significant gaps in its regulatory compliance.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

As shown in the table, Leading Alliance does not have any verifiable regulatory licenses. This lack of oversight raises red flags about its operations and the safety of client funds. The absence of a regulatory body overseeing its activities means that there are no guarantees regarding fair trading practices or the protection of client investments. Furthermore, the broker's claims of being regulated in various jurisdictions appear to be misleading, as it is not listed with any recognized regulatory authority such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. This lack of regulation is a significant indicator that Leading Alliance is not safe for traders.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its reliability. Leading Alliance is operated by Leading Alliance Holding Limited, a company that claims to be based in Hong Kong. However, the details surrounding its establishment and operational history are vague, lacking transparency. The company's website offers limited information about its ownership structure and management team, which raises concerns about its credibility.

The management team's background is another crucial factor to consider. A strong team with a proven track record in the financial industry often indicates a trustworthy broker. However, Leading Alliance fails to provide any substantial information regarding the qualifications or experience of its leadership. This lack of transparency can be a warning sign for potential investors, as it suggests that the broker may not be committed to maintaining high standards of accountability and service. Given these factors, it is evident that Leading Alliance does not exhibit the characteristics of a reliable broker.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly impact a trader's experience and profitability. Leading Alliance advertises competitive trading conditions, including high leverage and low spreads. However, it is essential to scrutinize these claims for potential discrepancies.

| Cost Type | Leading Alliance | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.9 pips | 0.5 - 1.0 pips |

| Commission Model | $10 per lot | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies |

The table above highlights the trading costs associated with Leading Alliance. While the broker claims to offer spreads starting as low as 0.9 pips, this is still higher than the industry average. Additionally, the commission structure appears to be on par with other brokers, but the lack of clarity on overnight interest rates raises concerns about hidden fees. Such practices are common among unregulated brokers, leading to potential losses for traders. Therefore, it is crucial for traders to be wary of the trading conditions offered by Leading Alliance, as they may not be as favorable as advertised.

Customer Fund Security

The security of customer funds is paramount when considering a broker. Leading Alliance's website provides minimal information regarding its fund security measures. A reliable broker typically segregates client funds from its operational funds, ensuring that traders' investments are protected in the event of insolvency. However, Leading Alliance does not specify whether it employs such practices.

Moreover, the absence of negative balance protection is concerning. This feature is crucial for protecting traders from losing more than their initial investment, especially in a volatile market. The lack of transparency regarding these policies suggests that investors' funds may not be secure with Leading Alliance, making it a risky choice for traders.

Customer Experience and Complaints

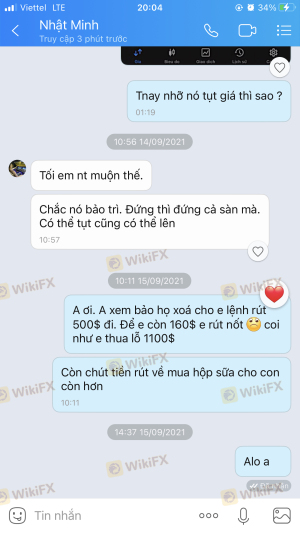

Customer feedback is a valuable resource for evaluating a broker's reliability. Reviews and testimonials can provide insights into the experiences of other traders. Unfortunately, the feedback surrounding Leading Alliance is predominantly negative. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Average |

| Trade Execution Issues | High | Poor |

The table above summarizes the main types of complaints associated with Leading Alliance. The high severity of withdrawal delays indicates a significant issue with fund access, which is a major concern for any trader. Moreover, the company's poor response to these complaints highlights a lack of accountability and customer service commitment. One typical case involved a trader who reported being unable to withdraw their funds for several months, leading to frustration and financial loss. Such experiences reinforce the notion that Leading Alliance may not be a safe broker for traders.

Platform and Trade Execution

The performance of a trading platform is crucial for a traders success. Leading Alliance utilizes the MetaTrader 5 (MT5) platform, which is known for its robust features and user-friendly interface. However, the platform's performance can vary significantly based on the broker's execution quality.

Traders have reported issues with order execution, including slippage and order rejections. These problems can lead to financial losses, especially during volatile market conditions. Moreover, the potential for platform manipulation is a concern, as some unregulated brokers have been known to engage in practices that disadvantage traders. Therefore, it is essential for traders to be cautious when trading with Leading Alliance, as the platform may not provide the reliability needed for successful trading.

Risk Assessment

Using Leading Alliance as a trading platform comes with inherent risks. The lack of regulation, poor customer feedback, and questionable trading conditions contribute to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund segregation |

| Withdrawal Risk | High | Reports of delayed withdrawals |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

The risk assessment table highlights the various risks associated with trading with Leading Alliance. Traders should be aware of these risks and consider mitigating strategies, such as using smaller investment amounts and conducting thorough research before engaging with the platform.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Leading Alliance is not a safe broker. The absence of regulation, poor customer experiences, and questionable trading conditions all point to potential risks for traders. Given these findings, it is advisable for traders to exercise extreme caution when considering this broker for their trading activities.

For those seeking a safer trading environment, it may be wise to explore alternatives that are regulated and have a proven track record of customer satisfaction. Reputable brokers such as OANDA, IG, or Forex.com are recommended for their regulatory compliance, transparent trading conditions, and strong customer support. Always prioritize the safety of your investments by choosing a broker that adheres to regulatory standards and demonstrates a commitment to customer service.

Is LEADING ALLIANCE a scam, or is it legit?

The latest exposure and evaluation content of LEADING ALLIANCE brokers.

LEADING ALLIANCE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LEADING ALLIANCE latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.