Is CTIN safe?

Pros

Cons

Is Ctin Safe or a Scam?

Introduction

Ctin is a forex broker that has been making waves in the trading community since its establishment in 2018. Operating out of Australia, Ctin positions itself as a multi-asset trading platform, offering a wide range of financial instruments. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with scams and unreliable brokers, making it essential for traders to assess the credibility of their chosen platform carefully. This article aims to provide an objective analysis of Ctin, evaluating its regulatory status, company background, trading conditions, and overall safety. The findings are based on a comprehensive review of multiple online sources, including user feedback and regulatory databases.

Regulatory and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Ctin claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory framework. This oversight is crucial for ensuring that brokers adhere to industry standards and protect client funds. Below is a summary of Ctin's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 504151 | Australia | Verified |

The significance of regulation cannot be overstated. Regulated brokers are required to maintain a certain capital threshold, segregate client funds, and adhere to strict operational guidelines. This framework is designed to protect traders from malpractice and financial loss. However, it is important to note that the quality of regulation can vary. While ASIC is considered a reputable regulator, the presence of clone firms—entities that attempt to mimic legitimate brokers—raises concerns. Some sources have flagged Ctin as a "suspicious clone," suggesting that it may not be as safe as it appears. Therefore, while Ctin is regulated, potential traders should remain vigilant and conduct further research into its compliance history.

Company Background Investigation

Ctin operates under the parent company Ctin Investment Pty Ltd, which is based in Melbourne, Australia. The company was founded in 2018 and has since aimed to establish itself as a reputable player in the forex and CFD trading market. However, the lack of extensive public information about its ownership structure and management team raises questions about its transparency. A well-structured company typically provides detailed information about its leadership, allowing clients to gauge the experience and qualifications of those at the helm.

The management team‘s backgrounds are critical in assessing the broker's reliability. Unfortunately, there is limited information available regarding the qualifications and experience of Ctin’s management. This lack of transparency can be a red flag for potential investors, as it complicates the ability to trust the broker. Furthermore, the companys online presence is minimal, which may hinder clients' ability to access vital information regarding its operations. In summary, while Ctin has been in operation for several years, its opaque company background may lead some traders to question whether Ctin is safe for their investments.

Trading Conditions Analysis

When evaluating whether Ctin is safe, it is essential to consider the trading conditions it offers. The broker provides access to over 25,000 trading instruments, including forex, stocks, and commodities. However, the overall fee structure and any hidden costs are critical factors that can impact a trader's profitability.

The following table summarizes the core trading costs associated with Ctin:

| Cost Type | Ctin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.5% - 1.5% | 0.3% - 1.0% |

Ctins commission-free trading model may appear attractive at first glance, but it's essential to scrutinize the spread and overnight interest rates. A wide spread can significantly erode profits, especially for day traders who rely on tight margins. Furthermore, the overnight interest rates are on the higher end compared to industry averages, which could deter long-term traders. Overall, while Ctin offers a variety of trading instruments, the cost structure may not be as competitive as it seems, raising questions about whether Ctin is safe for all trading styles.

Client Fund Safety

The safety of client funds is paramount when assessing any trading platform. Ctin claims to implement robust security measures to protect client funds, including segregated accounts and adherence to regulatory guidelines set forth by ASIC. Segregating client funds means that traders' money is held in separate accounts from the broker's operational funds, reducing the risk of loss in the event of financial difficulties faced by the broker.

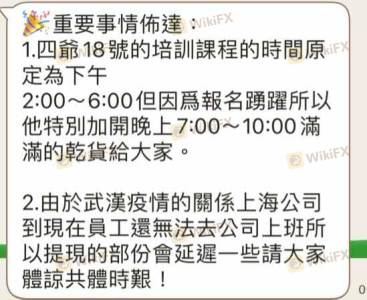

Despite these claims, there have been no significant disclosures regarding the effectiveness of these measures. Moreover, it is crucial to evaluate whether Ctin offers any investor protection schemes, such as negative balance protection, which ensures that clients cannot lose more than their deposited funds. The absence of such protections could be a significant risk factor for traders. Historical complaints regarding fund withdrawal issues also raise concerns about the broker's reliability. If traders encounter problems when attempting to withdraw their funds, it could indicate deeper issues with the broker's financial stability. Therefore, while Ctin claims to prioritize client fund safety, potential traders should remain cautious and consider whether Ctin is safe for their investments.

Customer Experience and Complaints

Customer feedback is a valuable resource when evaluating the trustworthiness of a trading platform. Reviews of Ctin reveal a mix of positive and negative experiences. While some users report satisfactory trading conditions and responsive customer service, others have expressed concerns regarding withdrawal issues and lack of transparency.

The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Minimal information |

| Customer Service Issues | Low | Generally responsive |

One notable case involved a trader who reported significant delays in withdrawing funds, leading to frustration and distrust toward the platform. While Ctin's customer service team eventually addressed the issue, the delay raised concerns about the brokers operational efficiency and commitment to client satisfaction. Overall, while some traders have had positive experiences, the recurring complaints about withdrawal issues suggest that potential users should carefully consider whether Ctin is safe for their trading needs.

Platform and Execution

The performance of a trading platform is a critical factor in determining whether a broker is trustworthy. Ctin offers several trading platforms, including a proprietary web-based application and mobile trading options. However, user reviews indicate that the platform may suffer from occasional stability issues, which can impact trading execution.

Traders have reported instances of slippage and rejected orders, which can be detrimental, especially during volatile market conditions. These issues raise concerns about the broker's ability to provide a reliable trading environment. Furthermore, any signs of platform manipulation, such as frequent rejections of profitable trades, could indicate an unethical approach to trading. Traders should be cautious and consider whether Ctin is safe for executing their trading strategies.

Risk Assessment

Assessing the risks associated with using Ctin is essential for any trader. While the broker is regulated by ASIC, the presence of complaints, mixed reviews, and concerns about transparency suggest that there are several risks to consider.

The following risk assessment table summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Potential issues with clone status |

| Fund Safety | High | Concerns over withdrawal issues |

| Customer Support | Medium | Mixed feedback on responsiveness |

Given these risks, traders should approach Ctin with caution. It is advisable to start with a small deposit and monitor the trading experience closely before committing more significant funds. Additionally, traders should remain vigilant for any signs of malpractice or operational inefficiencies that may arise.

Conclusion and Recommendations

In conclusion, while Ctin presents itself as a legitimate trading platform, several factors raise concerns about its overall safety. The regulatory status with ASIC provides a level of credibility; however, the warnings about potential clone status and the mixed customer feedback suggest that traders should exercise caution.

For those considering trading with Ctin, it is essential to conduct thorough research, start with a small investment, and remain vigilant regarding any operational issues. If you have significant capital to invest or are new to trading, it may be wise to explore alternative brokers that have a more established reputation and fewer red flags. Some recommended alternatives include brokers with strong regulatory backgrounds and positive customer feedback, such as FP Markets or Pepperstone.

Ultimately, the question of whether Ctin is safe remains complex, and traders should weigh the potential risks against the broker's offerings before making a decision.

Is CTIN a scam, or is it legit?

The latest exposure and evaluation content of CTIN brokers.

CTIN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CTIN latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.