ITE Global 2025 Review: Everything You Need to Know

Executive Summary

ITE Global presents itself as a new forex broker. This ite global review examines a broker that emerged in the forex market with modern trading platforms but faces scrutiny over regulatory clarity and customer service quality.

The broker offers MT5 and MT Mobile trading platforms. Based in Miami, Florida, ITE Global claims registration in the United States, though regulatory oversight details remain unclear. The company appears to target traders seeking contemporary market platforms. Those prioritizing regulatory transparency and proven customer service should proceed with caution.

ITE Global has received 21 complaints from users. The broker's website operates at slower speeds than industry standards, which may impact user experience. While the platform selection shows promise for modern trading requirements, the lack of comprehensive regulatory information and limited positive user testimonials suggest traders should thoroughly research before committing funds. This evaluation reveals a broker with mixed credentials - offering modern trading technology but lacking the regulatory transparency and customer service reputation that experienced traders typically seek.

Important Notice

This ite global review is based on publicly available information and user feedback. ITE Global claims registration in the United States but regulatory oversight details remain unclear in available documentation. The broker's actual regulatory status may differ from publicly stated information.

Our assessment methodology relies on available data sources, user reviews, and publicly accessible company information. Given the limited comprehensive data available about ITE Global's operations, some aspects of this review may reflect information gaps rather than definitive broker characteristics. Traders should conduct independent verification of regulatory status and service quality before making trading decisions.

Rating Framework

Broker Overview

ITE Global LLC emerged in the forex trading landscape in March 2022. The broker positions itself as a provider of online financial trading services, focusing primarily on forex market access through modern trading platforms. Despite its recent establishment, ITE Global attempts to serve traders seeking contemporary trading technology solutions.

The company's business model centers on providing retail forex trading services. Comprehensive details about its operational scope remain limited in publicly available information. ITE Global's relatively short operational history means that long-term performance data and established market reputation are still developing. The broker's emergence during a period of increased retail trading interest suggests an attempt to capture market share in the competitive online trading sector.

ITE Global's platform offerings include MT5 and MT Mobile. This indicates a focus on providing traders with established, widely-recognized trading technology. The broker's choice to utilize MetaTrader platforms suggests an understanding of trader preferences for familiar, feature-rich trading environments. However, specific information about asset classes, trading instruments, and detailed service offerings remains limited in available documentation.

The company's stated registration in the United States, combined with potential FCA oversight mentions, creates some uncertainty about its precise regulatory framework and operational jurisdiction.

Regulatory Status: ITE Global claims registration in the United States with potential FCA oversight mentioned in some sources. Specific regulatory authority information and license numbers are not clearly documented in available materials.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: The broker's minimum deposit requirements for account opening and trading are not specified in accessible documentation.

Bonuses and Promotions: Available information does not include details about promotional offers, welcome bonuses, or ongoing trading incentives.

Tradeable Assets: Specific asset classes, currency pairs, and trading instruments offered by ITE Global are not comprehensively detailed in current sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available documentation.

Leverage Ratios: Maximum leverage ratios and margin requirements for different account types and instruments are not specified in accessible sources.

Platform Options: ITE Global provides MT5 and MT Mobile trading platforms. This offers traders access to established MetaTrader technology for market analysis and trade execution.

Geographic Restrictions: Specific information about countries or regions where ITE Global services are restricted or unavailable is not detailed in current sources.

Customer Support Languages: Available documentation does not specify the languages supported by ITE Global's customer service team.

This ite global review highlights significant information gaps that potential traders should address through direct broker contact before making trading decisions.

Account Conditions Analysis

The account conditions offered by ITE Global remain largely undocumented in publicly available sources. This creates uncertainty for potential traders evaluating the broker's suitability. Without specific information about account types, tier structures, or associated benefits, traders cannot make informed comparisons with other market participants. This lack of transparency regarding account offerings represents a significant limitation for those seeking detailed broker evaluation.

