Is FOREX BLEND safe?

Pros

Cons

Is Forex Blend A Scam?

Introduction

Forex Blend is a forex brokerage that has been gaining attention in the trading community. Positioned as a platform for retail traders seeking to enter the foreign exchange market, it claims to offer a range of trading tools and resources. However, as with any financial service, it is crucial for traders to exercise caution when selecting a broker. The forex market is notorious for its lack of regulation, and many traders have fallen victim to fraudulent brokers. Therefore, it is essential to conduct thorough research and due diligence before investing any capital. This article aims to evaluate Forex Blend's credibility through an investigation of its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

One of the primary factors to consider when assessing the safety of any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices designed to protect client funds. Upon examining Forex Blend, it becomes evident that it operates without any regulatory oversight, which raises significant concerns regarding its legitimacy and trustworthiness.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory body overseeing Forex Blend is a major red flag. Without regulation, traders have limited recourse in the event of disputes or fraudulent activities. Furthermore, unregulated brokers often lack transparency, making it difficult for traders to verify their legitimacy. The lack of oversight also means that Forex Blend is not obligated to adhere to strict financial reporting or operational standards, increasing the risk for traders.

Company Background Investigation

Forex Blend's company history and ownership structure provide additional insights into its credibility. Unfortunately, detailed information about the company's origins, development, and management team is scarce. This lack of transparency can be alarming for potential investors, as it is crucial to understand who is behind the brokerage and what their qualifications are.

The absence of a clear ownership structure and the lack of information about the management team raises questions about the broker's accountability. A reputable brokerage typically provides detailed information about its founders and management, along with their professional backgrounds. In Forex Blend's case, the opacity surrounding its leadership may suggest that the company is not committed to fostering trust and reliability in its operations.

Trading Conditions Analysis

The trading conditions offered by Forex Blend are another critical aspect to evaluate. A transparent fee structure is essential for traders to understand the costs associated with their trades. Upon reviewing Forex Blend's trading conditions, it appears that the broker employs a commission-free model, but this may come with hidden fees or unfavorable trading terms.

| Fee Type | Forex Blend | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | $5 per trade |

| Overnight Interest Range | High | Low to Moderate |

The spread for major currency pairs can vary significantly, which may not be favorable for traders, especially during volatile market conditions. Additionally, the lack of a clear commission structure could result in unexpected costs that traders may not be prepared for. Traders should be cautious of brokers that advertise low or no commissions, as these can often be offset by wider spreads or other hidden fees.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Forex Blend's approach to safeguarding client funds is a crucial aspect to consider. A reputable broker typically holds client funds in segregated accounts, ensuring that they are kept separate from the broker's operational funds. This practice protects traders' money in the event of the broker's insolvency.

However, without regulatory oversight, it is unclear how Forex Blend manages client funds or whether it implements adequate security measures. The absence of information regarding fund segregation, investor protection policies, and negative balance protection is concerning. Traders should be aware that, should any issues arise, they may have limited options for recovering their funds.

Customer Experience and Complaints

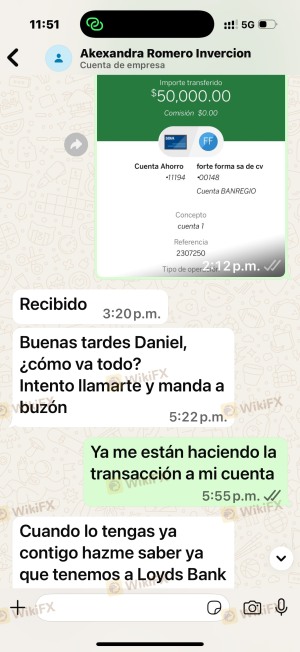

Customer feedback is an essential indicator of a broker's reliability and service quality. Reviews and complaints about Forex Blend have surfaced across various platforms, revealing a pattern of negative experiences among traders. Common complaints include difficulties in withdrawing funds, poor customer service, and lack of transparency regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Fee Transparency | High | Unresponsive |

Many users have reported prolonged delays when attempting to withdraw their funds, which is a significant concern for any trader. In some cases, traders have claimed that their requests were ignored or met with vague responses, further exacerbating their frustrations. These complaints highlight the importance of considering user experiences when evaluating a broker's trustworthiness.

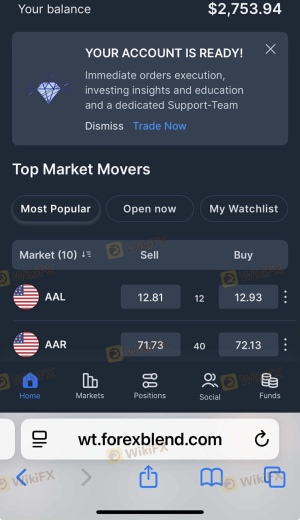

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders. Forex Blend's platform should ideally provide seamless execution, minimal slippage, and a user-friendly interface. However, there are indications that traders may experience issues with order execution, including high slippage rates and occasional rejections of orders.

An unreliable trading platform can lead to significant financial losses, especially in the fast-paced forex market. Traders should be cautious if they notice consistent execution problems, as this may suggest underlying issues with the broker's technology or practices.

Risk Assessment

Engaging with Forex Blend presents several risks that traders should carefully consider. The absence of regulation, lack of transparency, and negative customer feedback collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight |

| Fund Security Risk | High | Unclear safeguards |

| Execution Risk | Medium | Possible slippage |

To mitigate these risks, traders should conduct thorough research before engaging with Forex Blend. Seeking out well-regulated brokers with transparent practices can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the legitimacy and safety of Forex Blend. The lack of regulation, transparency issues, and negative customer experiences suggest that traders should exercise extreme caution when considering this broker. While Forex Blend may offer appealing features, the associated risks may outweigh the potential benefits.

For traders seeking a safer forex trading experience, it is advisable to consider regulated alternatives. Brokers with established reputations and strong regulatory oversight can offer greater security and peace of mind. Always prioritize due diligence and ensure that your chosen broker aligns with your trading goals and risk tolerance.

Is FOREX BLEND a scam, or is it legit?

The latest exposure and evaluation content of FOREX BLEND brokers.

FOREX BLEND Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOREX BLEND latest industry rating score is 1.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.