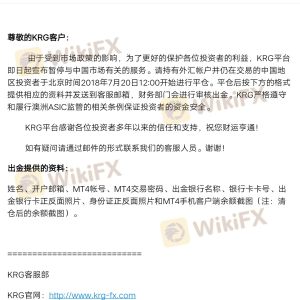

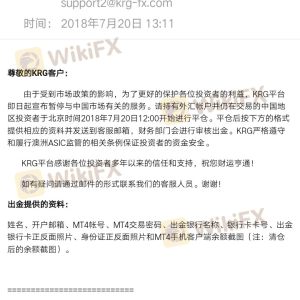

Regarding the legitimacy of KRG forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is KRG safe?

Pros

Cons

Is KRG markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

AFSL HOLDINGS AUSTRALIA PTY LTD

Effective Date:

2015-02-03Email Address of Licensed Institution:

reneferris@kingsroadwealth.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SuiTe 4 Level 10, 66 HunTer STreeT, SYDNEY NSW 2000Phone Number of Licensed Institution:

0404511019Licensed Institution Certified Documents:

Is KRG Safe or Scam?

Introduction

KRG, a forex broker operating in the online trading space, has gained attention among traders seeking opportunities in the foreign exchange market. With the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. This article aims to provide an objective assessment of KRG, examining its regulatory status, company background, trading conditions, customer safety measures, and overall reputation. The evaluation is based on a comprehensive analysis of available data, customer reviews, and industry standards.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of a forex broker. A well-regulated broker is typically seen as more trustworthy, as they are subject to oversight by financial authorities that enforce strict compliance standards. In the case of KRG, it is essential to investigate its regulatory status to ascertain whether it operates under the scrutiny of reputable regulatory bodies.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, KRG does not appear to be regulated by any recognized financial authority. This lack of oversight raises concerns about the broker's legitimacy and the potential risks involved in trading with them. Regulatory bodies such as the FCA (Financial Conduct Authority) in the UK or the SEC (Securities and Exchange Commission) in the US are known for their stringent regulations. Brokers operating without such oversight may not adhere to the same standards of transparency and accountability, which could expose traders to higher risks of fraud or malpractice.

Company Background Investigation

KRG's company background is another essential aspect to consider when assessing its safety. Understanding the history, ownership structure, and management team can provide insights into the broker's credibility. KRG has been in operation for several years, but specific details regarding its founding, ownership, and management are sparse.

The management teams qualifications and experience in the financial industry play a crucial role in a broker's reliability. A reputable broker typically has a team with extensive experience in trading and financial services. However, without transparent information on KRG's management and ownership, it is challenging to evaluate its credibility fully.

Moreover, the company's transparency regarding its operations and financial information is vital. Brokers that provide clear, accessible information about their services, fees, and business practices are generally more trustworthy. KRG's lack of detailed public disclosures may raise red flags for potential traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is crucial. A broker's fee structure can significantly impact a trader's profitability. KRG offers various trading options, but the specifics of its fee structure require careful examination.

| Fee Type | KRG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.5 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | 3% |

KRGs trading conditions appear to be variable, with spreads that may not be competitive compared to industry standards. The absence of a clear commission structure and overnight interest rates raises concerns about potential hidden fees. Traders should be wary of brokers that do not provide transparent information regarding their fee structures, as this can lead to unexpected costs that diminish trading profits.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. KRG's measures for ensuring the security of client deposits must be scrutinized. Key aspects to consider include fund segregation, investor protection schemes, and negative balance protection policies.

KRG's website does not provide clear information regarding these safety measures. A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is protected in the event of insolvency. Additionally, participation in investor protection schemes can provide an extra layer of security for clients, offering compensation in case of broker failure.

Without concrete information on KRG's fund safety protocols, potential clients should exercise caution. Historical issues related to fund security or unresolved disputes can also indicate a broker's reliability.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reputation and service quality. Analyzing user experiences can reveal common complaints and the broker's responsiveness to issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaints about KRG include difficulties with withdrawals and inadequate customer support. Users have reported challenges in accessing their funds, which is a significant concern for any trader. The quality of customer service is also critical, as traders need timely assistance with their inquiries or issues.

In some cases, clients have expressed frustration over the lack of transparency and responsiveness from KRG's support team. Such experiences can significantly impact a trader's confidence in the broker and highlight the importance of choosing a broker with a solid reputation for customer service.

Platform and Trade Execution

The performance of a trading platform is essential for a seamless trading experience. KRG's platform must be assessed for stability, ease of use, and execution quality.

Traders expect a reliable platform that minimizes slippage and ensures efficient order execution. Reports of high slippage or frequent rejections of orders can indicate potential manipulation or technical issues. KRG's platform has received mixed reviews regarding its performance, with some users experiencing delays and execution problems.

Risk Assessment

The overall risk associated with trading through KRG must be carefully evaluated.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight by regulatory bodies raises concerns. |

| Financial Risk | Medium | Unclear fee structures may lead to unexpected costs. |

| Operational Risk | High | Reports of execution issues and withdrawal problems. |

Traders should be aware of the potential risks involved in trading with KRG. To mitigate these risks, it is advisable to conduct thorough research, consider using a demo account, and only invest what one can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that KRG may not be a safe trading option for forex traders. The absence of regulatory oversight, unclear trading conditions, and reports of customer complaints raise significant concerns about the broker's legitimacy.

Traders are advised to exercise caution and consider alternatives that are well-regulated and have a proven track record of reliability. Brokers such as Interactive Brokers and eToro are examples of reputable firms that provide transparent trading conditions and strong regulatory oversight.

In summary, is KRG safe? Based on the available information, potential traders should remain vigilant and consider the risks before engaging with this broker.

Is KRG a scam, or is it legit?

The latest exposure and evaluation content of KRG brokers.

KRG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KRG latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.