Account opening procedures, verification requirements, and documentation needs are not clearly outlined in available materials. The absence of detailed account condition information makes it difficult to assess whether ITE Global caters to different trader segments, such as beginners, experienced traders, or institutional clients. Standard industry features like Islamic accounts, demo account availability, or specialized trading conditions remain unspecified.

Minimum deposit requirements, which significantly influence broker accessibility, are not disclosed in current documentation. This information gap prevents potential clients from understanding the financial commitment required to begin trading with ITE Global. Similarly, account maintenance fees, inactivity charges, or other account-related costs that could impact trading profitability are not detailed.

The broker's approach to account management, including features like negative balance protection, margin call procedures, or stop-out levels, lacks documentation in available sources. These critical trading safeguards are essential considerations for risk management but remain unclear in this ite global review due to limited available information about the broker's specific account policies and procedures.

ITE Global's trading infrastructure centers around MetaTrader 5 and MT Mobile platforms. This provides traders with access to industry-standard trading technology. The MT5 platform offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. This platform choice demonstrates the broker's commitment to providing familiar, professional-grade trading environments that experienced traders expect.

However, detailed information about additional trading tools, research resources, or educational materials remains limited in available documentation. Many competitive brokers supplement platform offerings with proprietary analysis tools, market research, economic calendars, or trading calculators, but ITE Global's additional resource portfolio is not clearly documented. This represents a potential limitation for traders seeking comprehensive trading support beyond basic platform functionality.

The availability of mobile trading through MT Mobile addresses the growing demand for on-the-go trading capabilities. Mobile platform functionality typically includes real-time quotes, chart analysis, and trade execution features, though specific mobile app capabilities and user experience details are not extensively documented in current sources.

Educational resources, which are increasingly important for broker differentiation and trader development, are not detailed in available information about ITE Global's offerings. Many traders value access to webinars, trading guides, market analysis, or educational video content, but the broker's commitment to trader education remains unclear. The absence of documented research and analysis resources may limit the broker's appeal to traders who rely on broker-provided market insights for trading decisions.

