Regarding the legitimacy of HLJY forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is HLJY safe?

Business

License

Is HLJY markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港恒利金业有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港上环干诺道中168-200号信德中心招商局大厦26楼12室Phone Number of Licensed Institution:

85239746466Licensed Institution Certified Documents:

Is HLJY Safe or Scam?

Introduction

HLJY, a forex broker established in 2017, positions itself within the competitive landscape of the foreign exchange market, targeting traders who seek a platform for trading various currencies. As the forex market continues to grow, the number of brokers has surged, leading to a mix of reputable firms and those that engage in questionable practices. Therefore, it is crucial for traders to carefully evaluate the integrity and reliability of forex brokers before committing their funds. This article aims to provide a comprehensive analysis of HLJY, exploring its regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on a review of multiple credible sources, including user feedback and regulatory databases, to formulate an objective assessment of whether "Is HLJY safe?"

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A well-regulated broker is generally considered safer, as it is subject to oversight by financial authorities that enforce strict compliance standards. In the case of HLJY, it operates under the auspices of the Chinese Gold & Silver Exchange Society (CGSE), which provides some level of regulatory oversight. However, the effectiveness of CGSE as a regulatory body has been questioned, particularly in light of the numerous complaints against HLJY.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 067 | Hong Kong | Suspicious Clone |

The CGSE is not recognized as a top-tier regulator, which raises concerns about the level of protection it offers to investors. Additionally, HLJY has been flagged as a "suspicious clone," indicating that it may not operate with the necessary transparency or accountability. The presence of 32 complaints within a short timeframe, as reported by WikiFX, further complicates the narrative regarding HLJY's legitimacy. While there have been no negative regulatory disclosures found during our evaluation, the overall regulatory quality and historical compliance of HLJY remain ambiguous, necessitating caution when considering this broker.

Company Background Investigation

HLJY, formally known as Hong Kong Hengli Gold Industry Co., Ltd., has a relatively short history since its inception in 2017. The company's development trajectory has been marked by efforts to establish itself in the forex trading space. However, the ownership structure and management team of HLJY are not well-documented, leading to questions about transparency and accountability. A thorough investigation into the backgrounds of the management team is essential, as experienced leaders can indicate a broker's reliability.

Despite being based in Hong Kong, HLJY's operational transparency has been criticized. There is limited information available regarding its shareholders and the company's financial stability. The lack of comprehensive disclosures raises red flags, as potential investors should be able to access detailed information about the company's operations and governance. Overall, the opacity surrounding HLJY's ownership and management structure may contribute to concerns regarding its credibility in the forex market.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is vital. HLJY offers a trading platform that primarily utilizes the popular MetaTrader 4 (MT4) software, which is known for its user-friendly interface and extensive features. However, the broker's overall fee structure appears to be inconsistent with industry standards.

| Fee Type | HLJY | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Not Clear | Clear |

| Overnight Interest Range | Unfavorable | Favorable |

The high spreads on major currency pairs may deter traders seeking cost-effective trading conditions. Additionally, the lack of clarity regarding commission structures raises concerns about potential hidden fees. Traders should be aware that unfavorable overnight interest rates can further erode profits. Overall, the trading conditions at HLJY do not appear to be competitive, which could be a significant drawback for potential clients.

Client Fund Security

The security of client funds is paramount in the forex trading environment. HLJY claims to implement measures to ensure the safety of client funds; however, the effectiveness of these measures is questionable. The broker's policy on fund segregation is unclear, which is a critical aspect of protecting client assets.

Moreover, the lack of investor protection mechanisms, such as negative balance protection, raises further concerns. In the event of a financial crisis or operational failure, clients may be left vulnerable. Historical issues related to fund withdrawals and client complaints about unresponsive customer service further amplify the risks associated with trading with HLJY. As such, potential investors should exercise extreme caution when considering this broker, as the safety of their funds may not be guaranteed.

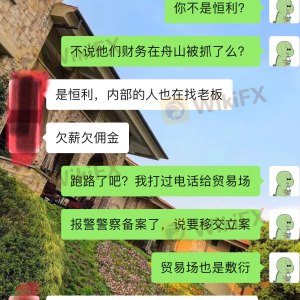

Client Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. In the case of HLJY, numerous complaints have surfaced, highlighting issues such as difficulty in withdrawing funds, unresponsive customer service, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency Concerns | High | None |

The predominant complaint involves withdrawal difficulties, with clients reporting that their requests were either delayed or outright denied. Additionally, many users have expressed frustration with the lack of effective communication from HLJY's customer support team. One notable case involved an Introducing Broker (IB) who introduced clients to HLJY but faced significant challenges when attempting to facilitate withdrawals for those clients. The complaints indicate a pattern of poor service and a lack of accountability, which raises significant concerns regarding the broker's trustworthiness.

Platform and Execution

The trading platform offered by HLJY is primarily based on MT4, which is widely regarded for its functionality and user-friendliness. However, users have reported issues related to platform stability, order execution quality, and slippage. The execution quality at HLJY has been called into question, with traders experiencing frequent slippage and instances of order rejections.

The potential for platform manipulation is another concern, as brokers with questionable practices may engage in tactics that disadvantage traders. Overall, while the MT4 platform provides a familiar interface for traders, the execution quality and reliability of HLJY's services appear to be lacking, which could negatively impact trading performance.

Risk Assessment

Engaging with HLJY comes with inherent risks that potential traders should carefully consider. The following risk assessment summarizes the key areas of concern related to trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak oversight by CGSE |

| Fund Security Risk | High | Unclear fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Conditions Risk | High | High spreads and unclear fees |

To mitigate these risks, traders should conduct thorough research before engaging with HLJY. It may be prudent to start with a small investment or seek alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendation

In conclusion, the evidence suggests that HLJY raises several red flags that warrant caution. The broker's questionable regulatory status, lack of transparency, poor customer service, and unfavorable trading conditions contribute to a perception that "Is HLJY safe?" may not be a straightforward answer. Traders should be wary of potential fraud and consider the risks associated with this broker.

For those seeking reliable alternatives, it is advisable to explore brokers with strong regulatory oversight, transparent fee structures, and positive customer reviews. Reputable options may include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a more secure trading environment. Ultimately, due diligence is essential to ensure a safe and profitable trading experience.

Is HLJY a scam, or is it legit?

The latest exposure and evaluation content of HLJY brokers.

HLJY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HLJY latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.