Is Ho-Forex safe?

Business

License

Is Ho Forex Safe or a Scam?

Introduction

Ho Forex is a relatively new player in the forex market, offering a range of trading services to retail investors. As the forex trading landscape continues to grow, it is crucial for traders to carefully evaluate the brokers they choose to work with. The rise of online trading has unfortunately also led to an increase in scams and unregulated brokers, making it essential for traders to conduct thorough research before committing their funds. This article aims to provide an objective analysis of Ho Forex, examining its regulatory status, company background, trading conditions, and overall safety for traders.

To assess whether Ho Forex is a safe trading option or a potential scam, we will utilize a comprehensive evaluation framework that includes regulatory compliance, company history, customer feedback, and risk assessment. By analyzing these critical factors, we will provide a clear picture of whether Ho Forex can be trusted by traders.

Regulation and Legitimacy

Regulation is a vital aspect of any forex broker's operations, as it ensures that the broker adheres to certain standards of conduct and provides a level of protection for clients' funds. In the case of Ho Forex, it is essential to scrutinize its regulatory status to determine its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA (Unauthorized) | N/A | United States | Not Verified |

Ho Forex is reportedly registered in the United States but lacks proper regulation from a recognized authority such as the NFA (National Futures Association) or the CFTC (Commodity Futures Trading Commission). This lack of regulation raises significant concerns about the broker's legitimacy and its commitment to protecting traders. Without oversight from a reputable regulatory body, traders are at risk of encountering issues related to fund security, fair trading practices, and overall transparency.

Furthermore, the absence of regulatory compliance can lead to a lack of accountability, making it difficult for traders to seek recourse in case of disputes or financial losses. The regulatory environment plays a crucial role in ensuring that brokers operate ethically and transparently, and Ho Forex's current standing does not inspire confidence in its operations. Therefore, when considering whether Ho Forex is safe, it is essential to factor in its regulatory shortcomings.

Company Background Investigation

Understanding the history and ownership structure of a broker is crucial for assessing its credibility. Ho Forex, while relatively new, has not provided comprehensive information regarding its founding and operational history. The lack of transparency surrounding the company's management team and ownership raises red flags for potential clients.

A broker's management team should ideally possess extensive experience in the financial markets and a proven track record of operating reputable trading platforms. However, Ho Forex has not publicly disclosed detailed information about its leadership, which makes it challenging for traders to evaluate the broker's reliability.

Moreover, the absence of clear information about the company's operations and its physical address can lead to skepticism regarding its legitimacy. Traders should be cautious when engaging with brokers that do not provide sufficient background information, as this can be an indication of potential scams.

In summary, the company background of Ho Forex lacks the transparency and credibility that traders should expect from a reliable broker. This lack of information further compounds the concerns regarding its safety and trustworthiness.

Trading Conditions Analysis

When evaluating whether Ho Forex is safe, it is essential to analyze its trading conditions, including fees, spreads, and commissions. A broker's fee structure can significantly impact a trader's profitability, and any unusual or hidden fees should be scrutinized.

Ho Forex offers various account types, but the details surrounding their fee structures remain ambiguous. A clear understanding of the costs associated with trading is crucial for traders to assess the overall value proposition offered by a broker. Below is a comparative analysis of core trading costs:

| Fee Type | Ho Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of specific information regarding spreads and commissions on Ho Forex's website raises concerns about transparency. Traders should be wary of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that may erode profits.

Moreover, if Ho Forex employs a commission-based model or hidden fees, it could negatively impact the trading experience, making it less favorable for clients. Without a transparent fee structure, it becomes difficult for traders to make informed decisions. Therefore, potential clients should proceed with caution and consider these factors when determining if Ho Forex is a safe trading option.

Client Fund Safety

The safety of client funds is one of the most critical aspects to consider when evaluating a forex broker. Ho Forex's approach to fund security must be scrutinized to determine whether it provides adequate protection for traders' investments.

Ho Forex claims to implement certain safety measures, but it is crucial to assess the effectiveness of these measures. Key factors to evaluate include the segregation of client funds, investor protection schemes, and negative balance protection policies. Traders should expect their funds to be held in segregated accounts, ensuring that their money is kept separate from the broker's operational funds.

