Is ITE GLOBAL safe?

Business

License

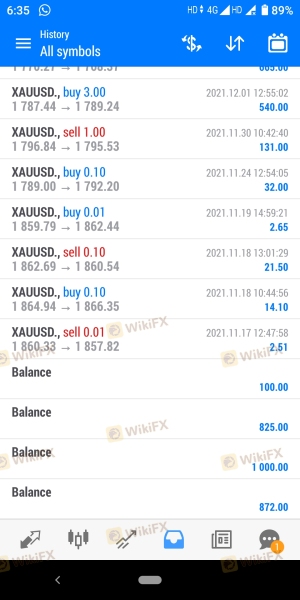

Is ITE Global Safe or a Scam?

Introduction

ITE Global Limited has emerged as a player in the forex market, promoting itself as a platform for trading various financial instruments, including forex, cryptocurrencies, and CFDs. As the online trading landscape grows, the importance of evaluating the legitimacy and safety of brokers becomes paramount for traders. Many individuals have fallen victim to scams, leading to significant financial losses, making it essential to scrutinize the regulatory status, operational practices, and customer feedback associated with ITE Global.

This article aims to provide a comprehensive analysis of ITE Global's credibility by examining its regulatory framework, company background, trading conditions, customer fund safety, user experiences, and overall risk assessment. The evaluation is based on data collected from various sources, including broker reviews, regulatory databases, and user testimonials.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and safety for traders. ITE Global claims to operate under the supervision of the British government, yet it lacks a clear regulatory endorsement from recognized authorities such as the Financial Conduct Authority (FCA) in the UK. The absence of a valid regulatory license raises significant concerns about the broker's operational integrity and accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of regulatory oversight means that traders engaging with ITE Global do so without the protections typically afforded by regulated brokers. This situation is alarming, as it exposes traders to potential risks such as fraudulent practices, mismanagement of funds, and unregulated trading environments. The historical compliance record of ITE Global is also questionable, given the absence of any verified regulatory history. Therefore, the question of "Is ITE Global safe?" remains largely unanswered, leaning towards a negative assessment.

Company Background Investigation

ITE Global Limited's company history and ownership structure are vital in assessing its credibility. Founded in March 2022, the broker is relatively new in the online trading space. However, the lack of transparency regarding its ownership and corporate structure raises red flags. Information about the management team and their professional backgrounds is scarce, which further complicates efforts to evaluate the broker's reliability.

The company's website provides limited information, and there are no clear contact details or physical addresses associated with the broker, leading to suspicions about its operational legitimacy. Transparency is a critical factor in building trust with clients; thus, the opaque nature of ITE Global's operations is concerning. The absence of detailed disclosures on key aspects such as ownership and management experience raises further doubts about whether "ITE Global is safe."

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. ITE Global presents a competitive trading environment with a low minimum deposit and high leverage options. However, the broker's fee structure warrants scrutiny. Traders have reported various fees that may not be clearly communicated upfront, including withdrawal fees and hidden charges, which can significantly impact overall profitability.

| Fee Type | ITE Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.0 pips |

| Commission Model | None (Standard) | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by ITE Global may appear attractive, the lack of clarity regarding commissions and additional fees can lead to unexpected costs for traders. This ambiguity further contributes to the question of "Is ITE Global safe?" as it indicates a potential for exploitative practices that could harm traders financially.

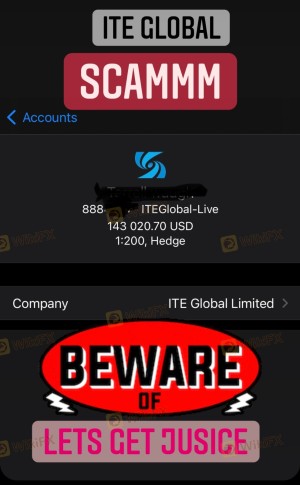

Client Fund Safety

The safety of client funds is a primary concern for any trader. ITE Global's policies regarding fund safety, such as fund segregation and negative balance protection, are crucial in determining whether it is a safe trading environment. Unfortunately, there is limited information available regarding ITE Global's fund security measures. The absence of clear policies on fund segregation and investor protection raises serious concerns about the safety of traders' investments.