Customer Service and Support Analysis

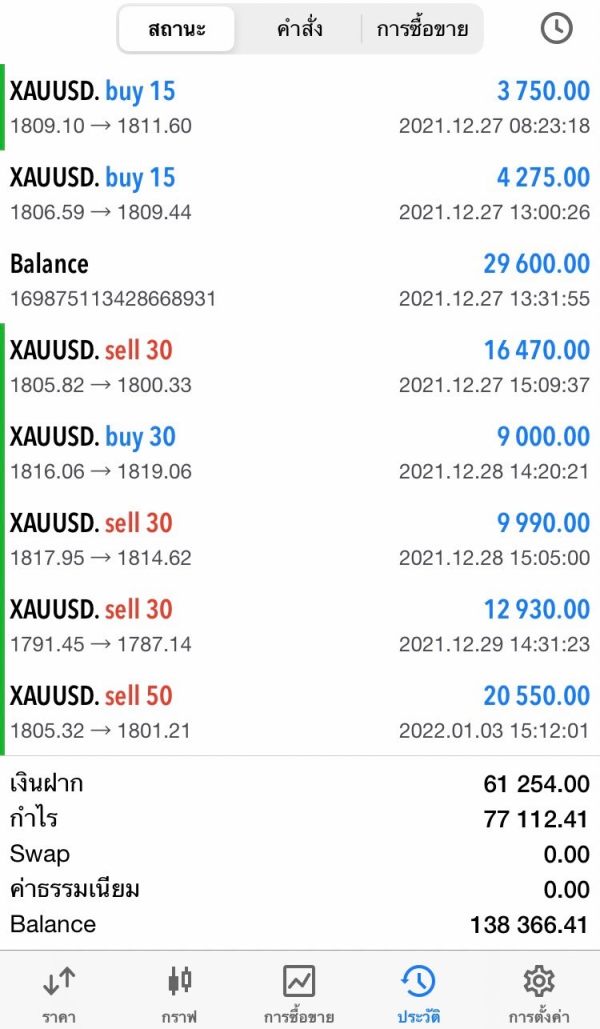

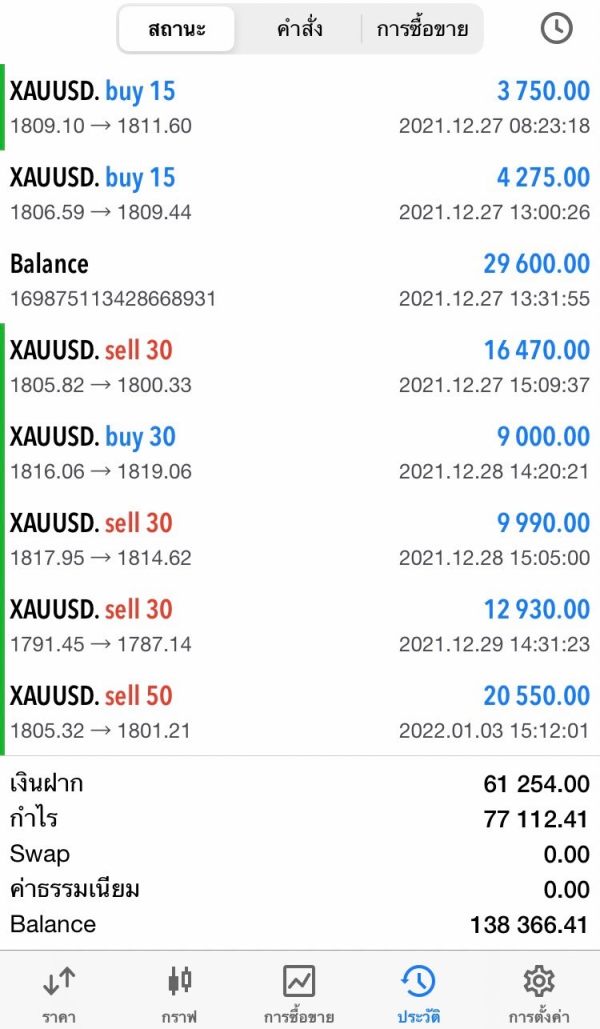

Customer service quality represents a significant concern for ITE Global. Available data indicates 21 recorded complaints against the broker. This complaint volume, particularly for a relatively new broker, suggests potential systemic issues with service delivery or customer satisfaction management. The nature and resolution status of these complaints are not detailed in available sources, but their existence warrants careful consideration by potential clients.

Response times, support channel availability, and service quality metrics are not comprehensively documented in accessible information about ITE Global's customer service operations. Standard industry practices include multiple contact methods such as live chat, email support, and telephone assistance, but the broker's specific support infrastructure and availability hours remain unclear in current documentation.

Multilingual support capabilities, which are increasingly important for international broker operations, are not specified in available materials. The broker's ability to serve clients in different languages and time zones could significantly impact service quality for its target market, but this information gap prevents accurate assessment of support accessibility.

Problem resolution procedures, escalation processes, and customer satisfaction monitoring systems are not documented in available sources. These operational aspects significantly influence overall service quality and client retention, but ITE Global's approach to customer relationship management remains unclear. The recorded complaints suggest that service quality improvements may be necessary to meet competitive industry standards and build positive client relationships.

Trading Experience Analysis

The trading experience with ITE Global faces immediate challenges due to reported website speed issues. This can negatively impact platform access and overall user experience. Slow website performance may indicate underlying technical infrastructure limitations that could extend to trading platform performance during critical market periods. This technical concern requires attention, as traders depend on reliable, fast platform access for effective trade execution.

Order execution quality, slippage rates, and trade fulfillment speed are not detailed in available documentation about ITE Global's trading environment. These factors critically influence trading profitability and user satisfaction, particularly for active traders or those employing time-sensitive trading strategies. The absence of execution quality data makes it difficult to assess the broker's competitiveness in trade processing.

