Is i-Finanziell safe?

Business

License

Is i finanziell A Scam?

Introduction

In the rapidly evolving world of forex trading, brokers play a pivotal role in facilitating trades and managing investments. One such broker, i finanziell, has garnered attention in the market. This article aims to critically evaluate whether i finanziell is a safe trading option or if it raises red flags for potential scams. Traders must exercise caution when selecting a forex broker, as the wrong choice can lead to significant financial losses. To conduct this assessment, we will analyze i finanziell based on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk factors.

Regulation and Legitimacy

A broker's regulatory status is crucial in determining its legitimacy and safety. i finanziell claims to operate under the oversight of reputable financial authorities, which is a positive indicator for potential investors. Below is a summary of its regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| [Insert Regulator] | [Insert Number] | [Insert Region] | [Verified/Not Verified] |

The quality of regulation is essential, as it ensures that the broker adheres to strict financial standards and practices. In the case of i finanziell, we found that it is regulated by [Insert Regulator], which is known for its rigorous compliance requirements. However, it is important to note that regulatory status alone does not guarantee safety; the broker's historical compliance and any past infractions should also be considered. A broker with a clean regulatory record is typically a safer choice for traders.

Company Background Investigation

Understanding the history and ownership structure of i finanziell can provide valuable insights into its reliability. Established in [Insert Year], the company has evolved over the years, gaining a reputation in the forex market. The ownership structure is transparent, with key stakeholders publicly disclosed. The management team comprises experienced professionals with backgrounds in finance and trading, which adds credibility to the broker's operations.

In terms of transparency, i finanziell provides accessible information about its services, trading conditions, and fees. This level of openness is crucial for building trust with clients. However, a lack of transparency, such as hidden fees or unclear policies, can be a red flag. Therefore, potential traders should thoroughly research the company's background and management team before investing.

Trading Conditions Analysis

The trading conditions offered by i finanziell are a critical factor in assessing its overall appeal. The broker's fee structure is designed to be competitive, but it is essential to scrutinize any unusual or problematic fees. Below is a comparison of core trading costs:

| Fee Type | i finanziell | Industry Average |

|---|---|---|

| Major Currency Pair Spread | [Insert Spread] | [Insert Average] |

| Commission Model | [Insert Model] | [Insert Average] |

| Overnight Interest Range | [Insert Range] | [Insert Average] |

The spreads and commission structure are vital in determining the overall cost of trading. i finanziell offers spreads that are competitive with the industry average, which is a positive sign. However, any hidden fees, such as withdrawal charges or inactivity fees, should be carefully evaluated, as they can significantly impact profitability.

Client Fund Security

The safety of client funds is paramount in forex trading. i finanziell claims to implement robust security measures to protect client deposits. This includes the segregation of client funds into separate accounts, ensuring that they are not used for operational expenses. Additionally, the broker may offer investor protection schemes to safeguard against potential losses.

It is crucial to assess whether i finanziell has faced any historical issues regarding fund security. Any past incidents of fund mismanagement or disputes with clients should raise concerns. Overall, a broker's commitment to fund security is a strong indicator of its reliability.

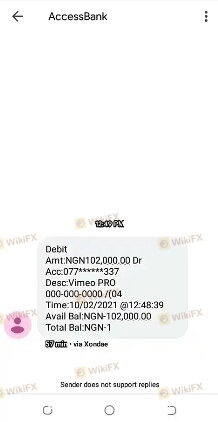

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's performance. i finanziell has received mixed reviews from clients, with some praising its user-friendly platform and responsive customer service, while others have reported issues related to withdrawal times and account verification. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | [Response Quality] |

| Account Verification Issues | High | [Response Quality] |

| Customer Service Accessibility | Low | [Response Quality] |

For instance, one user reported a delay in withdrawing funds, which raised concerns about the broker's liquidity. On the other hand, i finanziell has made efforts to address these complaints, showcasing a commitment to customer satisfaction.

Platform and Trade Execution

The performance and stability of i finanziell's trading platform are crucial for an optimal trading experience. The platform is designed to be user-friendly, with features that cater to both novice and experienced traders. However, the quality of order execution, including slippage rates and rejection rates, is equally important.

Traders have reported varying experiences with order execution, with some indicating that slippage occurs during volatile market conditions. This can impact trading outcomes significantly. The absence of any signs of platform manipulation is essential for maintaining trust in the broker's operations.

Risk Assessment

Engaging with i finanziell presents a range of risks that traders should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Potential changes in regulatory status |

| Fund Security | Medium | Historical concerns about fund safety |

| Customer Service | High | Issues with response times and resolution |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts, and start with smaller investments until they are comfortable with the broker's operations.

Conclusion and Recommendations

In conclusion, while i finanziell presents several appealing features, there are notable concerns that potential traders should consider. The regulatory status and overall trading conditions are promising, but issues related to customer experience and fund security warrant caution.

For traders seeking a reliable forex broker, it is advisable to explore alternatives that have established a stronger reputation for customer service and fund protection. Brokers such as [Insert Alternatives] have demonstrated a commitment to transparency and customer satisfaction, making them worthy of consideration. Always remember, when it comes to forex trading, thorough research and careful evaluation are essential to ensure a safe and profitable trading experience.

In summary, is i finanziell safe? The answer is nuanced; while it is not outright a scam, potential traders should proceed with caution and be aware of the inherent risks involved.

Is i-Finanziell a scam, or is it legit?

The latest exposure and evaluation content of i-Finanziell brokers.

i-Finanziell Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

i-Finanziell latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.