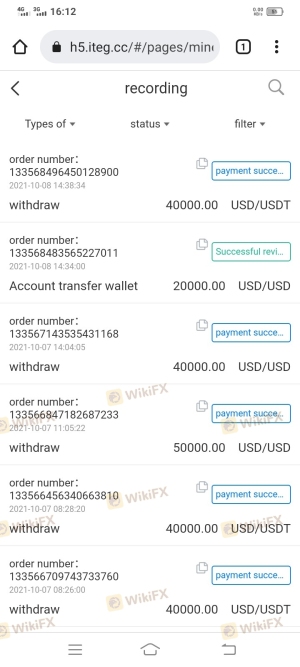

Moreover, there have been reports of difficulties in withdrawing funds, which is a common issue associated with unregulated brokers. Such incidents can lead to significant financial distress for traders and further question the broker's integrity. The lack of a robust framework for safeguarding client funds indicates that traders must exercise extreme caution when considering whether "ITE Global is safe."

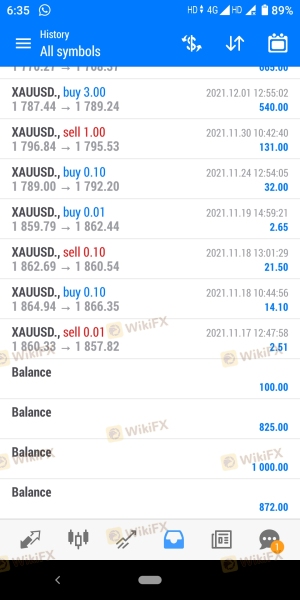

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operational practices and reliability. Reviews of ITE Global reveal a pattern of complaints regarding withdrawal issues, lack of transparency, and poor customer support. Many users have reported difficulties in accessing their funds and have expressed frustration over the broker's unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inconsistent |

| Customer Support Quality | High | Unresponsive |

Several case studies illustrate these concerns, with users describing experiences where their withdrawal requests were met with delays or outright denials. These complaints underscore a significant risk associated with trading through ITE Global, raising the question of whether "ITE Global is a scam" rather than a legitimate trading platform.

Platform and Trade Execution

Evaluating the trading platform's performance is crucial for assessing a broker's overall quality. ITE Global offers a proprietary trading platform, which may not have the same level of reliability and user experience as more established platforms like MetaTrader 4 or 5. User reviews suggest that the platform can be prone to technical issues, including slippage and order rejections, which can significantly impact trading outcomes.

The quality of order execution is also a concern, with reports of delays and inconsistencies in trade fulfillment. Such issues can lead to losses, especially in volatile market conditions, further questioning the broker's reliability. The potential for platform manipulation adds another layer of risk, making it imperative for traders to consider whether "ITE Global is safe."

Risk Assessment

Using ITE Global carries inherent risks that traders must understand before engaging with the platform. The absence of regulatory oversight, combined with the lack of transparency and numerous customer complaints, paints a concerning picture of the broker's operational integrity.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Fund Safety Risk | High | Lack of clear fund protection measures. |

| Customer Service Risk | Medium | Poor response to customer complaints. |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with small investments, and be prepared for potential difficulties in withdrawing funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that ITE Global poses significant risks to traders, and the question "Is ITE Global safe?" leans towards a negative assessment. The broker's lack of regulatory oversight, transparency issues, and numerous customer complaints raise serious concerns about its legitimacy.

For traders seeking a reliable trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide more robust investor protection and a transparent trading experience.

In light of the available information, potential users should exercise extreme caution and thoroughly evaluate their options before engaging with ITE Global.

Is ITE GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of ITE GLOBAL brokers.

ITE GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ITE GLOBAL latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.