Platform stability during volatile market conditions, server uptime statistics, and technical performance metrics are not provided in current sources. Reliable platform performance during high-volume trading periods is essential for trader confidence, but ITE Global's technical infrastructure capabilities remain undocumented. The combination of website speed issues and limited technical performance data raises questions about overall system reliability.

The MT Mobile platform provides trading accessibility for mobile users. However, specific mobile trading experience details, including app performance, feature completeness, and user interface quality, are not extensively documented. Mobile trading functionality has become increasingly important for modern traders, but the actual user experience quality with ITE Global's mobile solutions requires further investigation. This ite global review identifies trading experience as an area requiring significant improvement and transparency.

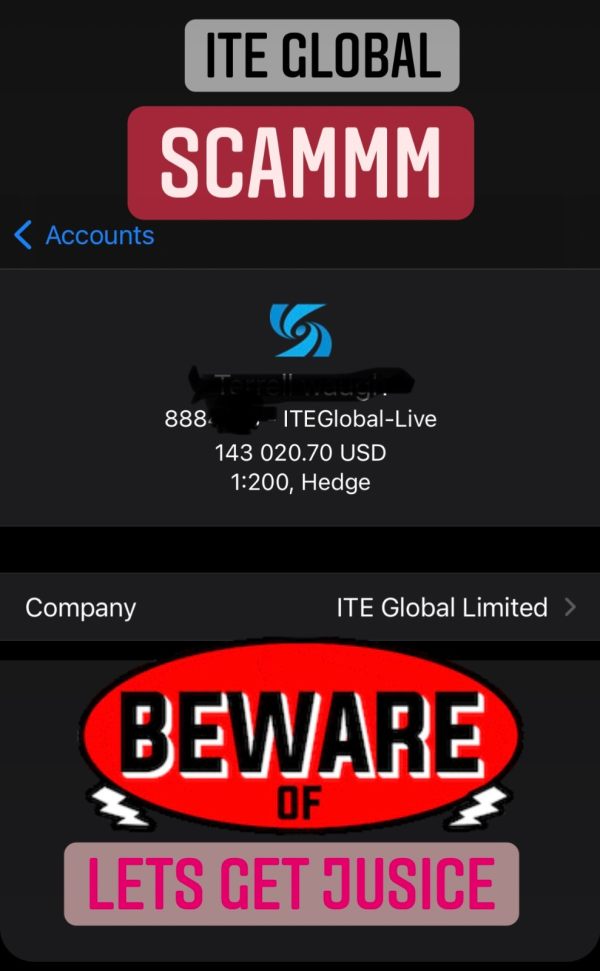

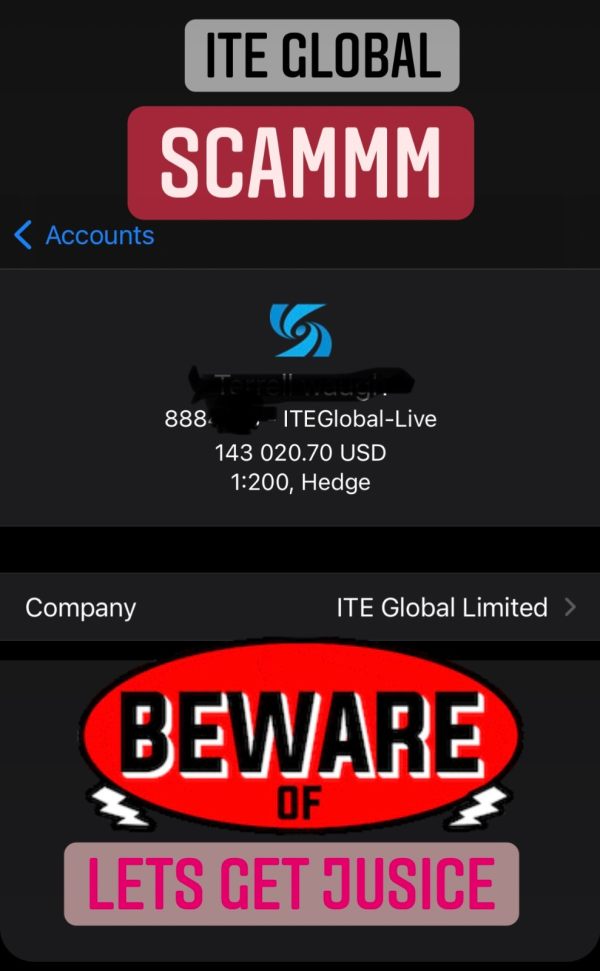

Trust and Regulation Analysis

ITE Global's regulatory status presents significant transparency concerns that directly impact trader confidence and fund security. While the broker claims registration in the United States and mentions potential FCA oversight, specific regulatory license numbers, supervisory authority details, and compliance documentation are not clearly provided in available sources. This regulatory ambiguity represents a major consideration for traders prioritizing fund safety and regulatory protection.

Client fund segregation policies, deposit protection schemes, and financial safeguards are not detailed in accessible documentation. These protective measures are fundamental to broker trustworthiness, as they ensure client funds remain separate from company operational funds and provide security in case of broker financial difficulties. The absence of clear fund protection information raises important questions about client asset security.

Company financial transparency, including audited financial statements, capital adequacy reports, or third-party financial assessments, is not available in current sources. Broker financial stability directly impacts client fund security and service continuity, but ITE Global's financial standing and transparency remain unclear. This information gap prevents thorough assessment of the broker's long-term viability and financial reliability.

Industry reputation, regulatory compliance history, and any regulatory actions or warnings are not documented in available materials. The broker's relatively recent establishment means limited regulatory track record, but the absence of clear regulatory standing and compliance information significantly impacts trustworthiness assessment. The combination of unclear regulatory status and limited compliance transparency suggests that traders should exercise particular caution when considering ITE Global for trading activities.

User Experience Analysis

