Is Gaman safe?

Pros

Cons

Is Gaman A Scam?

Introduction

Gaman is a relatively new entrant in the forex trading market, having been established in 2024. Positioned as a broker that offers a variety of trading instruments including forex, metals, energy, and indices, Gaman aims to cater to both novice and experienced traders. However, with the increasing number of scams in the forex industry, traders need to exercise caution and conduct thorough evaluations before engaging with any broker. This article will delve into Gaman's regulatory status, company background, trading conditions, client fund security, user experiences, platform performance, and associated risks. The assessment will be based on a comprehensive review of multiple sources, including user feedback, regulatory databases, and expert evaluations.

Regulation and Legitimacy

Regulation is a crucial aspect of any forex broker's credibility, as it ensures that the broker operates under a set of established guidelines aimed at protecting traders. Gaman, however, operates as an unregulated entity, which raises significant concerns regarding its legitimacy. Below is a summary of Gaman's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of any valid regulatory oversight means that Gaman does not adhere to the standards set by recognized financial authorities, exposing traders to higher risks. This lack of regulation is particularly alarming given that unregulated brokers often have questionable practices, including the potential for fund misappropriation and lack of transparency in operations. Historical compliance issues are non-existent, as Gaman has not been in operation long enough to establish a compliance record. Overall, the lack of regulation is a significant red flag for potential traders.

Company Background Investigation

Gaman's company structure and history are essential for assessing its reliability. Founded in the United States, Gaman has been operational for approximately one to two years. However, detailed information about its ownership structure and management team is scarce, which complicates the assessment of its credibility. A transparent company should ideally provide information about its founders and key executives, along with their professional backgrounds. Unfortunately, Gaman's website does not furnish adequate details regarding its management team, leading to questions about its operational transparency.

The company's brief history and lack of established reputation in the industry further contribute to skepticism. In a market where trust is paramount, the absence of a well-defined company background raises concerns about potential risks associated with trading on its platform. Without clear information about the people behind Gaman, traders may find it difficult to determine the broker's commitment to ethical practices and customer service.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for traders looking to optimize their trading strategies. Gaman offers various trading instruments and claims to provide competitive trading conditions. However, the specifics of its fee structure remain ambiguous. Below is a comparison of Gaman's trading costs against industry averages:

| Fee Type | Gaman | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.8 pips (Gold) | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Typically 0.5% - 2% |

The spreads offered by Gaman, particularly for gold, are significantly higher than the industry average, indicating that traders may incur higher costs when trading on this platform. Furthermore, the lack of clarity regarding commissions and overnight interest raises concerns about hidden fees that could impact overall profitability. Such opacity in fee structures is often a tactic used by less reputable brokers to exploit unsuspecting traders.

Client Fund Security

The security of client funds is a paramount concern in the forex trading industry. Gaman's approach to fund safety is questionable, especially given its unregulated status. The broker does not provide clear information about its fund segregation policies, which are crucial for ensuring that clients' funds are kept separate from the broker's operational funds. This lack of transparency is alarming, as it raises the possibility of fund misappropriation.

Additionally, there is no mention of investor protection measures or negative balance protection, which are standard features offered by reputable brokers. In the absence of these safety nets, clients could potentially lose more than their initial deposits, especially during volatile market conditions. Historical disputes or incidents related to fund safety have not been documented, but the absence of stringent security measures is a cause for concern.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Unfortunately, reviews for Gaman are predominantly negative, with many users reporting issues related to account access and withdrawal difficulties. Common complaint patterns include:

| Complaint Type | Severity | Company Response |

|---|---|---|

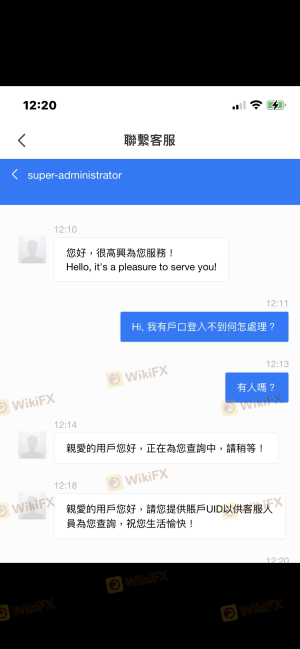

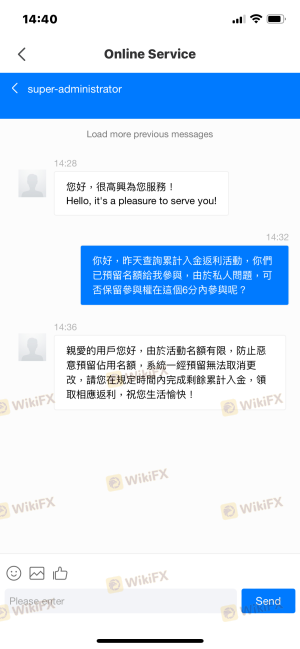

| Account Access Issues | High | No Response |

| Withdrawal Delays | High | Delayed or No Response |

Numerous users have expressed frustration over being locked out of their accounts without explanation, and many have reported that their withdrawal requests were either ignored or met with unreasonable conditions. For instance, one user recounted being told they needed to pay a fine before they could access their funds, a tactic often associated with fraudulent schemes. These patterns of complaints suggest a troubling trend that could indicate Gaman's untrustworthiness.

Platform and Execution

The trading platform provided by Gaman is another crucial aspect of the user experience. Gaman utilizes its proprietary ST5 platform, which is designed for both Windows and mobile devices. However, reviews indicate that the platform may suffer from performance issues, including slow execution times and high slippage rates. Users have reported instances of orders being executed at unfavorable prices, raising concerns about the broker's order execution quality.

Moreover, there are no indications of any market manipulation or unethical trading practices, but the lack of transparency in performance metrics makes it challenging to ascertain the platform's reliability. Traders should be cautious, as a poor trading environment can significantly impact trading outcomes.

Risk Assessment

Given the various factors discussed, the overall risk associated with trading at Gaman appears to be high. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk |

| Fund Safety Risk | High | Lack of segregation and protection |

| Trading Condition Risk | Medium | High spreads and unclear fees |

| Execution Risk | High | Poor execution quality and slippage |

To mitigate these risks, potential traders should consider starting with a minimal deposit, if at all, and conduct thorough research before committing significant capital. It may also be wise to seek alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, Gaman's status as an unregulated forex broker raises significant concerns regarding its legitimacy and safety for traders. The lack of regulatory oversight, coupled with numerous negative customer experiences, suggests that traders should exercise extreme caution when considering this broker. The high costs associated with trading and the absence of adequate client fund protection further compound these concerns.

For traders seeking a reliable forex trading experience, it is advisable to explore alternatives that are regulated and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com offer robust regulatory frameworks, transparent fee structures, and strong customer support, making them safer options for forex trading.

In summary, while Gaman may present itself as an attractive trading option, the potential risks and red flags indicate that it may not be a safe choice for traders.

Is Gaman a scam, or is it legit?

The latest exposure and evaluation content of Gaman brokers.

Gaman Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gaman latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.