Is SCHATZ safe?

Pros

Cons

Is Schatz Safe or Scam?

Introduction

Schatz Markets, a forex broker established in 2018, has emerged as a player in the foreign exchange market, offering a range of trading options and account types to its clients. However, the growing number of unregulated brokers in the industry has made it essential for traders to conduct thorough due diligence before committing their funds. This article aims to address the question: Is Schatz safe or a scam? By examining various aspects of the broker, including its regulatory status, company background, trading conditions, client fund security, and customer experiences, we will provide a comprehensive overview of Schatz Markets.

To assess the safety and reliability of Schatz, we utilized multiple sources, including user reviews, regulatory databases, and financial analysis reports. Our evaluation framework focuses on key areas that impact traders' decisions, ensuring an objective analysis of whether Schatz is safe for trading or if it raises significant red flags.

Regulation and Legitimacy

One of the most critical factors in determining the safety of any forex broker is its regulatory status. A well-regulated broker is typically subject to stringent oversight, ensuring that it adheres to industry standards and provides a level of protection for its clients. Unfortunately, Schatz Markets operates without any regulatory oversight, which is a significant concern for potential traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation raises serious questions about the broker's legitimacy. Without a regulatory body overseeing its operations, Schatz is not obligated to adhere to any specific standards regarding client fund protection, transparency, or ethical business practices. Traders using unregulated brokers like Schatz face heightened risks, including the potential for fund mismanagement and lack of recourse in the event of disputes.

Furthermore, various reports indicate that unregulated brokers often engage in questionable practices, such as delaying withdrawals or imposing unexpected fees. This lack of regulatory oversight is a crucial factor in evaluating whether Schatz is safe for trading or if it poses significant risks to traders' investments.

Company Background Investigation

Schatz Markets, owned by Schatz Marketz LLC, was founded in 2018 and claims to operate from the United Kingdom. However, a thorough investigation reveals a lack of transparency regarding the company's ownership and management structure. The absence of publicly available information about the management team raises concerns about their qualifications and experience in the financial industry.

The company's website provides limited details about its history and operational practices, which is a red flag for potential clients. A reputable broker typically offers clear information about its management team, including their backgrounds and professional credentials. The lack of such transparency may indicate that the broker is attempting to conceal information that could be detrimental to its reputation.

Moreover, Schatz's claims of operating in the UK are questionable, as verification from the Financial Conduct Authority (FCA) shows no record of the broker being licensed or regulated. This further emphasizes the need for caution when considering whether Schatz is safe for trading. Traders should be wary of companies that lack transparency and regulatory oversight, as these factors can significantly impact their trading experience and the safety of their funds.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital for assessing overall costs and potential profitability. Schatz Markets offers multiple account types, each with different minimum deposit requirements and trading conditions. However, the overall cost structure appears to be less competitive compared to industry standards.

| Cost Type | Schatz Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | Starting from 0.8 pips | 1.0 pips |

| Commission Model | Varies by account type | $6 - $10 per lot |

| Overnight Interest Range | Variable | Variable |

While Schatz offers competitive spreads starting from 0.8 pips, the commission structure can be concerning. For instance, some account types impose higher commissions than the industry average, which can eat into traders' profits. Additionally, there are reports of hidden fees associated with withdrawals and account maintenance, which can further complicate the trading experience.

The inconsistency in trading costs and potential for unexpected fees raises questions about the broker's transparency and reliability. This lack of clarity in fees is a critical factor for traders to consider when assessing whether Schatz is safe for trading or if it poses unnecessary risks.

Client Fund Security

The security of client funds is paramount in the forex trading industry. A reliable broker should implement robust measures to protect clients' investments. Unfortunately, Schatz Markets does not appear to prioritize client fund security adequately. The absence of regulatory oversight means that there are no mandated protections in place for client deposits.

Traders should be particularly concerned about the lack of segregated accounts and investor protection schemes. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency. Additionally, the absence of negative balance protection indicates that clients could potentially lose more than their initial investment, which is a significant risk factor.

Given the historical context of unregulated brokers, there have been numerous instances where clients have reported difficulties withdrawing their funds or have faced unexpected account closures. This lack of accountability is a strong indicator that Schatz is not safe for trading, and traders should exercise extreme caution when considering this broker.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a forex broker. Reviews and testimonials from traders can provide insights into their experiences with the broker, including any issues they may have encountered. Unfortunately, feedback regarding Schatz Markets has been mixed, with several users reporting significant challenges.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Slow |

| Account Closure Issues | High | Unresolved |

Common complaints include delays in processing withdrawals, inadequate customer support, and issues with account closures. Many users have reported difficulties in reaching customer service representatives, leading to frustration and dissatisfaction. The company's slow response times to complaints further exacerbate the situation, leaving traders feeling unsupported and vulnerable.

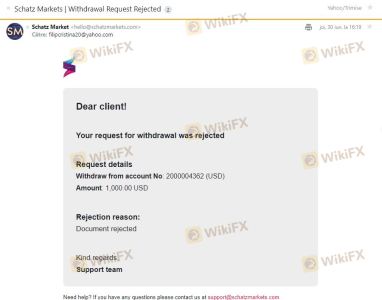

One notable case involved a trader who experienced repeated rejections of withdrawal requests without clear explanations. This incident highlights the potential risks of using an unregulated broker like Schatz, as clients may find themselves without recourse in the event of disputes.

Given the frequency and severity of these complaints, it is crucial for potential clients to consider whether Schatz is safe for trading. The lack of effective customer support and unresolved issues raises significant concerns about the broker's commitment to client satisfaction and fund security.

Platform and Trade Execution

The performance of a trading platform is essential for a smooth trading experience. Schatz Markets offers popular trading platforms, including MetaTrader 4 and MetaTrader 5. However, user feedback suggests that the platform's performance may not meet expectations.

Traders have reported issues with order execution quality, including slippage and rejected orders. These problems can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. Additionally, some users have raised concerns about potential platform manipulation, which is a serious allegation that can have severe implications for trust in the broker.

Overall, the platform's stability and execution quality are critical factors for traders to evaluate when considering whether Schatz is safe for trading. A broker that fails to provide a reliable trading environment may expose clients to unnecessary risks and hinder their trading success.

Risk Assessment

When deciding to trade with a broker like Schatz, it is essential to assess the overall risk involved. The lack of regulation, transparency, and customer support all contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Fund Security Risk | High | Lack of segregated accounts and investor protection. |

| Customer Support Risk | Medium | Poor response times and unresolved complaints. |

| Execution Risk | High | Issues with slippage and order rejections. |

To mitigate these risks, traders should consider diversifying their investments across multiple regulated brokers, ensuring that they do not expose their entire capital to one potentially risky entity. Additionally, conducting thorough research and reading user reviews can help traders make informed decisions regarding their investments.

Conclusion and Recommendations

In conclusion, after examining various aspects of Schatz Markets, it is evident that the broker raises significant concerns regarding its safety and reliability. The absence of regulatory oversight, coupled with a lack of transparency and poor customer support, strongly suggests that Schatz is not safe for trading. Potential traders should exercise extreme caution and consider alternative options that offer better protection for their investments.

For those seeking reliable forex trading options, we recommend choosing brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer enhanced security measures, better customer service, and a more transparent trading environment. By prioritizing safety and reliability, traders can protect their investments and improve their overall trading experience.

Is SCHATZ a scam, or is it legit?

The latest exposure and evaluation content of SCHATZ brokers.

SCHATZ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SCHATZ latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.