Regarding the legitimacy of IX Securities forex brokers, it provides SCB and WikiBit, (also has a graphic survey regarding security).

Is IX Securities safe?

Business

License

Is IX Securities markets regulated?

The regulatory license is the strongest proof.

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IX Capital Group Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

201 Church Street, Sandyport, West Bay StreetPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

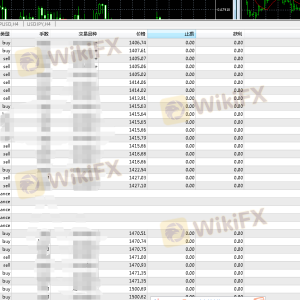

Is IX Securities Safe or Scam?

Introduction

IX Securities positions itself as a player in the forex market, offering various trading services and instruments to its clients. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is notorious for its lack of regulation and the potential for scams, making it imperative for traders to assess the legitimacy and safety of brokers like IX Securities. This article aims to provide a comprehensive evaluation of IX Securities, utilizing various sources and criteria to determine whether it is safe or a potential scam.

Our investigation method involves analyzing the broker's regulatory status, company background, trading conditions, client fund safety measures, customer experiences, and platform performance. By synthesizing this information, we aim to offer a balanced view of IX Securities, helping traders make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant indicators of its legitimacy. IX Securities claims to be registered with the Securities Commission of the Bahamas (SCB). However, the quality of this regulation is often questioned. The SCB is considered a low-tier regulator compared to its counterparts in Europe and North America, which raises concerns about the level of investor protection offered.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities Commission of the Bahamas | SIA-F-188 | Bahamas | Suspicious Clone |

Despite having a license, the lack of stringent oversight from the SCB means that IX Securities may not provide the same level of security and recourse as brokers regulated by more reputable authorities. Historical compliance issues have also been noted, with reports suggesting that IX Securities operates with a lack of transparency, which is concerning for potential clients.

Company Background Investigation

IX Securities operates under the name of IX Capital Group Limited, which has a somewhat opaque corporate structure. The company's history dates back several years, but details about its ownership and management team are not readily available. This lack of transparency can be a red flag for traders, as it raises questions about the accountability of the management team.

The management's professional experience is also unclear, which can be a significant factor in assessing the broker's reliability. A transparent company usually provides detailed information about its executives and their qualifications. The absence of such information can lead to skepticism about the broker's operational integrity.

Trading Conditions Analysis

When evaluating whether IX Securities is safe, one must consider the trading conditions it offers. The broker claims to provide competitive spreads and leverage options. However, there are indications that the fee structure may not be as favorable as advertised.

| Fee Type | IX Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.0 pips (claimed) | 1.0-1.5 pips |

| Commission Model | Not specified | Varies (typically $5-10 per lot) |

| Overnight Interest Range | Not disclosed | Varies |

The advertised spreads of 0.0 pips may not be realistic, as several user reviews have reported spreads significantly higher during trading hours. Additionally, the lack of clarity regarding commissions and overnight fees could lead to unexpected costs for traders, further complicating the evaluation of the brokers overall trading conditions.

Client Fund Safety

The safety of client funds is paramount in evaluating whether IX Securities is safe. The broker states that it employs various measures to safeguard client deposits, including fund segregation. However, the effectiveness of these measures is questionable given the lack of robust regulatory oversight.

Moreover, there are no investor protection schemes in place, which means that clients may have little recourse in the event of fraud or bankruptcy. Historical complaints about fund withdrawals and the handling of client money have surfaced, indicating potential issues with the broker's financial practices. This raises significant concerns about the safety of funds deposited with IX Securities.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. Many users have reported negative experiences with IX Securities, particularly regarding withdrawal processes and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Slippage Reports | Medium | Inconsistent |

| Account Accessibility | High | Unresponsive |

Common complaints include difficulties in withdrawing funds, unexpected slippage during trades, and a lack of communication from customer support. These issues not only highlight potential operational weaknesses but also contribute to the growing sentiment that IX Securities may not be a trustworthy broker.

Platform and Trade Execution

The trading platform offered by IX Securities is primarily MetaTrader 4 (MT4), a widely used platform known for its reliability. However, user experiences suggest that the execution quality may not meet industry standards. Reports of slippage and rejected orders have been common, which can significantly impact trading performance.

The platform's stability and execution speed are critical for traders, especially in the volatile forex market. Any indication of manipulation or inconsistent execution can be a serious concern for potential clients. Therefore, traders should approach IX Securities with caution regarding platform performance.

Risk Assessment

Using IX Securities presents several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Low-tier regulation with minimal investor protection. |

| Financial Risk | High | Historical issues with fund withdrawals and management practices. |

| Operational Risk | Medium | Complaints regarding platform execution and customer service. |

To mitigate these risks, traders are advised to start with minimal deposits, thoroughly read the terms and conditions, and consider using alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, while IX Securities presents itself as a legitimate forex broker, numerous red flags suggest that it may not be entirely safe. The lack of robust regulatory oversight, transparency in company operations, and numerous customer complaints all contribute to a cautious outlook on this broker.

For traders seeking a reliable trading experience, it is advisable to consider alternatives that are regulated by top-tier authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com may offer safer options for those looking to trade in the forex market.

Ultimately, the question remains: Is IX Securities safe? Based on the evidence presented, it is prudent for potential clients to exercise caution and conduct further research before engaging with this broker.

Is IX Securities a scam, or is it legit?

The latest exposure and evaluation content of IX Securities brokers.

IX Securities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IX Securities latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.