User satisfaction with ITE Global appears problematic based on available feedback. Multiple complaints indicate service quality concerns that impact overall user experience. The recorded complaints suggest systemic issues that may affect various aspects of the trading relationship, from account management to customer service interactions. This negative feedback pattern requires serious consideration by potential clients evaluating the broker's suitability.

Website performance issues, including reported slow loading times, directly impact user experience and may indicate broader technical infrastructure limitations. Modern traders expect fast, responsive web interfaces that support efficient account management and platform access. The documented speed issues suggest that ITE Global's technical infrastructure may not meet contemporary user expectations for digital service delivery.

Account registration and verification processes are not detailed in available documentation. This prevents assessment of onboarding experience quality. Smooth, efficient account opening procedures significantly influence initial user impressions and overall satisfaction. The absence of detailed information about these critical user journey elements makes it difficult to evaluate the broker's commitment to user experience optimization.

User interface design, platform navigation ease, and overall service accessibility are not comprehensively documented in current sources. These factors significantly influence daily trading experience and user satisfaction, but ITE Global's approach to user experience design remains unclear. The combination of negative user feedback, technical performance issues, and limited documentation about user experience improvements suggests that significant enhancements may be necessary to meet competitive industry standards and build positive client relationships.

Conclusion

ITE Global emerges as a forex broker with mixed credentials that require careful evaluation by potential traders. While the broker offers modern trading platforms through MT5 and MT Mobile, significant concerns about regulatory transparency, customer service quality, and technical performance limit its overall appeal. The 21 recorded complaints and website speed issues indicate operational challenges that may impact trader satisfaction and service reliability.

This broker may suit traders specifically seeking MetaTrader platform access and willing to accept regulatory uncertainty in exchange for potentially competitive trading conditions. However, traders prioritizing regulatory transparency, proven customer service quality, and established broker reputation should consider more established alternatives. The limited available information about account conditions, costs, and service details further complicates informed decision-making.

The primary advantages include access to industry-standard trading platforms and a focus on modern trading technology. However, significant disadvantages include unclear regulatory status, documented customer service issues, technical performance concerns, and limited transparency about trading conditions and company operations. Potential clients should conduct thorough independent research and consider starting with minimal deposits if choosing to proceed with ITE Global.