Is ipcforex safe?

Business

License

Is IPCForex Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, IPCForex has emerged as a notable player, attracting attention from both novice and experienced traders. However, as with any financial service, it is crucial for investors to conduct thorough due diligence before engaging with a broker. The need for caution is amplified by the prevalence of scams and fraudulent activities in the online trading space. This article aims to objectively assess whether IPCForex is a safe trading platform or a potential scam. Our investigation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

A broker's regulatory status is paramount in determining its legitimacy and trustworthiness. IPCForex is reportedly unregulated, which raises significant red flags for potential investors. The absence of oversight from recognized financial authorities indicates a lack of accountability and consumer protection. Below is a table summarizing the regulatory information for IPCForex:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight means that IPCForex does not adhere to the stringent requirements set by reputable authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This situation puts traders at risk, as they have no recourse in the event of disputes or financial losses. Furthermore, numerous warnings have been issued against IPCForex by various regulatory bodies, indicating a history of non-compliance and potentially deceptive practices.

Company Background Investigation

IPCForex, also known as International Pacific Capital Limited, presents itself as a forex trading platform. However, its history and ownership structure raise concerns. The company claims to have been operational since 2021, yet there is little verifiable information regarding its founders or management team. The lack of transparency regarding the company's ownership and operational history casts doubt on its credibility.

Moreover, the company's website has faced several outages, which further complicates the ability to gather reliable information. Reports indicate that IPCForex has engaged in questionable practices, including the potential misuse of regulatory claims and operating without valid licenses. Such behavior is indicative of a company that may not prioritize the security and interests of its clients.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. IPCForex has been criticized for its opaque fee structure and potential hidden costs. Below is a comparison of IPCForex's core trading costs against industry averages:

| Fee Type | IPCForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The absence of clear information regarding spreads and commissions raises concerns about the overall cost of trading with IPCForex. Traders may encounter unexpected fees that could significantly impact their profitability. Additionally, the lack of transparency in overnight interest rates could lead to further financial surprises for traders. These factors contribute to the overall uncertainty surrounding IPCForex's trading conditions.

Client Fund Safety

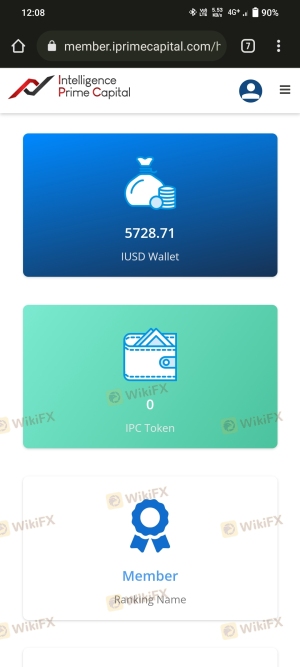

The safety of client funds is a critical consideration for any trading platform. IPCForex's lack of regulatory oversight implies that it may not have adequate measures in place to protect client deposits. A thorough analysis of IPCForex's fund safety measures reveals potential vulnerabilities.

Without proper segregation of client funds, traders face the risk of losing their investments in the event of the company's insolvency. Furthermore, IPCForex has not provided clear information regarding investor protection or negative balance protection policies, which are essential for safeguarding client interests. Historical complaints about fund withdrawal issues further underscore the concerns surrounding IPCForex's commitment to client fund safety.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. A review of user experiences with IPCForex reveals a pattern of dissatisfaction and frustration. Common complaints include issues with fund withdrawals, lack of responsive customer support, and difficulties in accessing trading accounts. Below is a summary of the major complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Unresponsive |

| Account Accessibility | High | Poor |

Many users have reported delays in processing withdrawal requests, often citing unavailability of funds or lack of communication from the broker. These issues raise serious concerns about IPCForex's operational integrity and its commitment to providing a satisfactory trading experience.

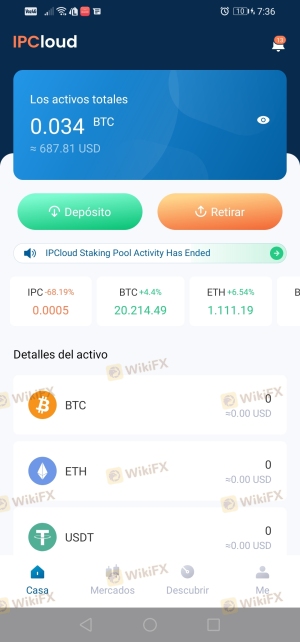

Platform and Trade Execution

The performance of a trading platform is crucial for successful trading. IPCForex claims to offer a standard trading platform; however, user reviews indicate problems with stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Furthermore, any signs of platform manipulation, such as artificial widening of spreads or freezing of trading platforms, are serious red flags. The lack of transparency regarding how trades are executed raises concerns about the fairness and integrity of IPCForex's trading environment.

Risk Assessment

Investing with IPCForex carries inherent risks, primarily due to its unregulated status and questionable operational practices. Below is a risk assessment summarizing the key risk areas associated with IPCForex:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Financial Risk | High | Potential for fund loss due to mismanagement. |

| Operational Risk | Medium | Issues with platform stability and execution. |

To mitigate these risks, potential traders should consider conducting thorough research before engaging with IPCForex. It is advisable to seek out regulated brokers that offer robust consumer protections and transparent operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that IPCForex presents several warning signs that indicate it may not be a safe trading platform. The lack of regulatory oversight, combined with a history of customer complaints and operational issues, raises significant concerns about its legitimacy.

For traders considering IPCForex, it is essential to exercise caution and conduct thorough research. If you are seeking a reliable trading platform, consider exploring regulated alternatives that prioritize client safety and transparency. Ultimately, the decision to engage with IPCForex should be made with a clear understanding of the associated risks and potential consequences.

In summary, is IPCForex safe? The overwhelming evidence points to the conclusion that it is not, and potential investors should proceed with extreme caution.

Is ipcforex a scam, or is it legit?

The latest exposure and evaluation content of ipcforex brokers.

ipcforex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ipcforex latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.