However, the lack of regulatory oversight raises concerns about the broker's commitment to safeguarding client funds. In the event of financial difficulties or insolvency, traders may find it challenging to recover their investments if proper safety measures are not in place.

In conclusion, while Ho Forex may present itself as a legitimate trading platform, the lack of transparency regarding fund safety and regulatory compliance raises significant concerns. Traders should prioritize brokers that offer clear and robust measures for protecting client funds.

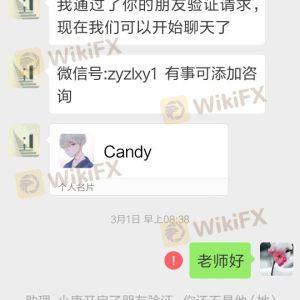

Customer Experience and Complaints

Customer feedback and experiences provide valuable insights into a broker's reliability and service quality. Analyzing user reviews and complaints can help potential clients gauge the overall satisfaction level of existing traders with Ho Forex.

Common complaints associated with Ho Forex include issues related to withdrawal delays, poor customer support, and lack of responsiveness to inquiries. Below is a summary of the major complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow to Address |

| Poor Customer Support | Medium | Limited Response |

| Account Verification | Low | Lengthy Process |

Several users have reported difficulties in withdrawing their funds, which is a significant red flag for any trader. A broker's ability to facilitate timely withdrawals is essential for building trust and confidence among clients. If traders encounter persistent issues with withdrawals, it raises concerns about the broker's financial stability and operational integrity.

Moreover, the quality of customer support plays a crucial role in the overall trading experience. If traders find it challenging to receive assistance or timely responses from Ho Forex's support team, it can lead to frustration and dissatisfaction.

In summary, while some traders may have positive experiences with Ho Forex, the prevalence of complaints and the severity of issues reported are concerning. Potential clients should carefully consider these factors when evaluating whether Ho Forex is a safe trading option.

Platform and Execution

The performance and reliability of a trading platform are critical for a successful trading experience. Traders need to have confidence in the platform's stability, order execution quality, and overall user experience.

Ho Forex utilizes popular trading platforms, but the specifics regarding their performance remain unclear. Factors such as order execution speed, slippage, and rejection rates should be evaluated to determine the platform's reliability. Traders have reported mixed experiences with order execution on Ho Forex, with some users experiencing delays and slippage during high volatility periods.

Additionally, any signs of platform manipulation or irregularities in order execution can significantly impact a trader's performance and profitability. A reliable broker should ensure that its trading platform operates efficiently and provides a fair trading environment for all clients.

In conclusion, while Ho Forex may offer a familiar trading platform, the lack of transparency regarding execution quality and user experiences raises concerns about its reliability as a trading venue.

Risk Assessment

When considering whether Ho Forex is safe, it's essential to evaluate the overall risks associated with trading through this broker. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns. |

| Fund Safety Risk | High | Unclear safety measures for client funds. |

| Customer Service Risk | Medium | Complaints regarding support and withdrawals. |

| Platform Reliability Risk | Medium | Mixed experiences with execution quality. |

Given the high regulatory and fund safety risks associated with Ho Forex, traders should exercise caution when considering this broker for their trading activities. It is advisable to conduct thorough research and consider alternative options that offer a more secure trading environment.

Conclusion and Recommendations

In conclusion, the analysis of Ho Forex raises significant concerns regarding its safety and legitimacy as a forex broker. The lack of proper regulation, transparency about company operations, and mixed customer experiences suggest that traders should approach this broker with caution.

While some traders may find success with Ho Forex, the potential risks associated with trading through this broker may outweigh the benefits. For those seeking a reliable and trustworthy trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record.

If you are a trader looking for reputable options, consider exploring well-established brokers such as HotForex, IG, or Pepperstone, which offer robust regulatory frameworks, transparent trading conditions, and positive customer feedback. Ultimately, thorough research and careful evaluation are essential for ensuring a safe and successful trading experience.

Is Ho-Forex a scam, or is it legit?

The latest exposure and evaluation content of Ho-Forex brokers.

Ho-Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ho-Forex latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.